The order block is a powerful concept that has gained popularity among retail and professional traders in 2025. Although it may seem like just another complex market term, order blocks are essential for identifying where large institutions buy or sell assets, allowing you to follow their lead.

This beginner's guide will clarify how they function and how to utilise them to enhance your trading strategy.

What Is an Order Block?

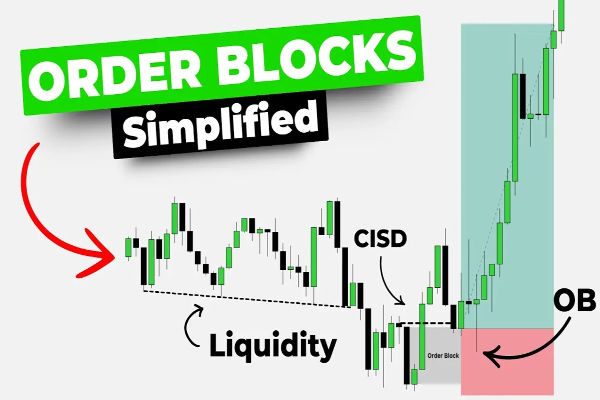

An order block is a consolidation zone on a chart where institutional traders, such as banks or hedge funds, place large buy or sell orders. These zones represent areas of significant trading activity that often precede a major price move. After the price exits the zone, it typically returns to test the area, offering opportunities for entry or exit.

In simple terms, think of order blocks as the footprints of smart money. They signal areas where large volumes were traded, which could affect future price action.

Order blocks are usually identified by a series of candlesticks forming a tight range, followed by a strong move in one direction. These blocks are later used as key levels of support or resistance.

Types of Order Blocks in Trading

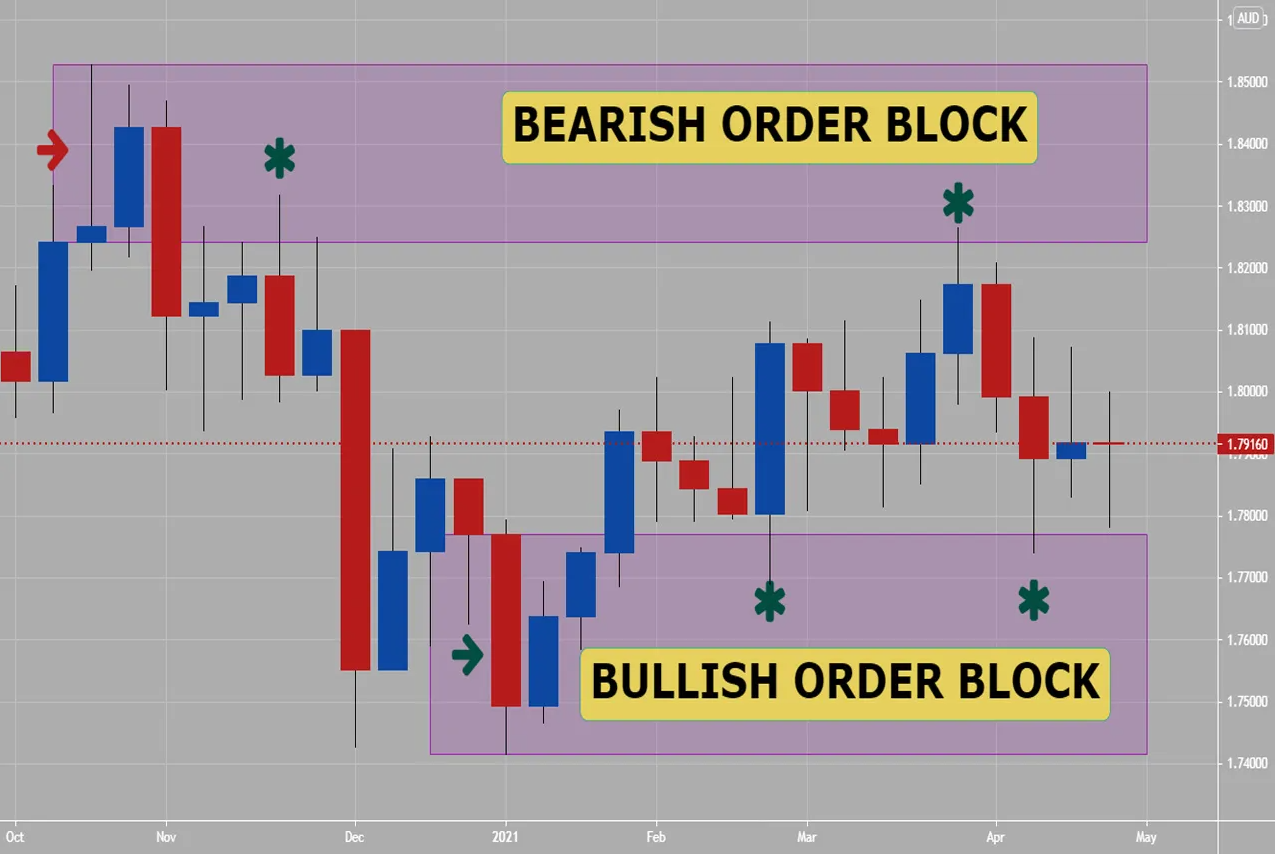

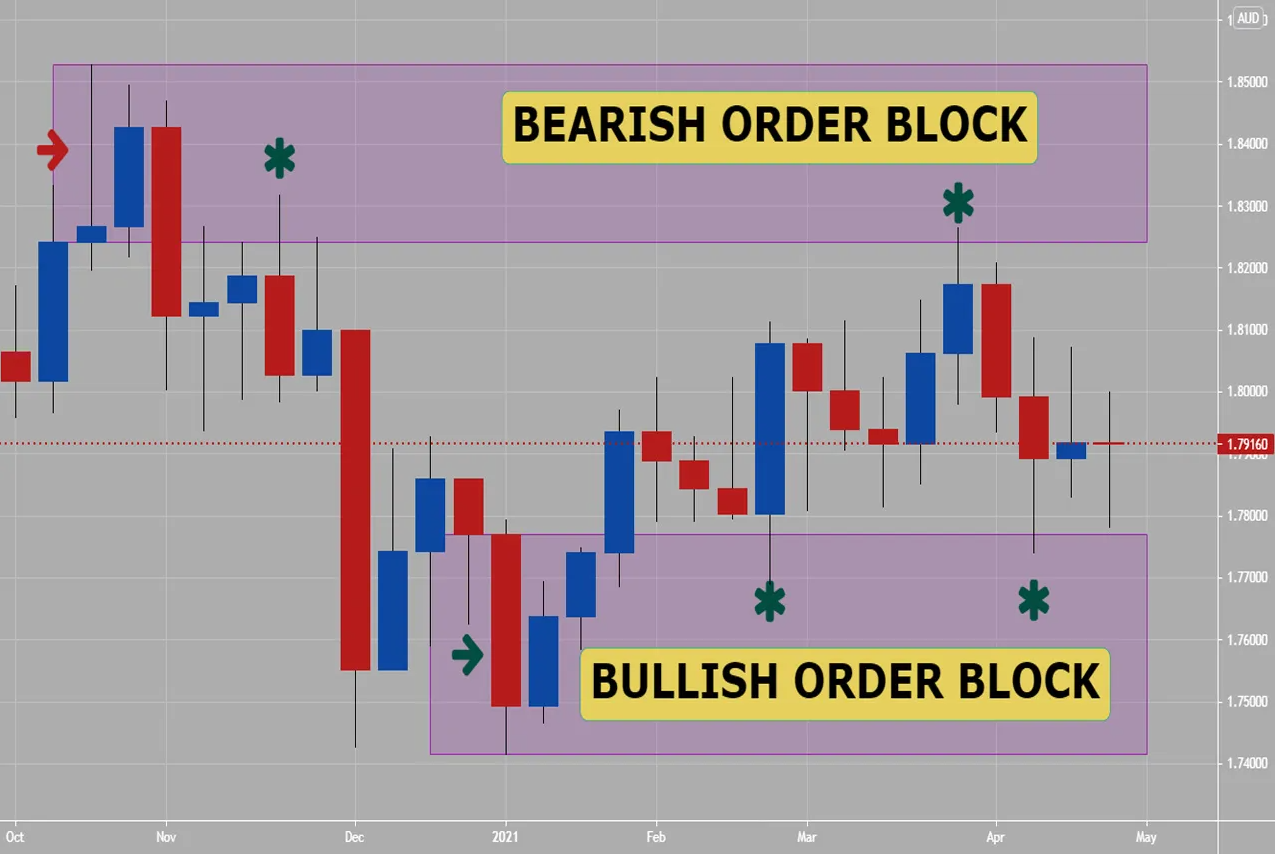

Bullish Order Block

A bullish order block signals buy-side liquidity and are formed when institutions accumulate positions before a price rally. It's typically marked by a small bearish candle or consolidation range, followed by a sharp bullish breakout.

Price often returns to this block later, and it acts as a demand zone.

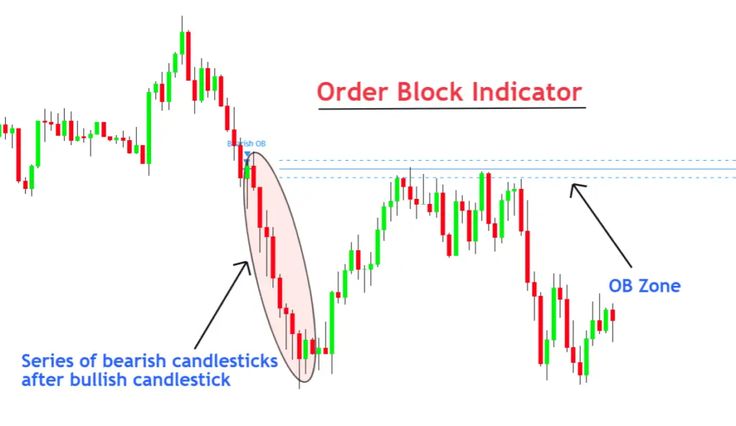

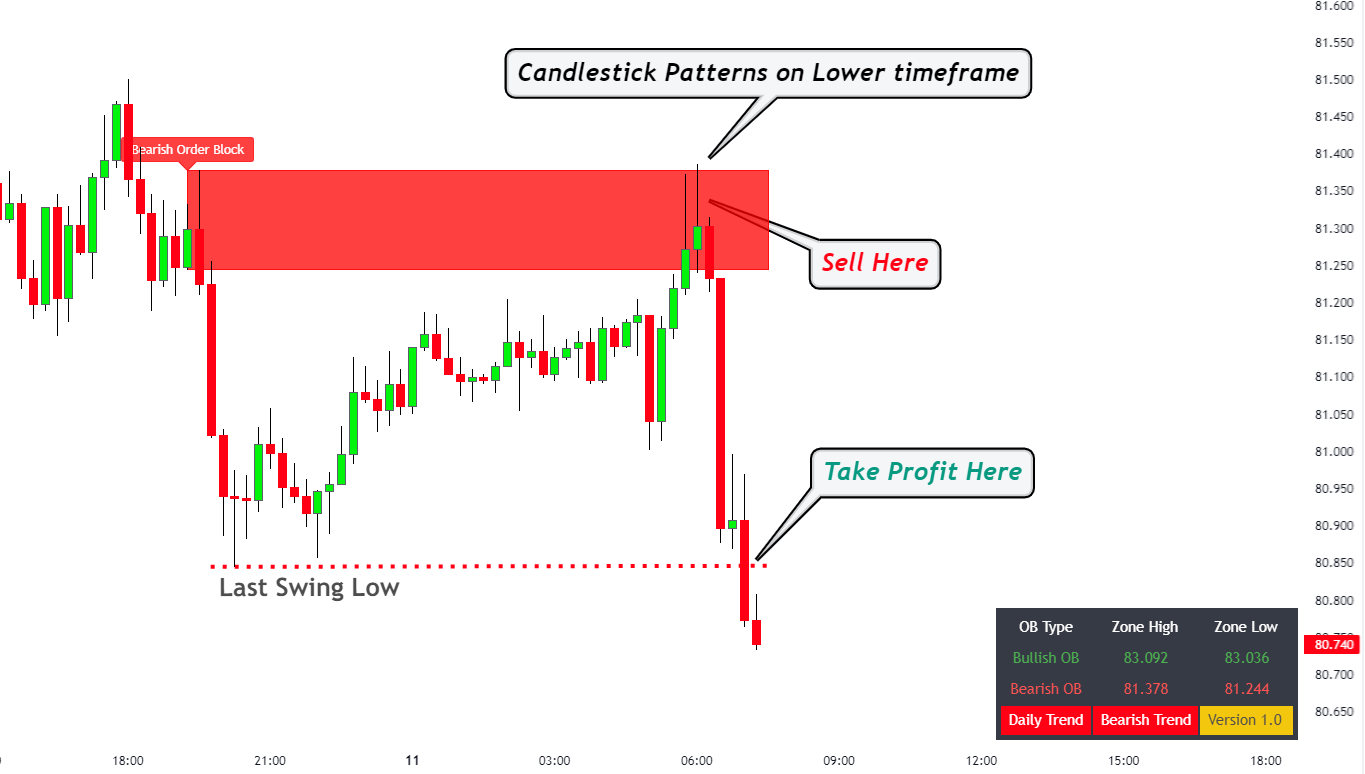

Bearish Order Block

A bearish order block indicates sell-side pressure. It forms when institutions distribute or unload positions before a price drop. It's usually a small bullish candle or tight range, followed by a strong bearish breakout.

Price revisiting this block often encounters resistance.

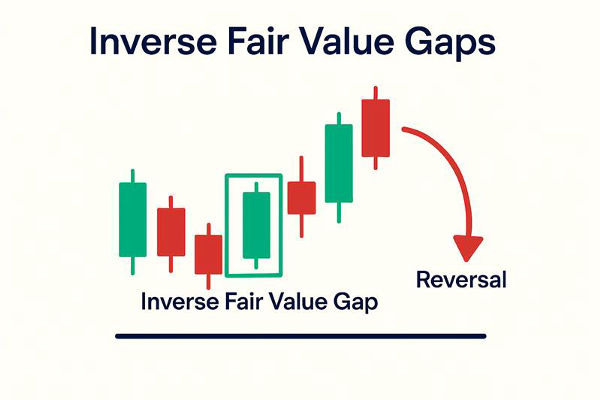

Breaker Blocks

A breaker block is a failed order block that was broken but then serves as a reversal level. For example, if a bullish order block is breached, it may later act as resistance instead of support. Traders use breaker blocks to understand shifts in market structure.

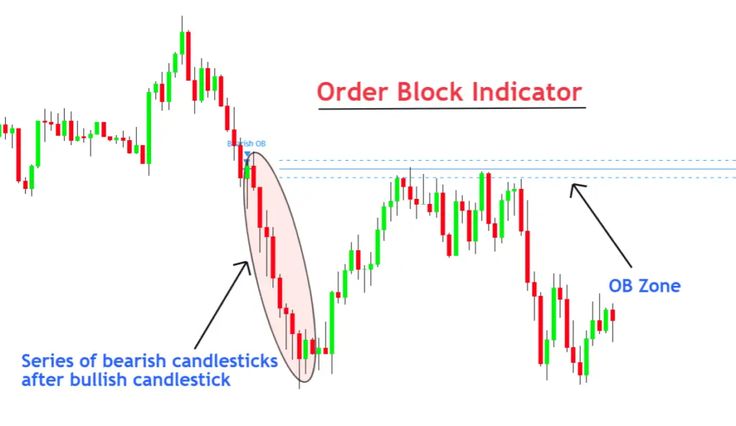

How to Identify Order Blocks on a Chart

Identifying order blocks requires practice but becomes simpler once you grasp the structure. Here's a more straightforward process:

Look for a strong impulsive move—a large bullish, or bearish candle with increased volume.

Identify the last opposite-coloured candle before that move. That candle or small group of candles forms the order block.

Mark the high and low of that candle as your order block zone.

Wait for the price to return to that zone. A reversal or continuation often occurs there.

Why Are Order Blocks Important?

Unlike regular support and resistance lines based on visible highs and lows, order blocks give insight into hidden liquidity and institutional intent.

Thus, it gives them more reliability in forecasting price reactions. Key reasons why order blocks matter:

They reflect the positions of large market participants.

They often mark the origin of trend reversals or breakouts.

They help traders align with the direction of institutional flow.

Because big players cannot enter or exit positions all at once, they often leave behind signs on the chart—clues retail traders can use to anticipate future moves.

How Order Blocks Differ from Supply and Demand Zones

At first glance, order blocks may look similar to supply and demand zones. While both represent market imbalance and potential reversal, there are subtle but crucial differences.

Supply and demand zones focus more on price reactions to visible price extremes, where buying or selling pressure dominates. Order blocks, however, emphasise the origin of a move before the breakout occurs, typically seen as the last bullish or bearish candle before a strong push in the opposite direction.

For example:

These nuances make order blocks more advanced and precise than general support/resistance areas.

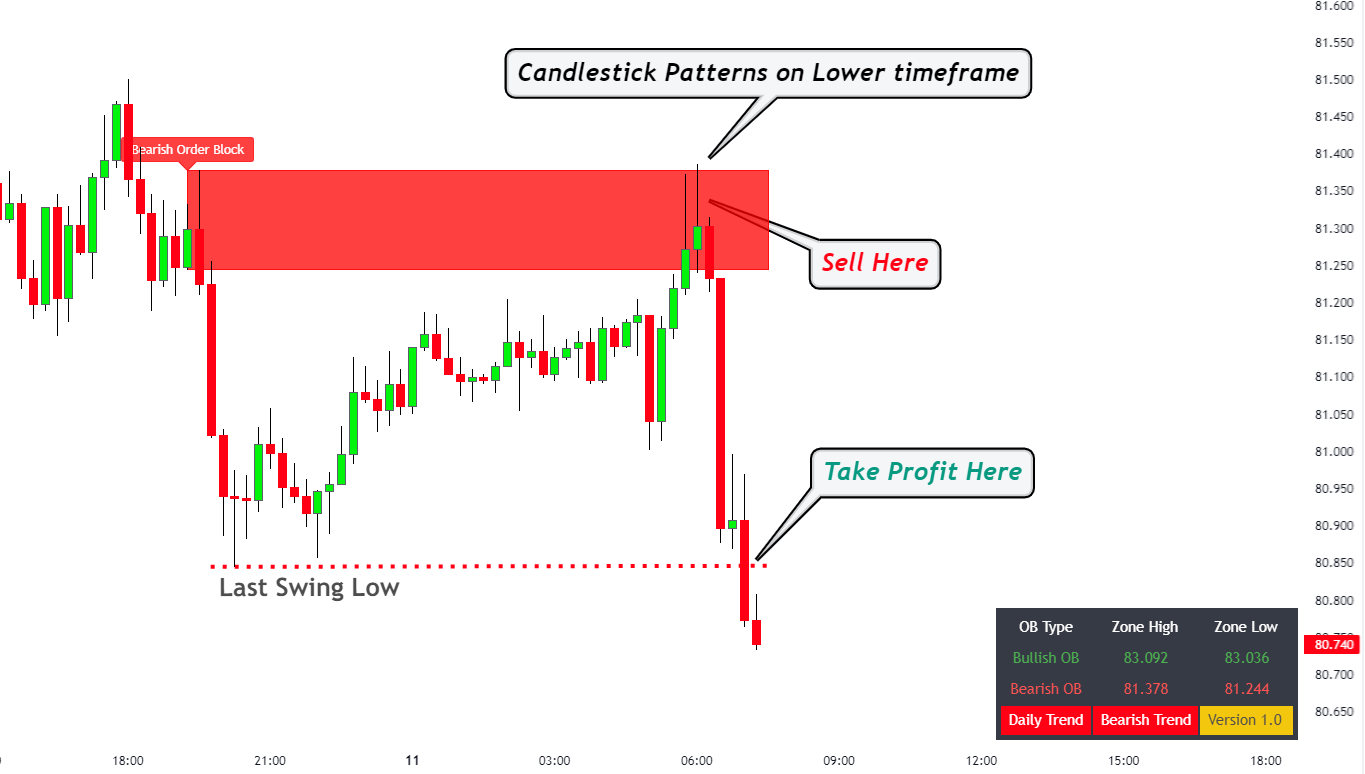

Using Order Blocks in a Trading Strategy

Order blocks are not standalone signals—they work best in a larger trading system. Here's how traders incorporate them into actionable strategies:

Entry Points

Wait for the price to return to the order block zone. Enter a trade when:

Price shows rejection (e.g., pin bar, doji, or bearish/bullish engulfing candle)

Volume confirms buying or selling pressure

Market structure aligns with the trade direction

Stop Loss Placement

Place the stop loss slightly above the high (for a bearish order block) or below the low (for a bullish order block). This accounts for potential liquidity grabs or fakeouts.

Profit Targets

Use prior swing highs/lows or Fibonacci extension levels to set logical take-profit targets. Many traders scale out positions as prices move in their favour.

Real-World Example

Imagine the price of a stock like Apple (AAPL) has been consolidating on the 1-hour chart. You spot a small bearish candle followed by a large bullish breakout. You mark that bearish candle as a bullish order block.

Two days later, the price retraces back into the zone. On the 15-minute chart, a bullish engulfing pattern appears within the block, and RSI shows oversold.

You enter a long trade with your stop loss below the block's low and target the previous high. Price respects the block and rallies—your strategy pays off.

This real-world dynamic makes order blocks attractive — they work across different assets, from stocks to forex.

Are Order Blocks Suitable for Beginners?

Yes—but only if you're willing to learn and practice. While order blocks are more advanced than moving averages or RSI, they offer deeper insight into market psychology and institutional behaviour.

Beginners should start by:

With time and discipline, traders can master this concept and significantly improve their strategy.

Conclusion

In conclusion, order blocks are not a silver bullet, but they represent one of the most powerful concepts in technical trading today. Thus, understanding where big money trades gives you a massive advantage in a market dominated by institutions.

As you build experience, combining order blocks with structure analysis, volume, and confirmation candles can dramatically enhance your win rate and consistency.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.