Over the past years, economic and trade cooperation between countries has not only achieved a win-win situation but also played an indispensable role in the process of economic globalization. However, recently, the deficit has become a recurring term and stirred the international wind and clouds. As the world's largest economy, the United States has maintained a trade deficit for decades. And the resulting international economic cycle, but also a profound impact on the world economic pattern. So, what is the trade deficit?

What is the What is Trade Deficit?

What is the What is Trade Deficit?

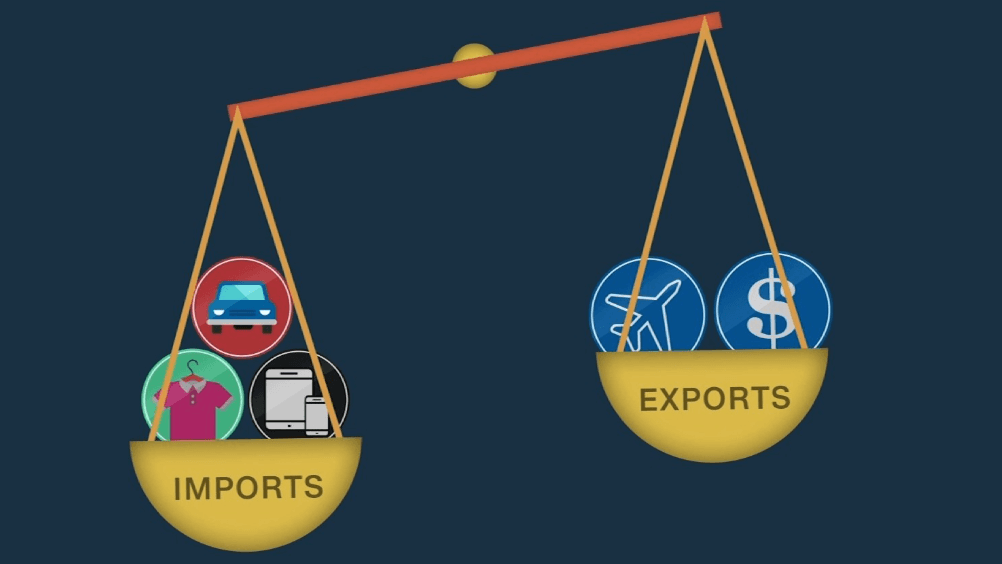

It is also called into the money; that is, in a certain period of foreign trade, the foreign country's imports are greater than its exports. Specifically, a trade deficit occurs when the total value of foreign goods and services purchased by a country is greater than the total value of goods and services sold to other countries.

Let's take a simple example: there is a country called Rice Country that is rich in rice. Another country is called the vegetable country, which produces vegetables. One month, the rice country exported 10.000 dollars of rice to the vegetable country but imported 20.000 dollars of vegetables from the vegetable country. By simple calculation, you can tell that the trade balance of the rice country is a deficit of 10.000 dollars.

Just like in business, once you buy back more than you sell, you are naturally losing money. So it's not a good thing because a chronic deficit leads to a constant outflow of wealth from the country, which affects the long-term development of a country's economic health.

It usually means that a country has a greater external demand and needs to import more goods and services from other countries. This may be due to domestic production not being able to meet demand or foreign goods being more competitively priced, thus triggering an increased demand for imported goods and services.

Some countries may be able to offer more competitive goods and services because of low production costs, and other countries may therefore prefer to import from those countries. This may lead to an increase in imports and the creation of a trade deficit. This may increase the country's sensitivity to fluctuations in international markets, as the deficit makes the country more dependent on external supplies as it needs to buy more from other countries.

Changes in exchange rates can affect international trade when a country's currency appreciates. It can then make exported goods uncompetitive in the international market, leading to a deficit as a result of reduced exports. At the same time, a long-term trade deficit may lead to a depreciation of the national currency. This is due to the fact that purchasing more foreign goods requires more foreign currency, which leads to a relative depreciation of the national currency.

Volatility and uncertainty in the global economy may also affect trade surpluses and deficits. In times of stronger economic growth, import demand may increase, leading to a deficit. To compensate for it, the country may need to attract foreign investment or borrow. This may lead to increased international capital flows, affecting the country's debt level and financial stability.

It may have an impact on domestic employment and industrial structure. Because more goods and services come from abroad, it may put competitive pressure on domestic industries. If domestic industries are unable to compete, this may lead to a decline in domestic employment and affect domestic manufacturing and other industries.

The deficit also reflects an imbalance in the balance of payments, which affects the country's economic situation and exchange rate. Because the country needs to pay more money out of the country, it means that the country spends more money on international trade, which may lead to a decrease in foreign exchange reserves and an increase in international debt.

Differences in a country's level of investment and savings can also affect trade conditions. If a country has a low level of savings and a high demand for investment, this may lead to a dependence on imports to meet demand, creating a deficit. In some cases, it may be seen as a signal of economic imbalances that require policy measures to be adjusted. For example, some countries may restrict imports by adopting protectionist policies to reduce the deficit.

Overall, the trade deficit is a complex phenomenon involving the interaction of several factors. The dynamics and complexity of international trade are such that the causes of deficits may vary in different periods and contexts, and the eventual consequences are not the same.

What does it mean to have a foreign trade deficit?

| Implications |

Impact |

| Foreign trade deficit |

Imports are greater than exports, creating a trade deficit. |

| Decline in exchange rate |

Deficits may lead to devaluation of the national currency. |

| Employment |

Deficits may lead to competitive pressure on industries. |

What Does a Trade Deficit mean?

When a country spends more on its imports of goods and services than it earns on its exports in international trade, it results in a negative trade account. In simple terms, this means that the country buys more goods and services in its economic dealings with other countries than the value of the goods and services it sells to them. This can lead to a number of economic, monetary, and political implications.

It may have an impact on the exchange rate of the country's currency and may lead to the devaluation of the currency. This is when the country needs to pay more in foreign currency as imports exceed exports, which may lead to a decrease in foreign currency reserves. It means that the country needs to borrow money from other countries to make up the payment difference, leading to an increase in international debt. If this situation persists, it may lead to debt problems.

A prolonged deficit may lead to a depreciation of the country's currency, which then triggers problems of inflation and reduced domestic purchasing power. This is because it takes more domestic currency to buy more foreign goods, while relatively fewer exports and relatively lower demand may lead to currency depreciation to boost exports.

It can also lead to a bias in domestic demand towards foreign goods, which may have a knock-on effect on domestic industries, especially those that are directly competing with imports. Increased imports may put competitive pressures on domestic industries, leading to the distress of domestic firms, for example, by causing employment and profits in domestic industries to decline.

The decline of these industries, in turn, can have a negative impact on employment. Because more goods and services come from abroad, this may reduce domestic employment opportunities. At the same time, a decline in the competitiveness of domestic industries can result in unemployment for domestic workers. These, in turn, may lead to an increase in unemployment, which can increase social and political pressures.

It is also usually associated with a reduction in domestic manufacturing, as large amounts of production may be shifted to countries with lower production costs. This may weaken the domestic industrial base. And it may spark political controversy and lead to a rise in trade protectionism, such as the imposition of tariffs or other trade restrictions to protect domestic industries, such as the tariffs imposed by the United States on China.

Chronic trade deficits may lead to pressure on the domestic currency in international foreign exchange markets, and measures may be needed to stabilize the exchange rate. At the same time, in order to cover the trade deficit, it will increase the country's external debt. In turn, the country's need to make interest and principal payments on the debt may have an impact on the country's fiscal position.

It is important to note that the deficit itself is not necessarily negative. Because international trade is complex, many factors can affect the trade position. In some cases, it may be a reflection of economic growth and consumer demand. For example, it may reflect a country's demand for foreign capital and investment, which can help drive domestic economic growth. Foreign investment can bring in new technology, management experience, and jobs.

And the deficit also brings in imports of cheap goods, which can lower the domestic price level in favor of consumers. And it helps control inflation and keep prices relatively stable. Meanwhile, the deficit allows domestic consumers to enjoy more diversified goods and services from other countries. This enriches market choices and improves consumers' quality of life.

In some cases, a trade deficit can lead to consumer welfare and economic growth, but in other cases, it can lead to employment problems and economic instability. And chronic or excessive deficits are cause for concern and may require government policies to adjust, a situation that is particularly evident in the United States.

US Trade Deficit

US Trade Deficit

The U.S. trade deficit has a long history and has been a prominent feature of U.S. economic history, rooted in multiple historical periods and global economic contexts. Since the aftermath of World War II, the U.S., the only major country at the time that was undamaged by the war, has quickly emerged as the leader of the global economy. However, this leadership position also shaped the U.S.'s chronic trade deficits.

In the early post-war years, other countries whose economies were severely ravaged by the war had to rely on imports from the United States, which allowed the United States to enjoy a trade surplus. During the Cold War, the U.S. supported the economic reconstruction of post-war Western European countries through the Marshall Plan, which provided large-scale assistance to these countries. However, with the outbreak of the Korean and Vietnam wars, the U.S. stationed troops overseas and made large purchases, which, coupled with the economic takeoff of Europe and Japan under U.S. military protection, led to a sharp increase in the U.S. trade surplus.

By 1976. the U.S. trade from surplus to deficit, and the deficit to GDP ratio gradually climbed, up to 6% or more. The oil trade deficit became the main source of the U.S. trade deficit, once accounting for a considerable proportion of the total U.S. trade deficit. In addition, excessive domestic consumption and insufficient savings, as well as changes in industrial structure, have become the structural causes of the deficit.

The problem of insufficient domestic savings was manifested in the long-standing phenomenon of high consumption and low savings in the United States, which led to excessive imports. Even after the 2008 international financial crisis, this downward trend has not been reversed, and the negative savings rate in the government sector has expanded further. The resulting increase in macroleverage has been particularly evident in the non-financial corporate and government sectors.

The international hegemony of the dollar gives the United States a special role in the global economic system. The dollar is the world's most important international currency, with a significant share of global foreign exchange transactions, central bank foreign exchange reserves, and global transaction payments. However, this has led to the Triffin dilemma, whereby the United States needs to maintain a deficit to export the dollar. But this could damage the dollar's credibility and was responsible for the dollar crisis of the 1960s.

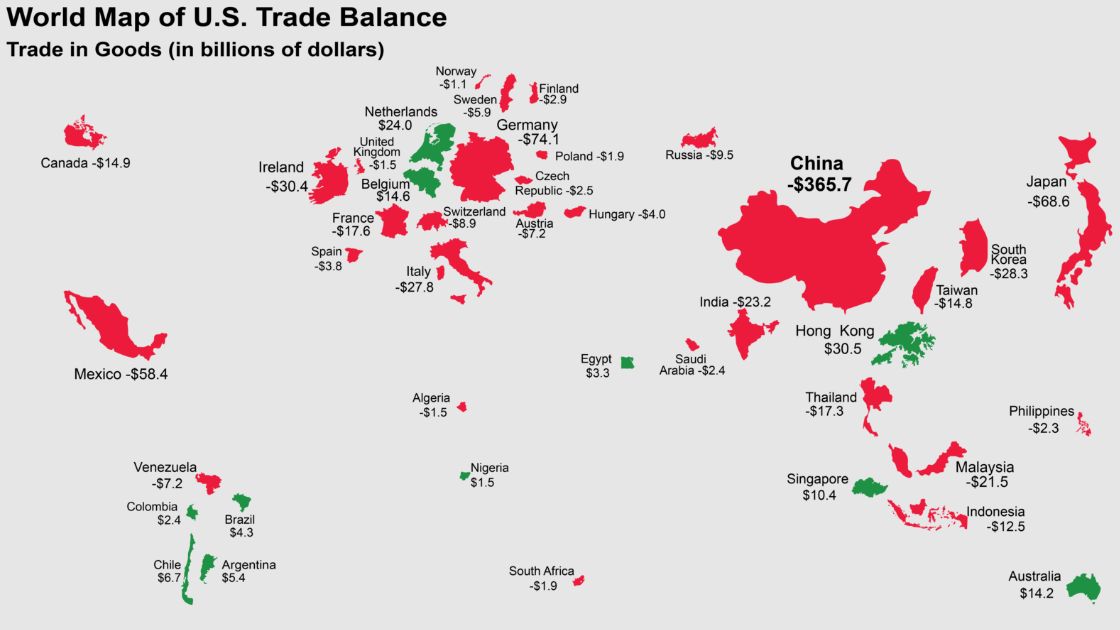

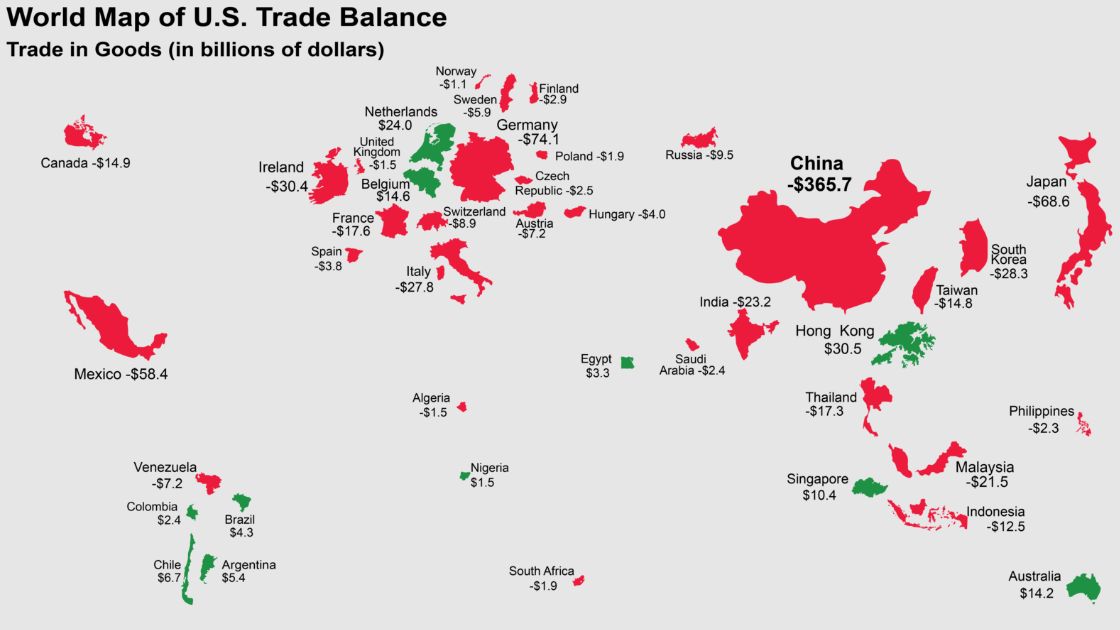

The U.S. deficit on trade exists globally, as shown in the chart above, where red indicates countries with which the U.S. has a deficit on trade, and green indicates countries with which the U.S. has a trade surplus. As can be seen, the U.S. has the largest trade deficit with China and the largest trade surplus with Hong Kong.

In this case, the United States wants to reduce the deficit, and the resulting trade war between China and the United States has been widely publicized around the world. Since 2001. China has introduced large amounts of foreign investment and attracted international companies to set up factories within its borders, creating a global pattern with China as the production center and the United States as the market center.

This has led to a shift in the trade balance. For example, after Japan and Taiwan invested and set up factories on the mainland, China's exports of intermediate and capital goods to the mainland gradually became the source of exports to the United States. Since then, the U.S.-China trade deficit has accounted for an increasing share of the total U.S. deficit, climbing from 26.6 percent from 2002 to 2008 to 44.8 percent from 2009 to 2018 in the post-crisis era.

The strict export controls imposed by the United States on trade with China are one of the major reasons for the bilateral trade imbalance. Trade in high-tech products and scarce resource goods has received particular attention. If the degree of U.S. export controls on China is relaxed, the deficit may be reduced. Overall, the U.S.-China trade imbalance is affected by both economic structure and industrial layout, as well as by a combination of factors such as policy and statistical methodology.

However, China and the United States have not been able to reach a cooperative agreement on this issue, and trade disputes have erupted over it. One of the main measures was the imposition of tariffs, which not only challenged the economic systems of China and the United States but also triggered the realignment of supply chains and an increase in global trade uncertainty on a global scale.

It is therefore important to note that the problem of international trade imbalances is not the problem of the United States alone. In the context of globalization, countries are interdependent, with deficit countries needing to save their surplus and the United States needing to maintain its deficit to preserve its own economy. After the financial crisis of 2008. emerging markets and developing countries started to strengthen their own economic systems, creating a new pattern of global economic imbalances.

Although the international economic system needs to be rebalanced in the context of global economic imbalances, the problem of the U.S. trade deficit still exists. Its ratio to GDP remains high, indicating that the trade issue has been deeply integrated into the economic structure of the United States. How to solve this problem requires the joint efforts of the international community to make global economic adjustments in order to achieve more balanced and sustainable global economic development.

China-US trade 2023

| Month |

Exports |

Imports |

Balance |

| Jan-23 |

13092.6 |

38252.9 |

-25160.3 |

| Feb-23 |

11618.6 |

30620.6 |

-19002 |

| Mar-23 |

14181.1 |

30789.7 |

-16608.6 |

| Apr-23 |

12794.4 |

33077.3 |

-20283 |

| May-23 |

10679.2 |

35890.6 |

-25211.5 |

| Jun-23 |

10223.1 |

34334.1 |

-24111.1 |

| Jul-23 |

10659.5 |

36099.5 |

-25440 |

| Aug-23 |

10765.3 |

36724.7 |

-25959.4 |

| Sep-23 |

11834.6 |

40282 |

-28447.4 |

| Oct-23 |

16046.5 |

41570.7 |

-25524.2 |

| Nov-23 |

13903.9 |

35494.9 |

-21591.1 |

| TOTAL 2023 |

135798.7 |

393137.1 |

-257338.4 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is the What is Trade Deficit?

What is the What is Trade Deficit? US Trade Deficit

US Trade Deficit