Forex trading, also known as forex speculation, stands as the investment and wealth management method witnessing the highest number of trades and the largest capital flow worldwide. Prior to engaging in forex margin trading, traders must initiate by opening an account. What exactly are the prerequisites for opening a forex Trading Account?

1. Adults over the age of 18

It must be a legal adult who meets the basic requirements for opening an account for trading.

2. Provide personal identification materials

Opening an account for foreign exchange margin trading requires the provision of identity proof materials. Common identity proof materials include national recognized proof materials such as ID card, household registration book, driver's license, etc. Investors need to upload scanned copies or photocopies of them.

3. Provide bank card information, phone number, and email address

4. Risk tolerance: Forex trading is a high-risk investment, and applicants need to have sufficient risk tolerance and experience.

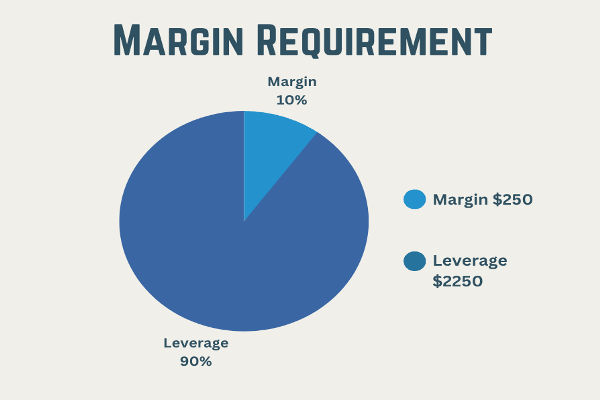

5. Funding requirements: Applicants are required to pay a certain amount of margin as trading capital when opening an account. Different brokers have different requirements for the amount of margin, usually requiring several hundred dollars or more.

In addition to the above conditions, basic information for other investors must also be provided, such as commonly used email addresses, bank information, and the account holder's commonly used mobile phone number. Investors must fill in their frequently used email addresses, bank card information, and mobile phone number information in order to ensure the normal entry and exit of foreign exchange investors.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.