When it comes to measuring the performance of an investment portfolio, there are a variety of metrics available. One of the most useful but often overlooked ratios is the Treynor ratio. Developed by Jack Treynor in the 1960s, this ratio evaluates the returns of an investment relative to its risk, specifically the systematic risk, which cannot be diversified away.

In this article, we'll explore the Treynor ratio, explain how it works, and highlight three key ways it can enhance your portfolio.

What Is the Treynor Ratio?

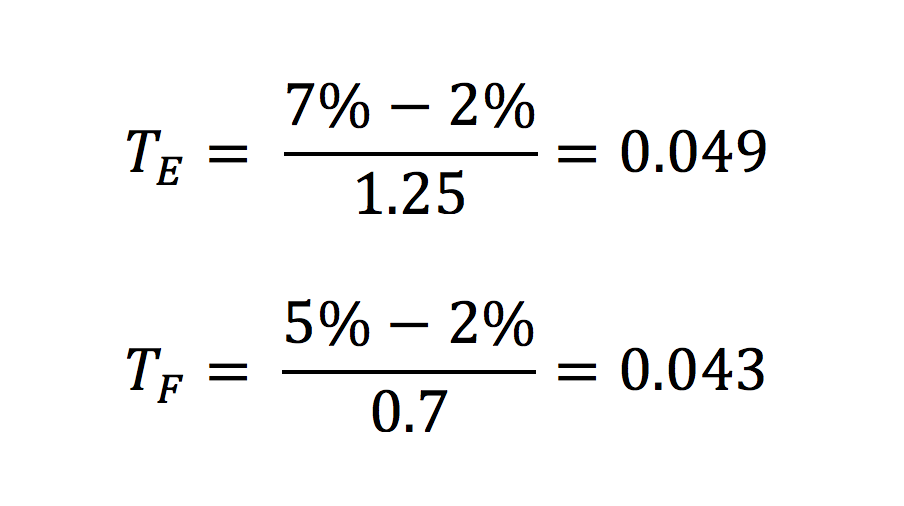

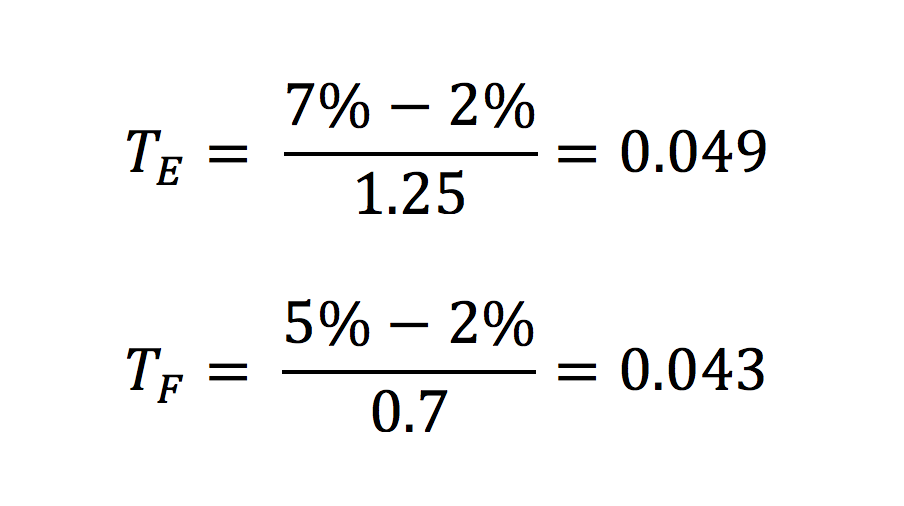

The Treynor ratio measures the excess return per unit of risk, where risk is defined as systematic risk (beta). Unlike other ratios, such as the Sharpe ratio, which considers total risk, the Treynor ratio focuses only on the risk that can't be eliminated through diversification.

A higher Treynor ratio indicates that the portfolio is providing better returns for each unit of risk, which is generally considered desirable for investors.

How the Treynor Ratio Can Enhance Your Portfolio

1. Helps Assess Risk-Adjusted Performance

The first way the Treynor ratio can enhance your portfolio is by providing a clear picture of your portfolio's risk-adjusted performance. When you invest in the stock market, it's not just about how much return your portfolio generates, but also how much risk you're taking to achieve that return.

The Treynor ratio allows you to compare the return earned for each unit of systematic risk. A higher ratio indicates that your portfolio is effectively generating more return for less market risk, meaning you're not overexposing yourself to volatility while still achieving good performance. This is especially useful when comparing portfolios or investment funds, as it helps you assess whether the returns justify the risk taken.

2. Compares Portfolios with Different Risk Profiles

Another key benefit of the Treynor ratio is that it allows you to compare portfolios with different levels of systematic risk. Since the Treynor ratio focuses on beta (systematic risk), it offers a way to evaluate how well portfolios perform in relation to the market risk, regardless of the total risk level.

For example, if one portfolio has a higher beta (more market risk), it might have a higher return. However, without comparing this return to the risk it took on, it can be difficult to assess whether the portfolio is truly outperforming or simply taking on excessive risk. By using the Treynor ratio, you can compare these portfolios in a more meaningful way and decide which one is best suited to your risk tolerance and investment goals.

3. Improves Strategic Asset Allocation

The Treynor ratio is particularly helpful for refining your asset allocation strategy. Investors typically allocate their assets across different investments based on risk tolerance, return expectations, and diversification goals. By using the Treynor ratio, you can assess whether your current allocation is optimally designed to achieve the best returns for the level of market risk you're comfortable with.

For instance, if you have a portfolio with a low beta (less market risk), but your Treynor ratio is low, this suggests that you're not getting sufficient returns for the risk you're taking. Alternatively, if you have a portfolio with a high beta and a high Treynor ratio, it may indicate that you are achieving a good return relative to the systematic risk.

By regularly monitoring the Treynor ratio, you can adjust your asset allocation to maximise the return for each unit of market risk, ultimately improving the overall performance of your portfolio.

How to Interpret the Treynor Ratio

A Treynor ratio above 1 generally indicates that the portfolio is providing a good return for the level of market risk it is exposed to. Conversely, a ratio below 1 might suggest that the portfolio is underperforming relative to its risk level. However, as with any ratio, it's important to compare it to relevant benchmarks, such as the market index or similar portfolios, to assess its true effectiveness.

It's also worth noting that the Treynor ratio can be particularly useful for large, well-diversified portfolios, as these typically have a stable beta. For smaller, more volatile portfolios, other ratios like the Sharpe ratio might provide additional insights into total risk and return.

Conclusion

The Treynor ratio is a powerful tool for assessing the performance of an investment portfolio, especially when you want to evaluate returns in relation to systematic risk. By focusing on market risk and providing a clear risk-adjusted return metric, the Treynor ratio can help you make more informed decisions about your portfolio's performance.

There are three main ways the Treynor ratio can enhance your portfolio: it helps assess risk-adjusted performance, compares portfolios with different risk profiles, and improves strategic asset allocation. By using the Treynor ratio in conjunction with other metrics, you can refine your investment strategy and make smarter decisions about where to allocate your resources.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.