EBC Forex Snapshot, 24 May 2024

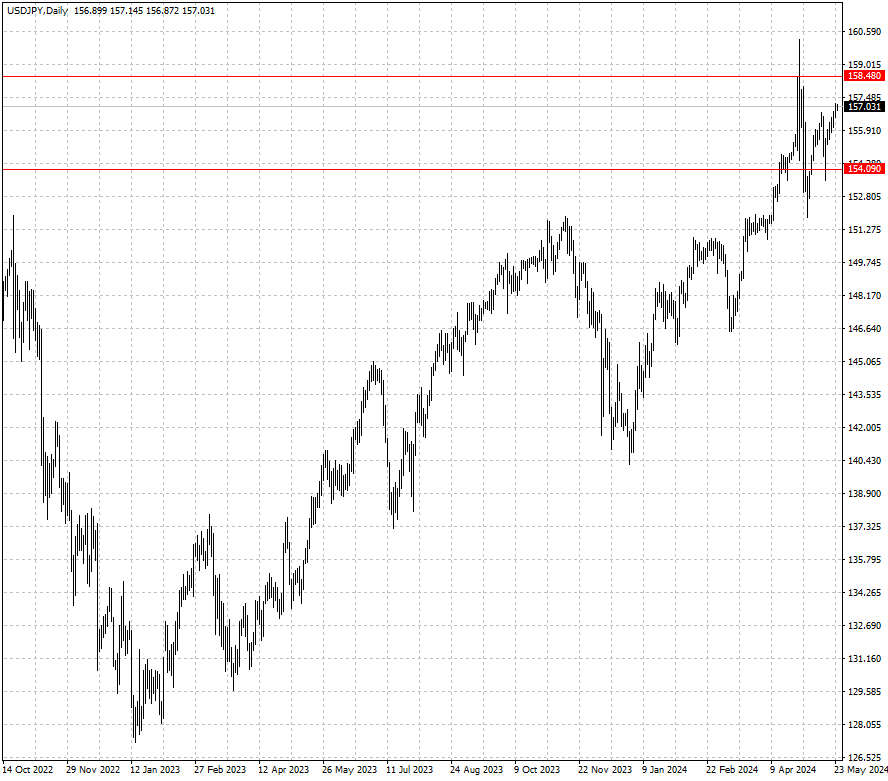

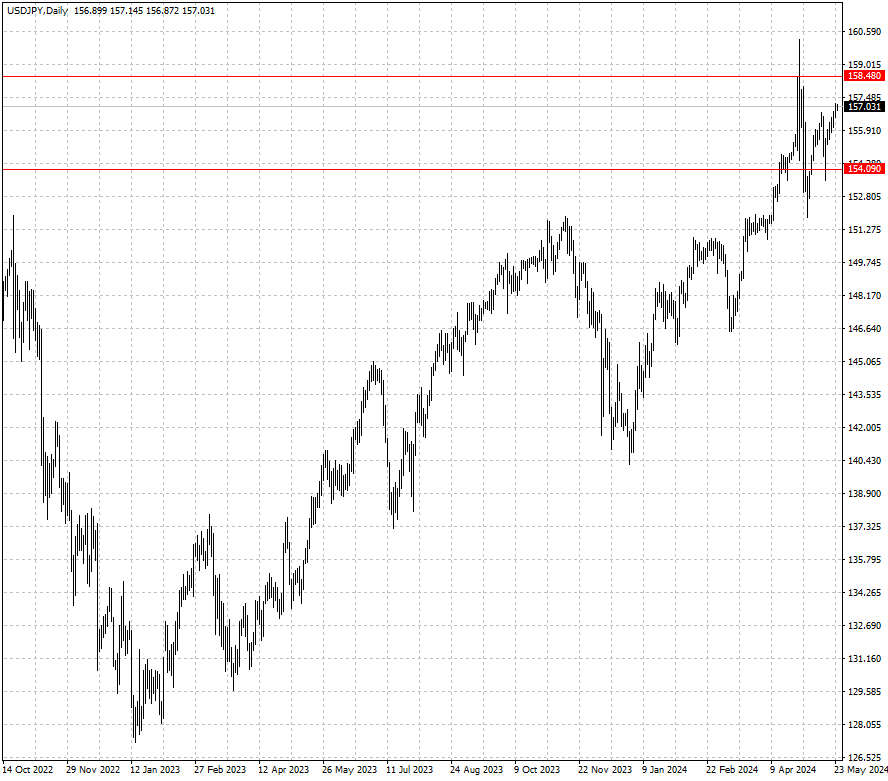

The dollar headed for its largest weekly rise in a month and a half on Friday

as surprisingly strong US economic data has left markets on edge about the

outlook for interest rates.

May figures showed US business activity accelerated to the highest level in

just over two years. The yen dipped below 157 per dollar as Japan's core

inflation slowed for a second straight month in April.

The increase in the nationwide core CPI marked the 25th straight month it has

remained above the BOJ's 2% target, but the slowdown may signal a scarcer chance

of an imminent rate hike.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 20 May) |

HSBC (as of 24 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0793 |

1.0895 |

1.0725 |

1.0897 |

| GBP/USD |

1.2300 |

1.2712 |

1.2506 |

1.2824 |

| USD/CHF |

0.8988 |

0.9244 |

0.9033 |

0.9205 |

| AUD/USD |

0.6443 |

0.6729 |

0.6537 |

0.6695 |

| USD/CAD |

1.3478 |

1.3846 |

1.3623 |

1.3798 |

| USD/JPY |

152.12 |

157.68 |

154.09 |

158.48 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.