In the trading world, strategy is everything. Two common approaches—order flow trading and technical analysis—often divide opinion among professionals and retail traders alike. Some swear by charts and indicators, while others read the tape and focus on what the market is actually doing in real time.

But which method offers more clarity, precision and edge? Is one better suited for modern markets, or do they complement each other? In this article, we break down the key differences between order flow trading and traditional technical analysis, helping you decide which method fits your style and goals.

Order Flow Trading vs Technical Analysis: 5 Differences to Know

1. The Core Philosophy

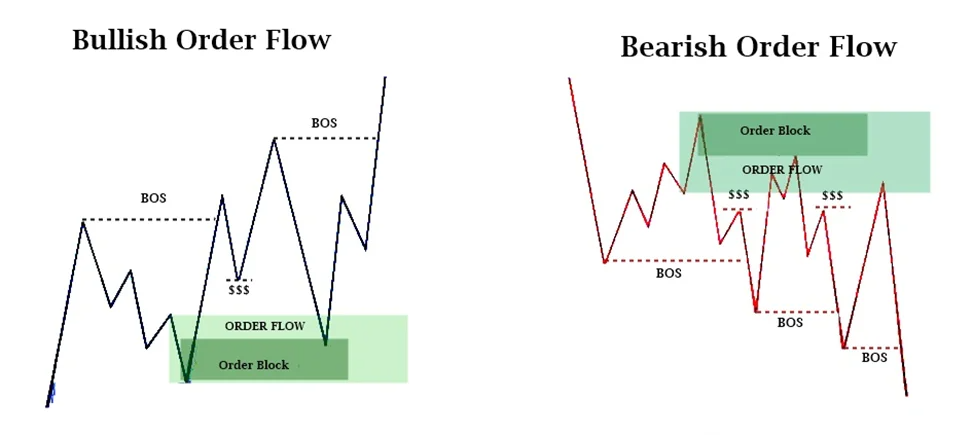

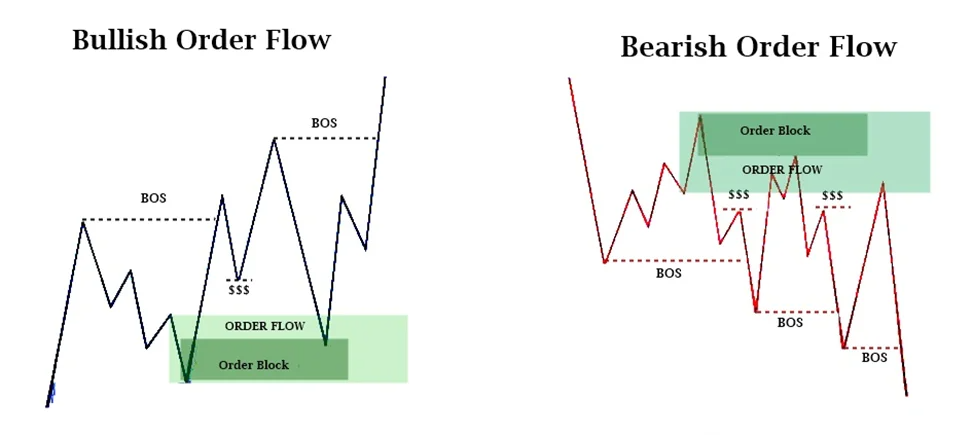

Order flow trading focuses on the live buying and selling pressure that moves the market. It studies how orders are placed, filled and executed in real time. By observing changes in bid-ask spreads, volume clusters, and limit order books, traders aim to spot imbalances before price reacts.

In contrast, technical analysis is the study of past price movements and patterns. It relies on indicators such as moving averages, RSI or MACD to identify trends and reversals. The assumption is that historical patterns tend to repeat, and price tells you all you need to know.

So, the key distinction lies in time sensitivity: order flow trading is about what's happening now, while technical analysis is based on what has already happened.

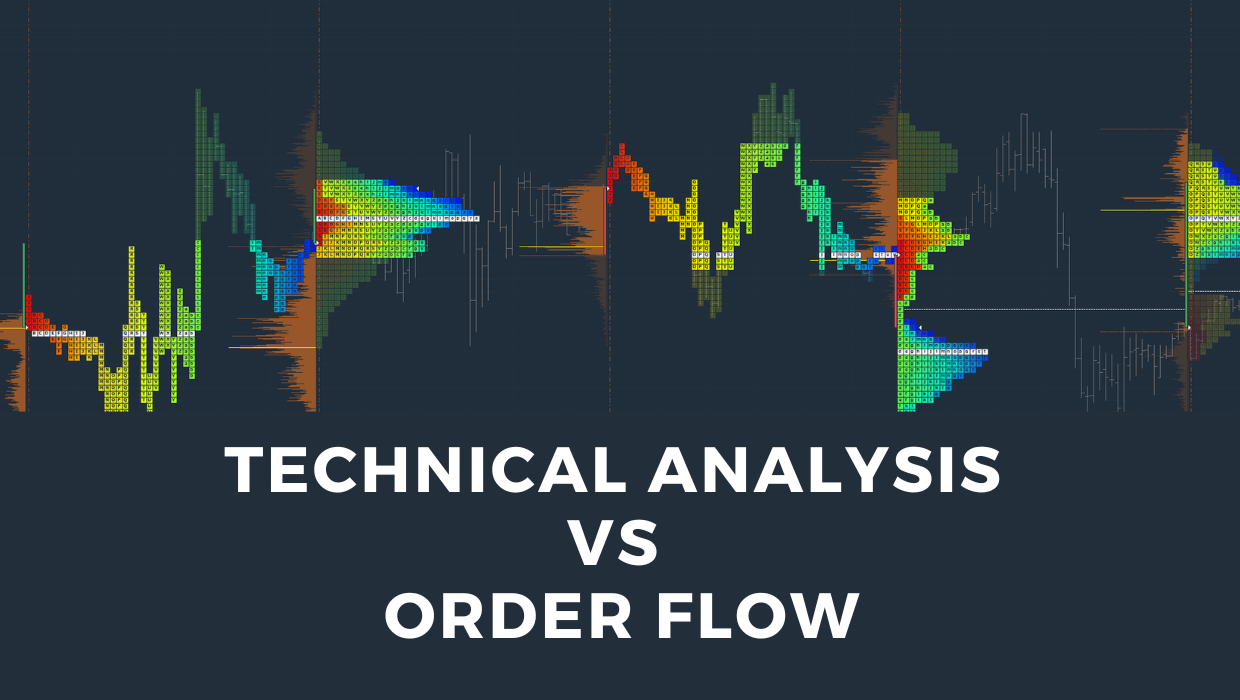

2. Tools of the Trade

For order flow trading, tools include the depth of market (DOM), time and sales (the tape), footprint charts and volume profile indicators. These tools show where liquidity sits and how aggressive buyers or sellers are behaving at certain price levels.

Technical analysts, by comparison, use candlestick charts, support and resistance levels, trendlines, Fibonacci retracements and momentum indicators. Their goal is to find confirmation through patterns and signals derived from price history.

Each toolkit shapes a different kind of mindset: order flow trading requires constant observation and fast reaction, while technical analysis allows for more structured, plan-ahead strategies.

3. Speed and Execution

Order flow trading is often used by short-term or intraday traders, including scalpers, who need to make rapid decisions. Since they trade based on real-time information, execution speed is vital. Many use hotkeys and direct market access (DMA) to minimise delay.

Technical analysis suits a wider range of timeframes. While it can be used for day trading, it is also common among swing traders and even long-term investors. There's usually more time to plan and wait for confirmation before entering or exiting a position.

In this sense, order flow trading rewards precision and fast reflexes, whereas technical analysis rewards patience and consistency.

4. Accessibility and Learning Curve

Technical analysis is more widely taught, accessible and easy to start with. Most trading platforms come with a range of built-in indicators and drawing tools. Learning the basics of support and resistance or moving average crossovers doesn't take long.

On the other hand, order flow trading demands a deeper understanding of market mechanics. Interpreting DOM data or footprint charts requires training and experience. It also requires data feeds with low latency, often at additional cost.

While anyone can start with charts, mastering order flow trading typically involves more of a learning curve—but potentially offers earlier signals than standard indicators.

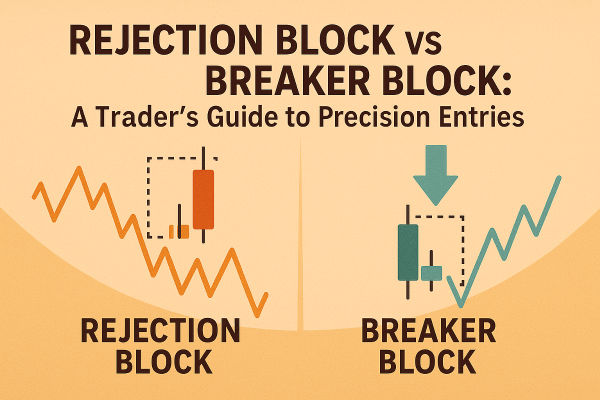

5. Which Is More Reliable?

Reliability depends on context. In highly liquid markets or around key news events, order flow trading can provide a real-time edge. Traders can see whether large buyers are absorbing sell pressure or if a support level is being defended with real capital.

Technical analysis may lag slightly, but it remains effective for identifying trend direction, breakout levels and risk management zones. Many traders use it as a roadmap, combining it with other methods for confirmation.

In fact, some traders blend both approaches—using order flow trading to fine-tune entries and exits based on levels identified by technical analysis. This hybrid approach aims to capture the best of both worlds.

Final Thoughts

The debate of order flow trading vs. technical analysis isn't about which is superior, but which better suits your personality, time horizon and access to tools.

If you prefer high-speed decision-making and reading raw market behaviour, order flow trading may give you the edge. If you're more comfortable identifying price trends and waiting for Chart Patterns to play out, technical analysis offers a clear and structured approach.

Both methods have their strengths. The key is to understand how each works, test them in practice and find what fits your Trading plan. With discipline and the right tools, either method can be effective—and used together, they can be even stronger.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.