Commodities are the raw materials that drive the global economy, from oil and gold to agricultural products like wheat and coffee. Investing in commodities can be an excellent way to diversify your portfolio, hedge against inflation, and gain exposure to global markets. However, for beginners, the commodities market can seem complex and intimidating.

This comprehensive guide will explain the basics of commodity investing, the different types of commodities, how to invest in commodities, and the key risks and rewards to consider.

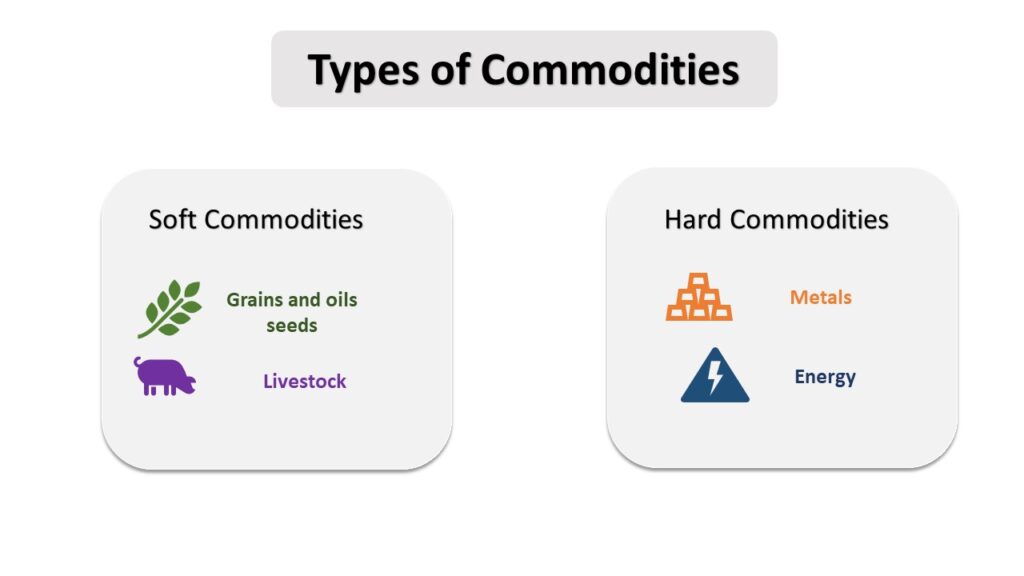

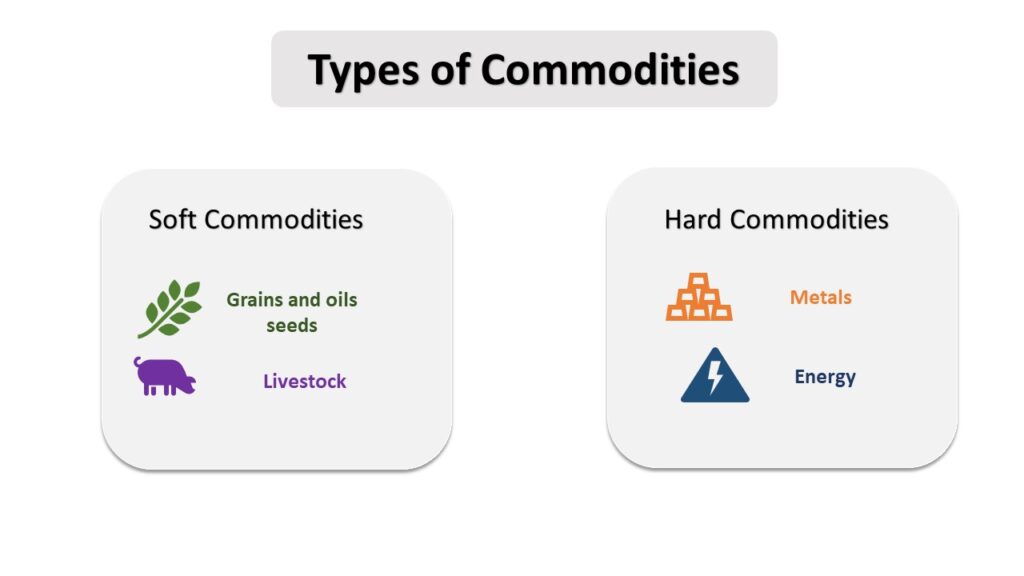

Commodities are tangible goods that can be bought, sold, or traded. They are typically categorised into two main groups:

Hard Commodities (Natural Resources)

These include natural resources that are mined or extracted:

1. Crude Oil

A liquid fossil fuel used primarily for transportation (gasoline, diesel) and industrial energy. It's also a key input in plastics and chemicals.

2. Natural Gas

A clean-burning fossil fuel used for heating, electricity generation, and industrial processes. It's also used as a raw material for fertilisers.

3. Gold

A precious metal valued for jewellery, investment (like coins and bars), and as a safe-haven asset during economic uncertainty.

4. Silver

A precious metal used in jewellery, electronics, solar panels and batteries. Similar to gold, it is also considered an investment metal.

5. Copper

Because of its excellent conductivity, copper is an industrial metal used for electrical wiring, plumbing, construction, and renewable energy technologies.

Soft Commodities (Agricultural Products)

These are agricultural products or livestock:

1. Wheat

A cereal grain that's a staple food worldwide, used in bread, pasta, and animal feed.

2. Corn

Corin is a versatile crop used for food, livestock feed, ethanol fuel, and various industrial products.

3. Soybeans

A protein-rich crop used for animal feed, cooking oil, tofu, and biofuels.

4. Coffee

A globally traded beverage crop, prized for its caffeine content and flavour. It's one of the most consumed drinks in the world.

5. Cotton

Cotton's soft fibre is used primarily in textile manufacturing in clothes, bedding, and other fabrics.

6. Cattle (Live Cattle and Feeder Cattle)

Refers to cows raised for beef production. Live cattle are ready for slaughter, while feeder cattle are still fattened.

Why Invest in Commodities?

1. Diversification

Commodities often move separately from traditional stock or bond markets, making them a valuable tool for balancing an investment portfolio.

2. Inflation Hedge

Commodities tend to perform well during periods of inflation, as prices of raw materials rise.

3. Supply and Demand Opportunities

Changes in supply (due to weather, geopolitics, etc.) or demand (from economic growth or technology shifts) can create profitable opportunities.

4. Global Exposure

Commodities are influenced by international events, offering investors a broader perspective.

How to Invest in Commodities: Step-by-Step Guide

1. Define Your Investment Goals

Are you looking to hedge against inflation?

Are you speculating on short-term price moves?

Do you want long-term exposure?

Understanding your objectives will guide your strategy and risk tolerance.

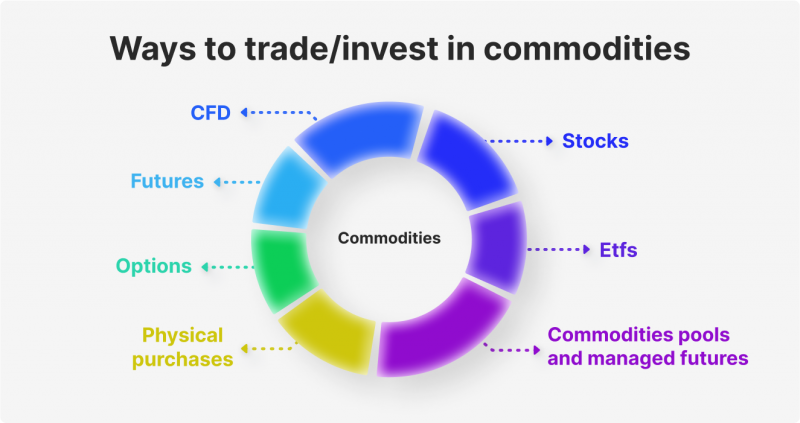

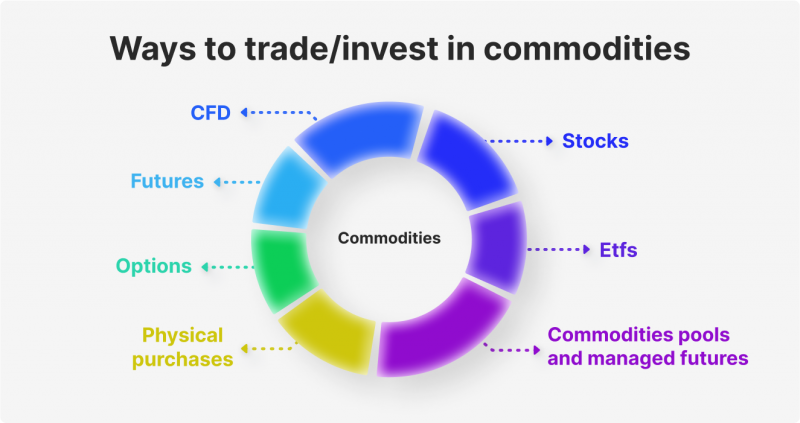

2. Choose Your Investment Method

Select futures, ETFs, stocks, or physical commodities based on your risk profile and experience.

3. Open a Brokerage Account

For futures: Use a commodities brokerage

For ETFs and stocks: A standard online brokerage works well

For physical commodities: Use reputable bullion dealers or investment services.

4. Research the Commodity Market

Before investing in any commodity:

5. Start Small

Begin with small positions to understand the market dynamics. You can always scale up later.

Common Ways to Invest

You don't need to store barrels of oil or corn to invest in commodities. Here are the main ways to get exposure:

1. Commodity Futures Contracts

Futures are standardised contracts primarily utilised by professional traders and institutions to buy or sell a commodity at a price on a specific date.

Pros:

High leverage potential

Direct exposure

Cons:

Risky and complex

Not ideal for beginners

2. Commodity ETFs and Mutual Funds

Exchange-traded funds (ETFs) and mutual funds offer an easier way to gain exposure to commodities without directly trading futures.

Examples:

Pros:

Low-cost and accessible

Diversified exposure

Cons:

3. Commodity Stocks

Invest in companies that produce or trade commodities, such as oil producers, mining companies, or agricultural firms.

Pros:

Cons:

Stock Prices are influenced by company performance, not just commodity price

4. Physical Commodities

Investors can also buy physical commodities like gold bars, silver coins, or farmland.

Pros:

Cons:

Popular Commodities for Beginners

Some commodities are more beginner-friendly due to liquidity and transparency:

1. Gold

2. Crude Oil

Highly liquid

Economically sensitive

Can be volatile

3. Silver

4. Agricultural Commodities

Wheat, corn, and soybeans are influenced by weather and demand cycles

Volatile but offers unique diversification

Tips and Risks to Know

| Tips for Success |

Risks to Watch Out For |

|

Stay Informed: Follow global news, supply/demand trends, and economic indicators. |

Volatility: Commodity prices can swing rapidly due to global or seasonal events. |

|

Use Technical Analysis: Utilize charts and indicators to spot patterns and entry points. |

Leverage Risk: Trading futures or CFDs can amplify both gains and losses. |

|

Diversify Within Commodities: Spread your investments across energy, metals, and agriculture. |

Geopolitical & Environmental Factors: Wars, sanctions, droughts, etc., can disrupt markets. |

|

Set Stop-Loss Orders: Limit your downside by using automated exits. |

Storage & Transportation Costs: For physical commodities, these can eat into profits. |

|

Avoid Overleveraging: Especially in futures, only risk what you can afford to lose. |

No Passive Income: Most commodities don’t pay interest or dividends. |

Conclusion

In conclusion, commodities investing offers a unique way to diversify your portfolio and gain exposure to global economic trends. The opportunities are vast, from gold and oil to wheat and cattle, but they come with risks that need to be managed carefully.

For beginners, the best path is to start small, choose easier instruments like ETFs or stocks, and focus on learning. With knowledge, strategy, and discipline, commodities can become a valuable part of your long-term investment toolkit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.