The Federal Reserve's July policy meeting is shaping up to be a pivotal moment for investors and analysts, but expectations for a rate cut this month have cooled rapidly in the wake of stubborn inflation and solid labour market data.

Instead, market focus has shifted squarely to September, as traders and policymakers weigh up the path of US monetary policy for the remainder of 2025.

No Immediate Relief: Fed Rate Cut Seen as Unlikely

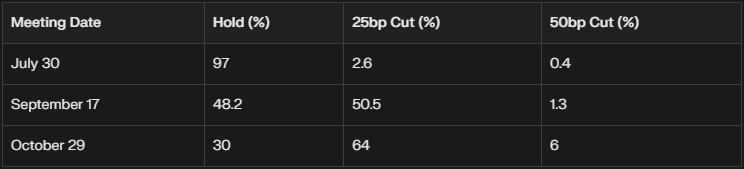

As July's meeting approaches, consensus across both market participants and central bank officials is that the Federal Open Market Committee (FOMC) will hold rates steady at the current target range of 4.25% to 4.50%. The CME FedWatch tool suggests a 97% probability that rates will remain unchanged this month, a figure that has held firm following the latest US inflation data.

This aligns with recent statements from Fed Chair Jerome Powell, who confirmed at the ECB's annual forum that the institution is proceeding “meeting by meeting,” and that any move will be contingent on incoming economic indicators.

“I wouldn't take any meeting off the table or put it directly on the table. It's going to depend on how the data evolve,” Powell noted. He emphasised prudence, especially after the Trump administration's tariff hikes earlier this year led to a jump in inflation forecasts.

Core Arguments for Caution

-

Inflation: The Bureau of Labor Statistics reported that inflation rose by 2.7% year-on-year in June, outpacing the central bank's 2% target. Such data has “crushed” hopes for an imminent cut, with concerns that tariff-induced price rises could be more than a temporary bump.

-

Labour Market: US jobless claims fell by 7,000 in July, taking the total to 221,000 — indicative of ongoing resilience in employment, even as some policymakers warn of growing risks.

Growth Outlook: As of July, GDP growth is widely expected to soften, hovering near 1% annualised, and Fed officials remain divided on the risks of delaying a cut too long versus acting too early.

Voices Within the Fed: Dovish vs. Hawkish

Dissent remains amongst central bank officials, with Governor Christopher Waller one of the few pushing for a 25 basis-point rate cut in July. He argues that with inflation “close to the Fed's 2% target” once tariffs are accounted for, and as private sector hiring slows to “near stall speed,” policy should be more accommodative, warning that waiting could necessitate more aggressive action if economic conditions deteriorate.

However, this view remains in the minority. Most voting members and Chair Powell himself believe that while rate cuts will likely be appropriate “at some point during the four remaining meetings in 2025,” urgency is lacking. The Fed's current stance is described as “modestly restrictive, but not enough to prevent the economy from growing or to diminish the labour market”.

Shifting Market Focus: September and Beyond

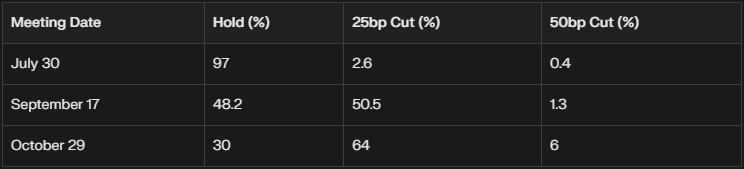

Investors and economists are now zeroing in on the September meeting, where the probability of a rate cut has climbed in recent weeks:

-

According to the CME FedWatch tool, as of mid-July, markets are pricing the odds of a September cut at 50.5%, with a further 1.3% chance of a larger 50 basis-point reduction.

-

Major institutions concur: Goldman Sachs analysts have revised their forecasts, now predicting the Fed will initiate a series of 25 basis-point cuts starting in September, continuing into October and December, with the terminal rate shifting to 3.0%-3.25% by year-end.

Futures on federal funds rates echo this, placing odds for a September cut at 64%, up from 58% before the last Fed decision, and strong expectations for an additional rate cut at the October meeting.

Traders' focus on September reflects persistent policy uncertainty, especially given ongoing tariff and trade policy developments.

Inflation, Tariffs, and Policy Uncertainty

Much of the policy debate now revolves around the inflationary impact of President Trump's 10% tariffs implemented in April, which the Fed believes could push 2025 inflation 0.75%–1% higher before effects fade next year. While some central bankers insist this warrants caution, others regard it as a one-off price level effect, not a trigger for sustained monetary tightening or hesitation to cut.

Chair Powell recently emphasised that the Fed is “fully prepared to wait for a clearer picture,” adding, “The net effect of trade, immigration, fiscal and regulatory policies is the factor that has the greatest impact on economic and monetary policy”. The risk remains that data could surprise, either with persistent inflation or a sudden labour market downturn.

The Broader Economic Context

Despite policy uncertainty, the broader US economy continues to show resilience:

-

GDP projections for Q3 stand around 1%, with headline growth slowing but still positive.

-

Labour force participation remains robust, though some data indicate that job searches — especially for new workforce entrants — are getting more difficult, signalling possible cracks beneath the surface.

Global partners, notably the ECB and Bank of England, have also paused rate adjustments this month, underscoring a worldwide shift towards data-driven, measured responses to inflation and growth headwinds.

Table: FOMC Meeting Probabilities (as of 21 July 2025)

Conclusion

While calls for rate relief are getting louder, July is unlikely to deliver a policy shift. The consensus among both officials and markets is for the Federal Reserve to remain on hold, assessing the effects of tariffs, inflation, and the employment landscape.

September's meeting now holds centre stage, with traders and economists increasingly convinced that a more accommodative stance is on the horizon, provided the data supports it in the intervening months. Attentive market-watchers will scrutinise every economic release and policy comment for clues on when the Fed's “patience” will give way to action.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.