Luxembourg is a small but influential country in Western Europe that plays a critical role in the European Union and global finance. Its vibrant economy, strategic location, and political stability have made it a banking, investment, and trading hub.

Many investors often ask: Is the euro the official currency of Luxembourg? The answer is yes, and the story involves a fascinating journey of economic integration, historical currency systems, and cross-border cooperation.

In this article, we'll explore Luxembourg's transition to the euro, its monetary history, why it matters today, and what this means for those investing in the Luxembourg currency.

Understanding Luxembourg's Currency Today

Yes, the euro (EUR, €) is Luxembourg's official currency. The country adopted the euro as its legal tender in 1999 for electronic and banking transactions and began circulating euro coins and banknotes in 2002 alongside other Eurozone countries. As a founding member of the European Union and a supporter of deeper European integration, Luxembourg was one of the earliest adopters of the common currency.

Today, the euro is used for all financial transactions in Luxembourg, including government payments, consumer purchases, wages, and investments. Like other Eurozone countries, Luxembourg uses euro coins with a national design on one side and the shared European side on the other.

A Brief History of Luxembourg's Currency Before the Euro

To fully understand the significance of the euro in Luxembourg, it's helpful to look back at the country's monetary history. Over the centuries, Luxembourg has used several different currencies, influenced by its changing political affiliations and economic alliances.

Use of Foreign Currencies in the 19th Century

Before creating a uniquely Luxembourgish currency, the region used various foreign currencies, including the French franc and the Dutch guilder, depending on which power held political or economic sway. This multi-currency landscape reflected Luxembourg's position as a small state surrounded by more dominant neighbours.

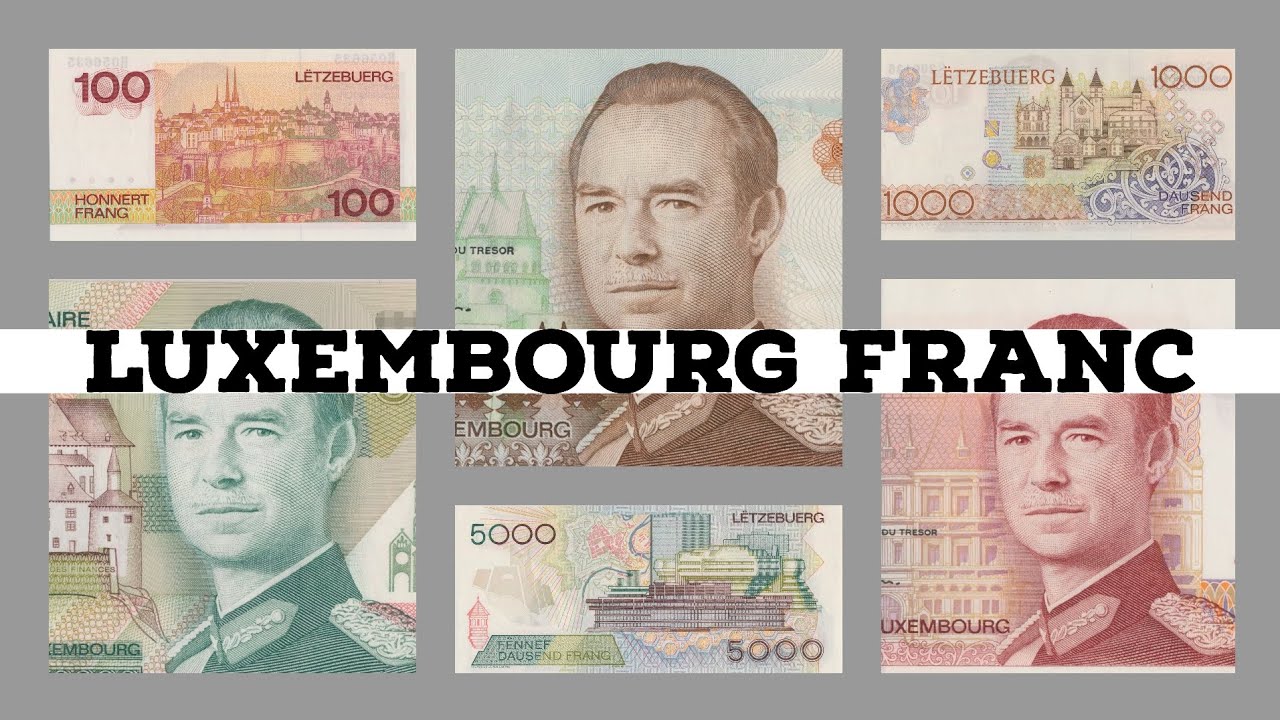

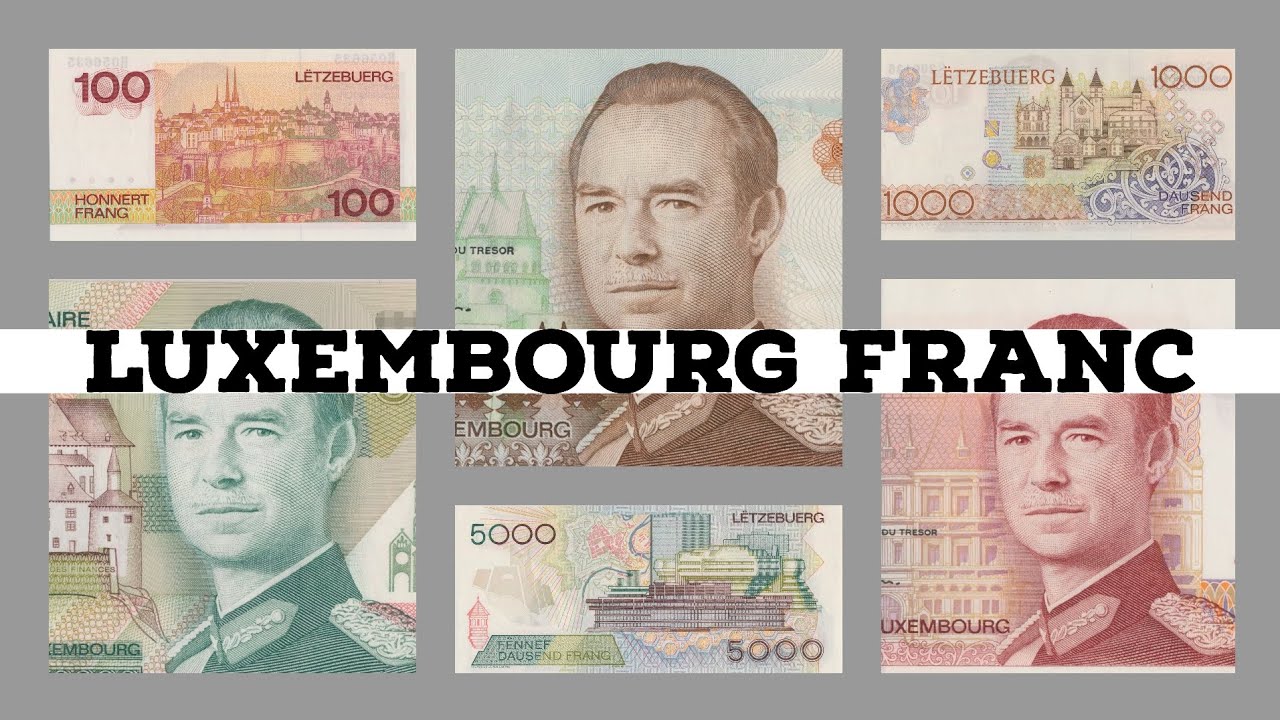

Creation of the Luxembourg Franc (LUF)

In 1854, Luxembourg established the Luxembourg franc (LUF) as its official currency, national identity and economic autonomy. Despite its status, the franc was never entirely isolated. Luxembourg formed a monetary union with Belgium in 1921, creating the Belgium-Luxembourg Economic Union (BLEU).

Under this agreement, the Luxembourg and Belgian francs were pegged at par value and circulated interchangeably. It allowed for greater economic cooperation while still retaining symbolic national currencies.

The Luxembourg franc remained in use for nearly 150 years until the introduction of the euro.

Adoption of the Euro in Luxembourg

Introduction of the Euro as a Book Currency

Luxembourg adopted the euro on January 1, 1999, in non-physical form. It meant that bank transactions, stock markets, accounting systems, and government finances were converted from the Luxembourg franc to the euro for official purposes. However, people still used franc banknotes and coins for everyday transactions then.

Physical Euro Currency Begins Circulating

On January 1, 2002, euro coins and banknotes officially entered circulation across the Eurozone, including Luxembourg. The country participated in the coordinated effort to replace its national currency with euro notes and coins, marking the end of the Luxembourg franc era.

During a short dual-circulation period, francs and euros were accepted, but by February 28, 2002, the euro became the sole legal tender.

Conversion Rate from Luxembourg Franc to Euro

The conversion rate was fixed at 1 euro = 40.3399 Luxembourg francs. This rate was applied universally to ensure the smooth conversion of prices, bank accounts, and financial records. After the transition, the Luxembourg franc ceased to be legal tender, although it remains exchangeable for euros under certain conditions.

What Happened to the Luxembourg Franc?

End of Circulation

The Luxembourg franc ceased legal tender in 2002, but its legacy remains. Old coins and notes are no longer accepted in shops, but many are exchangeable through the Banque centrale du Luxembourg (BCL).

Collectible Value

Some older Luxembourg franc banknotes and coins have numismatic value, especially those in good condition or with limited minting. Collectors seek these historical currencies for their unique designs and historical significance.

Comparing Luxembourg to Non-Euro Neighbours

Some European countries, such as Switzerland and the United Kingdom, have not adopted the euro, especially before Brexit. This situation results in differences in currency management, trade efficiency, and tourism appeal.

Luxembourg's full integration into the Eurozone gives it a strategic edge in trade and finance compared to neighbouring states that retain their national currencies. It also underscores the country's long-standing commitment to European unity and cooperation.

Conclusion

So, is the euro the official Luxembourg currency? Absolutely — and it has been for over two decades. Understanding how Luxembourg adopted the euro and the role of its former currency offers deeper insight into the country's political and economic evolution.

As global economic conditions evolve, the euro will continue to play a crucial role in shaping Luxembourg's position within the broader European and global economy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.