In finance, transparency is a cornerstone of trust and regulation. Yet, a lesser-known part of the market exists where trades happen out of sight of the public: dark pools. These private exchanges have sparked interest and controversy among investors and regulators alike.

The primary question people often ask is: Are dark pools legal? The short answer is yes, but the full explanation involves nuance, regulation, and implications for retail and institutional investors.

This article explores their definition, how they work, why they exist, the legality surrounding them, the controversies they invite, and what every investor, whether beginner or experienced, should know.

What Are Dark Pools?

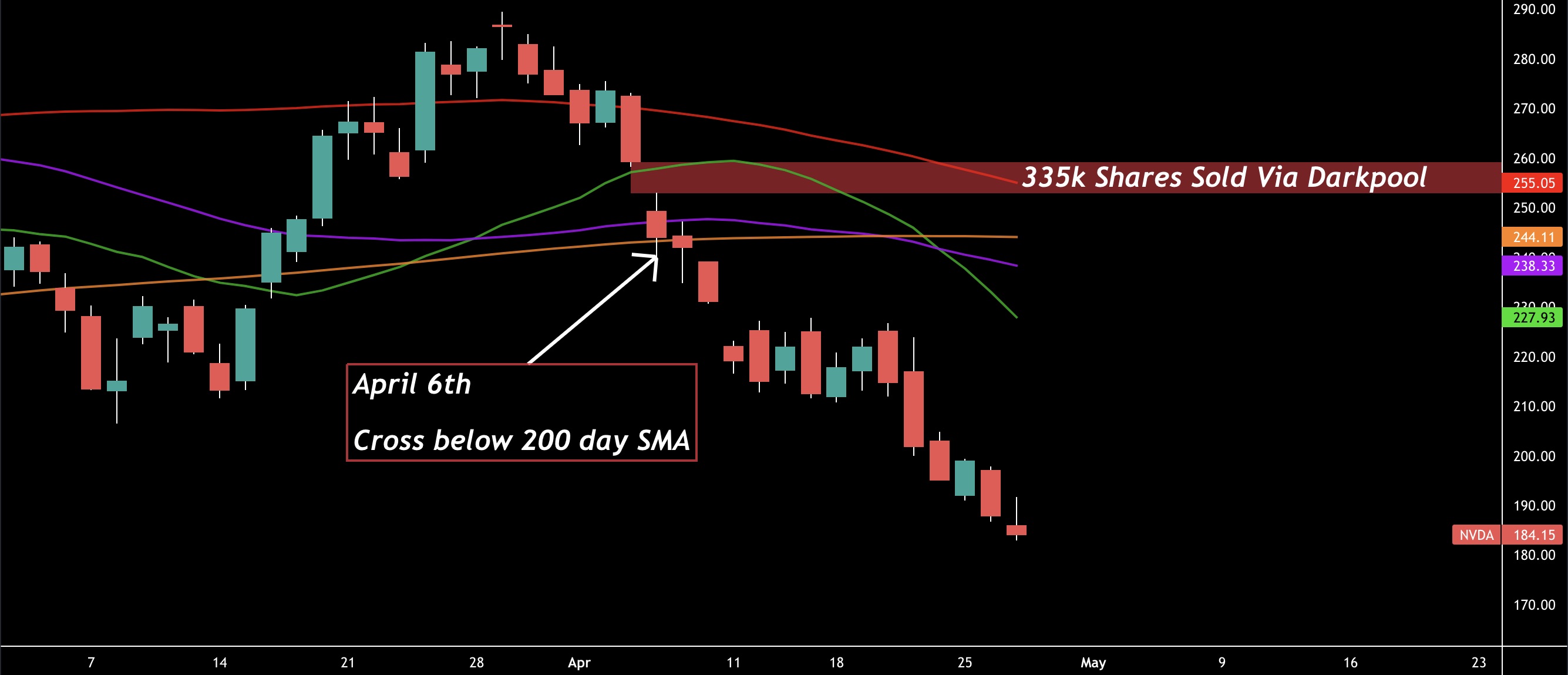

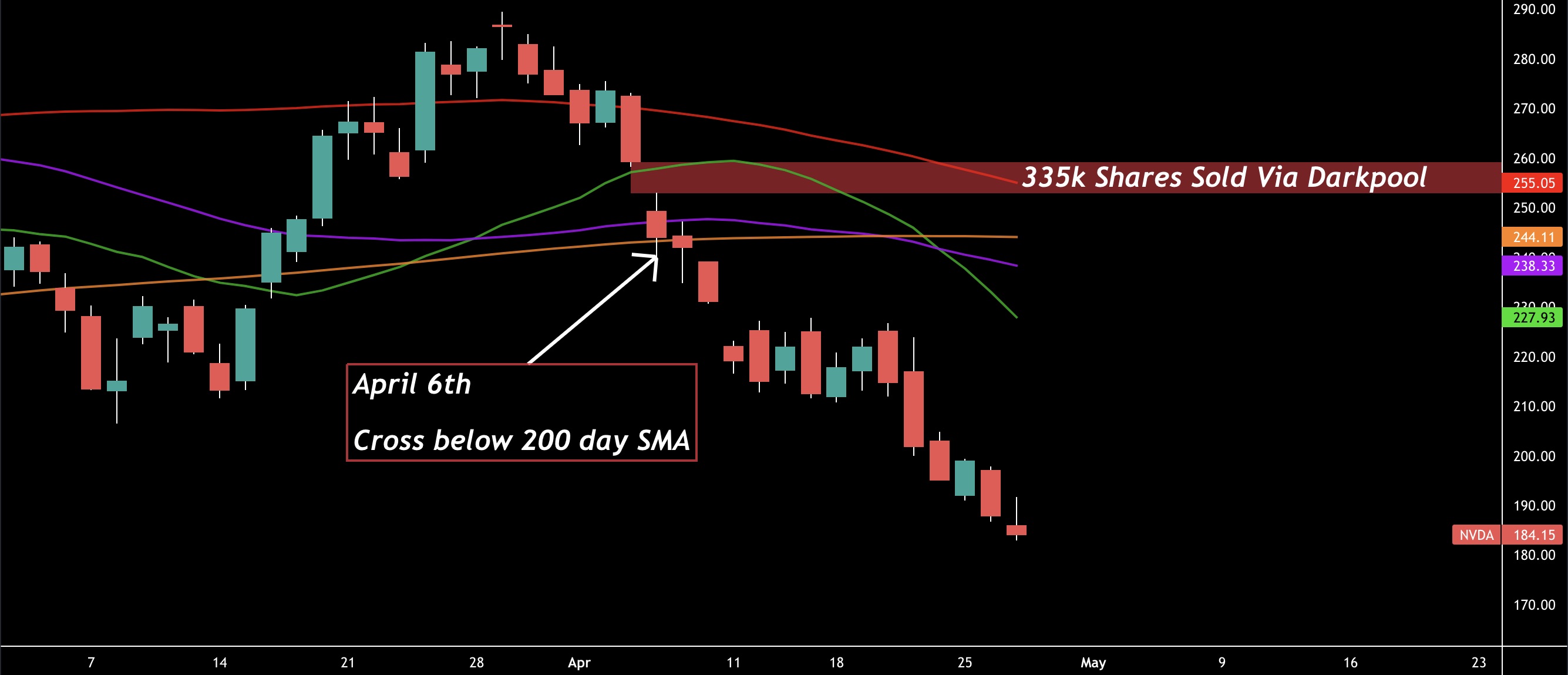

Dark pools are private trading venues where institutional investors such as hedge funds, pension funds, and mutual funds can trade large blocks of securities without displaying their orders publicly. Unlike traditional stock exchanges like the NYSE or NASDAQ, dark pools operate away from the public eye, where "dark" comes from.

The idea is simple: large investors don't want to move the market with their trades. For example, if a fund wants to sell 2 million shares of a company, placing that order in a public market would cause panic or a sharp price drop before the trade completes. A dark pool allows them to execute this large trade discreetly and, ideally, at a better price.

Dark pools are typically operated by:

While their names may sound shadowy, they function practically in today's fragmented and fast-moving financial markets.

Types

1. Broker-Dealer Owned Pools

These are operated by large brokerage firms, often to serve their clients. Examples include Credit Suisse's CrossFinder or Goldman Sachs' Sigma X.

2. Exchange-Owned Pools

Public exchanges, like the NYSE, also operate dark pools as alternative venues to attract institutional trading volume. These are often referred to as "off-exchange venues."

3. Agency Broker or Consortium Pools

These are generally utilised to match client orders without taking positions, thus minimising conflicts of interest. Understanding the type of dark pool used can assist investors in evaluating the associated risk and transparency levels.

How Do Dark Pools Work?

Dark pools function similarly to public exchanges, but with one key difference: order books are not displayed publicly. It means that buy and sell orders are not visible until the trade is executed. Here's how they generally operate:

Order Placement: An institution places a buy or sell order into the dark pool.

Matching: The system searches for a counterparty. If there's a match, the trade is executed internally.

Trade Reporting: Once executed, the trade is eventually reported to regulators, although often with a delay.

These trades are subject to reporting rules set by financial regulators, though the level of transparency is lower than in public markets. The lack of pre-trade transparency is what characterises these venues.

Purpose

1. Minimising Market Impact

Large trades executed on public exchanges can lead to significant price changes. For example, if an institutional investor wishes to purchase millions of shares of a stock, making that order public could increase the price.

Similarly, a large sell order could cause a crash. By trading in a dark pool, these participants reduce the chance of market distortion.

2. Improved Execution Prices

Since dark pool trades are not visible to the public, participants can often achieve better pricing. This environment reduces front-running, which occurs when traders exploit large orders by placing their trades ahead of them in public markets.

3. Anonymity

Institutional investors don't want their strategies revealed. Dark pools maintain confidentiality, allowing them to move large sums without exposing their intentions to competitors or the broader market.

Are Dark Pools Legal?

Yes. Dark pools are legal in the United States and many other jurisdictions, provided they comply with regulatory requirements. In the United States, dark pools are primarily regulated by the Securities and Exchange Commission (SEC) under Regulation ATS (Alternative Trading System).

Register with the SEC as an ATS

Submit regular reports and data

Provide access to regulators for oversight

Abide by fair access and best execution rules

They are also subject to FINRA (Financial Industry Regulatory Authority) oversight, ensuring compliance with fair trading standards.

That said, while the concept of dark pools is legal, abuse or misuse of dark pools is not. Any deceptive or manipulative practices like favouring clients or engaging in predatory trading, can lead to regulatory penalties.

Major Legal Cases and Investigations

1) Barclays Dark Pool Scandal (2014)

Barclays faced allegations from the New York Attorney General for misleading clients about the extent of high-frequency trading in its dark pool, known as LX. To resolve the case, the firm agreed to pay $70 million and implement reforms in its trading practices.

2) Credit Suisse and Liquidnet Fines

In 2016, Credit Suisse settled for $84 million to resolve claims of misrepresentation related to its dark pool operations. Similarly, Liquidnet, another dark pool operator, incurred fines for improper use of client information.

These cases highlight that while dark pools are legal, misconduct within them is not, and regulators are increasingly watching.

What Investors Should Know

Regulatory Oversight and Reforms

Regulatory bodies have taken steps to increase transparency and accountability in dark pool trading:

1. Regulation ATS (Alternative Trading System)

This rule requires operators of dark pools to register and report trading volumes, participant data, and system operations to the SEC.

2. FINRA's Trade Reporting

FINRA mandates the timely reporting of trades executed in dark pools. The Trade Reporting Facility (TRF) captures and publishes data to ensure post-trade transparency.

3. SEC Rule 605 and Rule 606

These rules emphasise the quality of order execution and the transparency of routing, requiring brokers to disclose how they route client orders and the execution quality of those transactions.

4. MiFID II in the EU

While not directly applicable to U.S. markets, the European Union's Markets in Financial Instruments Directive (MiFID II) has limited dark pool usage by enforcing volume caps and increasing disclosure requirements.

Advantages and Risks

Like any trading system, dark pools offer advantages and disadvantages:

Pros:

Reduced market impact for large trades

Improved anonymity and confidentiality

Potentially better execution prices

Lower trading costs in some cases

Cons:

Limited transparency

Potential for unfair advantages

Fragmentation of market liquidity

Susceptibility to misuse or manipulation

Conclusion

In conclusion, dark pools are a legal and functional element of modern financial markets to facilitate large-volume trades without causing unnecessary market disruption. While they benefit institutional players, they also raise significant questions about fairness and transparency.

Though controversial at times, dark pools are not inherently harmful. Like any financial tool, their impact depends on how they're used and regulated. For now, they remain a legal and integral component of the trading ecosystem, albeit one that demands constant vigilance from regulators and market participants alike.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.