The world's sovereign wealth funds are turning to long China, while central

banks are diversifying reserves to weather a volatile global environment, an

Invesco survey of sovereign funds and central banks showed.

They are seeing a major resurgence in interest in Chinese assets with nearly

60% intending to increase allocations there in the coming five years,

specifically the tech sector.

Notably the survey was carried out before Trump's "Liberation Day" tariff

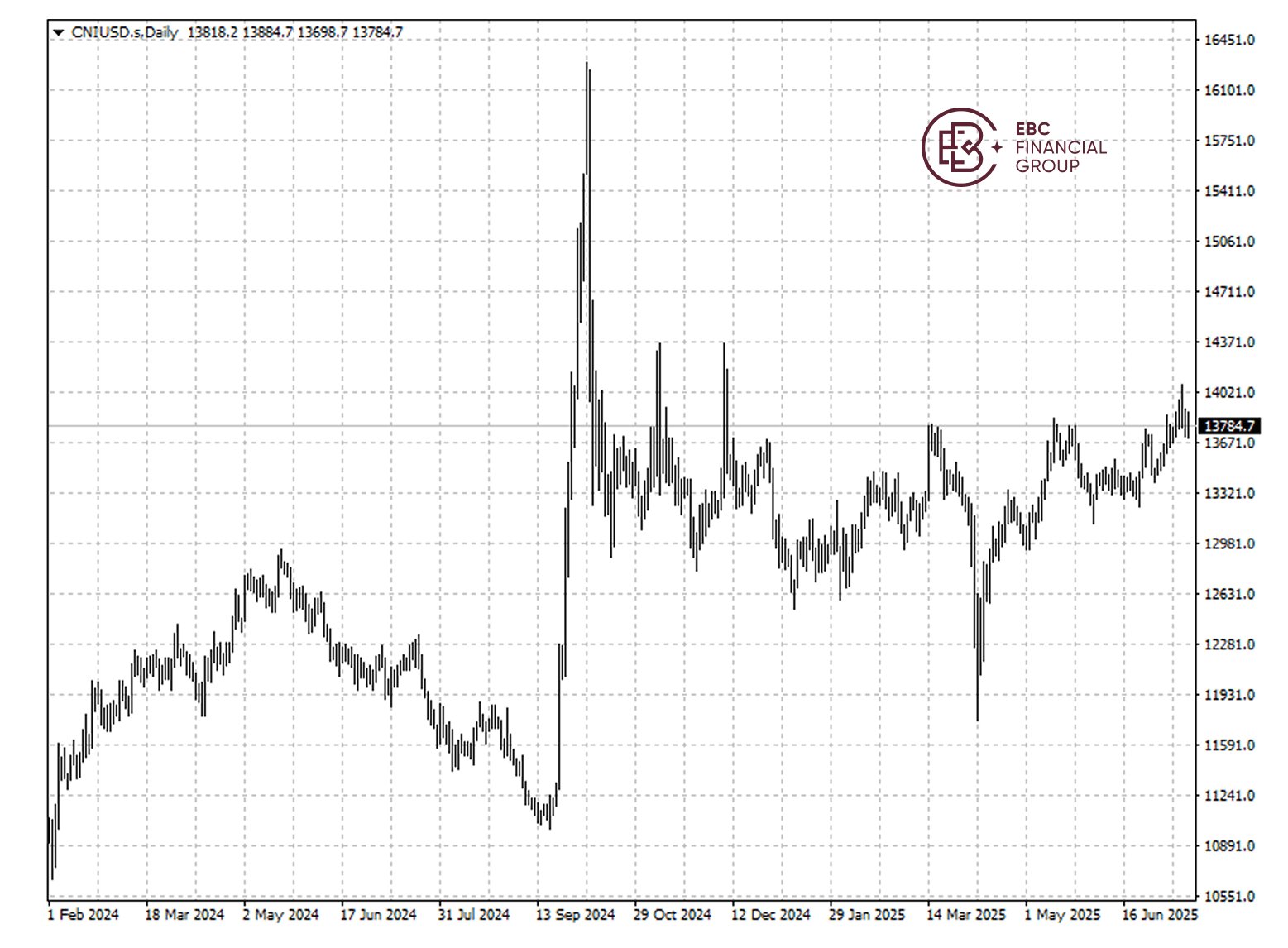

announcements, which has turned out to be prescient. The A50 index is set to

notch a third straight monthly gain.

China shapes up to be a global leader in semiconductors, cloud computing, AI,

EV and renewable energy, which prompted FOMO-driven buying, said Rod Ringrow,

Invesco's head of official institutions.

In contrast, over 70% of the central banks polled said rising US debt is

negatively impacting the dollar's long-term outlook. Two thirds said they are

looking to build larger, more diversified reserves to manage volatility.

But retail investor sentiment in the market remains neutral. Most of them

have barely benefited from the A50's uptrend and high trading volume this year

as the breadth of the rally is narrow.

Megacap banking stocks are on a record breaking steak, helped by funds in an

attempt to see higher return. China 10-year government bond yield is languishing

around the historical lows.

Anti-involution

Central government pledged to regulate "disorderly" price competition at a

high-level meeting earlier. Overcapacity has hurt profitability in sectors

ranging from solar, new energy vehicles to steel.

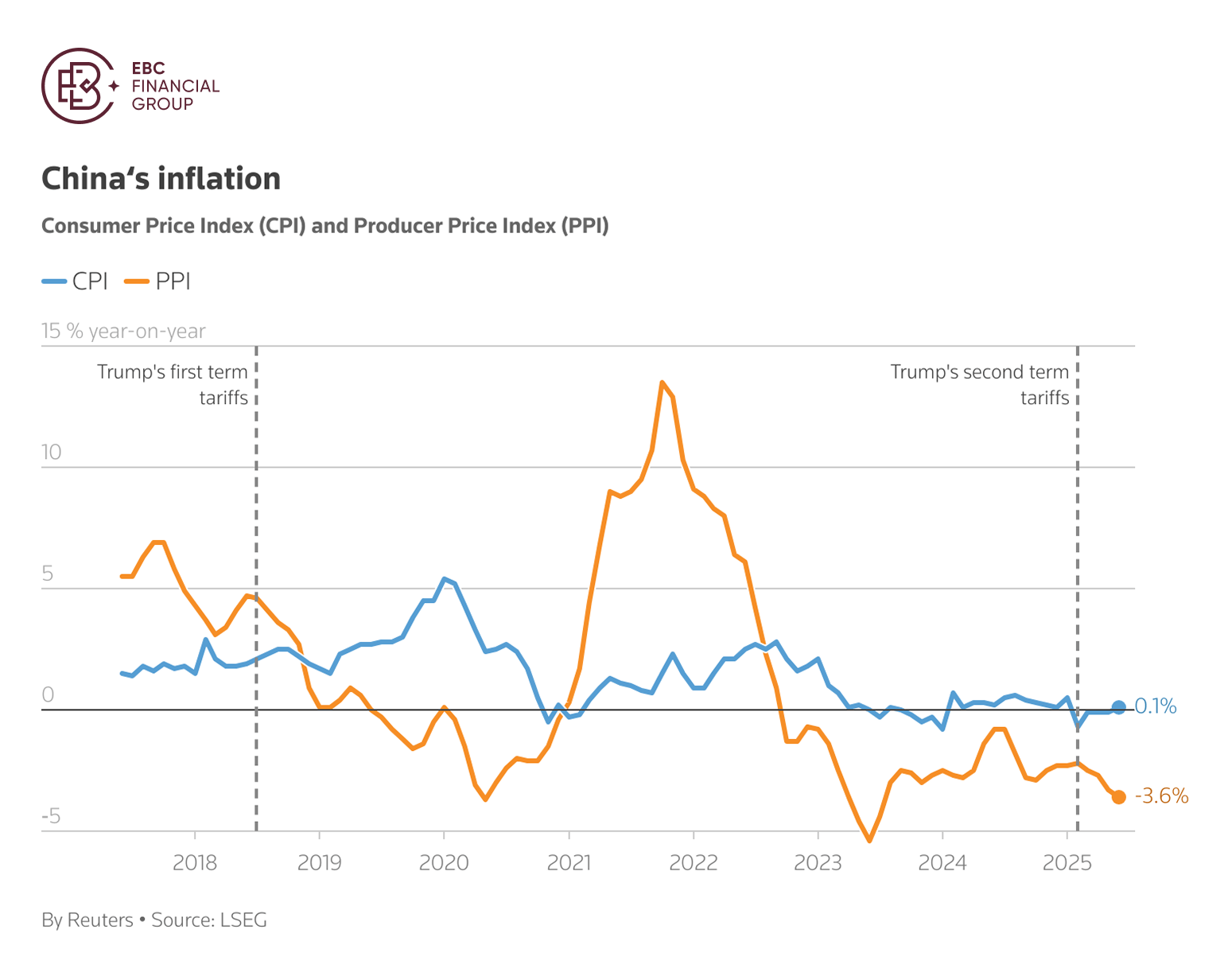

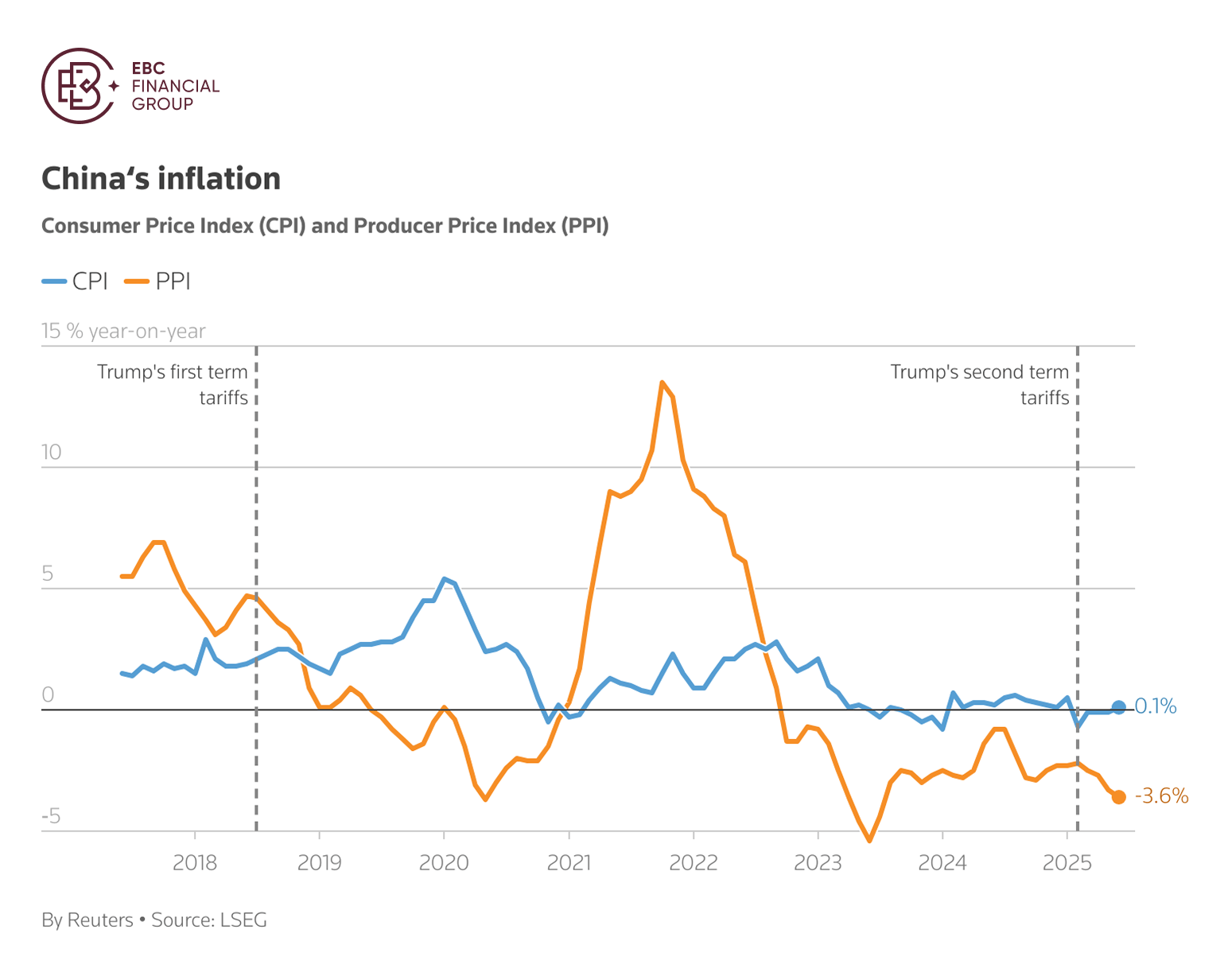

A more coordinated policy response to tackle the drivers of deflation is

needed to curb aggressive price-cutting biting into businesses, though Beijing

has not yet released any major plan.

PPI plunged 3.6% in June from a year earlier, marking its largest decline in

nearly two years. Profits at industrial firms plunged 9.1% in May from a year

earlier, marking the steepest fall since October last year.

While the current rhetoric recalls the supply-side reforms of 2015-2018,

there are key differences this time. Oversupply has spilled over to downstream

sectors and hence more tricky.

Morgan Stanley strategists said sentiment has improved with the government's

message, and added they now prefer A-shares over offshore ones. The Hang Seng

index has greatly outperformed in 2025.

The country risks a spiral into deeper deflation as it diverts US-bound

exports to domestic market. The PBOC cut interest rates in May before China and

the US agreed on a trade framework weeks ago.

Despite monetary loosening, the banking sector offering lucrative dividend

yields may still have room to run. The yuan's stability is another potential

tailwind, drawing more foreign inflows.

A pivot to consumption

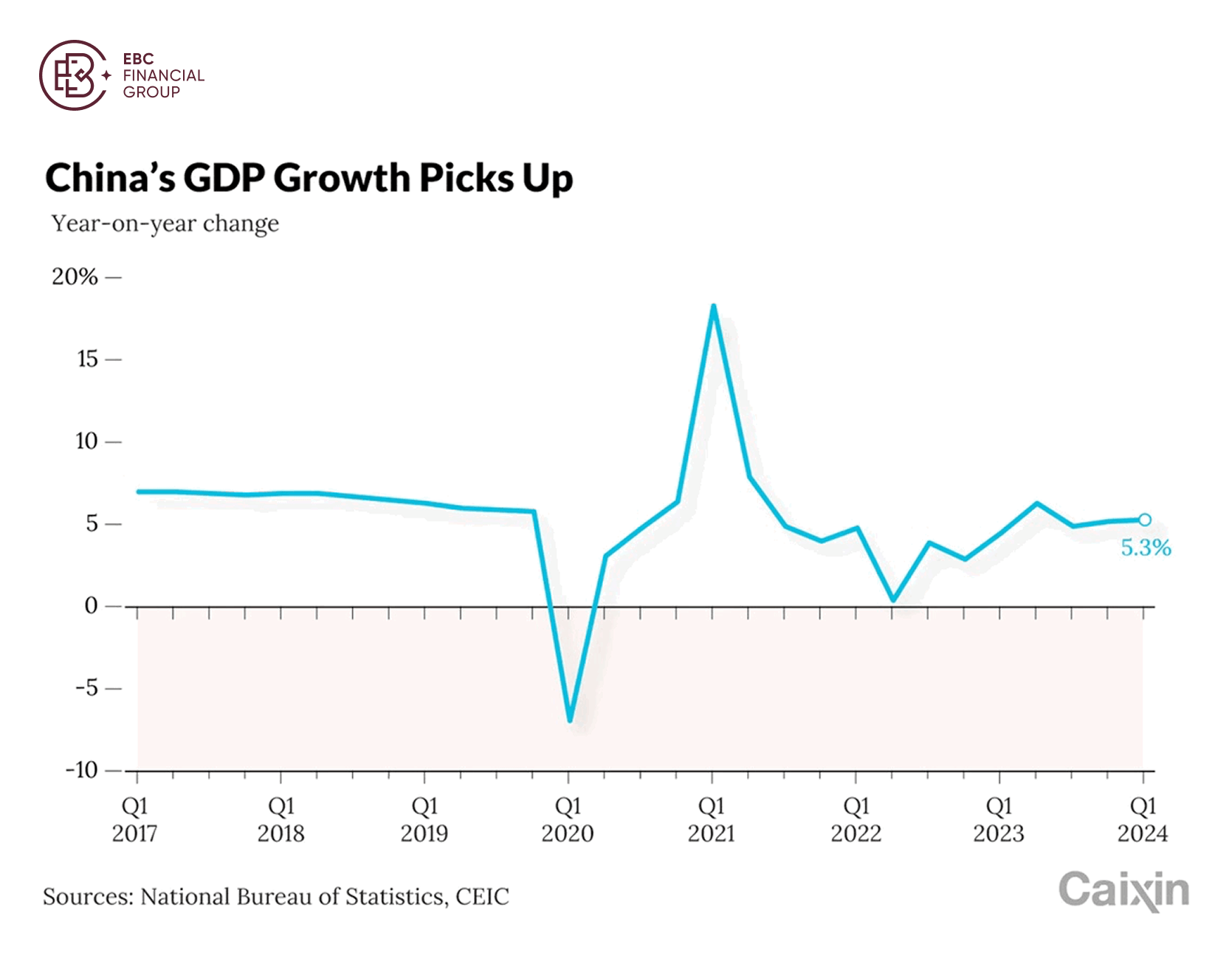

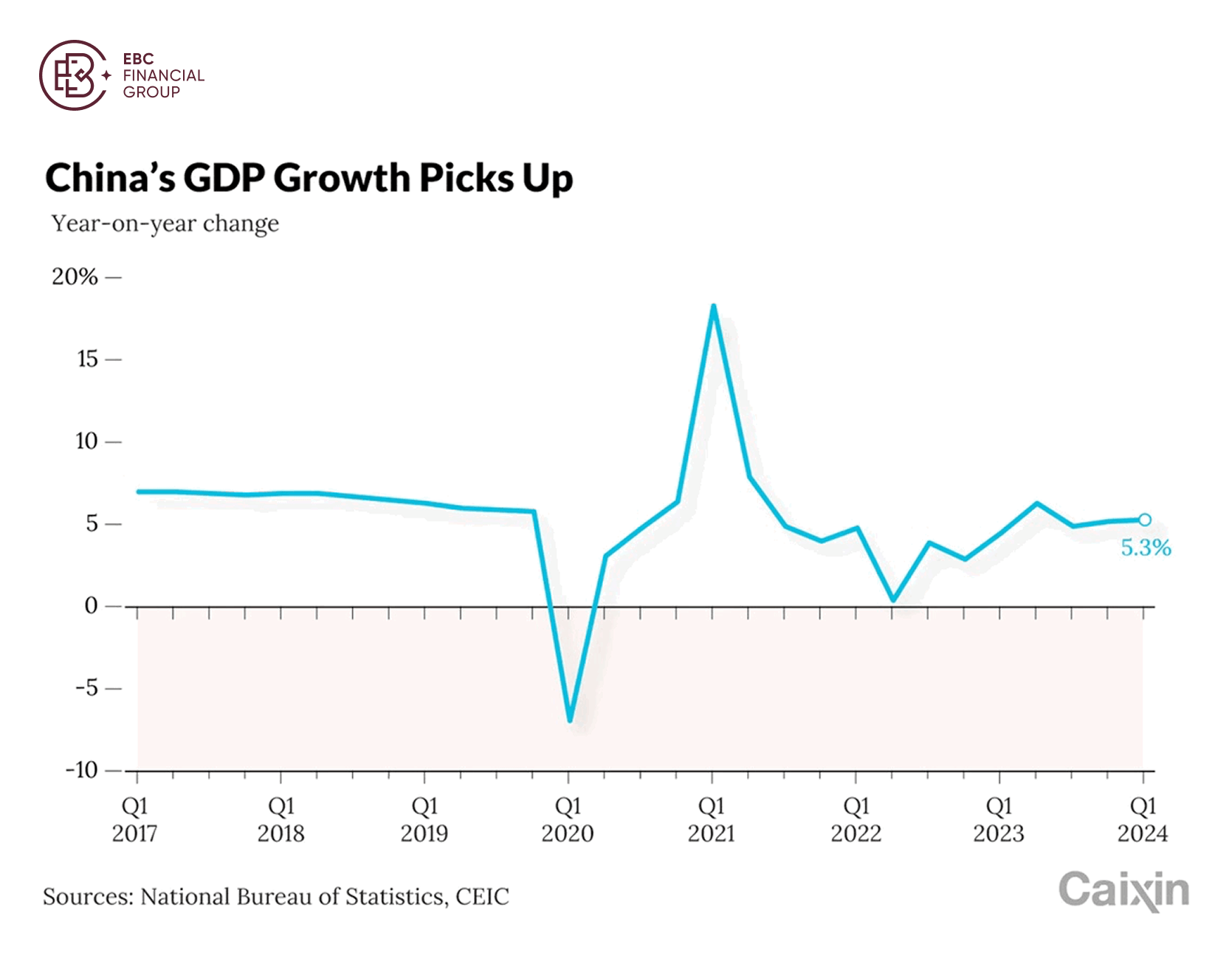

China's GDP grew at a faster-than-expected rate in Q2, keeping the country on

track to meet its full-year target of 5%. Though beating estimates of a 5.1%

growth, it represented a slowdown from the 5.4% in Q1.

Exports remain largely resilient this year. US-bound shipment shrank 10.9%

year on year as of June, while exports to Southeast Asia nations and the EU

jumped 13% and 6.6%, respectively.

Rare earths shipment rebounded significantly from the month before, in a sign

that agreements struck between Washington and Beijing to free up the flow of the

metals were possibly bearing fruit.

But Trump is pressuring third countries used heavily for transshipments of

Chinese goods and has warned of a 10% charge on imports from brics members, a

move that could strain Chinese manufacturers.

Retail sales growth slowed to 4.8% from a year earlier with catering sales

registering its worst performance since December 2022. EV boom is cooling, while

home sales have shown few signs of recovery.

However, consumption contributed to 52% of GDP in the first half of the year,

said Laiyun Sheng, deputy commissioner at the NBS, highlighting that the share

of consumption rose in Q2.

An uptick in household spending is pivotal to a more sustainable broadening

out and participation given heavy weighting of liquor stocks in the A50. The

road seems bumpy heading into Q4.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.