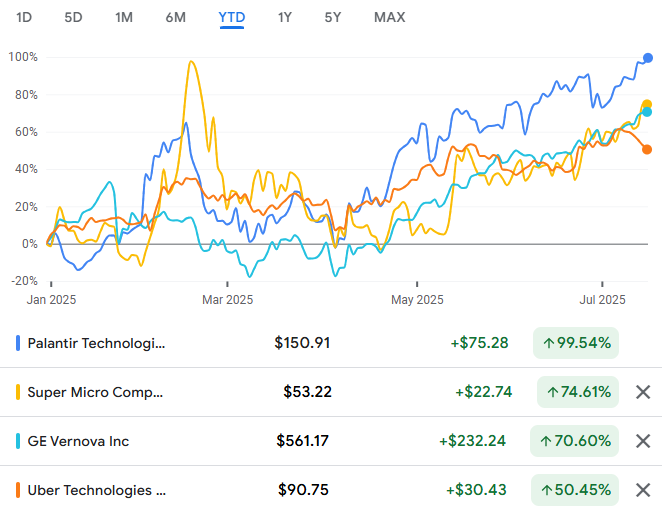

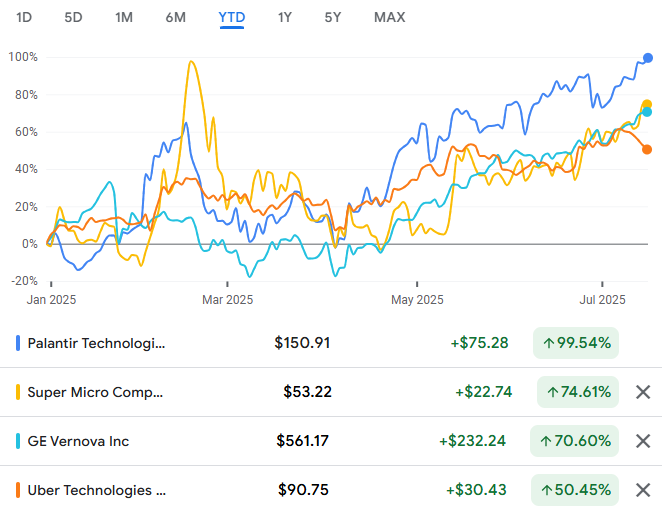

As the first half of 2025 closes, the global technology sector has continued to dominate investor attention, with several standout names notching remarkable year-to-date (YTD) gains. Amid the broader S&P 500 rise and a renewed race for artificial intelligence (AI) and digital infrastructure leadership, stocks such as Palantir Technologies (PLTR), GE Vernova (GEV), Super Micro Computer (SMCI), and Uber Technologies (UBER) have surged, delivering exceptional returns and outperforming many sector peers.

AI and Analytics Propel Palantir to New Heights

Palantir Technologies (PLTR) has emerged as one of 2025's top technology sector growth stocks, registering an impressive 80% gain YTD as of mid-July. Shares climbed to around $61 from $33 at the outset of the year, reflecting optimism over Palantir's evolving role as a strategic government technology supplier and a frontrunner in enterprise AI solutions. The company's Artificial Intelligence Platform (AIP) has witnessed expanded adoption, particularly by US government agencies and Fortune 500 firms seeking robust data analytics and secure decision support systems.

Palantir's Q2 2025 results beat Wall Street expectations with reported revenue of $865 million, up 36% year-over-year. Government contracts accounted for $530 million, including new multi-year agreements for defence AI systems and cyber threat detection.

The debut of AIP 2.0 contributed to Palantir's commercial revenue growth, with the customer base in the private sector expanding by over 30% from the previous quarter.

The company maintained positive adjusted earnings per share (EPS) of $0.19, compared to $0.11 in Q2 2024, underlining improved operational efficiency and margin expansion.

GE Vernova: Energy Transformation Powers Growth

GE Vernova (GEV) has captivated market attention by delivering a 54% YTD gain. Debuting on the NYSE in April after the General Electric (GE) split, GE Vernova is now a pure-play, publicly traded entity focused on clean energy infrastructure, renewables, and grid modernisation.

GEV shares opened at $29.50 and traded above $45 by mid-July, buoyed by robust Q2 earnings and positive guidance for full-year 2025.

Q2 2025 earnings posted a 22% year-over-year revenue increase, led by demand for advanced wind, solar, and grid digitalisation solutions. International projects in the EU and Asia contributed significantly, with the company securing new multi-year supply contracts in Germany and India.

GE Vernova has accelerated investments in AI-driven power grid optimisation and large-scale battery storage, strengthening its pipeline of next-generation energy solutions.

Super Micro Computer Surges on AI Hardware Demand

Super Micro Computer (SMCI) recorded a striking 61% rally in 2025, making it one of the best-performing S&P 500 constituents for the year so far. SMCI, headquartered in San Jose, California, provides specialised servers and data centre solutions optimised for AI, cloud computing, and high-performance workloads.

The company's Q2 2025 revenue surged 45% year-over-year, reaching $3.45 billion. Demand was propelled by hyperscale data centre expansions and partnerships with major AI chipmakers, including Nvidia.

Super Micro rolled out new “green computing” architectures, emphasising energy efficiency and total cost of ownership for enterprise customers.

The company now counts cloud giants and AI-driven enterprises among its largest clients, including Amazon Web Services and Meta Platforms.

Uber Technologies: Mobility and Platform Expansion Fuel Gains

Uber Technologies (UBER) has delivered a robust 54.7% YTD return, with shares rocketing from $58 to over $90 during the period. Uber's earnings momentum has been driven by record gross bookings and a profitable shift in both mobility and delivery verticals.

Q2 2025 saw total gross bookings reach $42.6 billion, up 23% over Q2 2024. Net income stood at $1.15 billion, buoyed by gains in both ride-hailing and Uber Eats.

Expansion into autonomous delivery trials and increased market share in the Asia-Pacific region added substantial top-line growth.

Uber finalised new agreements with automakers to expand its electric vehicle fleet, aligning the platform with broader transportation industry trends.

Table: 2025 YTD Performance Snapshot

Sector Drivers and Investment Implications

The exceptional performance of these technology sector growth stocks can be traced to several key trends:

Widespread enterprise and government deployment of AI platforms has unlocked new revenue streams, especially for analytics specialists like Palantir and infrastructure suppliers such as Super Micro Computer.

GE Vernova has capitalised on the accelerating push for clean energy infrastructure and digital grid solutions, with global policy and investment tailwinds.

Uber's platform expansion into new markets and transportation modalities continues to draw investor interest for sustainable revenue growth.

Investors have rotated into tech sector leaders that demonstrate strong earnings growth, resilient demand, and exposure to megatrends like AI and decarbonisation.

Despite these standout gains, analysts caution that rich valuations, fluctuating interest rate expectations, and shifting global trade policies could inject further volatility into tech and growth stocks in the coming months. As always, rigorous research and a diversified approach remain prudent.

Conclusion

With the second half of 2025 underway, Palantir, GE Vernova, Super Micro Computer, and Uber are likely to remain at the core of investor watchlists as bellwethers for both technological innovation and financial performance. Earnings season, product pipeline updates, and global policy developments will continue to drive share price action. Whether this pace of growth can be sustained will depend on both company execution and broader macroeconomic forces.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.