Greece is a country with a rich economic history, and its currency journey reflects centuries of change and adaptation.

If you're wondering what currency Greece uses today and why it made the switch, this article explores the historical context, the transition from the drachma to the euro, and the impact of this change on the Greek economy.

What Currency Does Greece Use Today?

Greece’s official currency is the euro (EUR, €), adopted on 1 January 2002 upon joining the Eurozone. The euro replaced the drachma, aligning Greece with the European Union’s monetary framework.

Using the euro allows Greece to benefit from price stability, lower transaction costs, and deeper access to European capital markets. It also strengthens investor confidence by anchoring Greece to the European Central Bank’s (ECB) monetary policy.

This is a key factor supporting credit ratings and long-term fiscal credibility.

What Was the Currency in Greece Before the Euro?

Before the euro, Greece's currency was the drachma, a name with deep roots in both ancient and modern Greek history. The drachma was one of the world's oldest currencies, used in Greek city-states as early as the 6th century BC.

Before the euro, Greece's currency was the drachma, a name with deep roots in both ancient and modern Greek history. The drachma was one of the world's oldest currencies, used in Greek city-states as early as the 6th century BC.

After Greece gained independence from the Ottoman Empire, the modern drachma was reintroduced in 1832, replacing the short-lived phoenix.

The drachma remained Greece's official currency until 2002, with various redesigns and revaluations over the years.

The final exchange rate was fixed at 340.75 drachmas to one euro when the transition occurred in 2001, with the euro officially entering circulation in 2002.

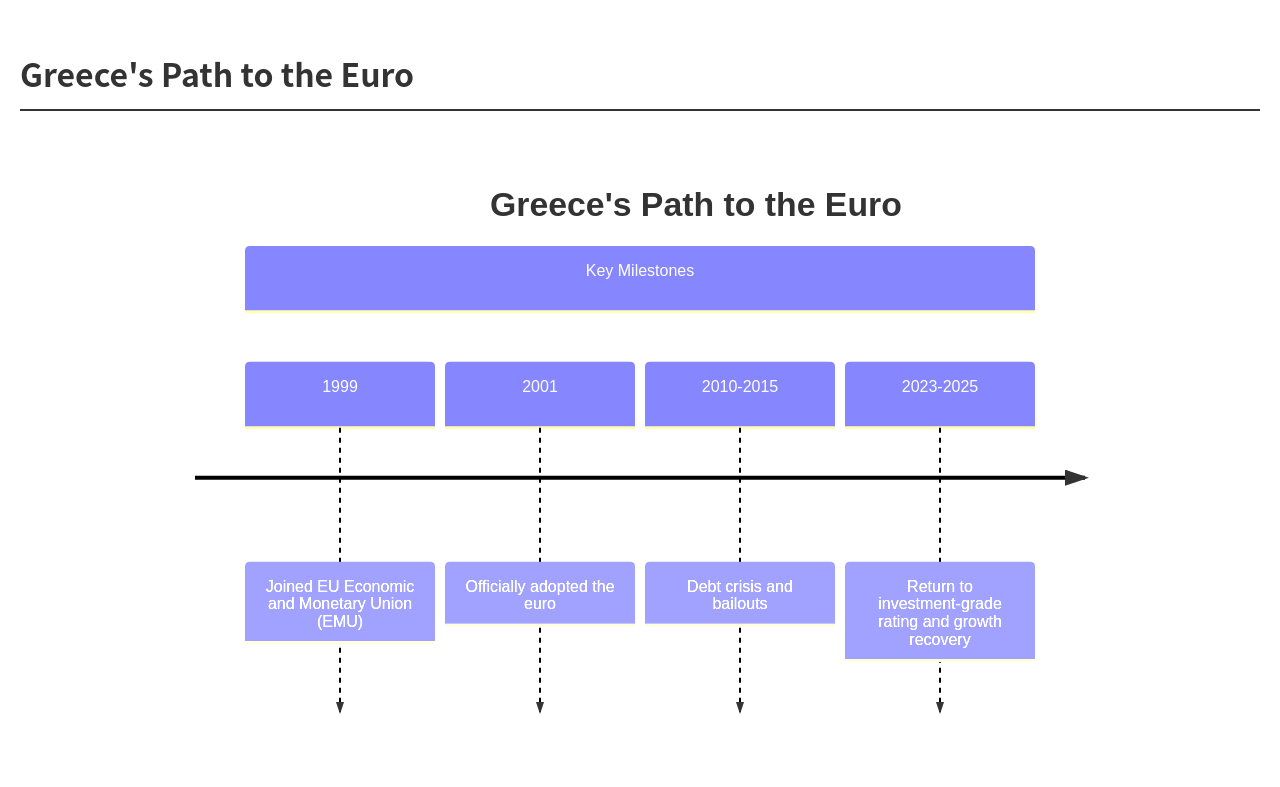

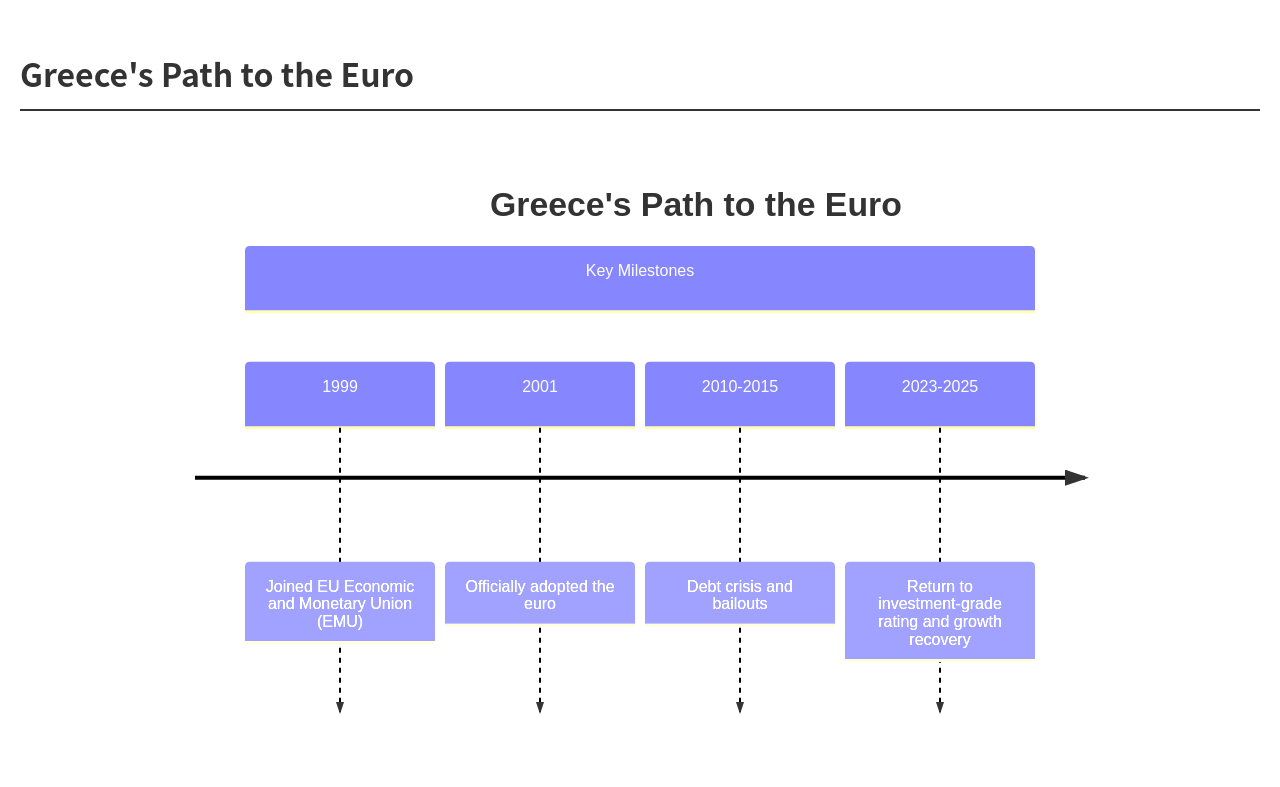

The Transition: From Drachma to Euro

The transition to the euro was a significant milestone in Greece's economic history. In 2001, the exchange rate was fixed, and by January 2002, euro notes and coins replaced the drachma in everyday use.

The process was carefully managed to ensure a smooth changeover for businesses and the public.

Why Did Greece Change Its Currency?

1. Joining the European Union and Eurozone

The primary reason for Greece's currency change was its entry into the European Union and, more specifically, the Eurozone.

By adopting the euro, Greece joined a single currency area that aimed to promote economic integration, trade, and stability among member states.

2. Economic Stability and Growth

Switching to the euro brought several potential benefits:

Stronger Currency: The euro was much stronger and more stable than the drachma, which had suffered from inflation and devaluation.

Lower Transaction Costs: Using the euro eliminated the need for currency exchange with major European partners, making trade and travel easier.

Access to Aid and Investment: As a Eurozone member, Greece gained access to financial support and investment from other EU countries, especially during times of crisis.

3. Modernisation and Globalisation

Adopting the euro was also a step towards modernising the Greek economy and integrating more fully with global markets.

It made Greece more attractive for international business and tourism, as visitors could use the same currency across much of Europe.

The Impact Of Changing From Drachma to Euro

For investors, Greece’s move to the euro reshaped its economic landscape, strengthening market confidence but also limiting policy flexibility. The table below highlights the main effects on trade, stability, and fiscal control.

| Positive Effects |

Challenges |

| The euro made Greece more accessible to European travellers and boosted trade. |

Greece lost control over its own interest rates and currency devaluation. |

| EU and IMF support during the debt crisis helped stabilize the economy. |

Strict Eurozone fiscal rules led to years of austerity. |

| The euro’s stability reduced exchange-rate risks for investors and businesses. |

The debt crisis triggered “Grexit” fears, creating uncertainty for markets. |

The Future Of Greece’s Economy: Market Outlook

Greece is in a steady recovery phase: real GDP growth of roughly ~2.0 -- 2.3% in 2025, supported by tourism, rising domestic consumption, and EU recovery funds; headline inflation is moderating but services inflation remains sticky.

The government has returned to running primary surpluses, and sovereign yields have fallen into the low-3% range for the 10-year bond.

Most official forecasts point to continued, modest growth, about 2.0 -- 2.4% in 2025–2026 as tourism and construction lead the expansion and EU Recovery & Resilience disbursements lift investment.

Growth is likely to slow later (structural issues: ageing population, productivity drag) unless reforms and investment pick up pace.

Investor takeaway: Expect steady but unspectacular GDP growth which is good for selective cyclical exposure (tourism, construction, domestic services), less so for over-leverage on long-term growth bets.

Risks To Keep Watch

External demand shock: slower EU growth or new trade barriers could hit exports and tourism.

Policy slippage: weaker reform momentum or poor RRF absorption would slow investment.

Inflation & rates: sticky services inflation could keep ECB-sensitive rates higher for longer, pressuring consumption and bond markets.

Geopolitical shocks: regional instability would proportionally hit tourism and sentiment.

Frequently Asked Questions (FAQ)

1. Is Greece’s economy stable for investment?

Yes. Growth is steady, debt is improving, and reforms are ongoing, though external risks remain.

2. What sectors look promising in Greece?

Sectors that look promising in Greece are tourism, renewable energy, shipping, and infrastructure.

3. How does Greece compare in the EU?

Greece is growing faster than many southern EU economies with improving investor confidence.

Summary

Greece’s economy in late-2025 is stabilising: modest 2%-plus growth, improving public finances, and lower sovereign risk have reopened investor opportunities across bonds, banks, tourism, and infrastructure.

The progression is pragmatic not boom, and rewards selective, reform-aware investments while keeping an eye on external demand and inflation risks.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.