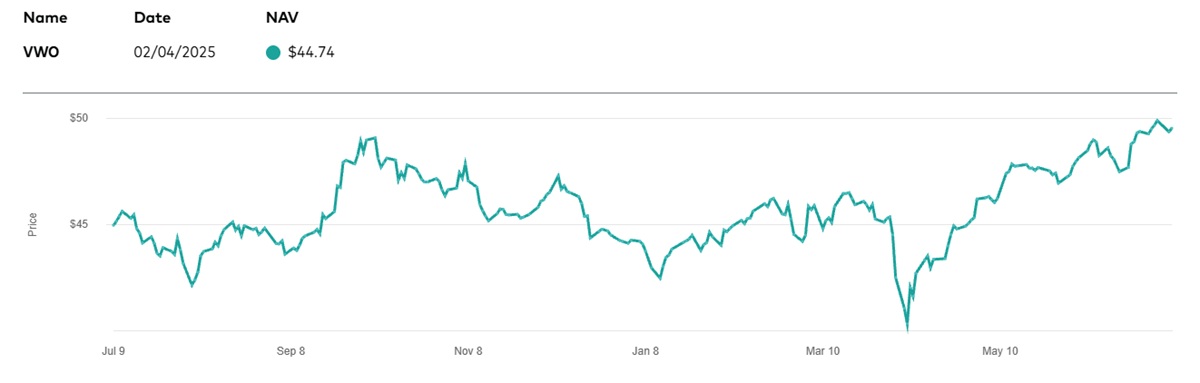

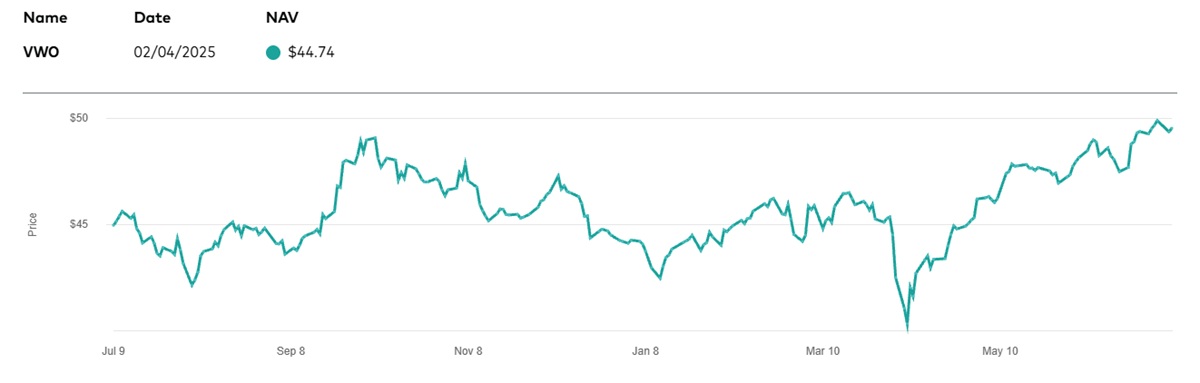

Emerging markets often sit at the crossroads of volatility and opportunity. While they come with unique challenges—political risk, currency swings, and regulatory unpredictability—they also offer exposure to fast-growing economies, rising consumer demand, and untapped innovation. For investors seeking long-term global diversification, the Vanguard FTSE Emerging Markets ETF (VWO) offers a simple, low-cost way to participate in that growth without picking individual stocks or navigating foreign exchanges.

With billions in assets and thousands of holdings, VWO has become a core building block for those looking beyond developed markets to capture the potential of the world's rising economies.

What is VWO?

The Vanguard FTSE Emerging Markets ETF (VWO) is an exchange-traded fund that seeks to track the performance of the FTSE Emerging Markets All Cap China A Inclusion Index. This index includes large-, mid-, and small-cap companies from over 20 emerging market countries.

The Vanguard FTSE Emerging Markets ETF (VWO) is an exchange-traded fund that seeks to track the performance of the FTSE Emerging Markets All Cap China A Inclusion Index. This index includes large-, mid-, and small-cap companies from over 20 emerging market countries.

VWO was launched in March 2005 and is managed by Vanguard, one of the world's largest and most reputable asset management firms. It was designed to give investors access to a broad range of companies in fast-growing economies, without the need to purchase individual stocks or manage foreign exchange accounts.

The fund is passively managed and aims to mirror the index's performance, making it suitable for long-term investors seeking to capture the overall growth of emerging markets over time.

Size, Liquidity & Fees

As of mid-2025. VWO holds over $90 billion in assets under management (AUM), making it one of the largest ETFs dedicated to emerging markets. Its liquidity is strong, with high average daily trading volume and a tight bid-ask spread, which helps reduce trading costs for investors.

As of mid-2025. VWO holds over $90 billion in assets under management (AUM), making it one of the largest ETFs dedicated to emerging markets. Its liquidity is strong, with high average daily trading volume and a tight bid-ask spread, which helps reduce trading costs for investors.

One of VWO's key selling points is its low expense ratio. Currently, the fund charges 0.08% annually, significantly lower than many competing emerging markets ETFs. This low fee structure is a core feature of Vanguard's philosophy and is particularly attractive for cost-conscious investors.

Its size and liquidity also make it a solid option for both retail and institutional investors who want reliable access to emerging markets exposure without worrying about slippage or illiquidity.

Geographic & Sector Exposure

VWO provides broad geographic diversification across emerging economies. Its largest country allocations as of 2025 are:

China – approximately 29%

India – around 24%

Taiwan – about 19%

Brazil, south africa, and saudi arabia – smaller but significant weightings

Unlike some peer funds, VWO includes China A-shares, which are mainland China-listed stocks that were previously hard for international investors to access. This inclusion enhances its representation of China's economy, which plays a crucial role in the global market.

In terms of sector exposure, VWO is balanced across:

Financials

Technology

Consumer discretionary

Energy and industrials

This blend gives investors access to both established companies and high-growth sectors across diverse economies.

Holdings & Concentration

VWO holds over 5.000 individual stocks, making it one of the most diversified ETFs in its class. This extensive diversification reduces the impact of any single company or country's performance on the overall fund.

The fund's top holdings as of this year include:

Taiwan Semiconductor Manufacturing Company (TSMC) – ~4.9%

Tencent Holdings Ltd. – ~3.5%

Alibaba Group Holding Ltd. – ~2.8%

Reliance Industries (India)

Samsung Electronics (via GDRs)

While it is broadly diversified, there is some concentration risk, particularly in the top few holdings and China's heavy weighting. However, this is reflective of the broader emerging markets landscape, where a few large companies dominate.

Who is VWO For?

VWO is best suited for long-term investors who are looking to diversify their portfolios geographically and are comfortable with the risks associated with emerging markets. These risks can include political instability, currency volatility, regulatory shifts, and varying standards of corporate governance.

However, the growth potential of emerging markets — fuelled by urbanisation, a growing middle class, and technological adoption — makes them an attractive part of a well-balanced investment strategy.

VWO can work well as:

A core emerging markets allocation in a diversified global portfolio

A complement to developed market funds like Vanguard Total World Stock ETF (VT) or Vanguard Developed Markets ETF (VEA)

A building block for investors seeking exposure to long-term macroeconomic growth trends

Because of its low cost, broad exposure, and ease of access, VWO is also an excellent option for those new to emerging markets investing.

Conclusion

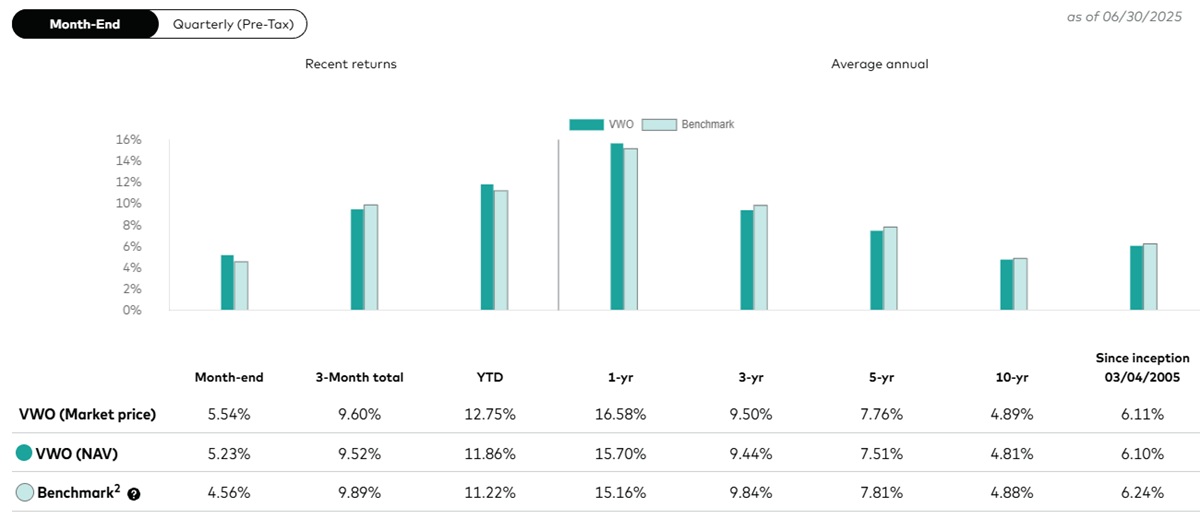

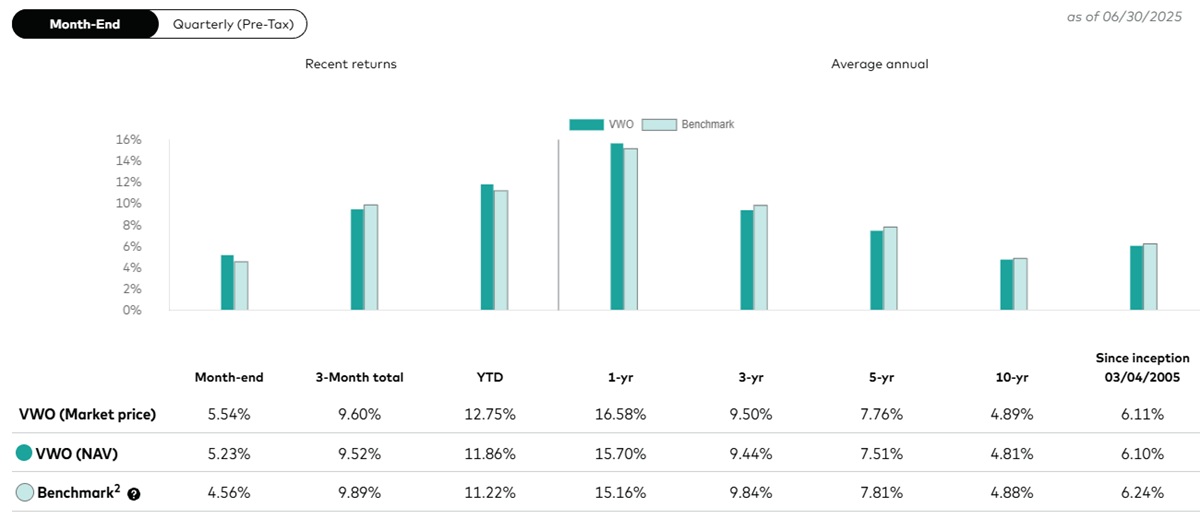

The Vanguard FTSE Emerging Markets ETF (VWO) offers a compelling way to access the world's fastest-growing economies, all within a single, low-cost investment vehicle. It provides exposure to thousands of companies across sectors and regions, from China and India to Brazil and South Africa.

While investing in emerging markets comes with its share of risks, it also presents significant opportunity — especially for investors who take a patient, long-term view. VWO's scale, simplicity, and affordability make it a trusted option for both beginners and experienced investors alike.

As global markets evolve, holding a stake in emerging economies could be one of the smartest moves for future-ready portfolios — and VWO stands out as one of the best tools to do just that.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The Vanguard FTSE Emerging Markets ETF (VWO) is an exchange-traded fund that seeks to track the performance of the FTSE Emerging Markets All Cap China A Inclusion Index. This index includes large-, mid-, and small-cap companies from over 20 emerging market countries.

The Vanguard FTSE Emerging Markets ETF (VWO) is an exchange-traded fund that seeks to track the performance of the FTSE Emerging Markets All Cap China A Inclusion Index. This index includes large-, mid-, and small-cap companies from over 20 emerging market countries. As of mid-2025. VWO holds over $90 billion in assets under management (AUM), making it one of the largest ETFs dedicated to emerging markets. Its liquidity is strong, with high average daily trading volume and a tight bid-ask spread, which helps reduce trading costs for investors.

As of mid-2025. VWO holds over $90 billion in assets under management (AUM), making it one of the largest ETFs dedicated to emerging markets. Its liquidity is strong, with high average daily trading volume and a tight bid-ask spread, which helps reduce trading costs for investors.