After a tumultuous spell for RxSight, Inc. (NASDAQ: RXST), many traders are wondering if this battered med-tech stock is a falling knife or now a contrarian opportunity.

With RXST stock down nearly 80% year-to-date, following a dramatic revenue guidance cut and a subsequent plunge in price, is there value lurking beneath the wreckage or are fresh risks pointing to further pain ahead?

Below, we dissect the data, newsflow, technical signals, and market sentiment to help traders evaluate the prospects of RXST for the rest of 2025.

RXST Stock: What Went Wrong in 2025?

A Timeline of the Crash

-

January 2025: RXST opened the year above $35 per share, riding high from strong 2024 growth in premium cataract intraocular lenses.

-

9 July 2025: Shares collapsed nearly 50% at intraday lows, closing the day down 37.8% at $7.95 after the company slashed full-year revenue guidance and missed Q2 expectations.

16 July 2025: RXST last closed at $7.74, putting its year-to-date loss near 80%, one of the sharpest declines for any US med-tech company this year.

Crash catalysts included:

-

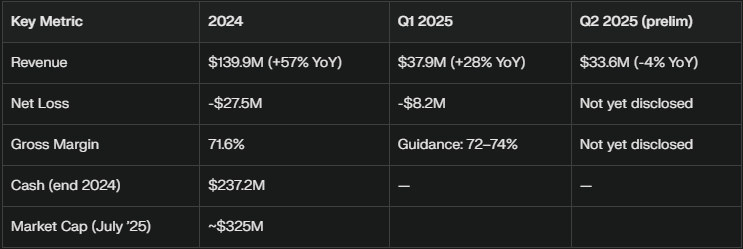

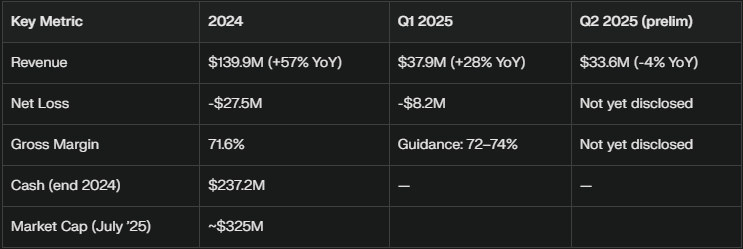

A preliminary Q2 revenue figure of $33.6 million, a 4% year-over-year decline and far below the market's expected $41.7 million.

-

Full-year revenue guidance cut to $120–130 million, down from an initial $160–175 million outlook.

Weaker-than-expected Q2 new device sales, with Light Delivery Devices (LDD) units down 49% year-on-year.

Core Business at a Glance

RxSight, Inc. develops, manufactures, and sells the Light Adjustable Lens (LAL)—the only FDA-approved intraocular lens that can be fine-tuned after cataract surgery. Its value proposition lies in post-surgical lens adjustments, targeting the fast-growing premium IOL segment, particularly in North America.

2024-2025 at a Snapshot:

-

Installed Devices: Over 1,040 LDDs in clinics by mid-2025.

Product Share: LAL used in approximately 15% of US premium IOL surgeon cases.

Why Did RXST Stock Collapse?

The Revenue Miss and Guidance Cut

-

Plunging sales of LDDs (down 49% for Q2 2025) hurt both revenue and market optimism.

-

Management's sharp cut to full-year revenue guidance shook confidence in predictive models and growth assumptions.

Multiple law firms launched investigations into RXST's prior disclosures, raising legal uncertainty.

Technical and Sentiment Factors

Current Technical Picture: Chart and Trend Analysis

-

Price Range (2025 YTD): $6.32 – $39.88.

-

Momentum: Deeply oversold across most indicators (RSI, MACD); some short-term consolidation evident, but no strong buy signals.

-

Support: Psychological level at $7, strong support zone at $6.30–$6.50.

Resistance: $9.50, then $12–$13; would require positive news to break higher.

Trader Considerations: Should You Buy RXST Now?

Bullish Arguments

-

Oversold Conditions: Stocks suffering “crash-level” drawdowns sometimes stage powerful technical bounces, especially after flushouts on high volume.

-

Premium Cataract Market Growth: The premium intraocular lens segment is expanding, and RXST's LAL remains a unique, FDA-cleared technology.

-

Cash Buffer: RXST's end-2024 cash position (~$237M) means it is unlikely to face near-term liquidity issues, buying time to execute a turnaround.

Potential for M&A: A deeply depressed valuation (now just 2x trailing sales) could spark acquisition interest from larger med-tech players.

Bearish Arguments

-

Revenue Uncertainty: The scale and pace of revenue misses cast doubt on management's forecasts and execution.

-

Operational Risks: Q2 LDD sales drop (>49%) may suggest demand is flagging, device fatigue is emerging, or competitive threats are rising.

-

Legal & Regulatory Risk: Ongoing litigation and SEC investigations could distract management and add financial or reputational costs.

Negative Momentum: With sentiment badly bruised, further downside is possible if the next earnings update disappoints.

Analyst & Trading Community Views

-

Many professionals recommend waiting for clear signs of stabilisation before buying.

-

Momentum traders highlight high intraday volatility for short-term plays, but warn that negative news could lead to sharp further losses.

Value investors are cautiously assessing cash burn and path back to growth before committing capital.

Risk Management Tips for Trading RXST

-

Size Positions Appropriately: Only allocate what you're prepared to lose; position sizing is crucial during extreme volatility.

-

Set Stop-Losses: With such deep declines, consider both percentage-based and technical stop-loss points to mitigate tail risk.

-

Watch for News: Mark the upcoming Q2 earnings date—guidance and updated sales trends may be decisive.

-

Volatility Trading: Advanced traders can use the heightened implied volatility to trade options; spreads and hedges may be preferable to outright calls or puts.

Diversification Matters: Don't let RXST dominate your portfolio in search of a turnaround—balance with less volatile positions.

What to Watch: Upcoming Catalysts

-

Q2 2025 Earnings Call: Scheduled for 7 August—management's updated guidance and commentary on LDD/LAL adoption will be critical.

-

Sector M&A Activity: Any signs of acquisition interest in the premium cataract space could shift sentiment.

Legal Updates: Watch for resolutions or developments in ongoing investigations.

Conclusion

RXST stock has lost nearly 80% in 2025, reflecting a breakdown in growth expectations and deepening revenue concerns. While extremely oversold conditions sometimes precede sharp rebounds, the absence of clear evidence that fundamentals are stabilising means caution is warranted.

For those with a high risk appetite and a tight Trading plan, the coming weeks could present short-term trading opportunities. For long-term investors, clarity on demand, management execution, and legal risks will be essential before considering an entry.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.