Impossible Foods, the maker of the plant-based Impossible Burger, has long been touted as an ipo candidate. The company's executives and analysts say an eventual Impossible Foods IPO may come, but timing remains uncertain.

In an April 2024 Reuters interview, CEO Peter McGuinness said Impossible Foods is targeting a "liquidity event" (such as an IPO) in the next two to three years. He insisted the company isn't committed to an IPO schedule, even considering a sale or private raise if needed.

In short, while many expect Impossible Foods to go public eventually, management has indicated it likely will not happen in the immediate term. As of mid-2025, there is no official IPO date or filing.

Recent Impossible Foods IPO Speculation and Company Plans

Despite no confirmed IPO plans, the rumour mill remains active. During 2021, Impossible Foods reportedly prepared for a public listing (possibly via ipo or SPAC) at $10 billion or more. That year, the company raised $500 million in venture funding at a $7 billion valuation.

But market conditions changed: higher food prices and economic uncertainties dampened enthusiasm. Beyond Meat's stock collapse (from over $200 per share in 2019 to under $10 by late 2023) warns of IPO timing risks. In a recent interview, McGuinness reiterated that Impossible Foods "will raise cash with or without an IPO" – meaning the company may seek funding or wait for better markets before listing.

Analysts now say an IPO is conceivable in 2025 or 2026 if conditions improve. Financial media note that Impossible Foods will likely need a "near-perfect environment" to go public, to avoid post-IPO dilution and valuation loss.

For example, investment analysts point out that traditional IPO investors in plant-based foods are now cautious, given Beyond Meat's steep downturn. In practical terms, the CEO's latest guidance suggests an IPO is not imminent (not in 2024, and probably not in 2025).

Financials and Valuation

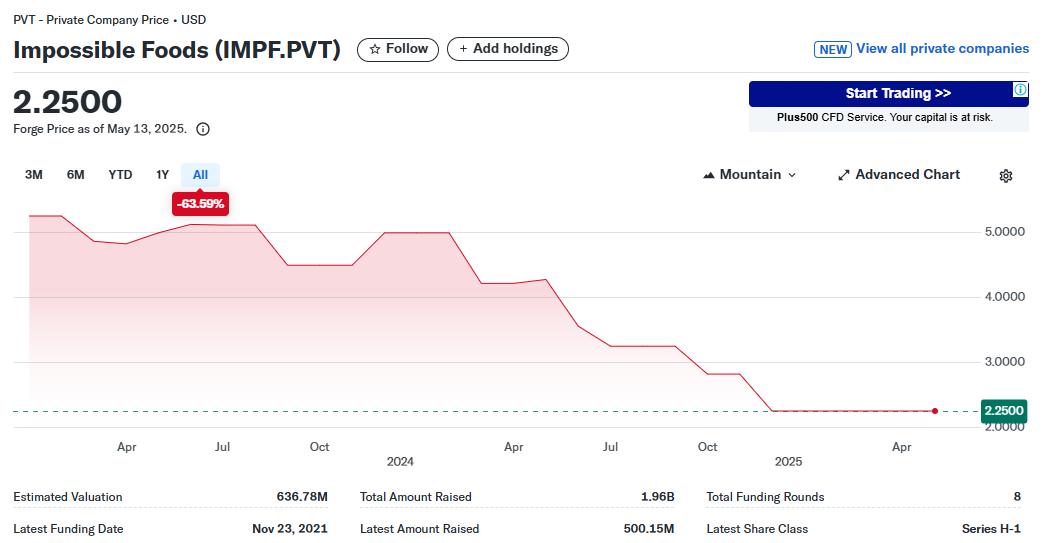

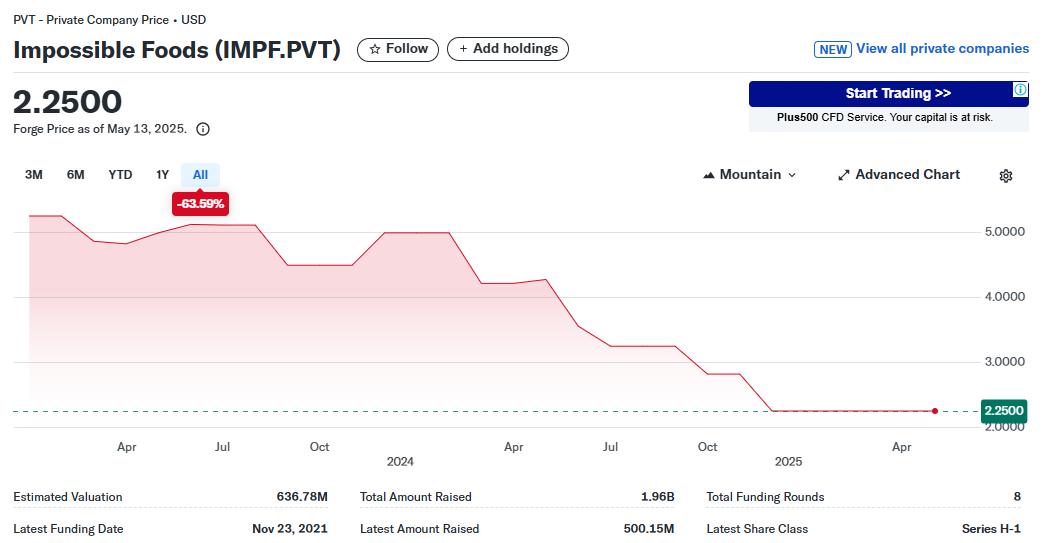

Impossible Foods remains a privately held "unicorn" with substantial venture capital backing. To date, the company has raised roughly $1.9 billion in funding. Major rounds include a $300 million Series E in 2019 (led by Horizons Ventures and Temasek) and a $500 million Series H in late 2021 (led by Mirae Asset). That 2021 round pegged the company's valuation at about $7 billion.

On the revenue side, Impossible Foods has been growing quickly but remains unprofitable. The company reported record 2022 sales, driven by surging demand during the pandemic and new restaurant deals, with retail dollar sales up over 50% from the year before. Industry data shows Impossible Foods achieved about $460 million in sales in 2022, roughly a 50% year-over-year gain.

However, despite healthy top-line growth, profitability is still elusive. TechCrunch notes that as of early 2023, Impossible Foods had a "strong balance sheet" with growth rates of 65–70%, but the company also underwent layoffs and cost-cutting. Late 2022 and early 2023 saw staff reductions (around 6–20% of the workforce) as the company restructured.

These moves, executives said, were strategic rather than due to slack sales. Still, like many high-growth startups, Impossible's losses remain significant on an absolute dollar basis.

Investor Sentiment and Expert Views

Investor and analyst commentary on an Impossible Foods IPO is cautious. Many experts say market timing is critical. For example, a fintech newsletter warned that Impossible would need a near-perfect environment to avoid devaluation after an IPO. Beyond Meat serves as a stark warning: beyond a post-IPO boom, its valuation cratered when sales growth slowed, costing shareholders dearly.

Anecdotal reports suggest that even insiders are reluctant. Some private-market investors hold on to their stakes pending clearer industry signs. Pre-IPO secondary marketplaces (e.g. EquityZen) still list Impossible Foods shares for accredited investors, but note that "an IPO has grown unlikely, at least in the near term".

On the positive side, Impossible has demonstrated strong partnerships and growth potential. The company's founder was named to TIME100 in 2023, and organisations like the World Economic Forum have praised its innovations.

Some analysts believe investors may bide their time: if Impossible can steady sales and margins in 2025, it could still achieve a $ 10 B+ valuation on the public markets. But given the current climate, most forecasts lean toward postponement. Harness Wealth's IPO watch lists Impossible as "potentially in 2025".

Regulatory and Market Risks

Regulation: Labelling laws (e.g. Iowa's 2024 requirement) and evolving approvals (EFSA clearance reduces risk, but new countries may have hurdles).

Market Demand: Recent stagnation in plant-based meat sales, high price premium, and shifting consumer budgets.

Competition: Intense rivalry from other alt-proteins (Beyond Meat, in-house products by global brands) and cheaper substitutes.

Financial: High burn rate, pending profitability, and macroeconomic uncertainty in financial markets.

Conclusion

In mid-2025, an Impossible Foods IPO is not imminent, but it remains a possibility. The company's leadership insists on waiting for the right moment – one that maximises valuation and minimises downside.

For more proactive investors, late 2025 or 2026 could be a timeframe to watch. If Impossible demonstrates sustained growth and the public markets regain confidence in high-growth companies, its IPO could happen. However, caution is warranted.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.