Fed up with chasing last month's winners, only to see sharp reversals wipe

out gains?

Copy trading can work differently when it follows a long‑term plan that puts

capital protection first.

By keeping profits in the account, spreading risk across more than one

provider, and using clear limits on losses, gains can build on gains over

time.

The aim is steady progress, not quick wins, and platform controls help keep

that discipline when markets turn.

Compounding in Practice

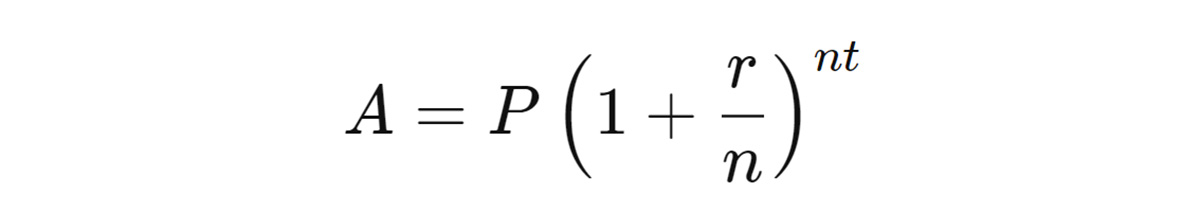

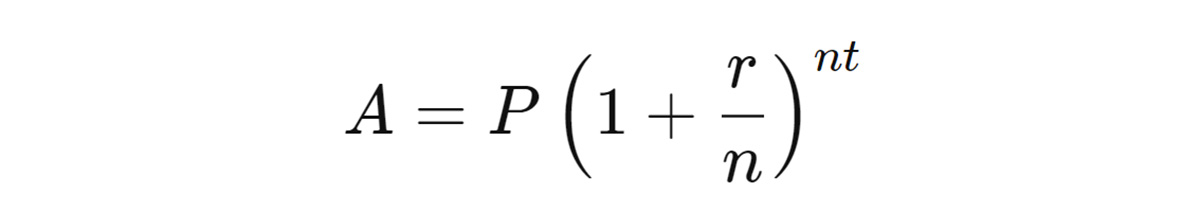

The classic formula is:

Where A is the future amount, P the initial investment, r the annual rate, n

the compounding frequency, and t the number of years. Time in the market and

consistent reinvestment matter far more than tactically timing every move.

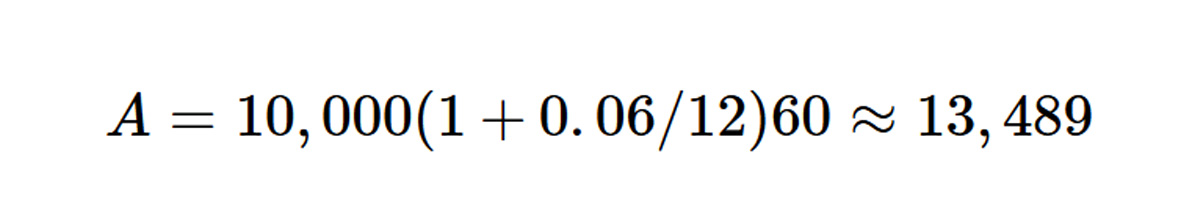

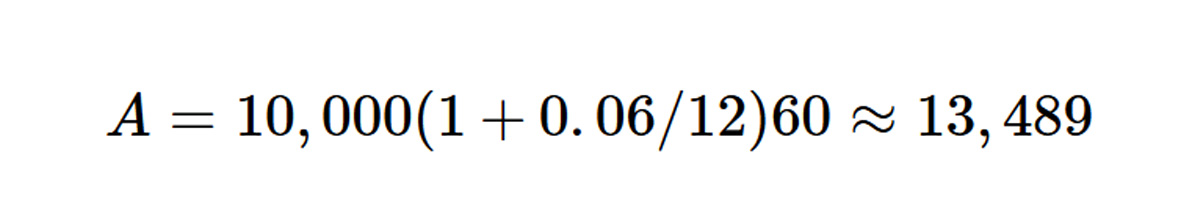

Example

Suppose you begin with a capital of $10,000, earn 6% a year, compounding

monthly, over 5 years would mean:

But suppose the capital amount sees a 20% loss ($2,000) in year one, dropping

the capital to $8,000. Compounding monthly from there over the next 4 years at

6% yields only $10,164, not $13,489.

Early losses permanently shrink the capital that future gains compound on, so

the highest‑impact decision is to protect the base and let time do more of the

work.

A Note on Sequence-of-Returns Risk

2 portfolios with the same average annual return can finish far apart if one

suffers large losses early. For instance:

Year 1: –20% (base $8,000).

-

Years 2–5: +6% per year → grows to $10,790.

Compared with uninterrupted growth to $13,489, this "sequence of returns"

illustrates why deep early losses are so damaging to long-term accumulation.

Designing a Long-Term Copy Portfolio

A durable copy portfolio starts with diversification. One can do this by

following providers who trade different symbols and employ distinct methods.

This reduces correlation and smooths returns, which helps compounding.

Proportional sizing means copying each provider's trades as a set percentage

of your account, not at the provider's full size, avoiding overexposure as your

balance changes. Decide what your reinvestment policy is at the start and stick

with it. For example, it could be to retain all realised gains for 12 months

unless needed for emergencies.

Preserving the Compounding Base

Subscription-level drawdown caps set a ceiling for acceptable losses and

pause copying if hit, limiting damage from bad streaks. Setting standard

stop-loss and take-profit values can secure profits and cap risks on individual

trades, while symbol-level filters help avoid unwanted risk concentration.

Behavioural Discipline

Discipline is key. Instead of making day-to-day tweaks, set a review

schedule. Perform quarterly allocations and provider selection, with a brief

weekly/monthly check on risk and performance. Write down any changes to copying

ratios, symbol filters, or providers. Include reasons and results so you can

review what worked.

Keeping turnover low and batching changes only at set intervals reduces

slippage and lets the compounding effect play out.

How EBC and Brokeree Enable Long-Term Habits

EBC Financial Group* ("EBC"), in partnership with Brokeree's Social Trading

solution, provides controls and tools that make it easier to stay disciplined

for the long run:

Proportional copying lets you set trade size as a share of your account

equity.

Subscription-level drawdown limits pause copying before losses get out of

hand.

Symbol-level filtering keeps your trading within your written plan.

Real-time dashboards track rolling 12-month maximum drawdown, exposure by

symbol, and consistent provider performance.

Education and community: EBC's webinars and Pulse360° podcast on Spotify

provide listeners with trading insights from industry leaders that can help with

market navigation and risk management.

Practical Checklist

Define a risk level for each provider and allocate a fixed share per

provider, e.g., 20%–30% each using proportional copying.

Start with 3–5 independent providers and filter for low overlap in symbols

and style to match the plan.

Set drawdown limits: 3%–5% per provider of account equity plus a

portfolio‑wide cap, with standard exits.

Establish a reinvestment policy that retains most realised gains; schedule

withdrawals by plan to preserve the compounding base.

Evaluate providers on maximum drawdown, consistency across market conditions,

typical risk per trade, and average holding time; keep symbol filters aligned

with these criteria.

Batch any account changes during scheduled reviews (e.g., quarterly), not in

response to daily P&L.

Common Errors to Avoid

Chasing last month's winners instead of judging longer‑term performance and

drawdown behaviour.

Concentrating exposure by overloading providers that trade similar symbols or

strategies, creating hidden overlap.

Skipping explicit drawdown caps per provider and at the portfolio level, or

removing loss caps after a good run.

Over‑allocating beyond a fixed per‑provider risk share, undermining

diversification.

Switching providers frequently, which increases slippage and disrupts

compounding effects.

Skimming realised gains impulsively rather than following a reinvestment and

scheduled withdrawal policy.

Ignoring a provider's typical risk per trade and average holding time,

leading to mismatched expectations and risk.

Closing Thoughts

Building wealth through copy trading depends more on capital preservation and

steady reinvestment than on hot streaks. Well-chosen rules, discipline, and a

clear review process allow time and compounding to work in your favour—no matter

the market's mood.

Looking for a smarter path to long-term wealth building through copy

trading?

Open a Copy Trading Account with EBC to begin your copy trading journey.

Disclaimer: Trading Forex and Contracts for Difference (CFD) on margin

carries high risks and may not be suitable for all investors. Losses can exceed

your deposits. You should consider whether you understand how CFD works and

whether you can afford to take the high risk of losing your money. Before

deciding to trade Forex and CFDs, you should carefully consider your trading

objectives, level of experience and risk appetite, and consult an independent

financial advisor if necessary. Statistics or past performance is not a

guarantee of future performance. This material is for general information only

and is not intended to be treated as (and should not be considered to be)

financial, investment or other advice. No opinion given in the material

constitutes a recommendation by EBC Financial Group (SVG) LLC ("EBC") or the

author that any particular investment, security, transaction or investment

strategy is suitable for any specific person. Please make sure that you comply

with the legal and regulatory requirements of your country/region to use the

services provided by EBC. Evaluate the risks carefully and make sure to read

relevant risk disclosure notice before trading.

EBC Financial Group is a global brand encompassing a collective of

separately incorporated entities, each operating independently under its own

regulatory framework. Copy trading and its features are not offered by EBC

Financial Group (UK) LTD, EBC Financial Group (CAYMAN) LTD, EBC Financial Group

(AUSTRALIA) PTY LTD, and EBC Financial (MU) Limited.