Gold prices rose on Wednesday to their highest levels in a week on increasing

safety demand amid US fiscal uncertainty. Trump is ramping up pressure on

Republicans to support his centrepiece budget plan.

Key House Republicans from blue states are opposed to the tax bill, which

they say does not do enough to boost so-called SALT deductions for their

constituents.

Currency options traders are now more pessimistic than they have ever been

about the dollar's path over the next year, according to one commonly-cited

measure of investor sentiment.

One-year risk reversals fell to minus 27 bps in favour of puts over calls for

a proxy of Bloomberg's dollar gauge, surpassing even a level briefly hit at the

outset of a pandemic five years ago.

Likewise, traders now hold some $16.5 billion in short dollar positions, near

the most bearish since September, according to the CFTC data through May 13

aggregated by Bloomberg.

The PBoC expanded gold reserves for a sixth straight month in April, adding

2.2 metric tons to its gold holding. The WGC said Chinese investor interest in

gold futures reached unseen levels in April.

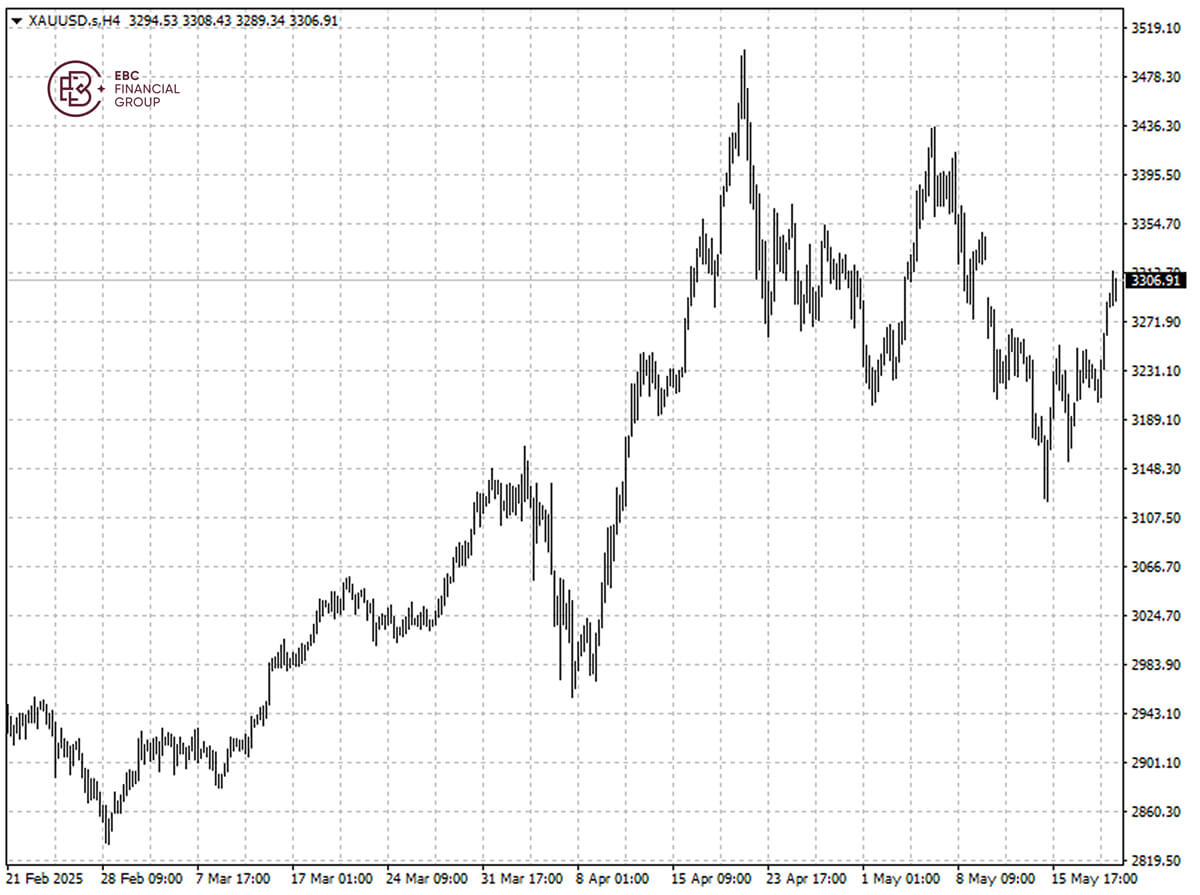

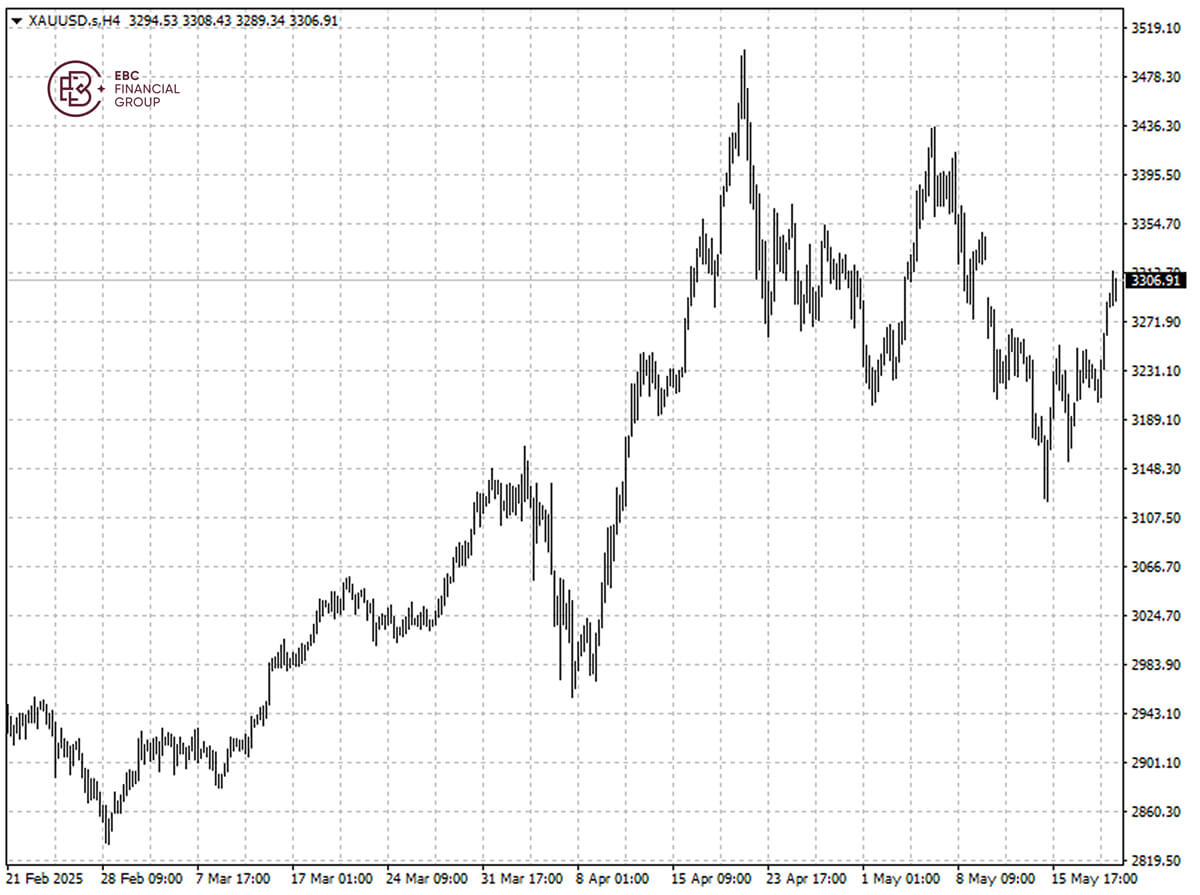

Bullion's rally continues after it bottomed out in mid-May. The risk is

tilted towards the upside with a push above $3,260, and we see it rise towards

$3,315.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.