The DAX futures market, tracking Germany's blue-chip index, is one of the most liquid and exciting instruments in global finance. Whether you're a beginner or a seasoned pro, trading DAX futures offers opportunities for directional bets, hedging, and short‑term speculation.

This comprehensive guide covers everything you need to know: from contract specifics and trading hours to entry strategies, risk control, and advanced setups.

What Is DAX Futures?

The DAX (Deutscher Aktienindex) represents the 40 largest German companies listed on the Frankfurt Stock Exchange. In 2025, DAX trades with a total market cap of nearly €1.9 trillion. Futures contracts, known as FDAX (full size), Mini-DAX (FDXM), and Micro-DAX (FDXS), enable traders to access this index with both leverage and flexibility.

Each full-size DAX futures contract is €25 per index point; mini and micro versions scale that down to €5 and €1, respectively, making them more accessible to retail traders. These contracts settle in cash and expire quarterly (March, June, September, December) on the third Friday of the contract month.

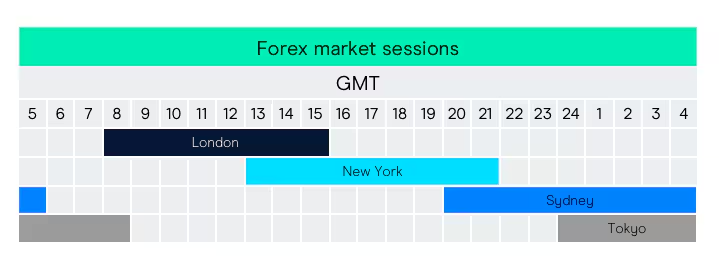

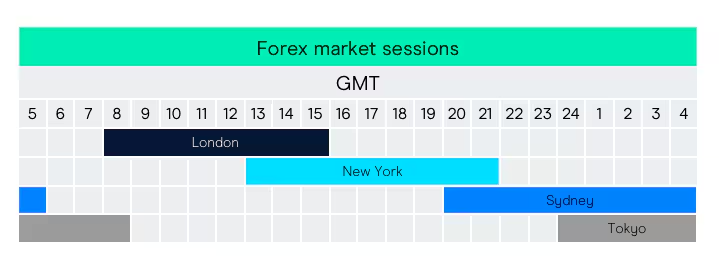

DAX futures are available for trading almost 24/7, from Sunday night to Friday afternoon (ET), providing outstanding liquidity and narrow spreads, which makes them favoured by day traders, swing traders, and institutional players.

Essential DAX Futures Specs and Contract Selection

The primary contract, FDAX, offers the greatest liquidity and is suited for professionals and institutional traders. The FDXM and FDAX offer 1/5 and 1/25 the size, respectively, appealing to retail traders or those needing finer position sizing.

Tick values:

FDAX: €25 per point, often moving ~200 points/day (≈€5,000/day range).

FDXM: €5 per point; FDXS: €1 per point.

Margin requirements vary by broker and contract. Always be aware of maintenance and initial margin to avoid margin calls.

Timing Your Trades: Trading Hours & Important Events

DAX futures correspond to European market hours, operating from Sunday 7 pm to Friday 4 pm ET. Key activity often coincides with:

European open around 8 am CET,

Major German macroeconomic announcements,

The U.S. market opens, and news announcements, which frequently influence reactions in European futures

To prevent unpredictable price movements, short-term traders pause during the first one to two hours of volatility and engage in trading established price ranges, particularly within the initial two hours following the market open.

Why Trade DAX Futures? Key Advantages

High Liquidity & Tight Spreads

A high volume suggests minimal slippage for both entering and exiting, ideal for active traders or algorithmic strategies.

Leverage & Capital Efficiency

Traders control a position equal to the index value multiplied by the contract multiplier but only need to post initial margin, significantly reducing capital required while magnifying gains (and risk).

Trade Long or Short with Equal Ease

DAX futures allow directional bets on rising or falling markets without restrictions common in equities.

Eurozone Market Insight

DAX often leads or mirrors major U.S. index movements and reflects sentiment in European markets, making it a strategic gauge for global trends.

Core Trading Strategies for DAX Futures

1. Mean Reversion (Multi-day Reversal Systems)

Recent studies suggest that DAX futures frequently return to the average after temporary peaks and troughs. One profitable system uses Bollinger Bands on a 30‑minute timeframe and opens trades after the price crosses established bounds.

This approach has delivered solid average trade value, particularly on the short side, when using mini/micro contracts to manage risk.

A second model uses a 15-minute timeframe and enters when price breaches previous session highs or lows before reversing. It identifies momentum exhaustion and executes accordingly.

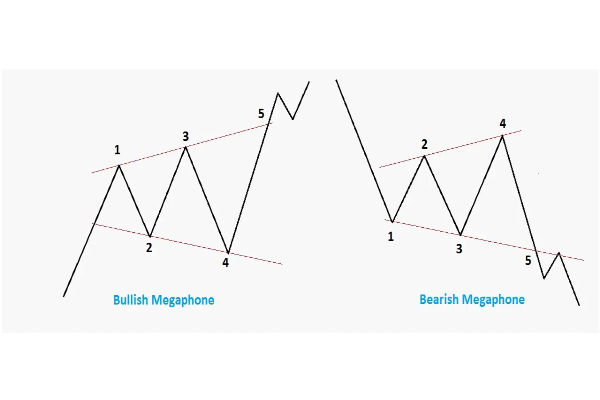

2. Trend-Following

Traders identify sustained directional moves by using tools like moving averages or channel breakout systems and let profits run. It mirrors classic trend-following logic: buy when the trend turns up, exit when momentum begins to fade.

It works in trending days when market momentum is strong and clear.

3. Range Breakouts

Day traders frequently seek breakout opportunities from ranges established in the initial two hours after the market opens. When DAX breaks cleanly above or below a defined range with volume confirmation, it can offer scalable intraday opportunities.

4. RSI-Based Reversal Entries

A popular method is using RSI(14) on, say, a 5-minute chart. When the indicator drops below 25 and later closes above it, and RSI moves above 75 and then returns below, this suggests a possible oversold turnaround.

Traders frequently execute just one high-probability trade daily with this approach, maintaining a risk-reward ratio of 1:3 to uphold discipline.

5. Event-Driven Trades & News Sensitivity

DAX is sensitive to German/EU economic data releases. Traders often close or reduce exposure before major releases (like CPI, unemployment, policy statements) or trade breakouts if volatility is expected to continue.

How to Craft a Winning DAX Futures Trading plan

1) Choose Your Trading Style

Decide if you're a day trader (in and out within a session), swing trader (holding for days), or position trader (weeks/months). Your time commitment and strategy will vary accordingly.

2) Select the Right Contract Size

3) Define a Strategy and Entry Logic

Choose a proven method: RSI reversal, mean reversion, breakout, or trend-following.

Backtest it and understand the conditions where it performs best and worst.

4) Set Clear Risk Management Rules

Risk no more than 1–2% of your capital per trade.

Always use stop-loss orders, and avoid changing them emotionally mid-trade.

Modify position sizes according to volatility and contract dimensions.

5) Pick Trade Timing Windows

Concentrate on timeframes that align with your strategy, like the initial two hours post-European open or during U.S. macro announcement times.

6) Limit Your Trade Frequency

Especially in the beginning, commit to one to two high-quality setups per day. It reduces overtrading and decision fatigue.

7) Use a Trading Journal

Log every trade: why you entered, how it played out, what you learned. Over time, this becomes your best coach.

Conclusion

In conclusion, trading DAX Futures offers a potent blend of liquidity, flexibility, and leverage. For beginners, selecting smaller contract sizes with clear strategies such as RSI reversal or early-session breakout patterns provides an approachable entry point.

For experienced traders, systems based on multi‑day reversal logic or trend-following can deliver consistent profits with disciplined execution.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.