In the world of finance, few benchmarks have had as much influence as the Interbank Offered Rate, better known as IBOR. Whether you're an institutional investor or a retail trader, understanding IBOR is crucial for making informed decisions in today's markets.

IBOR has long served as the reference point for trillions in financial contracts, including derivatives, loans and bonds. However, its future is evolving. Knowing how IBOR functions, why it's being replaced in many regions and what it means for trading strategies could be the difference between staying ahead or falling behind.

What Is IBOR?

IBOR stands for Interbank Offered Rate, a set of benchmark interest rates at which banks lend to one another. Multiple types of IBOR exist depending on the region, including LIBOR (London), EURIBOR (Eurozone), TIBOR (Tokyo) and HIBOR (Hong Kong).

Each IBOR is calculated daily based on submissions from a panel of banks. These banks estimate the interest rate at which they believe they could borrow funds from other banks on an unsecured basis. The final rate reflects an average of these submissions after excluding outliers.

For decades, IBOR has provided the basis for pricing a vast range of financial products. However, due to issues with transparency and manipulation scandals, major reforms have been introduced to transition away from some forms of IBOR.

Why Was the IBOR System Challenged?

The downfall of IBOR, particularly LIBOR, began when banks were found to be manipulating rates for their own benefit. This scandal shook market confidence and led regulators to call for alternative benchmarks.

In addition to trust issues, IBOR rates are based on estimates rather than actual transactions. This has made them vulnerable to human error or intentional distortion. Furthermore, the unsecured lending market between banks has shrunk since the 2008 financial crisis, reducing the relevance of IBOR in modern finance.

All of this prompted authorities worldwide to search for more robust and transparent alternatives.

The Transition Away from IBOR

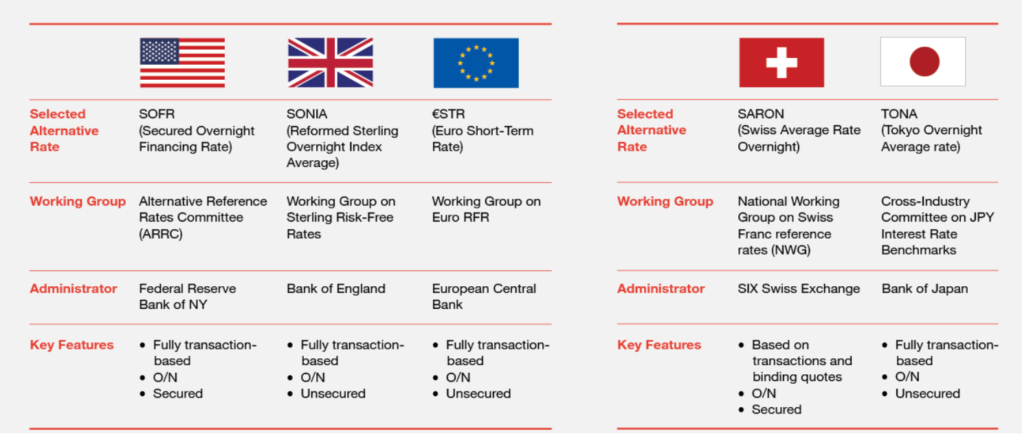

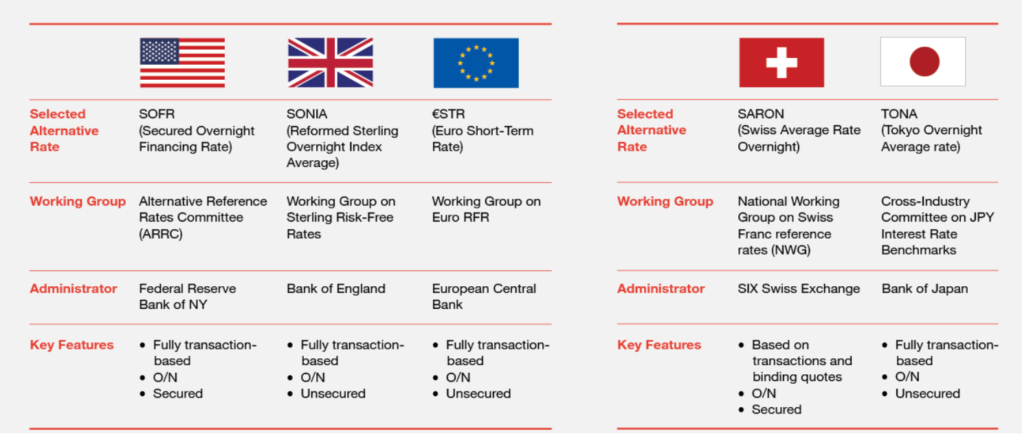

One of the most significant developments in global finance in recent years has been the transition away from IBOR. Following regulatory pressure and industry consensus, several regions have already started replacing IBOR with alternative reference rates (ARRs).

For example, in the United States, the Secured Overnight Financing Rate (SOFR) has replaced USD LIBOR. In the UK, the Sterling Overnight Index Average (SONIA) is now used in place of GBP LIBOR. Each alternative rate is based on real market transactions, offering improved transparency and resilience.

Despite these changes, IBOR is still relevant in certain regions and financial contracts. Many traders remain exposed to instruments referencing IBOR, so it's essential to understand how this benchmark still affects markets.

How IBOR Affects Traders Today

Although many forms of IBOR are being phased out, it remains a key benchmark in some financial centres. For instance, HIBOR and TIBOR are still in use in Asia. Even where transition plans are underway, legacy contracts continue to reference IBOR, meaning its influence persists.

For traders, understanding the nuances of IBOR is essential for several reasons:

Pricing Derivatives: Many swaps, futures and options were historically priced using IBOR, and some still are.

Interest Rate Differentials: Currency trading strategies that involve carry trades are influenced by interest rates, often tied to IBOR.

Risk Management: Portfolios exposed to floating-rate instruments need to be aware of how changes in IBOR can affect valuations and hedging strategies.

Is IBOR Still Relevant in 2025?

Yes, in some regions and contracts, IBOR remains in effect. While LIBOR has largely been phased out, other versions such as EURIBOR and HIBOR are still active. Financial institutions continue to support these benchmarks while gradually transitioning to alternatives.

For new contracts, regulators encourage the adoption of ARRs. However, IBOR remains embedded in many older agreements, and the process of unwinding them will take years. Traders must track which instruments are still linked to IBOR to assess risk and performance correctly.

Preparing for a Post-IBOR Environment

Even if your current trades are not directly linked to IBOR, understanding the shift away from it is essential. Transition risks include valuation mismatches, liquidity changes and legal ambiguities. Traders must stay updated with the timelines and protocols issued by regulators and exchanges.

Moreover, some ARRs behave differently from IBOR. For example, ARRs are often overnight rates, while IBOR includes various maturities. This means the transition affects pricing models, volatility calculations and forward rate estimations.

Understanding these technical differences can give traders a strategic advantage in a post-IBOR landscape.

Final Thoughts

IBOR may no longer dominate the financial world as it once did, but its legacy is far from over. It remains relevant in specific regions and financial instruments, and understanding its structure, function and replacement process is essential for modern traders.

By staying informed and adapting strategies, traders can navigate the evolving interest rate landscape with confidence. Whether you're trading FX, bonds or interest rate derivatives, keeping a close eye on IBOR developments could improve both your risk management and profitability.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.