Have you ever wondered how central banks influence the economy and financial markets? Or why interest rates seem to have such a powerful effect on everything from bond yields to Stock Prices? One of the key tools they use is the repo rate—a critical lever in controlling liquidity and stabilising the economy. But what exactly is the repo rate, and how does it impact your investments?

In this article, we'll dive into the mechanics of this rate, explain why central banks set it, and explore how it affects the broader financial landscape. Understanding this vital interest rate can help you better navigate market shifts and make more informed investment decisions.

Repo Rate's Definition and Formula

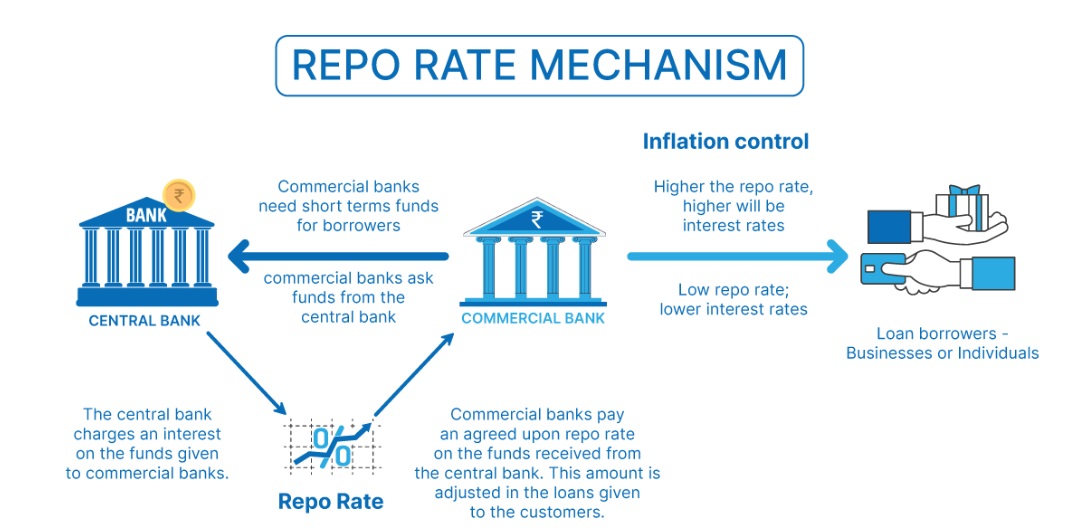

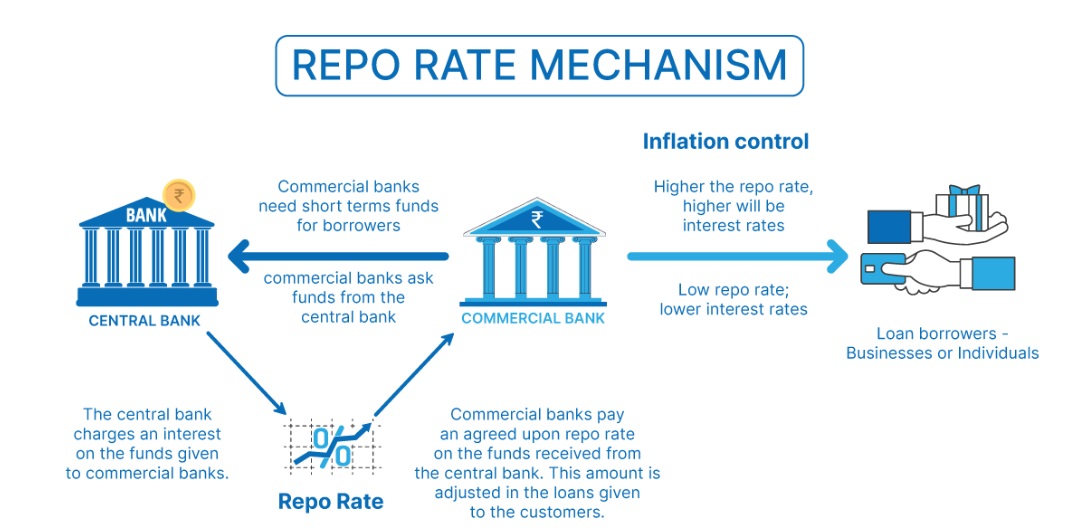

At its core, the repo rate refers to the rate at which commercial banks can borrow short-term funds from a central bank, typically by selling government securities to the central bank with a commitment to repurchase them at a slightly higher price. The difference in the sale and repurchase prices reflects the interest charged by the central bank. This rate is a crucial tool for regulating liquidity in the financial system.

In contrast to other interest rates, such as the discount rate or the federal funds rate, the repo rate is specifically related to short-term borrowing between commercial banks and central banks. The discount rate generally refers to the rate at which commercial banks can borrow directly from a central bank, usually on a longer-term basis, whereas the federal funds rate is the rate at which US banks lend to one another overnight. While these rates influence the broader economy, this rate plays a direct and immediate role in controlling the supply of money in the system, which is central to central banks' monetary policies.

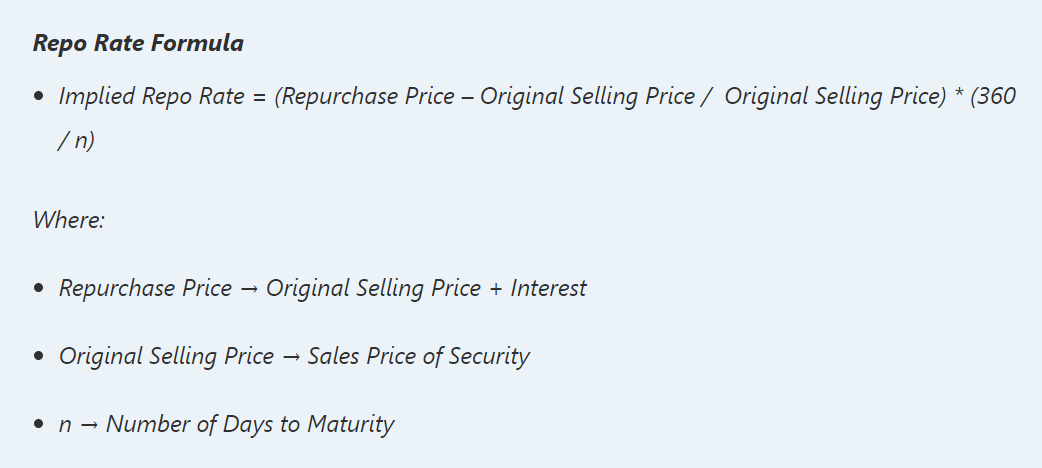

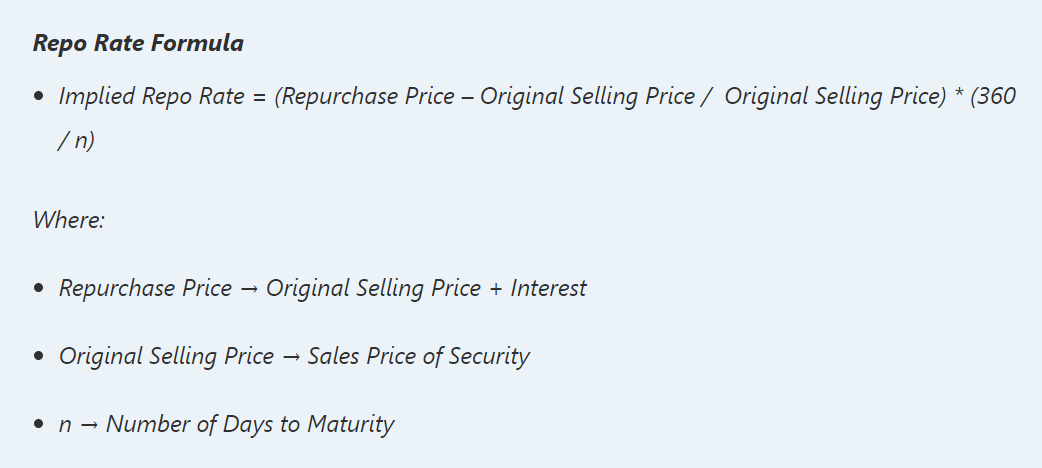

This rate typically calculated based on the repurchase price and the repurchase amount involved in the transaction. The formula for this calculation is as follows:

Repo Rate = (Repo Interest ÷ Repo Amount) × (365 ÷ Holding Period in Days)

In this formula, Repo Interest refers to the interest paid during the term of the repurchase agreement. Repo Amount is the amount of funds involved in the repurchase transaction. Holding Period in Days indicates the length of time the investor holds the repurchased securities, usually measured in days.

This formula is based on an annualised method, adjusting the repo interest to an annual benchmark, which makes it easier to compare transactions with different durations and interest rates. It's important to note that there are various ways to calculate the repo rate, and the precise method can vary depending on market practices and the terms of the agreement.

Repo Rate and Central Banks

Central banks rely on this key rate as one of their primary tools for implementing monetary policy. When a central bank raises or lowers the rate at which commercial banks can borrow from it, it signals its stance on economic conditions. A higher Repo rate typically indicates that the central bank is seeking to control inflation or slow down an overheating economy. By making borrowing more expensive for commercial banks, the central bank reduces the amount of money circulating in the economy, cooling consumer spending and business investment.

On the other hand, when this rate is lowered, borrowing becomes cheaper, which can encourage spending and investment to stimulate economic growth.

This Repo Rate is crucial for managing liquidity within the banking system. Central banks can inject liquidity into the economy by lowering the rate, making it easier for commercial banks to borrow funds. Conversely, they can withdraw liquidity by raising this rate, making borrowing more expensive and limiting the flow of money in the economy. This control over liquidity allows central banks to influence both short-term interest rates and long-term economic activity, which are key to maintaining financial stability.

Over the years, central banks have made strategic adjustments to this rate in response to various economic conditions. For instance, during periods of economic recession, the Reserve Bank of India (RBI), the European Central Bank (ECB), and the Federal Reserve have cut this borrowing rate to stimulate growth by making borrowing more affordable. Conversely, in times of inflationary pressure, these banks have raised their rates to curtail excessive spending and lending.

Repo Rate's Implications for Economy and Financial Markets

The Repo Rate has far-reaching implications for both the broader economy and financial markets. One of its most significant impacts is on inflation and economic growth.

By adjusting this rate, central banks can influence the inflation rate, which in turn affects the cost of living, consumer behaviour, and investment patterns. A higher rate typically dampens inflationary pressures, while a lower rate can increase inflation by encouraging more spending and borrowing.

This Repo Rate is also instrumental in controlling the money supply. When central banks raise the rate, it makes borrowing more expensive, thereby reducing the amount of money circulating in the economy. This can help to cool down an overheated economy or address inflation concerns. In contrast, lowering the rate stimulates the flow of money into the economy, encouraging spending and investment. This balance of money supply is crucial for maintaining economic stability and avoiding both runaway inflation and deflation.

Another key area impacted by the Repo Rate is lending rates and borrowing costs. When this rate increases, commercial banks pass on the higher borrowing costs to consumers and businesses in the form of higher interest rates for loans, mortgages, and credit. This can reduce the demand for loans and slow down economic activity. Conversely, when this rate decreases, borrowing becomes cheaper, which can stimulate consumer and business spending, potentially boosting economic growth.

This rate also has a profound effect on currency values, bond prices, and equity markets. A rise in the central bank's borrowing rate typically strengthens a country's currency, as higher interest rates attract foreign investors seeking better returns on their investments. This increased demand for the currency can lead to an appreciation in its value. On the flip side, when the rate is lowered, the currency may weaken due to reduced interest rate differentials between countries.

In the bond markets, the relationship between the central bank's rate and bond yields is inverse. When this borrowing rate rises, the yield on newly issued bonds tends to increase, which can cause the price of existing bonds to fall. Similarly, a decrease in the rate generally leads to lower bond yields and higher bond prices, as investors seek out the higher returns offered by existing bonds with fixed rates.

In equity markets, changes in the Repo Rate can have a significant impact on stock prices. An increase in the rate typically makes borrowing more expensive for businesses, which can reduce corporate profits and lead to a decline in stock prices. Conversely, a lower borrowing rate reduces borrowing costs for businesses, potentially leading to higher profits and increased stock prices.

This rate also has an impact on both short-term and long-term investments. Short-term investors who rely on Liquid Assets are more sensitive to changes in this rate, as it directly affects short-term borrowing costs and returns on money market instruments. For long-term investors, the impact of this rate is more indirect, but it still plays a crucial role in shaping the overall investment environment. A rise in this rate can signal a tightening of monetary policy, which can lead to a more cautious approach to investment, while a cut in the rate can signal a more favourable environment for long-term investments.

Market reactions to changes in this interest rate can vary depending on the economic context, but generally, any movement in the rate is closely watched by financial markets. Traders, investors, and analysts use changes in this rate to gauge the future direction of monetary policy, inflation, and overall economic conditions. As such, this rate plays a central role in shaping the dynamics of financial markets and guiding investment strategies.

In conclusion, the central bank's Repo Rate is a vital component of monetary policy that impacts the economy and financial markets in numerous ways. By understanding its definition, function, and the broader implications of changes in this rate, businesses, investors, and individuals can better navigate the complexities of the financial landscape. Whether influencing inflation, economic growth, or the valuation of assets, this rate serves as a critical signal of central banks' economic priorities, making it a key variable in both domestic and global financial systems.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.