In the world of modern investing, technology has revolutionised how traders buy and sell assets. Two of the most widely used digital tools are the oil trading platform and the stock trading platform.

While both serve as gateways to financial markets, they are designed to handle different types of assets, risks, and trading strategies. Understanding the differences between these platforms is essential for any trader aiming to diversify their portfolio or specialise in a particular sector.

What Is an Oil Trading Platform?

An oil trading platform is a specialised online system that enables users to trade oil and oil-related derivatives. These platforms provide real-time pricing, charting tools, news feeds, and access to various contracts including Crude Oil Futures, options, and CFDs. Most oil trading platforms also allow for leveraged trading, which means traders can gain larger exposure to the market than their initial capital would normally allow.

These platforms are particularly important in the energy market, where price movements are often influenced by global politics, supply and demand shifts, and natural disasters. Traders using an oil trading platform must therefore be comfortable with volatility and quick decision-making.

What Is a Stock Trading Platform?

In contrast, a stock trading platform is primarily designed for buying and selling shares of publicly listed companies. These platforms offer access to major exchanges like the London Stock Exchange or the New York Stock Exchange. Most also include educational tools, portfolio tracking, dividend information, and company financials.

While oil trading platforms focus on commodity markets, stock trading platforms are built around equity markets. They are generally seen as more suitable for long-term investment strategies and tend to attract a wider audience, from beginners to experienced investors.

Oil Trading Platforms vs. Stock Trading Platforms

1) User Interface and Features

One noticeable difference between an oil trading platform and a stock trading platform is the user interface. Oil trading platforms tend to have advanced charting features, technical indicators, and tools tailored for fast-paced trading. This is because the oil market can experience sharp price swings in short periods, demanding swift execution.

Stock trading platforms, meanwhile, often focus on simplicity and ease of use. While advanced features are available for professional users, the majority of retail investors prefer clean interfaces with straightforward navigation.

2) Market Hours and Liquidity

Oil trading platforms typically offer access to markets nearly 24 hours a day, five days a week. The global nature of oil trading means that markets in Asia, Europe, and the US are open at different times, creating near-continuous trading opportunities. Liquidity can vary based on contract type and timing, but the oil market is generally very active.

Stock trading platforms operate based on exchange hours. While pre-market and after-hours trading are available in some cases, the bulk of trading activity occurs during standard market hours. Liquidity is also influenced by the popularity and market capitalisation of the stock.

3) Risk and Volatility

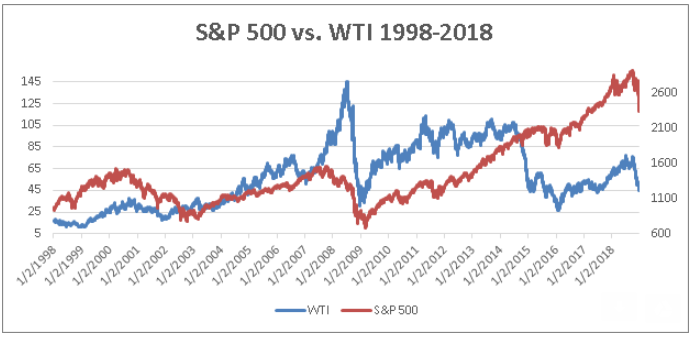

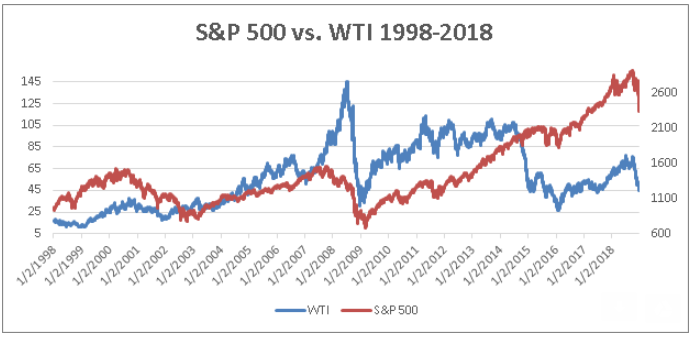

One of the key differences between using an oil trading platform and a stock trading platform is the level of risk and volatility. Oil trading often involves higher risk, especially when using leverage. Prices can be extremely volatile due to geopolitical tensions, OPEC decisions, or changes in global supply chains.

Stocks can also be volatile, particularly in uncertain economic conditions, but the diversity of available shares provides more opportunities for managing risk. For example, defensive stocks like utilities and healthcare firms often remain stable even during downturns.

4) Costs and Fees

Another important factor is cost. Oil trading platforms may charge fees on leveraged products, overnight financing, and spreads. Because of the speculative nature of commodity trading, these costs can add up quickly if trades are not well managed.

Stock trading platforms have become increasingly affordable due to competition. Many offer commission-free trades for certain markets or have lower account minimums. However, fees may still apply for international trades or premium features.

5) Regulation and Transparency

Both oil trading platforms and stock trading platforms are subject to regulatory oversight, but the level and type of regulation can vary. In the UK, for example, platforms must be authorised by the Financial Conduct Authority (FCA). Reputable oil trading platforms provide transparent pricing and robust risk management tools, but the fast-paced nature of oil markets demands even greater scrutiny from users.

Stock trading platforms tend to have more built-in investor protections, especially when it comes to blue-chip stocks. Information about companies is widely available, which helps support more informed investment decisions.

6) Accessibility and Learning Curve

Oil trading platforms are often seen as tools for more experienced traders. The complexity of oil markets, combined with the high risk involved, can be daunting for beginners. That said, many platforms now offer demo accounts and educational resources to help new users get started.

Stock trading platforms are more accessible to beginners, especially those looking to invest in well-known companies or build a diversified portfolio over time. Many platforms include educational videos, tutorials, and customer support designed to assist novice investors.

Which Platform Should You Choose?

The choice between an oil trading platform and a stock trading platform largely depends on your financial goals, experience level, and risk tolerance. If you're looking for high-risk, high-reward opportunities and have an interest in commodities, an oil trading platform might be right for you. However, if you prefer long-term investing and greater diversification, a stock trading platform may be more suitable.

In some cases, investors choose to use both types of platforms. This allows for better portfolio diversification and exposure to multiple asset classes.

Conclusion

While both oil trading platforms and stock trading platforms offer powerful tools for market participation, they cater to different investor needs. Oil trading platforms provide speed, leverage, and access to global commodity markets, but require deep knowledge and risk management. Stock trading platforms are more beginner-friendly, offering a broad range of assets and resources for steady portfolio growth.

Understanding how each platform operates helps traders make more informed decisions and align their strategies with their financial goals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.