Learning how to trade options as a beginner can feel overwhelming at first. Options are often seen as complex financial instruments, and their terminology, mechanics and strategies can intimidate new traders. However, with a structured approach and a clear understanding of the basics, anyone can learn how to trade options and incorporate them into a broader investment strategy.

Options give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a set timeframe. They are widely used for speculation, income generation and risk management.

If you are wondering how to trade options effectively, the first step is understanding what you are actually trading and how the contracts function.

5 Steps on How to Trade Options as a Beginner

1) Understand the Basics of Options Contracts

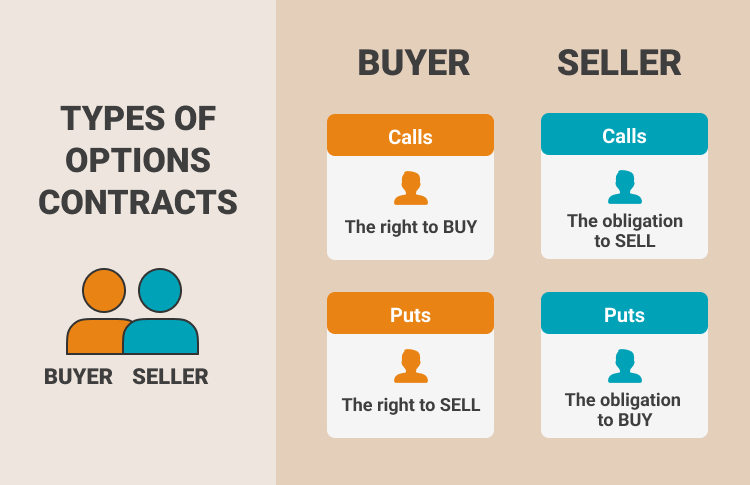

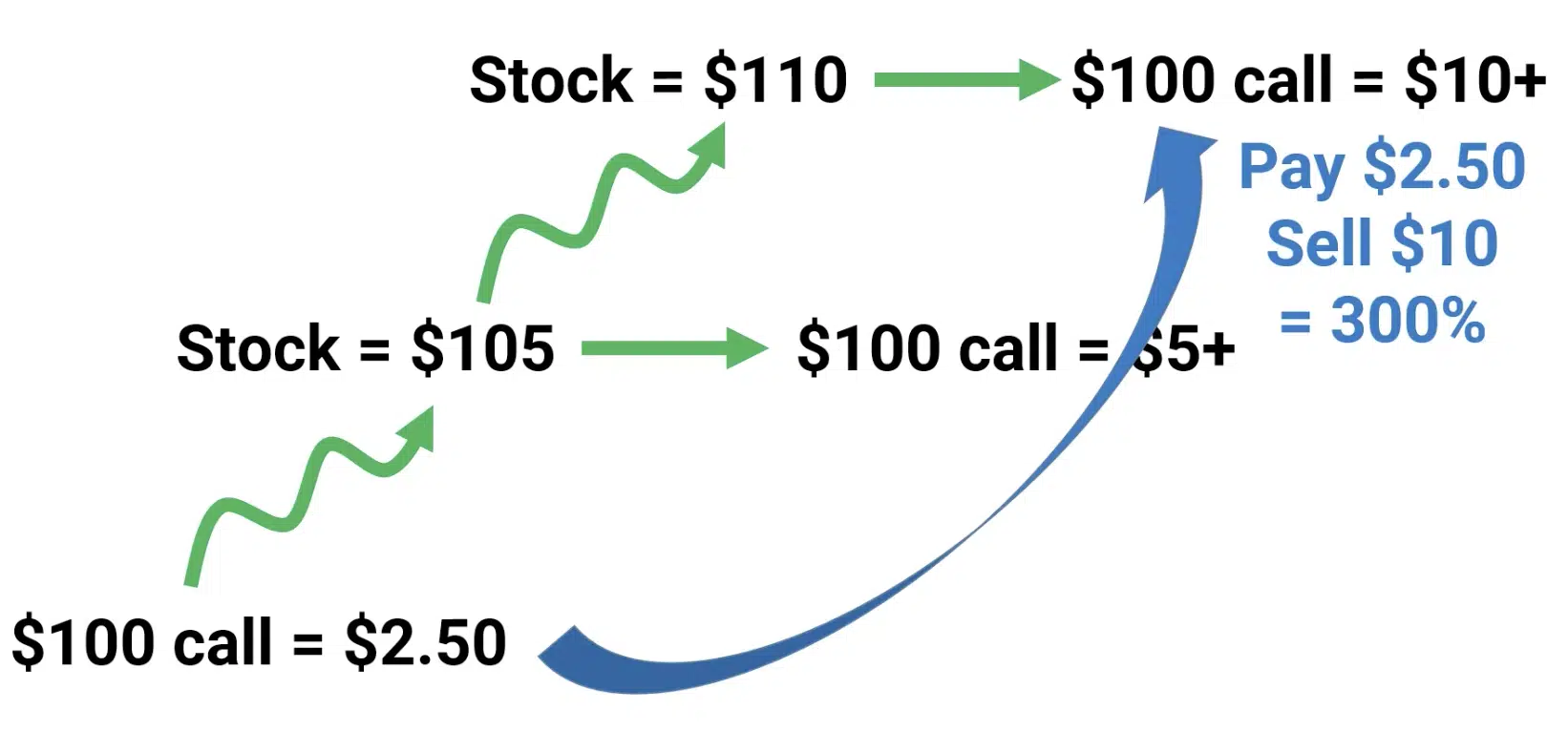

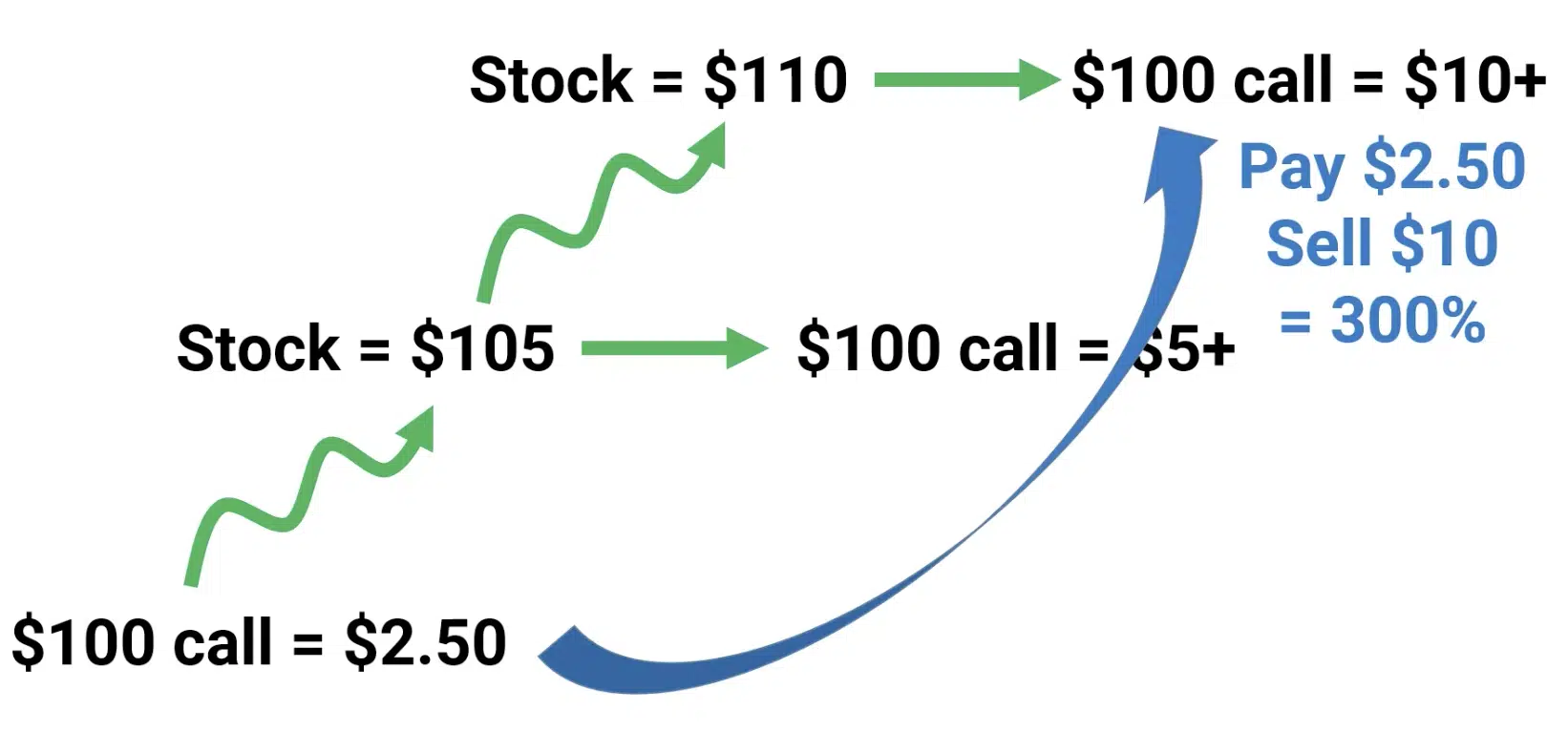

When learning how to trade options, it is essential to start with the two main types of contracts: call options and put options. A call option gives the buyer the right to purchase the underlying asset at a fixed price (known as the strike price) before the contract expires. A put option gives the buyer the right to sell the underlying asset at a predetermined price within a specific time period.

Each options contract typically represents 100 shares of the underlying stock. The buyer pays a premium for this right, and the seller of the option receives that premium in exchange for taking on the obligation to fulfil the contract terms if exercised.

To learn how to trade options properly, beginners need to grasp a few key terms: strike price, expiration date, premium, intrinsic value and time value. These elements work together to determine the price and potential profitability of any given options trade.

2) Choose the Right Strategy

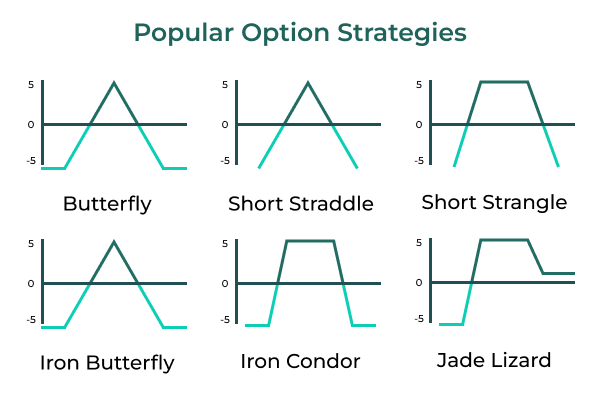

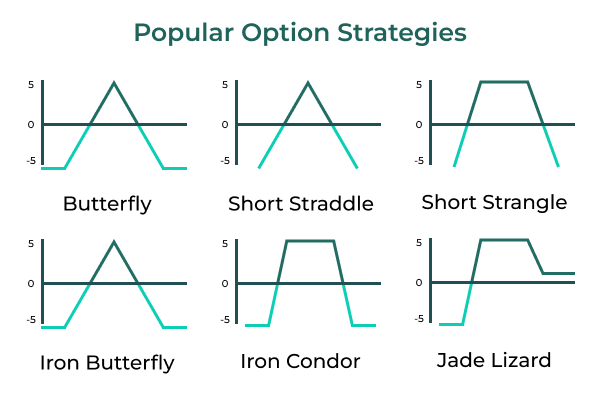

One of the most important decisions you will make when learning how to trade options is choosing the right strategy. Beginners often start with buying calls or puts, as these are the simplest strategies with clearly defined risk and reward. Buying a call means you believe the underlying asset will go up. Buying a put indicates you expect it to fall.

As you gain experience, you might explore more advanced strategies such as covered calls, cash-secured puts or vertical spreads. Each approach has a specific risk profile and is suited to different market conditions. Knowing how to trade options includes not just picking a direction, but also selecting a strategy that fits your outlook, time horizon and risk tolerance.

Unlike stocks, options lose value over time due to time decay. This means even if the price moves in your favour, waiting too long can still result in a loss. Timing is critical in options trading, and successful traders plan their entries and exits with precision.

3) Use a Reliable Broker and Platform

To trade options, you will need a brokerage account that supports options trading. Not all platforms are equal when it comes to execution speed, charting tools, and risk management features. Choose a broker with transparent pricing, robust education resources and responsive support. Some platforms also offer paper trading accounts, which allow you to practise trading options without risking real money.

When setting up your account, you may be required to answer questions about your financial background and trading experience. This is because options trading carries higher risk than buying stocks outright, and brokers are obligated to ensure clients understand what they are doing.

Execution matters in options trading. Even small delays can impact profitability, especially in short-dated contracts. Learn how to trade options efficiently by familiarising yourself with your platform's order types, such as market, limit, stop-limit and conditional orders.

4) Risk Management Is Essential

Perhaps the most important part of learning how to trade options is understanding the risks. Unlike buying a stock, where your maximum loss is the amount you paid, options can expose you to significant losses if not used carefully. Some strategies have defined risk, while others, such as selling naked calls, carry unlimited risk potential.

To manage this, set clear rules for position sizing, stop losses and profit targets. Always know how much you are willing to risk on a single trade, and never place trades based on emotion or fear of missing out. Understanding the risk profile of each strategy is non-negotiable when learning how to trade options safely.

Volatility also plays a major role in options pricing. When implied volatility is high, premiums increase, and when it drops, options lose value more quickly. Traders need to account for this, especially when holding positions during earnings releases or macroeconomic events.

5) Learn Through Practice and Patience

Like any skill, learning how to trade options takes time. The best way to build experience is through structured practice. Many platforms offer historical simulations and demo accounts where you can test your ideas. Reviewing past trades, keeping a trading journal and analysing your results will help you improve over time.

Avoid chasing complex strategies before mastering the basics. The simplicity of buying a call or put provides valuable insights into how options behave in different conditions. Once you are comfortable, you can gradually expand your toolkit.

Education is ongoing. Read books, follow professional traders, watch market commentary and attend webinars. The more you expose yourself to real-world examples of how to trade options, the more confident and disciplined you will become.

Final Thoughts

Options trading offers flexibility and control, but it requires knowledge, discipline and the ability to manage risk. If you want to learn how to trade options as a beginner, start with the fundamentals, choose a simple strategy, and build confidence gradually. Avoid the temptation to jump into complicated trades, and focus instead on developing a repeatable process.

Options are not suitable for everyone, but for those willing to learn how to trade options carefully, they offer unique ways to express market views, hedge risk or generate income. With patience and the right mindset, beginners can become skilled options traders and navigate the markets with greater precision.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.