The exchange rate between the United States dollar (USD) and the Japanese yen (JPY) is one of the most closely watched currency pairs in global financial markets. As a major component of international trade and investment flows, the USD/JPY rate reflects a wide array of economic indicators, monetary policies, and geopolitical events. In this article, we delve into how much yen you get for one dollar today, what has influenced this exchange rate historically, and what factors are currently driving movements in the pair.

Current USD to JPY Exchange Rate

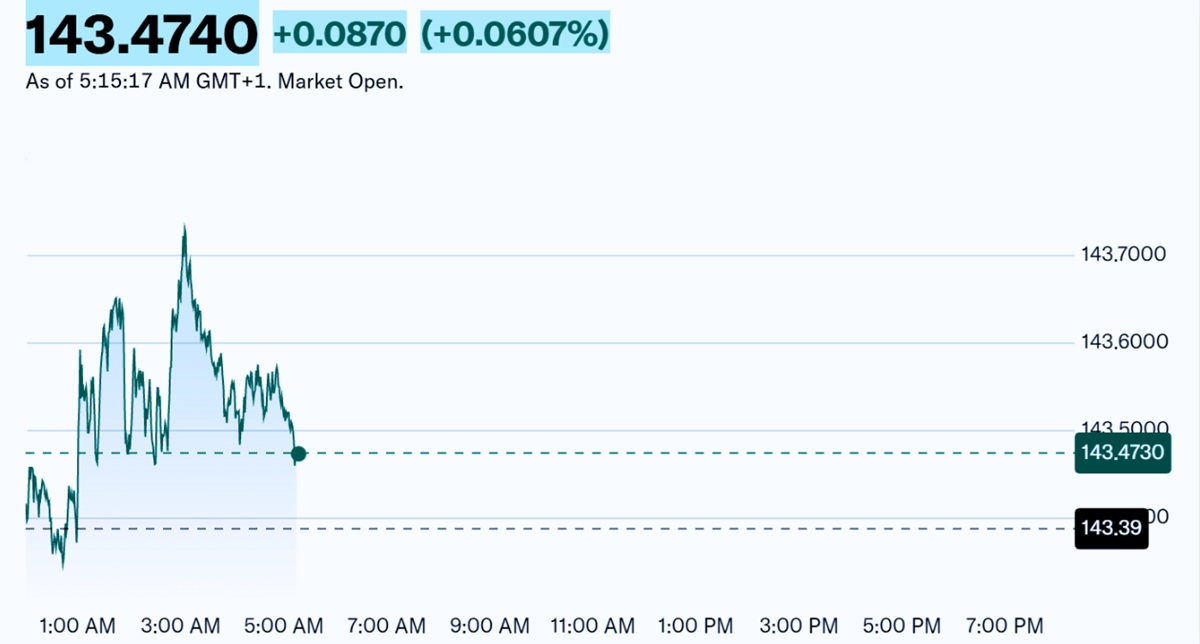

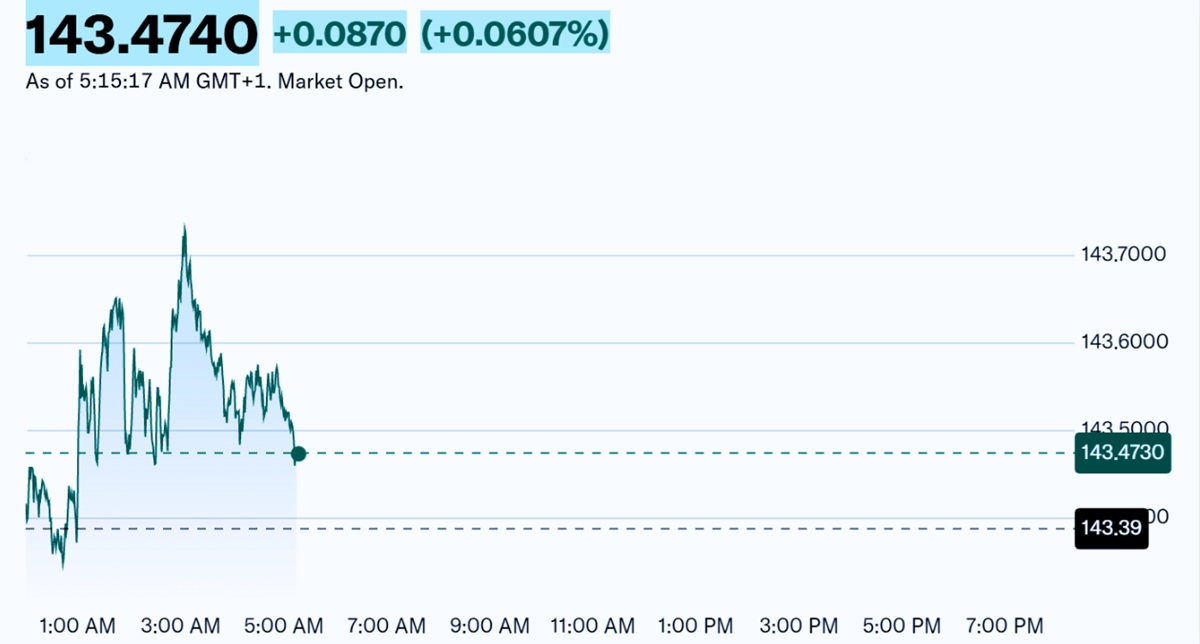

As of early July 2025. the USD/JPY exchange rate is trading around ¥143.50 per $1. This level reflects recent volatility driven by shifting interest rate expectations in the United States and Japan, as well as broader macroeconomic trends.

It's important to note that this is the mid-market rate, also known as the interbank rate, which is the rate at which banks trade currencies between themselves. Retail customers exchanging dollars for yen at banks or currency exchanges will typically receive a less favourable rate due to service fees and profit margins.

If you're looking to convert dollars to yen, services like Wise, Revolut, and XE offer real-time conversion rates with competitive fees. For example, on Wise, you might see $1 fetching around ¥143.30 after transaction costs are applied.

Historical Trends in USD/JPY

The USD/JPY exchange rate has experienced significant fluctuations over the past few decades, often reacting to central bank policies, trade tensions, and global risk sentiment. In the early 2010s, the pair hovered in the ¥80–¥100 range. However, a shift began when the Bank of Japan (BoJ) implemented aggressive monetary easing policies under Abenomics, driving the yen lower.

The USD/JPY exchange rate has experienced significant fluctuations over the past few decades, often reacting to central bank policies, trade tensions, and global risk sentiment. In the early 2010s, the pair hovered in the ¥80–¥100 range. However, a shift began when the Bank of Japan (BoJ) implemented aggressive monetary easing policies under Abenomics, driving the yen lower.

From 2020 onward, the COVID-19 pandemic, coupled with supply chain disruptions and aggressive U.S. monetary tightening starting in 2022. saw the USD surge to levels above ¥150 — its highest in over 30 years. In contrast, recent months have shown a modest retreat, as Japan hints at a gradual policy shift and U.S. inflation trends point to a possible rate cut cycle.

Highs and Lows Over Time

In the last 12 months, the USD/JPY has seen considerable swings:

Shorter-term volatility remains, with daily moves often driven by inflation data releases, central bank speeches, or geopolitical developments. For instance, the yen tends to strengthen during global risk-off episodes due to its status as a safe-haven currency.

It is also worth observing that the Japanese government has occasionally intervened in the currency market, particularly when the yen weakens too rapidly. Such interventions usually aim to stabilise markets and protect the competitiveness of Japanese exports.

Market Drivers Influencing USD/JPY

Several key factors influence the USD/JPY rate on a regular basis:

Interest Rate Differentials: Perhaps the most significant driver. When the U.S. Federal Reserve raises interest rates while the BoJ maintains low or negative rates, the dollar tends to strengthen against the yen. Investors seek higher yields, prompting capital to flow into dollar-denominated assets.

Economic Indicators: Employment data, GDP growth, and inflation figures from both countries have a substantial impact on expectations for monetary policy, thereby affecting the exchange rate.

Central Bank Policies: Markets closely monitor statements from the Fed and BoJ. For instance, hints of policy normalisation by the BoJ have supported yen strength in recent months.

Geopolitical Risk and Safe-Haven Flows: The yen has traditionally served as a safe-haven asset. During times of geopolitical uncertainty or financial stress, demand for the yen increases, pushing the USD/JPY rate lower.

Where to Check Live Exchange Rates

If you're planning a trip to Japan or conducting business that requires currency exchange, it's essential to stay informed on real-time rates. Here are some trusted platforms to check live USD/JPY exchange rates:

Wise (TransferWise) – Offers competitive mid-market rates with transparent fees. Ideal for international transfers.

XE.com – Popular for live exchange rate data and currency charts.

Revolut – A mobile banking app that allows free foreign exchange at interbank rates (within certain limits).

OANDA – A professional trading platform offering real-time FX data and analytics.

It's advisable to compare a few platforms to get the best available rate and understand associated fees, especially for larger transfers.

Conclusion

Understanding how much yen one dollar can buy involves more than just glancing at a rate. The USD/JPY exchange rate reflects a dynamic interplay between monetary policies, interest rate differentials, global risk sentiment, and historical trends. While the current rate hovers around ¥143.50. it is subject to daily changes based on market expectations and economic data.

Whether you're a traveller, investor, or just curious about forex markets, keeping an eye on these drivers and using reliable tools for real-time data can help you make informed decisions. As Japan's monetary landscape begins to shift and the U.S. economy moves through its post-hiking cycle, USD/JPY is poised to remain one of the most active and telling indicators in the global currency market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The USD/JPY exchange rate has experienced significant fluctuations over the past few decades, often reacting to central bank policies, trade tensions, and global risk sentiment. In the early 2010s, the pair hovered in the ¥80–¥100 range. However, a shift began when the Bank of Japan (BoJ) implemented aggressive monetary easing policies under Abenomics, driving the yen lower.

The USD/JPY exchange rate has experienced significant fluctuations over the past few decades, often reacting to central bank policies, trade tensions, and global risk sentiment. In the early 2010s, the pair hovered in the ¥80–¥100 range. However, a shift began when the Bank of Japan (BoJ) implemented aggressive monetary easing policies under Abenomics, driving the yen lower.