The Middle Ages were an era of turbulence and significant innovation. In this article, let's travel back to the Middle Ages and take a look at the financial world at that time.

994

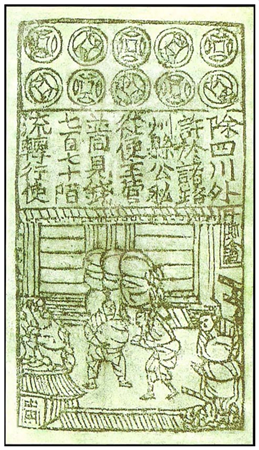

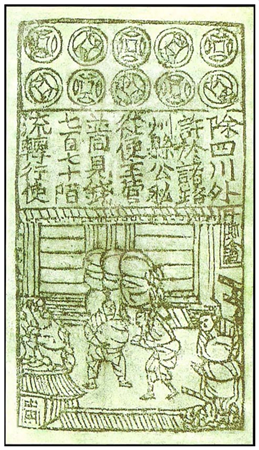

The world's first paper currency

The picture shows "Jiaozi", a type of paper currency from the Song Dynasty, used in Sichuan from 960 to 1279

Source: GARRY-SAINT

In the Song Dynasty, there was a shortage of metal coins and the production of copper coins was difficult, resulting in the emergence of "paper currency". Paper currency played an important role in domestic transactions, when gold and silver were used for international trade.

Due to the fact that this type of paper currency is not linked to metal, it leads to high inflation. In the late 13th century, Marco Polo came to China and brought the concept of "paper currency" back to Europe. In Europe, the first batch of paper currency was issued byThe Stockholm Bank, founded by Johann Palmstruch, went bankrupt due to insufficient reserves. The issuance of paper currency was not perfected in Europe until the 18th century.

Mid 13th century

France created its first joint-stock company

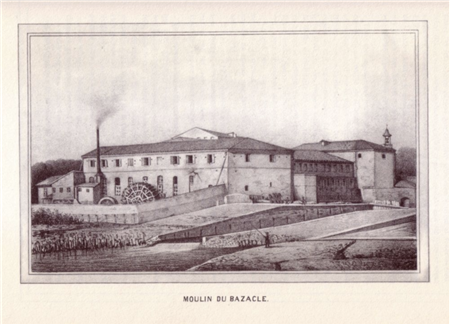

巴扎克磨坊 资料来源:WIKIMÉDIA COMMONS

Around 1250, in Toulouse, France, in order to raise funds for the construction of a dam, the miller established a company called "SOCI É T É DES MOULINS DEBAZACLE entrusted their savings to the company, and in return, they received notarized documents proving their investment. These notarized documents are called UCHAUX. Like the shares of existing limited companies, they can be passed on anonymously, so the ownership of the three companies operating the dam quickly transferred from the miller's hands to the Toulouse bourgeoisie eager for good investment.

The company is composed of 96 UCHAUX units, with the owner having the right to resell, not under the control of other partners, and without the right of first refusal. The exchange price of these limes varies depending on economic conditions and the quality of mill operation. The owner of each share, also known as "UCHAUX" shares, receives one sixteenth of each bag of wheat stored by farmers who grind wheat. In 1888, the water mill became a hydroelectric power plant. one thousand nine hundred and tenIn the year, it was renamed as "SOCI É T É TOULOUSAINE D 'É LECTRICIT É DU BAZACLE". Like other power sectors, it was established in 1946It was nationalized in.

1290-1360

Currency manipulation to fund royal expenses

AGNEL D'OR (front)

Source: BANQUE DE FRANCE

In France, especially during the reign of King Philip IV (1285-1314In order to finance royal expenses and promote trade, King Philip IV carried out a series of currency manipulation by creating new currencies and reducing their metal content without changing their face value.

These manipulations continued until the first half of the 14th century to fund military expenditures brought about by the Hundred Years' War.

14th and 15th centuries

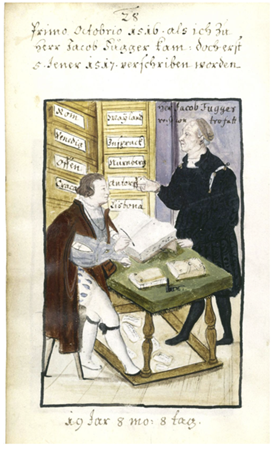

The birth of the largest bank

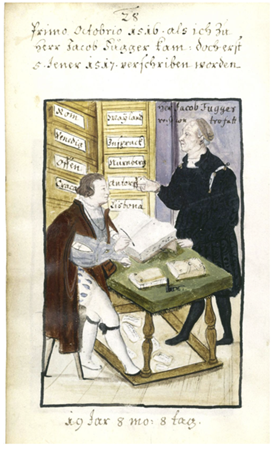

Banker Fuge is borrowing money. From book LIVRE DES COSTUMES, FOLIO 17V

Source: National Library of France

Jacob Fuge Stamp

Source: National Library of France

In Europe, these banks were mainly founded by the Medici family in Italy, Jacques Cole in France and the Fugger family in the Holy Roman Empire. The development of European banking activities was initially hindered by the Church's condemnation of interest bearing loans. For a long time, interest bearing loans have been a specialty of Jewish families.

In the 14th century, due to the need of trade, a group of merchant families, such as the Medici family in Italy, the Fugger family in the Holy Roman Empire, and the Jacqueline family in France, began to specialize in diversified and large-scale banking business, especially foreign exchange and discount transactions (repurchasing bills held by merchants in exchange for cash advances from their customers).

fourteenth century

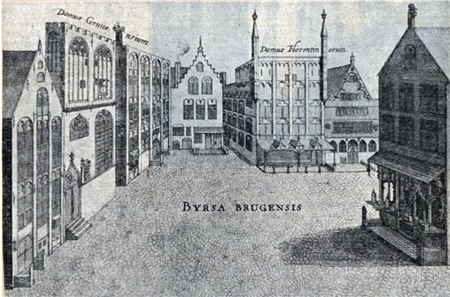

Creating the world's first stock exchange

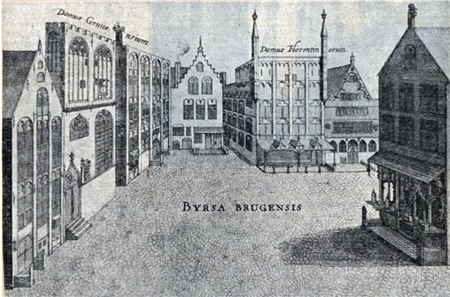

OLD TER BUERSE SQUARE, Bruges, Belgium, VAN DER BUERSE's house is a house with storks on the chimney

Source: UNIVERSI-TEITSBIBLIOTHEEK GENT

Prior to the establishment of a stock exchange, financial Securities (such as debt securities) were only traded on the "counter", i.e. between sellers and buyers, who traded in Pont au Change in Paris or VAN DER in BrugesExchange on the square in front of the hotel operated by the BUERSE family. The first stock exchange was established in Bruges, Belgium in 1309 and was named after this family.

In France, the first commodity exchange was established in Lyon in 1540. The first batch of stocks was issued in 1698Trading at Jonathan's Cafe in London in. These stock exchanges allow all buyers and sellers to meet in one place, thereby promoting securities trading.

The Economic Crisis of the 14th Century

The bodies of famine victims lying in the fields

The image is from JEAN DE WAVRIN's "Chronicles of England" (1470-1480). Source: British Library Council/ROBANA/LEEMAGE

In the Middle Ages of the 12th and 13th centuries, the economic revolution led to the flourishing of economic activities in Europe, especially in France. But due to a series of events, this was suddenly interrupted in the early 14th century: climate change, agricultural production crises (especially1314-1317The Hundred Years' War between England and France in 1337 caused various disasters and infectious diseases to the Byzantine Empire (the Black Death from 1347 to 1351, followed by repeated outbreaks until 1370).

Especially due to these epidemics, the population in certain regions of Europe has decreased by more than half. The population of France did not recover to the level of 1320 until around 1600.

Against this backdrop, commodity prices have plummeted, and countless countries have defaulted and private banks have gone bankrupt throughout Europe: for example, in 1345, Edward III of England defaulted on debts, while banks in FlorenceBARDI and PERRUZI have also gone bankrupt. Infectious diseases have made labor supply increasingly scarce and have also driven up wages.

1360

The Birth of the Franc

FRANC DE CHEVAL (gold, 24 K) issued between 1360 and 1364 (obverse)

FRANC MAX CHEVAL (reverse)

Source: BANQUE DE FRANCE

King John II of France was captured by the British in 1356 and released in 1360, but was ordered to pay the remaining ransom.

He passed three tax and currency laws, one of which created a new gold currency called FRANCCHEVAL (horseback franc), the franc coin bears the portrait of King John II being released on horseback.

The new franc will become the only currency used in the entire kingdom, and its stability will be guaranteed by the monarch. John II ended the currency manipulation during his predecessor's reign.

The name "franc" in English means to be released, referring to John's liberation.

In order to help raise ransom, the king also introduced a new tax called aide, which was retained by his son and successor Charles V. Charlie also minted new franc coins, showing the king standing upright instead of riding a horse, meaning that the king was released on foot, similar to their predecessorsIn stark contrast, these are known as FRANC DE PIED (walking francs). Soon, the users of coins simply referred to them as "francs".

1636-1637

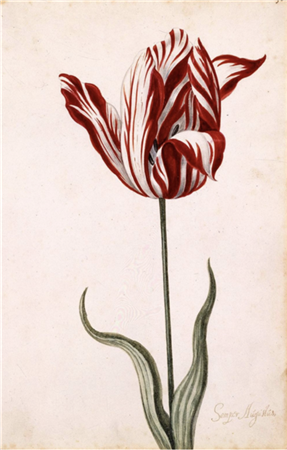

The first speculative foam, the foam of tulip bulb market

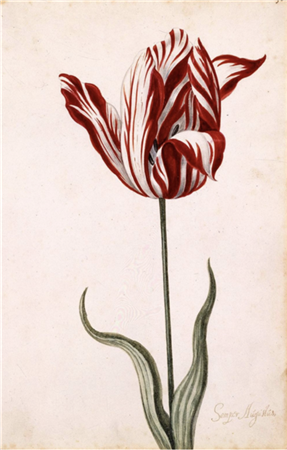

The representative of the 17th century Semper Augustus tulip, which was the most expensive variety during the Dutch tulip craze

Source: Norton Simon Art Foundation

In the 17th century Netherlands, tulips were promoted for their rarity and novelty. In the 1630s, they became objects of speculation. This investment hype continued until 1637At that time, a sudden price reversal caused buyers to panic and sell off.

1668

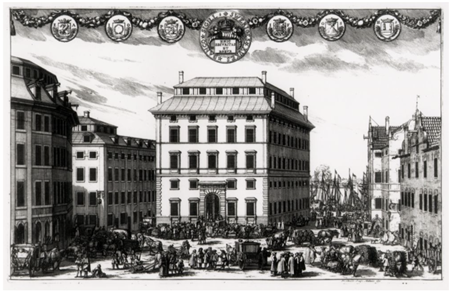

Establishing the first central bank

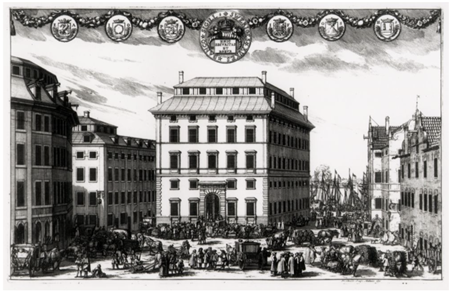

The first building of Riksens St ä nders Bank, originally named Sveriges Riksbank

Source: Gabriel Hildebrand/Kungliga Myntkabinette

The Swedish Bank was established in 1668, followed by the Bank of England in 1694. Johan PalmstruchAfter the collapse of the Stockholm Bank under his management (he innovatively issued paper currency exceeding the amount of precious metal deposits in 1661).

The Bank of the Estates of the Realm (now the Swedish Bank) was established in 1668. The Bank of England was established in 1694The Bank of France was established in 1800. These early central banks gradually distinguished themselves from other banks (now known as' secondary banks' or 'commercial banks') by gradually acquiring monopoly rights in the issuance of banknotes in specific regions.

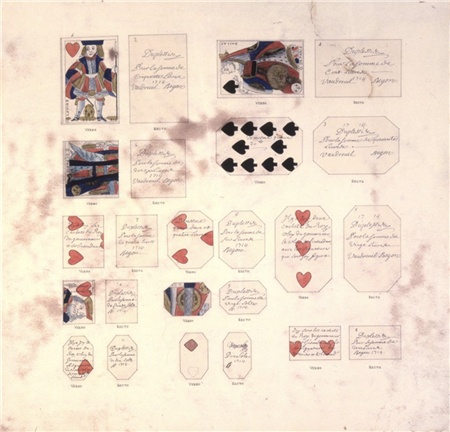

1685

Issuance of currency through repeated use of playing cards in Canada (New France)

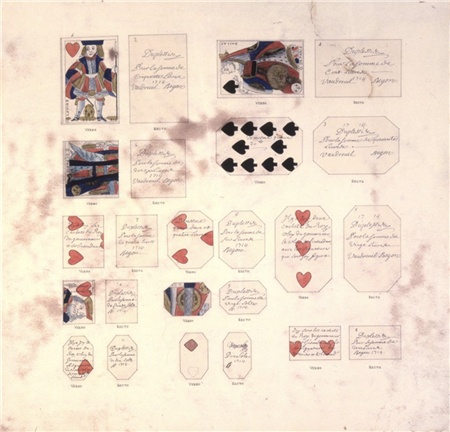

Money Playing Cards

Source: Canadian Library and Archives (C-017059)

This is a measure taken by French administrative personnel to address the shortage of funds for the royal family.

1701-1716

France's First Issuance of Paper Money

During the reign of John Law (1671-1729), speculation on Quincampoix Street (due to legal bankruptcy)

Source: Luisa Ricciarini/Leemage

A 1000 Livre note of the Royal Bank -- Louis XV of France -- February 15, 1719; By Fenellon, Bourgeois, andDuverest signature (front).

Source: Bank of France

The first issuance of banknotes ("bills de monnoye") was in France, but the issuance was still limited.

In 1716, the head bank established by John Law was located in the Regent PhilipUnder the guarantee of d'Orl é ans, a larger scale of gold banknotes was issued. However, the issuance of paper money soon got out of control, and the bank's gold reserve could not meet more and more exchange requirements, which caused widespread panic. Finally, John LawLaw's bank went bankrupt in 1720.

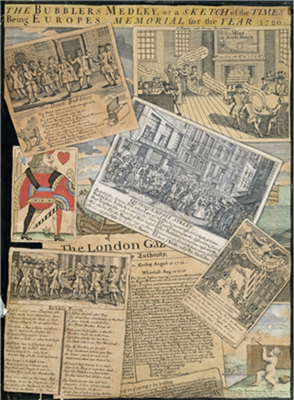

1720

Britain's South China Sea foam

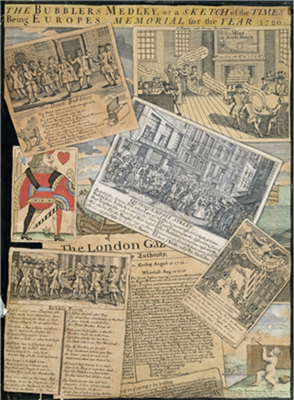

In 1720, the crisis of South Sea Company

Source: Metropolitan Archives, City of London/Bridgeman Images

The South China Sea crisis is known as the "South China Sea foam". Edward Matthew Ward's oil painting (19th century)

Source: Wikimedia Commons

As one of the ancestors of the modern financial market, the London stock market has witnessed numerous ups and downs, manias, stock market disasters and crises. The first major crisis occurred 300 years ago, known as the South China Sea foam in history.

South Sea Company was established in London in 1711 and granted the monopoly right to trade with South America. It is a British overseas trading company with a special identity and innovative business. It actually focuses on financial investment. In 1713, it began to create a foam in the London stock market. In the spring and summer of 1720, the stock price of the South China Sea rose sharply and fell sharply. The stock market foam burst, triggering political turmoil. At the same time, it also gave birth to public discussions on market supervision, government behavior constraints, potential risk control and other modern financial market elements. Later studies also found that fake news played a role in the rise and collapse of the foam.

When the South China Sea foam burst, the public opinion was in an uproar, and the sentiments from all walks of life were intense. Politicians demand a serious investigation to uncover the culprit; Members of the Board of Directors of South Sea Company were accused of treason and fraud, and were summoned to the parliament to attend the inquiry. Scholars and literati use poetry, criticism, satirical comics, and stage dramas to criticize the market and those who are considered the initiators. The British Prime Minister was once imprisoned at the Tower of London.

After the storm finally subsided, the South China Sea foam became a synonym for financial scandals, and gradually became a special term in economics, referring to the sudden rise and fall of Stock Prices caused by unconventional investment mania, and the subsequent chaos.

one thousand seven hundred and twenty-four

Establishing the Paris Exchange

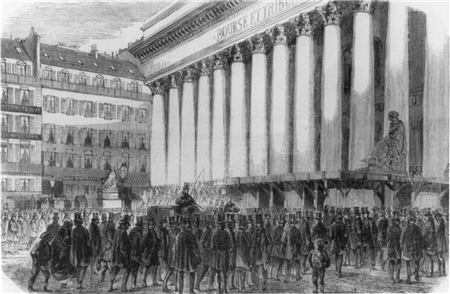

Interior of Palais Brongniart, circa 1880-1900

Source: Rue des Archives/Tallandier

The revolving door facility of the Paris Stock Exchange, Sygma Keystone (1857).

Source: Bank of France

Initially, the Paris Stock Exchange was listed on H Ô TEL DE NEVERS. In 1826, it moved to the Browniad Palace, where stockbrokers gathered.