Gold hit a fresh record high above $2100 at the weekend as the dollar’s

strength appears to have peaked. The focus is now on when the Fed will begin

rate cuts next year.

Surging Treasury yields spooked investors this year, but policymakers in the

US and Europe that swerved from a hawkish stance in Nov have upended market

dynamics.

Gold prices are on course to hit fresh highs next year and could remain above

$2,000 levels, analysts said. It is a bold forecast as the precious metal always

retreated towards $1,800 or even lower after crossing $2,000.

The conflict in the Middle East barely concerns investors as Iran’s pledge to

support Hamas did not translate into tit-for-tat between Jews and Muslims. But

That does not dent gold demand.

Net long positioning on COMEX rose 23% month on month in Nov and 24% of

central banks intend to increase their gold reserves in the next 12 months,

according the WGC.

Global gold ETFs outflows also slowed significantly last month, Still the

precious metal perched precariously high is particularly vulnerable to any risks

that could derail the rally.

China and India demand wane

China and India make up more than 50% of the physical gold market, and higher

prices are beginning to impact on retail demand in both countries.

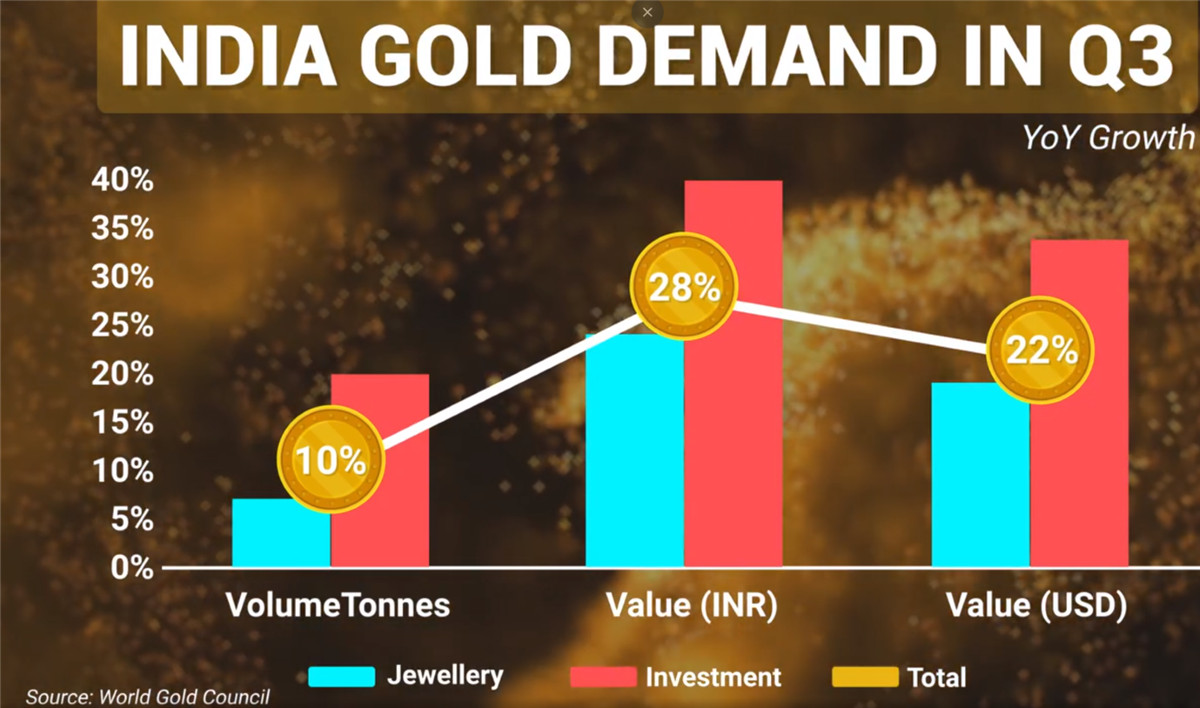

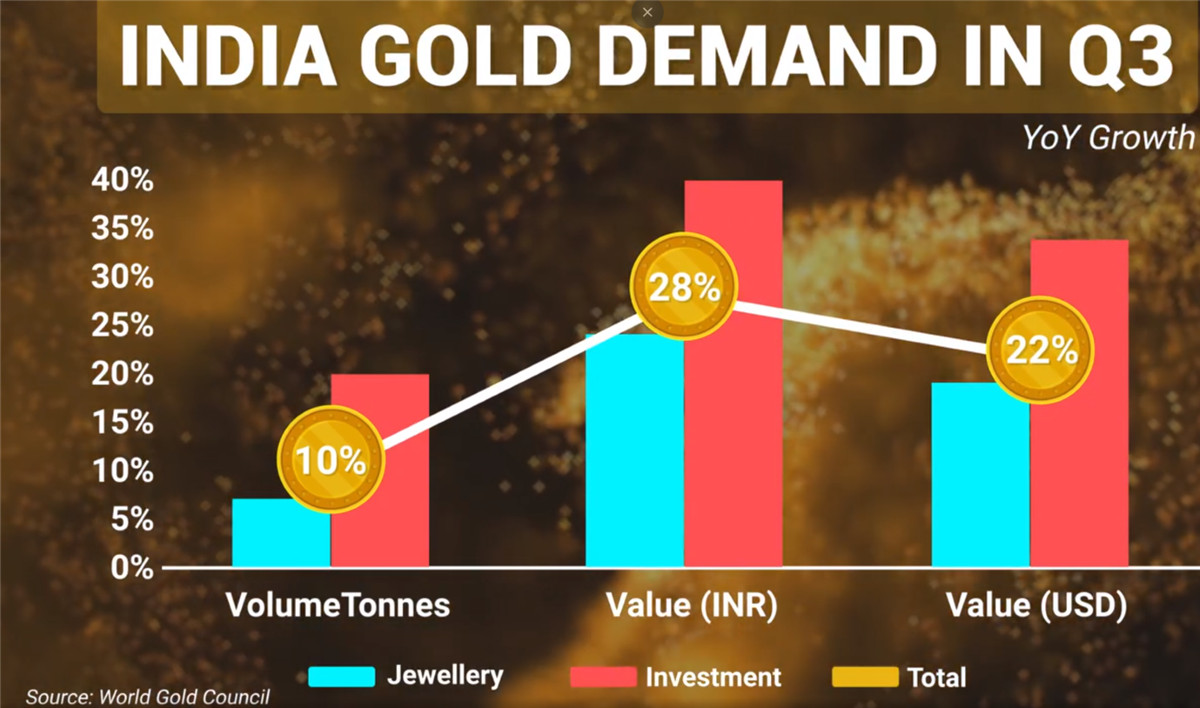

While India's gold demand has been solid so far in 2023, matching strength in

the domestic economy, it appears that some momentum may be fizzling out.

The price-sensitive market saw an annual increase of 7% in its jewellery

demand in the third quarter but rising costs should put a lid on further growth

in the current quarter.

China's net imports from Hong Kong slid 23% to 26.793 metric tons in Oct,

compared with 34.757 tons in September, data showed. It was the second monthly

drop in a row.

The country's jewellery demand was down 6% year on year in the third quarter.

It is expected that macroeconomic uncertainties may further crimp demand in the

fourth quarter.

McKinsey said China’s consumer is not going to spend anytime soon. Consumer

sentiment at the same level it was about 12 months ago, when the country was

still living under Covid restrictions.

Bet on rate cuts overdone

Markets are pricing in at least 100 basis points of interest rate cuts next

year, starting in the second quarter. For BlackRock, that is unreasonable and

unreal.

“Something will have to go seriously wrong for that to come through. So we do

think that the Fed will cut rates … but how many cuts they will deliver will be

quite a bit less compared with the old economic cycles, old recessions."

Last week Fed Chairman Jerome Powell pushed back on expectations for

aggressive interest rate cuts ahead, though his remarks indicated the central

bank may at least be done hiking for now.

Economists and analysts widely believe the US can achieve a soft landing in

2024. Gold will likely have limited room for growth to set another record high

if that’s the case.

A metric of leveraged funds’ net longs on the greenback against eight

currencies rose to its highest level since February 2022 as of 21 Nov, according

to data from the CFTC.

The increase in net dollar longs was mainly driven by a shift in positions

against the pound, australian dollar and Mexican peso, while bullish bets on the

greenback were cut against the canadian dollar, yen and euro.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.