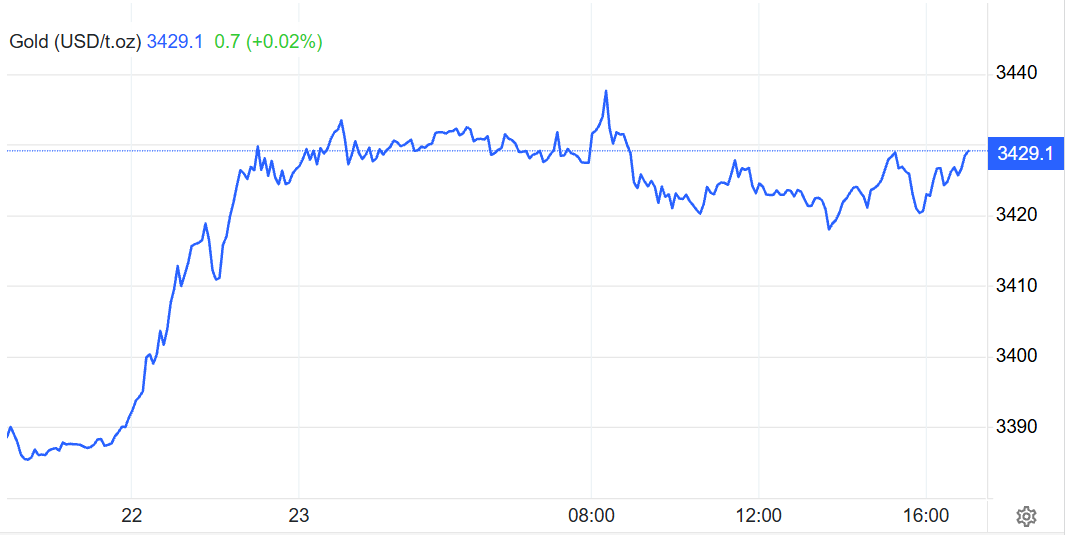

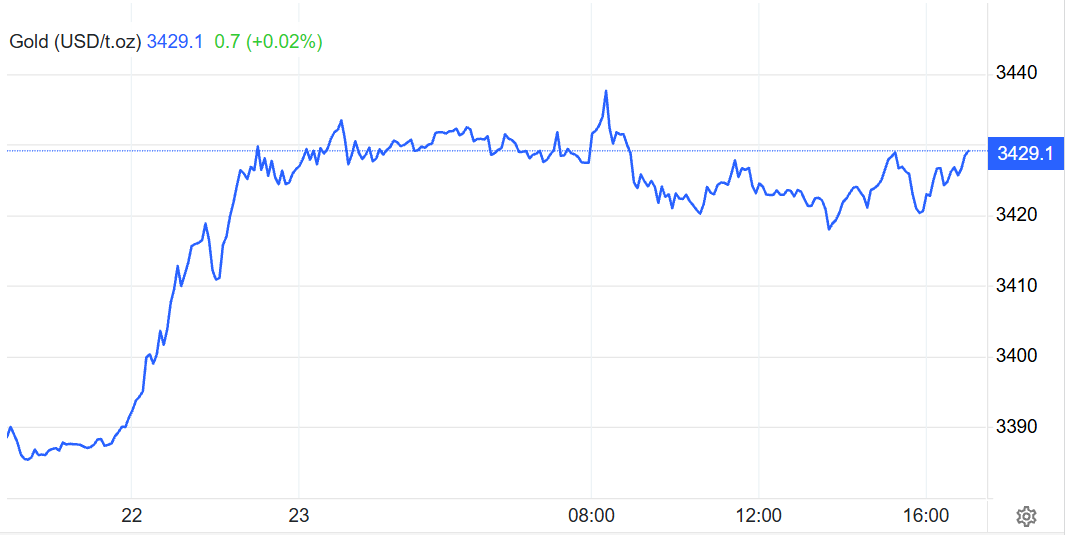

The Gold Price put on a dramatic display at the start of the week, vaulting almost $60 from an early‑Monday trough of $3.338 to an intraday peak of $3.401 on 21 July. That single thrust sliced straight through the stubborn $3.360 barrier that had capped every rally since the beginning of the month, signalling the market's strongest bout of bullish conviction in weeks. By the afternoon of 23 July the spot Gold Price was still trading north of $3.430 per troy ounce, its highest closing zone of the year so far.

Safe‑haven flows eclipse a faltering dollar

Two forces powered the surge. First, recession anxiety resurfaced as traders looked beyond the robust Q2 GDP headlines and fixated on slowing real‑wage growth and a softening services PMI. Those doubts coincided with the 1 August deadline for a new US tariff package aimed at European and Japanese imports, reigniting memories of 2022's supply‑chain shock. As investors dumped dollars, front‑end Treasury yields and Brent crude alike, bullion regained its traditional safe‑haven allure.

The policy backdrop: tariffs, debt ceilings and a divided Fed

Gold's advance is also being greased by monetary‑policy arithmetic. Should fresh duties sap activity just as the US debt‑ceiling "X‑date" looms in early September, the Federal Reserve may be forced into a pre‑emptive rate cut despite a still‑sticky core PCE print. Bank of America's late‑March update captured the mood: the bank upgraded its 2025 average Gold Price target to $3.063 and warned that a mere 10 per cent uptick in investment demand could catapult bullion to $3.500 within two years.

Transatlantic trade tensions add tinder

Across the Atlantic, Brussels has dusted off its Anti‑Coercion Instrument, threatening retaliatory levies on US tech giants should Washington proceed with blanket tariffs of 15 per cent or more. Germany, historically wary of overt trade warfare, has quietly endorsed the plan. EU capitals have further hinted at sector‑specific restrictions on American investment and public‑procurement bids if talks collapse. Such sabre‑rattling helps explain why the Gold Price reacted more violently than either the S&P 500 or the euro: the metal is an insurance contract written on policy mis‑calculations.

A rally built on shifting sand?

For all the excitement, the fundamental case for a sustained climb is less clear‑cut. Tariffs stoke inflation even as they weigh on growth, leaving the Fed torn between its employment and price‑stability mandates; a July pause is therefore the default.

Meanwhile, signs are growing that Washington and Beijing could stage a leaders' meeting on the sidelines of November's APEC summit, potentially removing one of gold's chief geopolitical props. If trade rhetoric cools into August, haven demand might fade as quickly as it appeared.

Technical perspective – the triangle breaks, but confirmation is pending

On the charts, gold has spent the past six weeks carving a contracting triangle with progressively higher lows but virtually unchanged highs. Monday's burst finally punched through that upper trend‑line, yet volume was middling and the daily candle left a conspicuous long upper shadow. Bulls need at least two consecutive daily closes above the former $3.360‑$3.380 resistance band to convert it into reliable support; failure would leave the move looking like a classic bull‑trap.

Conclusion – keep one eye on policy, the other on the tape

In short, the latest leap in the Gold Price rests on a precarious blend of tariff brinkmanship, recession angst and rate‑cut hopes. Unless those three pillars strengthen in unison, the metal's new‑found altitude may prove temporary. Traders chasing momentum should watch 1 August and 18–19 September (the next FOMC meeting) as the binary risk‑events most likely to decide whether gold grinds towards Bank of America's aspirational $3.500 or slips back into its prior $3.200‑$3.350 range. Either way, the market has made one point crystal‑clear this week: ignore gold at your peril.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.