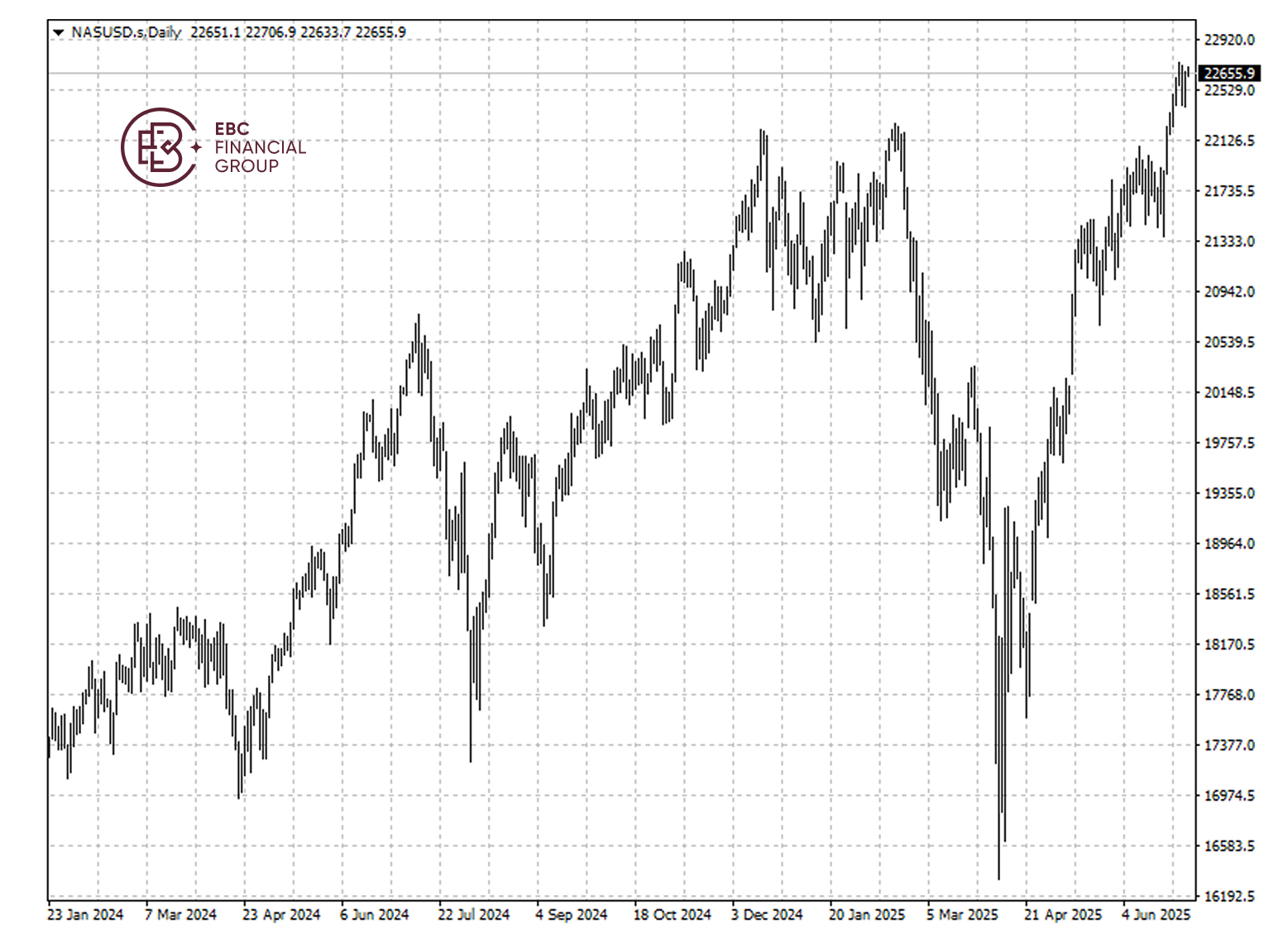

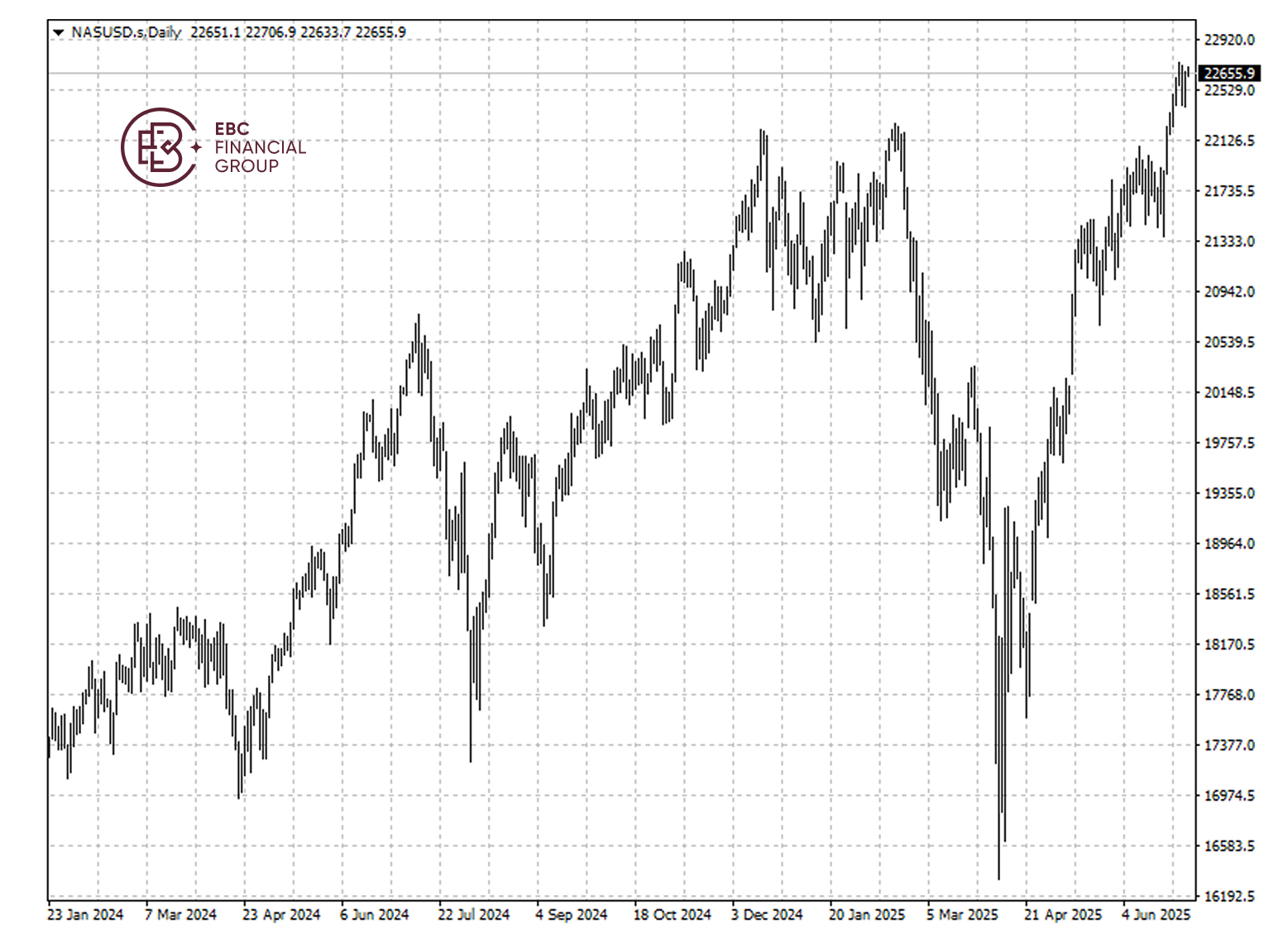

US equities have ripped to new records as the market's worst fears about US

tariffs evaporated. A large part of inflows back into stocks came from retail

investors, per VandaTrack Research's data.

Institutional investors, who mostly stayed put for much of the 25% upswing

since April, are also buying. Options data shows that Wall Street has ruled out

substantial volatility anytime soon.

Systematic strategies have ratcheted up their equity exposures, though they

remain underweight, with positioning in most sectors below the historical

average, according to data compiled by Deutsche Bank.

JPMorgan's trading desk says the setup is bullish, projecting a streak of

all-time highs as earnings carry positive momentum with trade deals expected to

be announced.

The previous earnings season was a bang as 8 out of 10 companies beat EPS

estimates, with significant contributions from financials, communication

services and real estate sector.

Trump said Wednesday the US has reached a trade deal with Vietnam, pulling

off a significant deal. The administration has resumed negotiations with Canada

after Ottawa scrapped digital services tax targeting Big Tech.

Morgan Stanley chief investment officer Mike Wilson, who holds a 6,500

year-end target for the S&P 500 in 2025, said EPS tailwinds would expand in

Q3 including expected Fed's rate cuts.

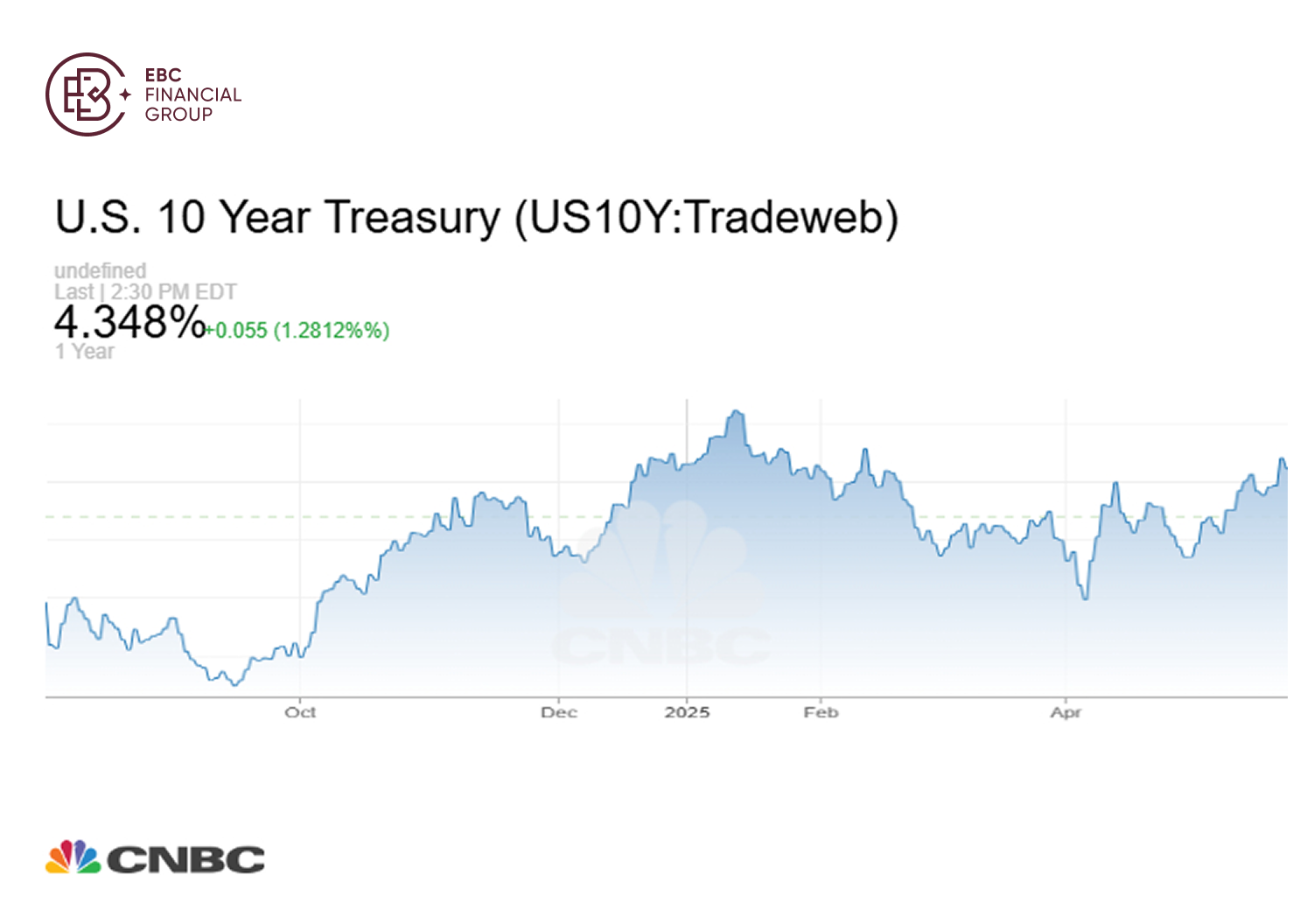

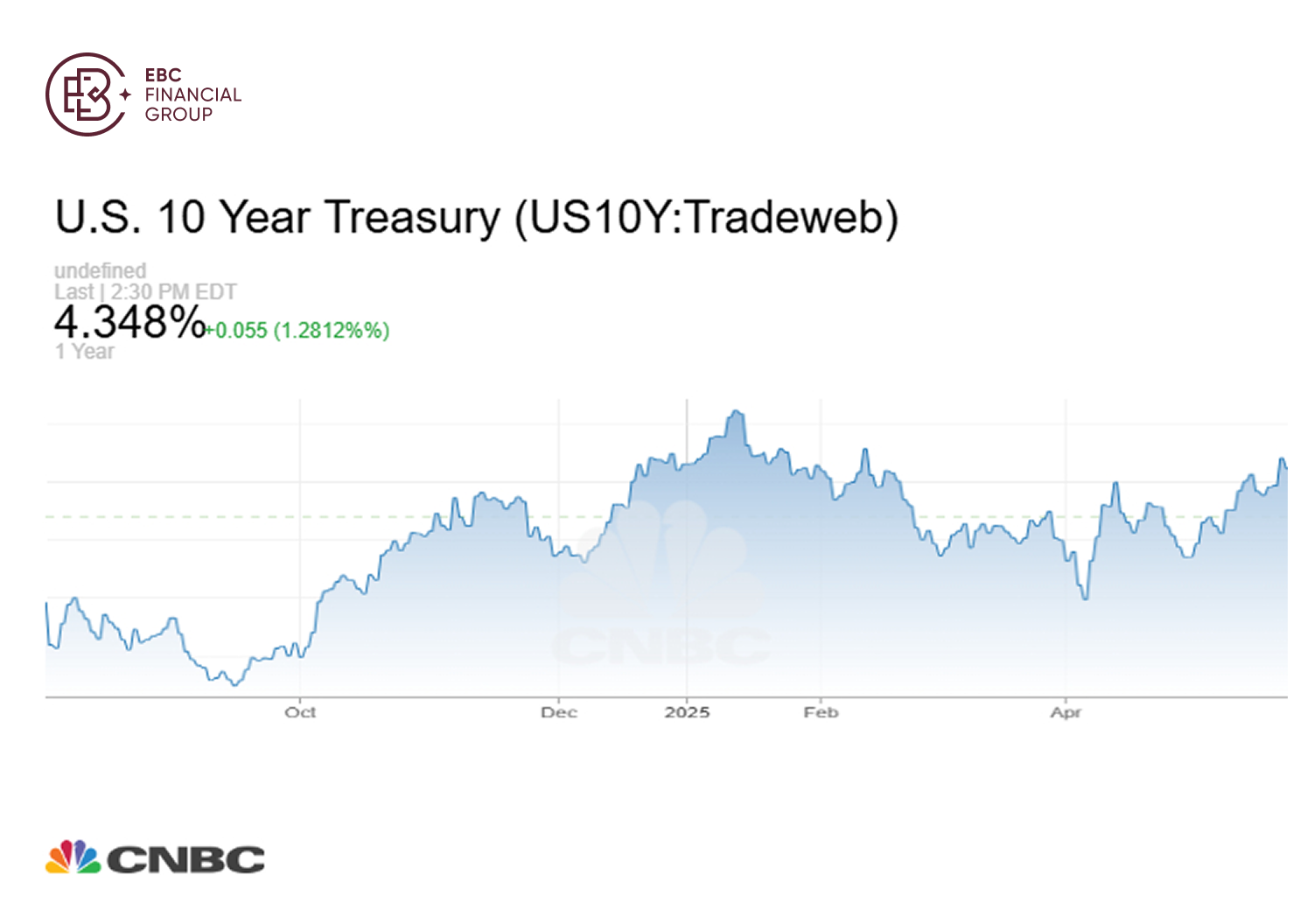

Treasury rally

Benchmark Treasury yield has fallen after reports on US job openings and

non-farm payrolls failed to provide justification for a Fed interest-rate cut as

soon as next month.

Momentum is building in favour of earlier cuts despite expectations that

tariffs will contribute to faster inflation. Trump on Tuesday said he was not

considering delaying the July 9 deadline for those levies.

Goldman Sachs now sees a 25-bp rate cut each in September, October and

December. Consumer spending unexpectedly fell in May as the boost from the

pre-emptive buying of goods ahead of the tariffs faded.

Citigroup and Wells Fargo also expect the Fed to cut rates by 75 bps in 2025,

while UBS Global Research forecasts 100 basis points of reduction.

Trump's tax-cut and spending bill, which passed Congress on Thursday, averts

the near-term prospect of federal government default, but it makes the long-term

debt problems even worse.

The addition of $3.4 trillion to the nation's debt over the next decade, as

estimated by nonpartisan analysts, would exacerbate market oversupply jitters.

Still Treasurys have firmed for the time being.

Meanwhile, overseas asset managers and pensions are adding protection against

a weakening dollar, concerned about the currency's diminishing ability to

diversify their US equity portfolios.

Tesla in tailspin

US profit margins face a big test in the upcoming reporting season as

investors assess the damage from a trade war, according to Goldman Sachs, and Q2

earnings will "capture the immediate effects” of tariffs.

Data compiled by Bloomberg Intelligence show EPS are expected to rise only

2.6% for the previous quarter, the smallest increase in two years, though they

have proved robust so far.

Some companies are particular worrying, such as Tesla. While its sales are

plunging in Europe, elimination of a consumer tax credit of up to $7,500 for the

purchase of EV will add to the pains.

JPMorgan analyst Ryan Brinkman reiterated his $115 price target on the stock

— the lowest among major analysts, according to Yahoo Finance data.

"Based on our checks, the softer demand for Tesla vehicles evident in Q1

results appears to have continued into Q2," Brinkman wrote. He flagged the risk

that full-year delivery projections are overly optimistic.

Musk has now taken aim at Trump's "big, beautiful bill," even suggesting he

might form a new political party. Some investors fear the escalating rhetoric

could further polarize the brand.

Tesla is pushing ahead with its long-promised robotaxi programme, which is

seen as crucial to the company's financial future. It is also likely to begin

making "more affordable products" later this year.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.