Asset managers turned bullish on the Japanese yen for the first time since

May as the BOJ will likely end its ultra-easy policy in 2024 while its major

peers cut interest rates.

The currency hit its highest since the end of July against the dollar this

month. Still it was down nearly 8.5% year-to-date and set for its third straight

year of decline.

The Fed is preparing for potential interest rate cuts next year while the ECB

and the BOE appear to have taken a more hawkish stance. But Europeans

policymakers cannot afford to err on the side of over-tightening as the

economies are on the brink of recession.

Dollar-yen risk reversals, which are contracts that show demand for call

options to buy the yen relative to put options to sell it, also suggest that

traders are bullish on the Japanese currency.

“Asset managers are likely to keep their long positions on the yen as

speculation continues that a move is possible at the BOJ’s January monetary

policy meeting, even after there was no policy change in December,” said

Hirofumi Suzuki, chief FX strategist at Sumitomo Mitsui Banking Corp.

Exit on knife-edge

BOJ governor Kazuo Ueda said on Monday the odds were growing of achieving the

inflation target and it would consider policy shift if more evidence point to

sustainable price growth.

He said the central bank had not decided on a specific timing to change its

ultra-loose monetary policy given uncertainties over economic and market

developments.

"We will carefully examine economic developments as well as firms' wage- and

price-setting behaviour, and thereby decide on future monetary policy in an

appropriate manner."

Ueda's hawkish remarks in parliament contrasted with recent comments by

several board members warning against any premature debate of an exit, former

BOJ board member Takako Masai said.

"The sequence of the BOJ's recent communication is confusing and may narrow

its options on the exit timing by prompting traders to price in the chance of

imminent action," she said.

More than 80% of economists polled by Reuters in November expect Japan to end

its negative rate policy next year with half of them predicting April as the

most likely timing.

The thing is that raising rates at a time other central banks are loosening

could trigger a spike in the yen that hurts big manufacturers' profits and

discourages them from hiking wages, analysts say.

“It's hard to see the BOJ lifting rates much further than 0%," said Stefan

Angrick, senior economist at Moody's Analytics.

Labour market tightness

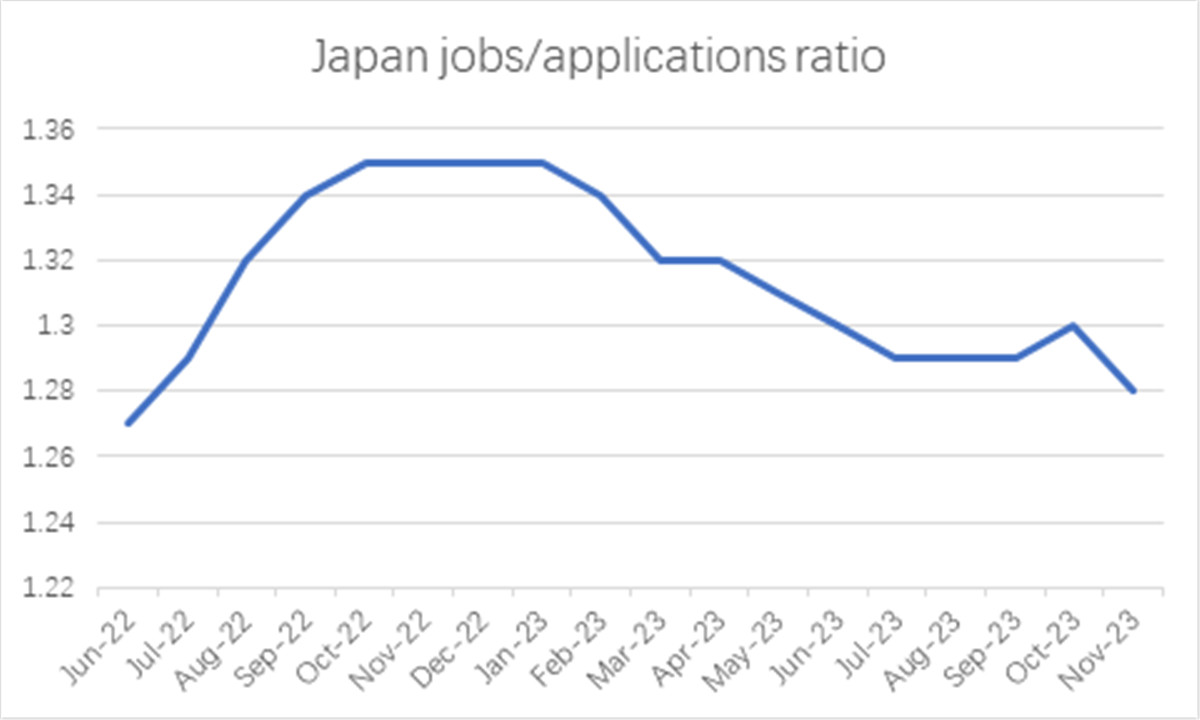

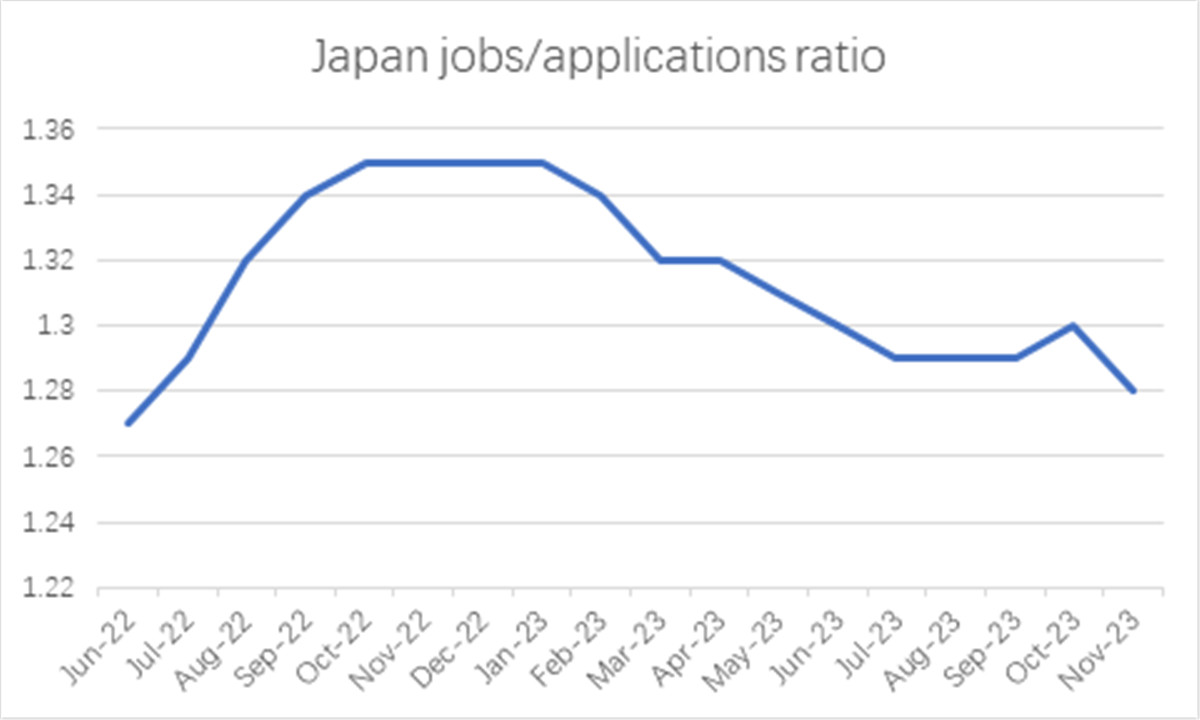

Japan’s labour market remained relatively tight in November, keeping pressure

on employers to boost pay in order to fill positions in a super-aged nation.

The job-to-applicants ratio slightly eased to 1.28, data showed on Tuesday.

The number of workers rose by 560,000 year-over-year, marking the 16th

consecutive increase.

PM Fumio Kishida on Monday urged firms to raise pay at a faster pace in 2024

than this year. The ball is now in the court of Japanese firms, which have been

passing on higher costs to consumers.

Multinationals have benefited from a weaker yen to boost exports, but small

and midsize firms find themselves in a much more difficult situation, having

been unable to raise prices.

Labour shortages are becoming increasingly severe across industries,

particularly in the services sector. The latest Tankan survey showed that

non-manufacturers experienced the worst workforce tightness in more than three

decades.

The number of bankruptcies due to manpower constraints reached 206 this year

as of October, the most since 2014, according to a report by Teikoku

Databank.

Still, the lower-than-expected job-to-applicants ratio which dipped to its

lowest since June 2022 could portend softening recruitment activities.

The run is near its end because when institutional investors turned bullish

on the yen over the past year, it soon went into retreat, said Brad Bechtel, the

global head of foreign exchange at Jefferies.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.