What is the Forex Margin?

Forex margin, also known as forex deposit, generally refers to customers investing a certain amount of funds as margin, and conducting forex trading within an expanded investment amount range based on a certain leverage ratio. There are two forms of forex margin trading: futures trading and spot trading.

In forex futures trading, the amount paid by the client to the broker or delivered by the broker to the clearing house as the transaction guarantee. Futures trading generally does not involve actual delivery, but is offset by both buyers and sellers selling or buying opposite contracts before the expiration date of the futures contract, with only the need to pay the price difference.

Since the clearing house provides guarantee for both parties to the transaction to ensure that the futures contract will be repaid by the clearing house when it expires, if one party to the transaction is unwilling or unable to write off the original contract with the opposite contract due to adverse changes in price, the clearing house will suffer losses due to price fluctuations.

In order to protect the legitimate rights and interests of the clearing house, the futures trading adopts the margin system. All customers who carry out futures trading must pay a certain amount of margin to the clearing house through brokers. The amount of margin is determined based on the exchange rate change rate of the trading currency and its daily trading profit and loss probability distribution. The greater the rate of exchange rate change, the greater the required amount of deposit.

Margin can generally be negotiated and determined, and the amount of margin charged by different brokers to customers varies, and there is no maximum limit regulation. However, there is a minimum limit for the whole futures market, that is, the amount of margin deposited by the member brokers of the clearing house to the clearing house. When signing a contract with the clearing house, the member broker of the clearing house should generally indicate that the amount of the deposit it collects from the guest room is not less than the above minimum limit.

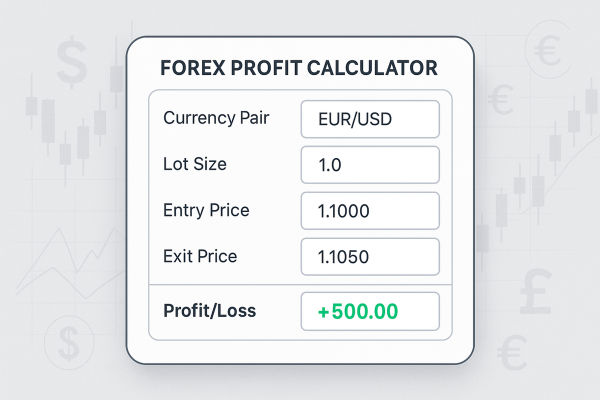

The calculation formula for forex margin is as follows:

Firstly, the account setting conditions are as follows: for an account worth $10000, the leverage is 100:1, and the trading contract is based on the standard hand, which is a contract worth $100000.

The first type: forex trading margin=number of contracts x number of trading hands. For example, the current price of USD/JPY is 88.65/88.68. To buy a standard hand, the required margin is 100000x1/100=1000 US dollars.

The second type: forex trading margin=number of contracts x number of trading hands x entry price of the currency pair.

For example, the current price of GBP/USD is 1.6284/87. Buying a standard hand requires a deposit of 100000x1.6287/100=1628.4 US dollars. Of course, if it is a mini hand, the contract amount is 10000, and according to the above formula, it is equivalent to 162.84 US dollars.

The calculation method for margin is still very simple, but there are different calculation methods for different currencies.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.