Bhutan, the small Himalayan kingdom often known for its focus on Gross National Happiness rather than GDP, remains a unique destination for traders and investors. While its cultural richness and pristine landscapes attract tourists, those interested in finance and trade often pose an essential question: What is the currency of Bhutan?

This guide breaks down everything investors need to know about the Bhutanese currency, including its origins, current structure, relationship with neighbouring countries, and implications for forex traders.

What Is the Currency of Bhutan?

Before the ngultrum, Bhutan's economy operated without a standardised currency. People used bartering, Tibetan coins, Indian rupees, and even silver coins minted within the kingdom. However, as part of a broader modernisation effort, Bhutan introduced its official currency, the Bhutanese Ngultrum, abbreviated as BTN and symbolised as Nu in 1974.

Although Bhutan now has its official currency, the Indian Rupee (INR) is still widely accepted and legally circulated. This dual currency framework creates a unique monetary system that balances Bhutan's economic independence with its dependence on India.

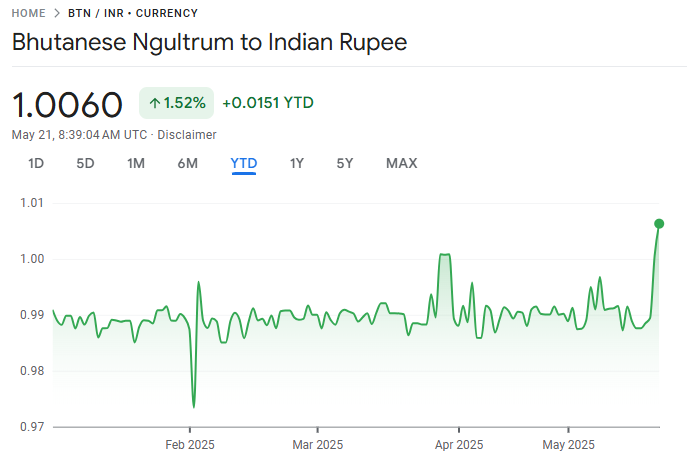

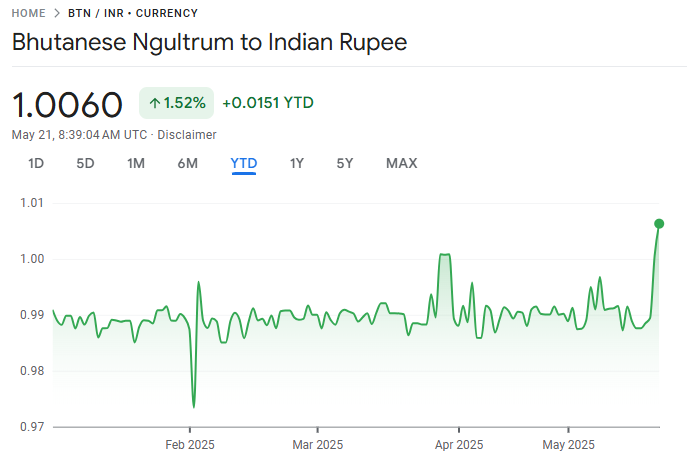

The ngultrum was pegged 1:1 with the Indian rupee, a relationship that continues. This peg helped Bhutan stabilise its currency, manage imports and exports, and maintain inflation control in an environment where India is its massive trading partner.

Bhutan's Relationship with India and Its Impact on Currency

Bhutan has pegged its currency to India primarily because India is its largest economic partner, responsible for over 80% of Bhutan's imports and exports. Additionally, Bhutan receives significant financial and technical assistance from India.

Advantages of this relationship include:

Trade facilitation through a shared currency peg

Inflation control due to India's relatively stable economy

Investment flows from the Indian public and private sectors

However, Bhutan's dependence on India also means it has limited manoeuvrability in times of Indian economic turbulence, such as during the demonetisation of indian currency notes in 2016, which affected liquidity in Bhutan as well.

Understanding the Peg: Ngultrum to Indian Rupee

One of the most distinctive features of the Bhutanese currency system is its fixed peg to the Indian rupee. This means that 1 BTN always equals 1 INR, a decision made to ease trade and financial transactions between the two countries.

India remains Bhutan's largest trading partner and financial backer, so this peg offers several advantages:

Stable exchange rate for Bhutanese trade

Simplified financial transactions with India

Monetary policy alignment that allows Bhutan to achieve economic stability

However, the fixed peg also comes with limitations. Bhutan does not have full monetary sovereignty and is indirectly affected by India's interest rate policies, inflation, and fiscal decisions.

Implications for FX Traders and Investors

Traders and investors considering Bhutan must understand the broader currency environment, as it affects pricing, repatriation, and risk.

Currency Risk

Because the ngultrum is pegged to the INR, it inherits the currency volatility of the Indian rupee. Any devaluation in the INR relative to the U.S. dollar will directly affect the value of investments made in Bhutan.

Inflation and Interest Rates

Bhutan's inflation is closely linked to that of India, and its interest rate policy often reflects the decisions made by the Reserve Bank of India (RBI). Investors should monitor macroeconomic indicators from both countries to effectively manage their exposure.

Capital Controls

Bhutan enforces capital controls, which means that moving large sums of money in or out of the country requires prior approval. This can limit the agility of foreign investments.

Government Incentives

Despite these constraints, Bhutan offers tax incentives, subsidies, and partnership opportunities for green and socially responsible investments. Its stable governance and low corruption also make it an appealing frontier market.

Can You Invest in the Bhutanese Ngultrum?

Unfortunately, the ngultrum is not fully convertible on the global market.

1. Limited Convertibility

The ngultrum is not a freely convertible currency, which means it cannot be bought or sold on forex markets like the U.S. dollar, euro, or yen. Currency exchanges involving the ngultrum can generally only occur within Bhutan, primarily for practical use (like tourism or business operations), not for speculation or investment.

2. Fixed Peg to the Indian Rupee

The ngultrum is pegged at a 1:1 ratio to the Indian Rupee (INR). This means that when you invest in the ngultrum, you are essentially taking on exposure to the Indian rupee. Since the ngultrum does not fluctuate independently, it is impossible to achieve speculative gains from currency appreciation.

3. No Foreign Exchange Market

There is no international foreign exchange (forex) trading platform that offers BTN pairs. For example, even institutional investors cannot directly buy BTN for speculative purposes.

Conclusion

In conclusion, investing in the Bhutanese currency directly is not practical for most investors or traders in 2025.

If you're looking for speculative currency gains, you'll want to consider freely traded currencies like the INR, USD, or EUR. But if your goal is long-term, ethical investing in emerging economies, Bhutan remains an underrated and unique opportunity worth exploring.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.