When referring to the forex trading market or other markets similar to foreign exchange, you may have heard of the term ECN broker. This word can be seen everywhere, but not many people realize its true meaning.

What is an ECN broker?

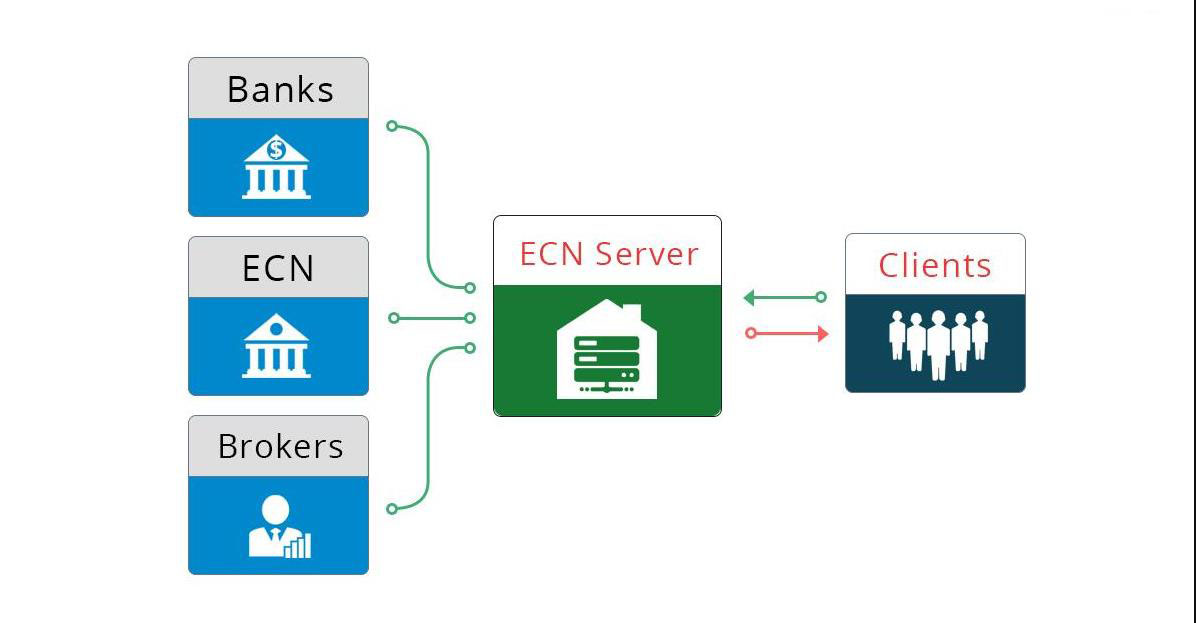

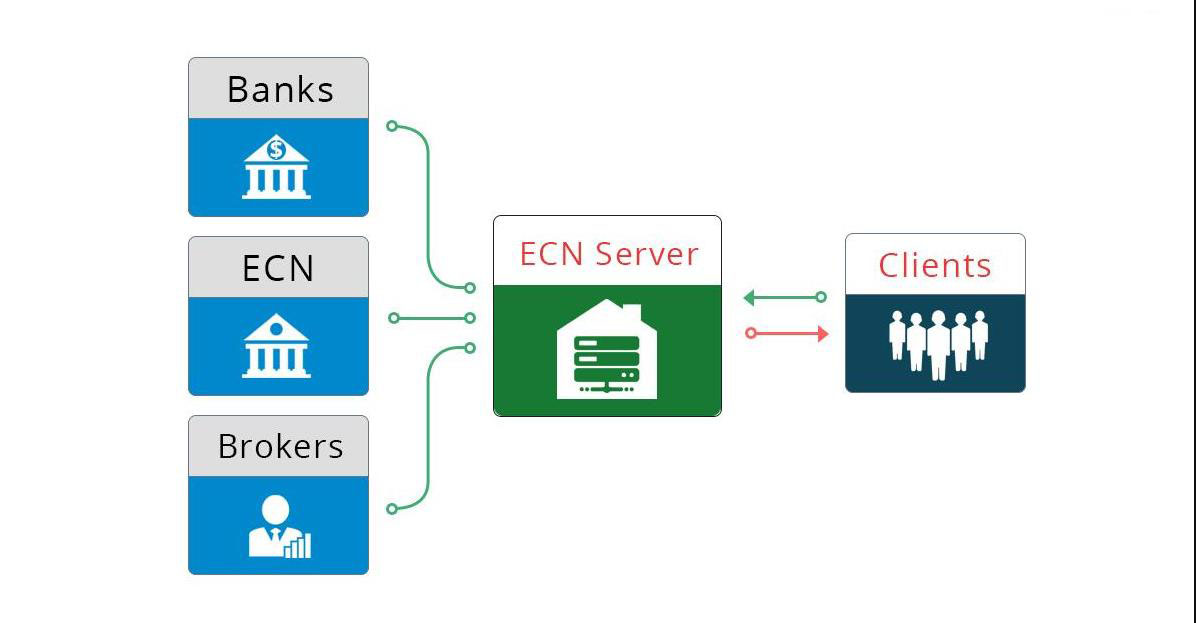

ECN brokers refer to brokers who use electronic communication networks related to the forex market. The working principle of an ECN broker is to transfer your order to the interbank market or liquidity provider. This means that your trading will continuously match other Types of Traders in the real market (with a ranking similar to the operation of an exchange).

How does an ECN broker operate?

ECN brokers typically earn profits through the buy/sell price difference. This means that they prefer traders who are profitable and active in trading, as these traders achieve larger trading volumes. ECN brokers consolidate a list of the best selling and buying prices for liquidity providers such as financial institutions and large banks. Then, they will match the trades with the lowest spread and the best price, without considering the source of the quotation. Overall, the role of an ECN broker is like an intermediary between the seller and the buyer. They have no intention of manipulating prices, but they can use the market to benefit you.

Regarding ECN trade

ECN trading is like a bridge connecting small participants in the market with liquidity providers through ECN brokers. This bridge is implemented using FIX protocol technology or financial information exchange protocol. These two technologies will automatically match and execute the required orders based on the best available price.

Advantages of using ECN brokers

The advantages of using ECN trading and ECN brokers instead of other trading schemes include but are not limited to:

Immediate execution of transactions - ECN customers can execute forex trade in real-time. This can be achieved by instantly confirming the best executable real-time prices in the market. ECN trading can reduce the risk of traders being disturbed by pricing parties, which means that all such transactions will be confirmed immediately after processing and execution. Traders will not be subject to any type of re quotation or interference.

Customers can obtain liquidity - ECN trading provides customers with the opportunity to trade within a liquidity pool covering regulated, competitive, and qualified financial institutions worldwide.

Variable point difference - Due to the lack of market makers or traders controlling the sell or buy spread, ECN trading can also provide customers with a true variable spread. Through this broker, you can directly obtain the overall market price. Market prices usually fluctuate according to demand, supply, volatility and other market conditions. This allows customers to trade at a smaller buy/sell spread (which may be less than 1 point depending on market conditions).

Automatic Data Source - With ECN trading, customers can access and connect to intelligent trading systems, trading algorithms, and risk management systems through automated real-time data sources. Market data includes the applicable selling price and competitive buying price at any given time. This means that the trading process of real or backtesting trading models will remain consistent and reliable.

Anonymous - ECN transactions can be conducted anonymously. This enables traders to fully leverage the advantages of neutral pricing, as it ensures that data sources always reflect real market conditions. Therefore, customers will not deviate when adopting strategies, trading strategies, or current market positions.

Price - ECN brokers do not manipulate spreads. When trading with ECN brokers, you will receive the best available price at the specified time.

How to find a suitable ECN broker

Finding a true ECN broker can be difficult, especially when you don't know where to start. Here are some suggestions on how to find an ECN broker that suits your personal needs.

Legal identification -As a trader, you have the right to request the ECN broker you choose to provide their legal identification to understand whether their services comply with the regulations of your country. Without legal confirmation, you face the risk of turning hard earned money into useless investment.

Order Restrictions -Your order limit refers to the number of orders, maximum transaction volume, and total position size that you can send to the broker. True ECN brokers will not mind your investment amount, as the more times you invest, the higher their commission. If the brokers you choose drive you to engage in specific transactions, their purpose is definitely to satisfy their personal interests, which means they are not legitimate ECN brokers.

Reliable updates -Your ECN broker should be able to provide you with regular updates on the Trading Account situation. A true ECN broker will continue to provide you with the latest information, explain uncertain content, and help you solve any problems you encounter.

ECN brokers and other types of brokers

There are three common types of forex brokers:

Market makers

No processing platform

Electronic Communication Network (ECN)

Since ECN brokers have been mentioned, we will now compare them with market makers and non processing platform brokers.

Market makers and brokers

Forex market makers usually provide customers with a two-way market where professional forex traders work together with internal processing platforms of brokers. If the price is agreed upon, the broker will become the client's counterparty and act as the buyer or seller of the quotation.

The goal of a market maker is to obtain a point spread and create sufficient trading volume between both parties in the market, so that the high trading volume of both parties can avoid the cumulative risk brought by other professional counterparties.

If market makers believe that the direction of the market may be unfavorable for trading, they can also choose to hedge trading immediately when the trading volume is large enough. They can also add hedging transactions to the trading book based on market prospects and transaction size.

Forex broker without processing platform

Non processing platform (NDD) forex brokers mean they do not use processing platforms. This may seem bad, but in fact, it can provide the best comprehensive quotation. These quotations mainly come from multiple forex quotation providers. This helps to provide liquidity for the entire forex market for non processing platform forex brokers. The liquidity provider will cooperate with NDD forex brokers and provide them with the best market price. Then, the broker will monitor and execute the customer's order to complete the transaction. They usually charge commissions or strive to widen the buy/sell spread, and then earn a small portion of profits from each executed transaction.

Conclusion

Compared to other types of brokers, ECN brokers can bring great benefits to anyone who wishes to enter the forex market. If you are a novice in the forex market, it is best to conduct some detailed research first to identify ECN brokers that meet your needs and have a good reputation. Although there are many different brokers in the industry, given the advantages of ECN brokers, they may be the best choice that meets your overall trading needs.

EBC Platform Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.