The financial markets are home to a wide range of participants, each with their own unique strategy, risk appetite, and time commitment. Whether you're trading equities, forex, or commodities, you'll come across various types of traders, each approaching the market in their own way.

Understanding these types can help you choose a trading style that fits your goals, lifestyle, and temperament. From rapid-fire scalpers to patient position traders, every type serves a different purpose in the ecosystem of financial markets.

Which 7 Types of Traders Are You?

1. Day Traders

One of the most fast-paced types of traders, day traders enter and exit positions within the same trading session. They rarely hold positions overnight and instead rely on short-term price movements to generate profits.

Day traders typically use technical indicators like moving averages, RSI, and candlestick patterns. This style requires intense focus, quick decision-making, and discipline. Since trades are executed frequently, transaction costs can add up quickly, making efficient execution essential to success.

2. Swing Traders

Swing traders hold positions for several days or even weeks, aiming to profit from medium-term market swings. This group of traders falls between day traders and long-term investors in terms of trade duration. They rely on both technical and fundamental analysis to catch short- to mid-term trends.

Among all types of traders, swing traders enjoy more flexibility as they don't need to monitor the market constantly. Instead, they focus on identifying trend reversals or breakouts and usually wait for confirmation before entering trades.

3. Position Traders

Position traders are the most long-term oriented among the types of traders. They aim to ride larger trends that can last months or years. Their trading decisions are often based on fundamental analysis, including economic indicators, interest rates, and earnings reports.

Because position traders have longer holding periods, they are less affected by short-term market noise. However, this strategy requires patience and a strong conviction in the trade idea. It also means enduring periods of drawdown without reacting emotionally.

4. Scalpers

Scalping is the most aggressive form of short-term trading. Scalpers open and close positions within seconds or minutes, attempting to profit from tiny price movements. Of all the types of traders, scalpers require the fastest decision-making and often use automated tools to execute trades.

High-frequency execution, low latency, and minimal slippage are critical in scalping. Scalpers often trade during times of high liquidity, such as market open or close, to ensure they can enter and exit positions efficiently. While potential profits per trade are small, the volume of trades can lead to significant returns.

5. Algorithmic Traders

Among the more technical types of traders are algorithmic traders. They develop automated systems or bots that follow pre-defined rules for entering and exiting trades. These rules are based on quantitative analysis, price action, or statistical models.

Algo traders remove emotional decision-making from the equation and can operate across multiple markets and timeframes simultaneously. While this approach is typically used by institutional players, retail traders are increasingly adopting algorithmic strategies due to the rise of user-friendly trading platforms and coding tools.

6. Trend Followers

Trend followers look to identify and capitalise on sustained directional movements in price. They use moving averages, momentum indicators, and trendlines to enter trades in the direction of the prevailing trend.

These types of traders aim to stay in trades as long as the trend continues, sometimes using trailing stop losses to lock in profits. Trend following can be applied on multiple timeframes and is particularly popular in trending markets such as commodities or major indices.

One key to success in trend following is not trying to predict tops and bottoms, but rather riding the “middle” of the move with a clear Exit Strategy.

7. Contrarian Traders

Contrarian traders go against prevailing market sentiment. When the majority of traders are bullish, contrarians look for signs that the market is overbought and ripe for a reversal. When others are fearful, they look for undervalued opportunities.

These types of traders often rely on sentiment analysis, volume divergences, and contrarian indicators like the VIX or put-call ratios. This strategy requires excellent timing and the courage to stand apart from the crowd, which can be psychologically demanding.

Choosing the Right Trading Style for You

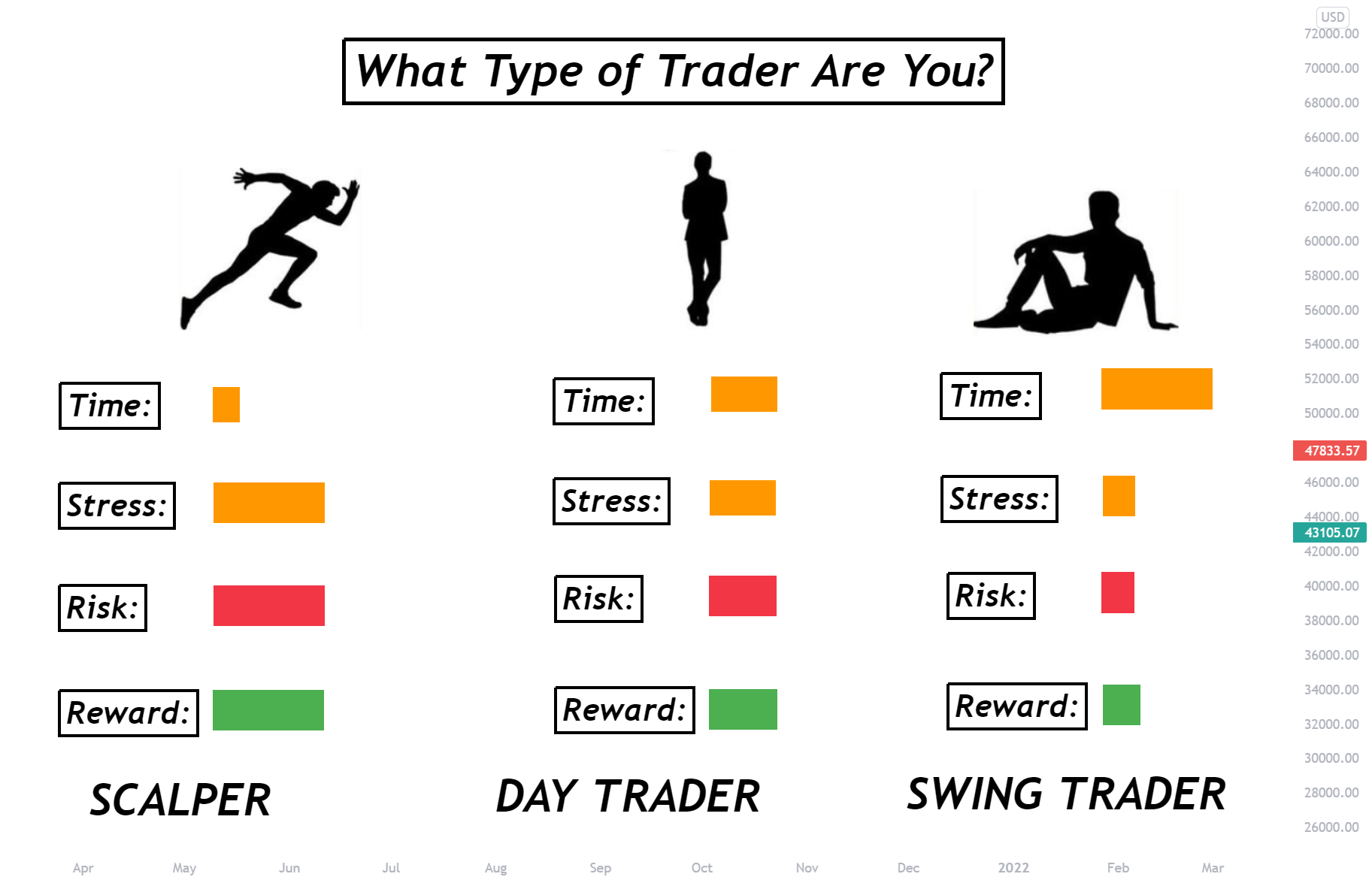

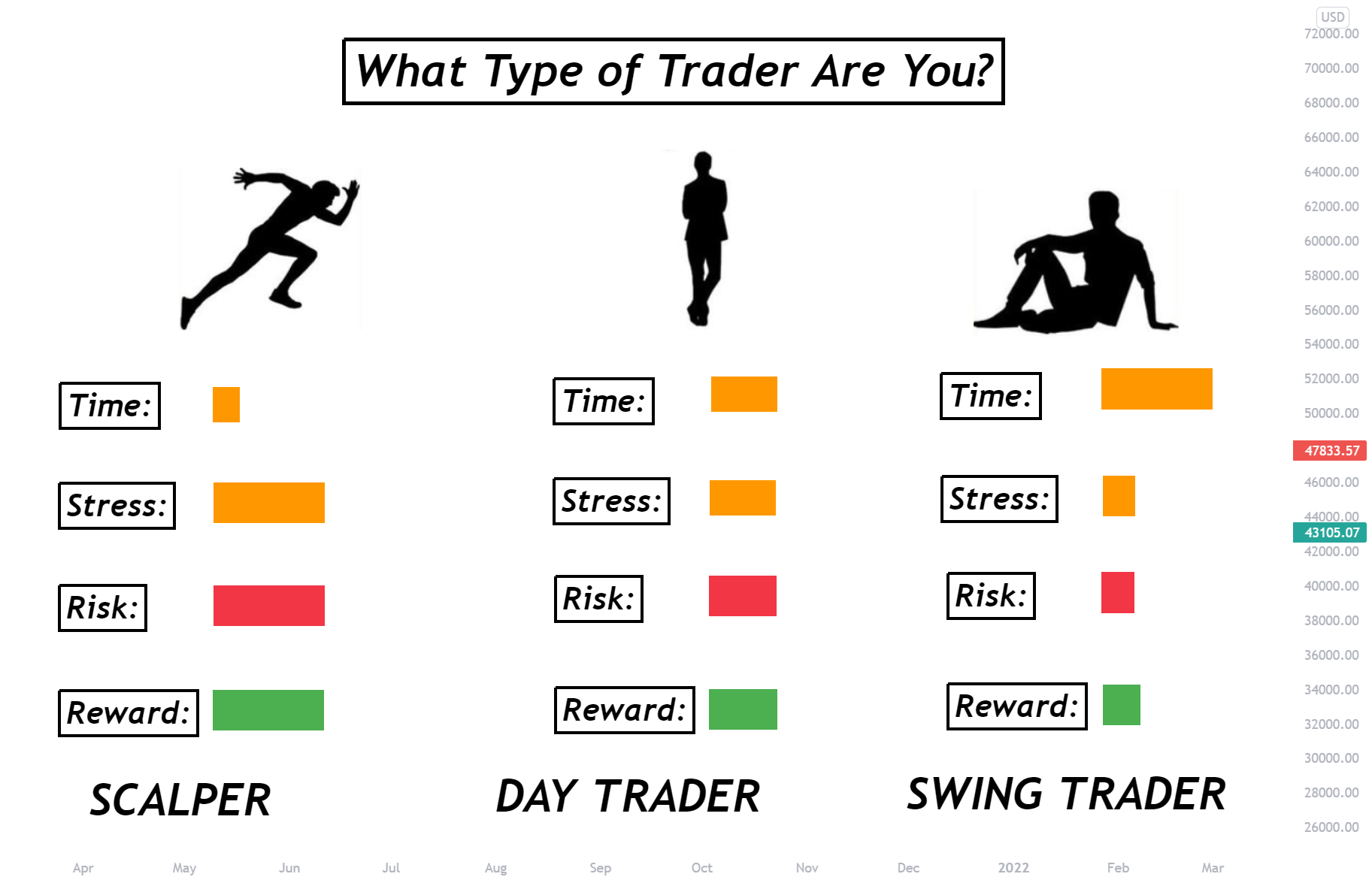

With so many types of traders operating in the market, it's essential to determine which approach best aligns with your goals, time commitment, and risk tolerance. Are you comfortable making quick decisions under pressure, or do you prefer a more analytical, long-term approach?

If you thrive in fast-paced environments and enjoy short-term speculation, day trading or scalping may suit you. If you prefer analysis and trend observation, swing or position trading may be a better fit. For those with coding knowledge or a data-driven mindset, algorithmic trading offers efficiency and scale.

Knowing which style suits you also helps in developing a structured Trading plan, setting realistic expectations, and avoiding unnecessary losses due to strategy mismatches.

Final Thoughts

Whether you're just starting or refining your trading strategy, it's important to understand the different types of traders that populate the market. From day traders to contrarians, each group brings its own strengths, weaknesses, and market impact. Finding the right trading style is a personal journey, and it often evolves over time as you gain experience and better understand your own Trading Psychology.

Avoid jumping between styles too quickly. Instead, take the time to study each approach, try them in a demo environment, and evaluate what works best for you. By choosing a method aligned with your personality and lifestyle, you increase your chances of long-term trading success.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.