The 1990s: The True Prosperity of Hedge Funds

Hedge funds grew exceptionally rapidly in the 1980s and began to flourish in the 1990s.

During this decade, several dominant funds have been launched. Steve Cohen's SAC Capital Advisors (today known as Point72 Asset Management), David Tepper and Jack Walton's Appaloosa Management, and John Paulson's Paulson& Co and Daniel Och's Och Ziff Capital Management (now OZ Management) are some of them.

Bridgewater Associates also gained fame in the 1990s.

In 1991, Qiaoshui launched Pure Alpha, which adopts a portable alpha strategy or a strategy that requires investing in assets unrelated to the market and fully leveraging leverage to maximize returns.

In 1996, Dario launched the all-weather fund, which was the first to adopt a stable, low-risk strategy and later became known for its risk parity. Today, it is one of the most important hedge funds in the world.

This era has witnessed the emergence of outstanding hedge fund managers and the entry of new strategies in the field of hedge funds. From the usual long and short stock positions, the hedge fund asset field continues to cover a wide range of asset classes and investment styles. The new hedge fund investment strategies are arbitrage, macro, non-performing investment, radicalism and multi strategy, which began to dominate in this decade.

1992: George Soros defeats the Bank of England

September 16, 1992 was known as the day of 'beating the pound'. England was part of the European exchange rate mechanism, which was a fixed exchange rate agreement between several European countries. Other countries are beginning to pressure Britain to devalue its currency or exit the system.

After resisting a period of depreciation, Britain caused its currency to float, leading to a decline in the pound. George Soros' quantum investment fund leveraged and held a £ 10 billion short position, earning $1 billion in a single day. The assets under management increased from $3.3 billion in mid October 1992 to $11 billion in 1993.

George Soros, founder and chairman of the Open Society Foundation, delivered a speech at the Brussels Economic Forum in Belgium on June 1, 2017

Other hedge funds have also made big profits. Kona's Caxton Company earned nearly $300 million, while Jones' fund earned $250 million.

This mainly speculative move prompted the UK to withdraw from the exchange rate mechanism and skyrocketed interest rates by 5% in just a few hours. The UK Treasury estimates that this decisive day, also known as' Black Wednesday ', resulted in a loss of £ 3.4 billion in the UK, which is approximately $6 billion based on currency conversion in 1992. Therefore, Soros began to be referred to as the "person who defeated the Bank of England".

Shortly after, the Malaysian Prime Minister accused Soros of triggering the Asian financial crisis, calling him a "rogue speculator".

1994: Steinhardt Partners suffered huge losses

In February 1994, the Federal Reserve suddenly announced that it would raise interest rates by a quarter of a percentage point for the first time, which led to the decline in the value of US treasury bond bonds and the loss of market liquidity.

The dual event caused panic among institutional investors, which was a major disaster for Steinhardt Partners, resulting in a loss of 31%. In addition, in 1994, Steinhardt's company agreed to pay $40 million as a settlement against the federal regulators. In 1991, the group violated the anti trust law and the Securities law because it issued two-year treasury bond bonds in a monopolistic market.

By the end of 1995, the fund was able to partially cover its losses, but Michael Steinhardt retired from the hedge fund industry the same year.

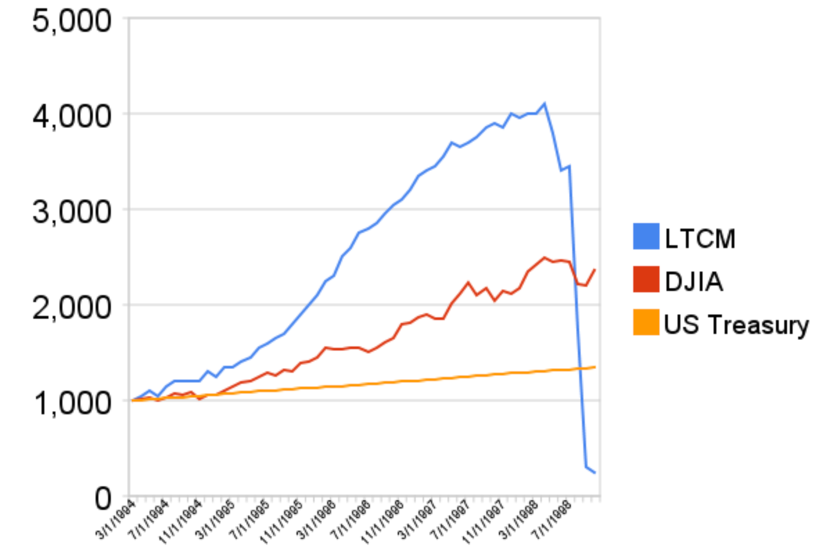

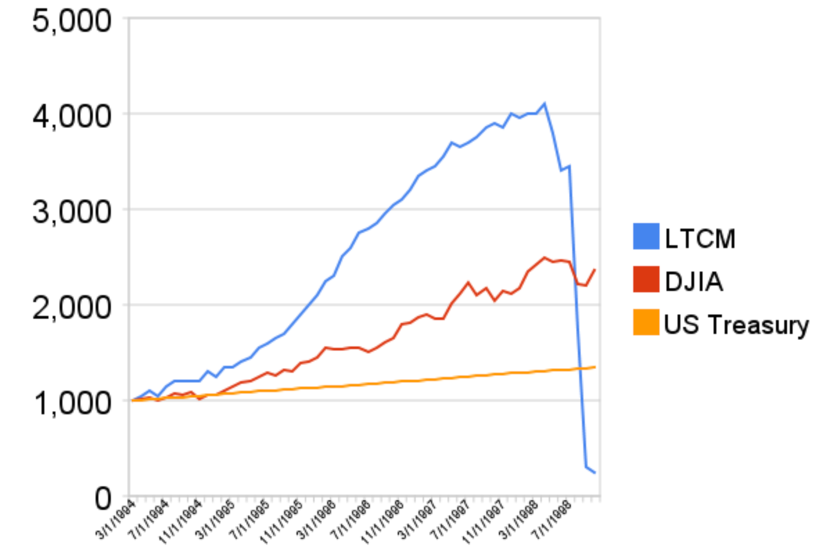

1998: Long Term Capital Management (LTCM) went bankrupt

On September 23, 1998, several Wall Street giants - the bosses of Mobil Bank, Bear Stearns, Chase Manhattan, Goldman Sachs, JP Morgan, Lehman Brothers, Merrill Lynch, Morgan Stanley, and Solomon Brothers - met in the conference room on the 10th floor of the Federal Reserve Building in New York to discuss assistance to LTCM

One of the most important events of the 1990s was the near collapse of Long Term Capital Management (LTCM), a long-term capital group that could have snowballed into a global financial crisis if it had not been for timely assistance from Wall Street and the Federal Reserve.

The hedge fund industry expanded without any regulation until the LTCM collapse in 1998. LTCM is a hedge fund with assets under management of $126 billion, witnessing astonishing annual returns of up to 40% in 1995 and 1996.

Due to its size, it began to be too large to fail, and the Federal Reserve had to step in to rescue it. This has led regulatory agencies to seek more understanding of the hedge fund industry.

In 1998, Long Term Capital Management (LTCM), a hedge fund based in Greenwich, Connecticut, managed assets worth $120 billion. The fund focuses on betting on narrow spreads, trading bonds, swaps, options, stocks, and derivatives.

The fund was launched by John Meriwether in 1994 and experienced success in the first three years, but disaster struck after the Asian financial crisis in 1997 and the Russian financial crisis in 1998. Within two days, there was a huge loss of $4.6 billion. Losses account for 90% of hedge fund equity.

The Federal Reserve Bank of New York is concerned about the collapse of LTCM and its impact on global markets. Therefore, it has designed a rescue plan with 14 other financial institutions and agreed to a $3.6 billion capital restructuring under its guidance.

The participating bank obtained 90% of the fund's shares in return, and promised to establish a supervisory board. Although referred to as a rescue plan, technically speaking, the rescue plan is not like that. This transaction resulted in the systematic liquidation of the positions held by LTCM with the participation of creditors and the supervision of the Federal Reserve.

2007: Synthetic Hedge Fund

In 2007, a synthetic hedge fund was launched, which is nothing more than a mutual fund and an exchange traded fund that tracks hedge fund indices. Also known as synthetic exchange traded funds (ETFs), they are a collective investment tool that deposits funds in derivatives and swaps rather than physical securities.

On the contrary, synthetic hedge fund managers and counterparties (in most cases investment banks) reach an agreement to ensure that the fund receives benchmark returns.

Investment banks such as Goldman Sachs and Merrill Lynch have also launched "synthetic" hedge funds to simulate hedge fund returns, utilize historical data from hedge funds, and track up to 15 stock indices simultaneously.

2008: The Consequences of the Subprime Crisis

By 2008, the global hedge fund industry had assets under management (AUM) of $1.93 trillion. However, the global financial crisis of 2008 reversed the decline of many hedge funds, and their popularity gradually declined.

Hedge funds are known as the culprits of the subprime crisis, as they put too much risk on the banking industry. No matter what role hedge funds play in this issue, it seriously affects them.

Many funds have closed after witnessing huge losses, resulting in a significant decline in asset management. Since June 2008, investors have withdrawn $1 trillion during the year, resulting in a loss of nearly 19% in 2008. Some personal funds have even experienced a 50% or more decline.

After the global financial crisis, hedge funds have been constrained by multiple new regulations to improve investor protection, ensure market integrity, and reduce systemic risks.

2008: Madoff Crisis

The discovery and subsequent collapse of the multi billion dollar Ponzi scheme operated by Bernie Madoff at the end of 2008 was one of the biggest events in the past decade. Bernie Madoff is the former chairman of NASDAQ and the founder of Bernard L. Madoff Investment Securities, who led the largest Ponzi scheme in history.

Although it is not a hedge fund, the $65 billion fraud has shaken the investment community.

In January 2009, Bernie Madoff left the Manhattan Court. From Palm Beach to the Persian Gulf, his fraud victims numbered tens of thousands.

While pleading guilty, Bernard L. Madoff admitted that he had not engaged in any transactions since the early 1990s and fabricated all of his returns. The whistleblower Harry Marko polos estimates that Madoff reported a fictitious profit of at least $35 billion to his clients.

He was sentenced to 150 years in prison and ordered to compensate $170 billion. Investors demand higher governance standards, with a focus on independent verification of positions and valuations. In short, the Madoff scandal has led to a significant change in the monitoring of hedge funds.

2009: Entering the mainstream investment field

By 2009, hedge funds had entered the mainstream investment field. Many institutional investors, such as pension funds, insurance companies and sovereign wealth funds, have shown interest in alternative investment channels and started investing in hedge fund products after suffering losses in the Internet foam.

As a result, the managed hedge fund assets increased in December and reached $2.037 trillion by 2009.

During this period, Hedge Fund Research, another research firm, stated that hedge funds have had a return of 18.80% since January 2008 and are expected to achieve their best returns in a decade.

2010-2013: Strong regulatory mechanisms implemented

In the 2010s, significant changes occurred in the regulation of the long unregulated hedge fund industry. For example, Jones failed to comply with the 1940 Investment Company Act, a rule governing mutual funds, which limited the number of investors in his limited partnership to 99 or less.

According to the Investment Company Act of 1940, the minimum requirement for banks and corporate entities is a total asset of $5000000. For several investors in larger hedge funds, the criteria for a "qualified buyer" are having a personal investment of $5000000 and a pension plan and company assets of $250000.

The Investment Company Act of 1940 also prohibited hedge funds from making public offerings. They are subject to the anti fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934.

The 2010 Dodd Frank Wall Street Reform and Consumer Protection Act came into effect as a direct response to the global financial crisis, emphasizing more critical compliance requirements for registration and reporting to the Securities and Exchange Commission.

In the United States, many hedge funds fall under the jurisdiction of the Commodity Futures Trading Commission (CFTC), including registering as commodity pool operators (CPOs) and commodity trading advisors (CTAs). Hedge fund investments under the jurisdiction of the CFTC are regulated by the requirements of the Commodity Trading Law.

Some hedge funds are subject to restrictions under the Securities Act of 1933 (Reg D). The Securities and Exchange Commission's Reg D allows funds to be raised only in non-public offerings and only from "qualified investors".

These individuals have a minimum net asset of $1000000 or a minimum income of $200000 per year for the past two years. The authorization also sets a reasonable expectation of achieving the same level of revenue this year.

In Europe, the EU alternative investment Fund Manager Directive (AIFMD) or Directive 2011/61/EU mandates hedge funds, private equity funds and real estate funds to protect investors and reduce the systemic risks that these alternative investment funds may face to the EU economy.

Alternative investment Fund Managers (AIFM) have been required to comply with relevant requirements since July 22, 2013, including governance, conflict of interest identification and management, and minimum capital.

At the same time, the Volcker Rule prohibit banks from engaging in certain investment activities and from engaging in proprietary trading or investing or sponsoring hedge funds or private equity funds.

In short, these regulations set entry barriers, leading to the institutionalization and specialization of the hedge fund industry.

2015: Numerai: First AI Driven Hedge Fund

Richard Craib is a South African born in July 1987. Graduated from the Department of Mathematics at Cornell University, founded DataProphet, a machine learning consulting company, in 2013, and Numerai, a mass outsourcing hedge fund, in 2015.

In October 2015, South African technology expert Richard Craib launched Numerai, an artificial intelligence operated crowdsourcing hedge fund. Numerai's transactions are determined by artificial intelligence and run by a network of 30000 anonymous data scientists from around the world. These data scientists are actively committed to improving the fund's machine learning led investment strategy.

Numerai adopts an open-source hedge fund investment method and has a unique operating model. Even in the turmoil of 2020, it was able to stand out and stand out among other blue chip quantitative hedge funds. Numerai also revealed that most of these mature funds face high risks.

In 2021, Numerai has become the first artificial intelligence based hedge fund to reward its co authors with its native cryptocurrency called Numeraire.

2020-2021: COVID-19 and Hedge Funds

The COVID-19 disaster shows that alternative investment is beneficial to investors' portfolios in the stage of market volatility and uncertainty. In the first half of 2020, when market volatility reached its peak, hedge funds suffered losses of only half that of the stock market and balanced investment portfolios.

In addition, when the market experiences a significant pullback, hedge funds outperform other asset classes, demonstrating their ability to minimize risk.

According to Bloomberg, after the initial round of losses, hedge funds have rebounded and increased by 35% from March 2020 to September 2021. According to data compiled by eVestment, investors injected $38 billion into hedge funds in 2021 and pushed assets to record levels.

conclusion

As of 2021, many hedge funds have remained strong in the face of a market crash dominated by COVID-19. The pandemic caused by the coronavirus has completely changed the way hedge fund managers operate.

As the vitality of the business environment weakens, they have reduced many processes, including due diligence, portfolio building, investor engagement, and recruitment. Because of this, investment managers have started to rely on disruptive technologies such as digitization, automation, and outsourcing to cater to customers.

Tom Kehoe, the global head of research and communication of the alternative investment Management Association (AIMA), foresaw the emerging trend of hedge funds. Firstly, hedge funds will incorporate ESG elements such as sustainability, climate change, and social responsibility to enhance the accountability of investors and policymakers. In the future, hedge funds may have a robust operational architecture, as well as reliable governance and risk management procedures.

The second trend is that disruptive technologies such as artificial intelligence, big data, and machine learning will become important components of hedge funds. We can also see that fund companies are increasingly adopting ultra-high frequency trading (HFT).