Political assassinations are rare but profoundly destabilising events. In addition to their tragic human cost, such events can affect financial markets by triggering sell-offs, spikes in volatility, and changes in investor sentiment.

From the assassination of U.S. President John F. Kennedy in 1963 to more recent political violence in other countries, these shocks serve as a reminder that markets are as much about psychology as fundamentals.

In this article, we examine how stock markets have historically responded to assassinations, how modern trading systems and globalisation have altered these dynamics, and the insights investors can gain about managing political risk in 2025.

The JFK Assassination (1963): A Defining Market Shock

How JFK's Assassination Impacted Financial Markets?

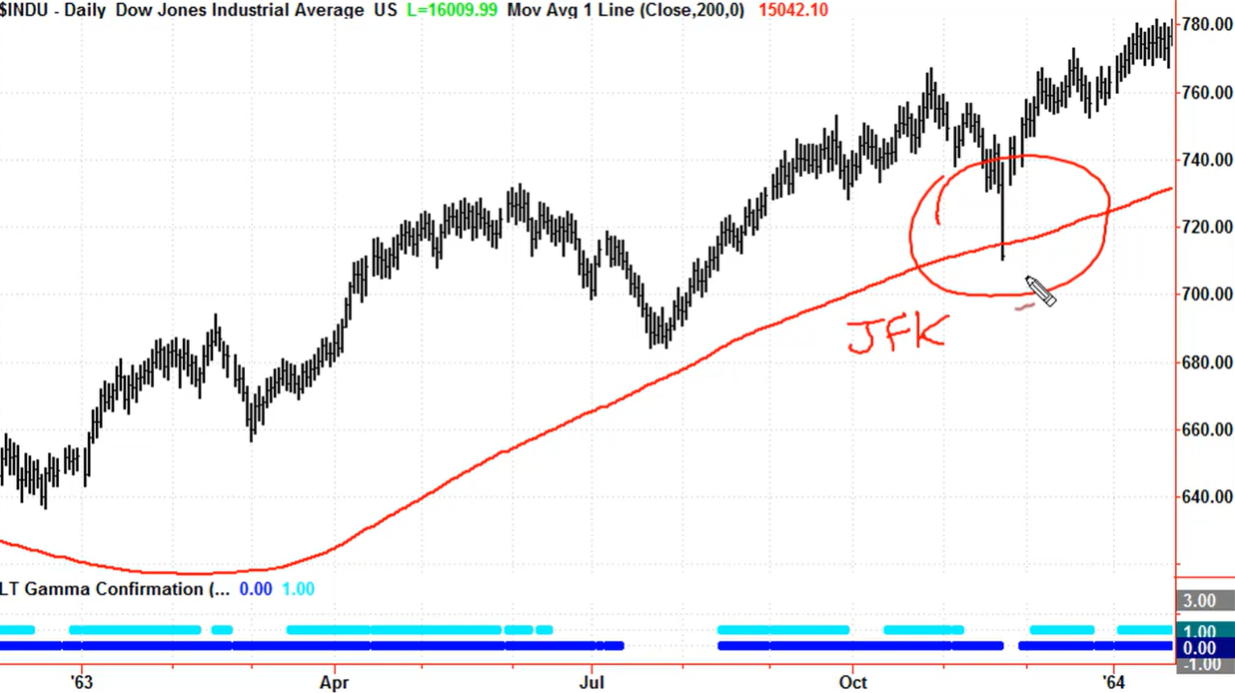

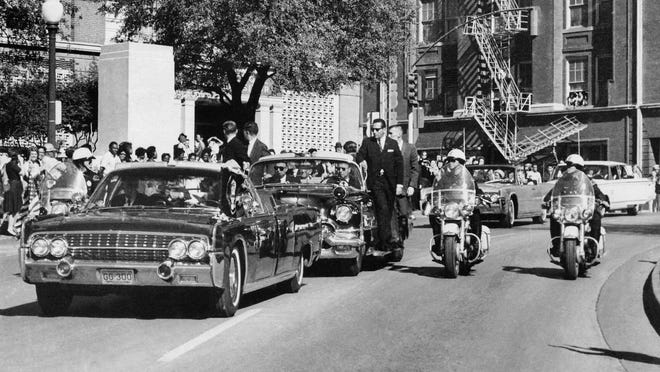

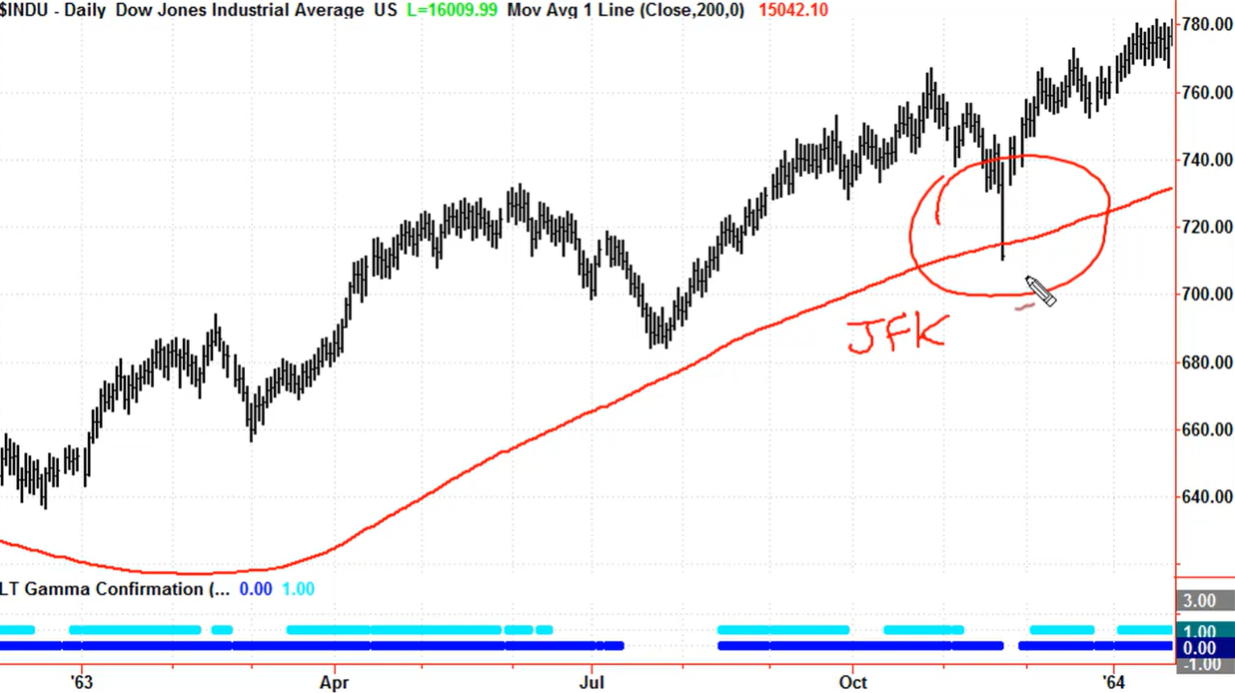

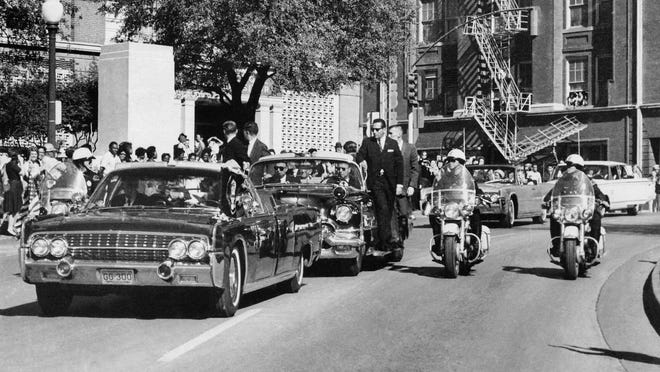

On November 22, 1963, U.S. President John F. Kennedy was assassinated in Dallas. The immediate reaction on Wall Street was one of confusion and panic.

The New York Stock Exchange halted trading early after confirming the news, but not before the Dow Jones Industrial Average fell nearly 3% in one of its sharpest single-day drops since World War II.

Trading volume spiked as investors rushed to sell, fearing political instability. The next morning, The New York Times described the selloff as a "stampede driven by fear rather than fundamentals."

Yet, the recovery was surprisingly swift. When markets reopened following the national day of mourning, investor confidence had mostly returned, aided by the quick transfer of power to Lyndon B. Johnson. Within two trading sessions, the Dow had gained back 4.5%, erasing most of the loss.

Why This Case Still Matters

The JFK assassination shows how markets often react first with emotion, but quickly reassess based on political and institutional stability. In the 1960s, without today's circuit breakers, instant communication, or global liquidity, the shock was amplified.

In modern markets, such an event would likely still trigger short-term volatility. However, safeguards from trading halts to central bank communications would soften the blow and shorten the recovery time.

Lesson for investors: Even the most shocking political events often have only temporary effects on financial markets, especially in countries with strong governance.

Other Historical Cases

Yitzhak Rabin (1995, Israel): The Tel Aviv Stock Exchange dipped briefly but stabilised quickly, showing localised but contained effects.

Benazir Bhutto (2007, Pakistan): Pakistani stocks and the rupee hit record lows, reflecting fragility in emerging markets. However, gold gained globally.

Shinzo Abe (2022, Japan): The Tokyo Stock Exchange experienced a brief dip but quickly recovered, underscoring investor confidence in institutional resilience.

Modern Dynamics: Why Today's Markets React Differently

Unlike in the 1960s, today's markets are faster, more global, and more interconnected. Several factors amplify or dampen reactions:

High-Frequency Trading (HFT): Algorithmic trading can amplify short-term price movements in response to unexpected news headlines.

Global Interconnection: Shocks in one country can ripple across multiple exchanges.

24/7 News & Social Media: Information spreads instantly, magnifying initial panic but also enabling quicker clarification.

Derivatives & Volatility Instruments: Products like the VIX index and futures markets give investors tools to hedge immediately.

For instance, when Abe was assassinated in 2022, the Nikkei 225 fell 1% intraday but quickly rebounded, demonstrating how liquidity and hedging tools mitigated panic.

Geographic Comparisons: Developed vs Emerging Markets

1) Developed Markets (U.S., Japan, Europe)

Assassinations generally cause short-term volatility but have a limited long-term impact due to strong institutions and investor confidence.

2) Emerging Markets (Pakistan, Latin America, Africa)

Political murders often cause sharper, prolonged declines due to weaker governance and higher perceived instability.

3) Middle East & Asia

Leadership violence often interacts with commodity markets (oil, gold) as investors seek safe havens.

Additionally, not all industries react the same way:

Defence & Security: May rise on expectations of increased government spending.

Financials & Equities: Often fall first as investors reduce risk.

Gold & Bonds: Traditional safe-haven assets typically rally.

Energy & Commodities: Sensitive to geopolitical dimensions of an assassination.

What Are the Lessons for Investors in Managing Political Risk?

Diversification: Geographic and asset diversification reduces exposure to local shocks.

Safe-Haven Allocation: Holding a portion in gold, U.S. Treasuries, or stable currencies provides downside protection.

Use of Derivatives: Futures and options help hedge sudden market drops.

Focus on Long-Term Trends: History shows markets generally recover quickly from even the most shocking events.

Frequently Asked Questions

1. How Do Stock Markets Usually React Immediately After a Presidential Assassination?

Markets typically fall sharply as uncertainty spikes, but in developed countries, recoveries are often rapid.

2. Which Assets Benefit During Political Assassinations?

Gold, bonds, the U.S. dollar and the Swiss franc often experience a rally.

3. What About the Impact on Currencies?

Local currencies often weaken, especially in emerging markets. For example, the Pakistani rupee fell after Bhutto's assassination.

4. Do Assassinations Change Long-Term Economic Outlooks?

Rarely. Unless they trigger wider political crises, markets usually revert to fundamentals.

Conclusion

In conclusion, presidential assassinations and political murders are tragic events with immediate financial consequences. While markets often experience sharp volatility, recoveries tend to be fast in stable, developed economies.

For investors, the key is preparation: diversify portfolios, use hedging strategies, and avoid emotional decision-making during periods of shock.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.