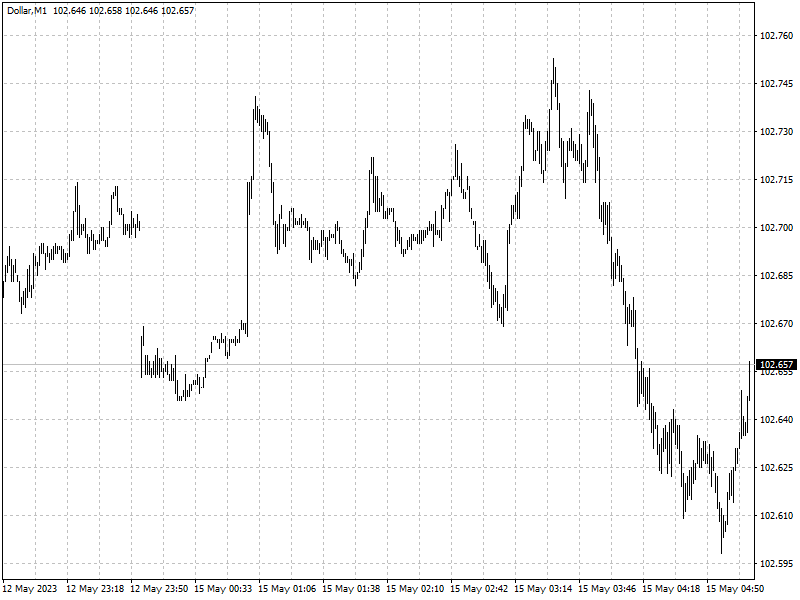

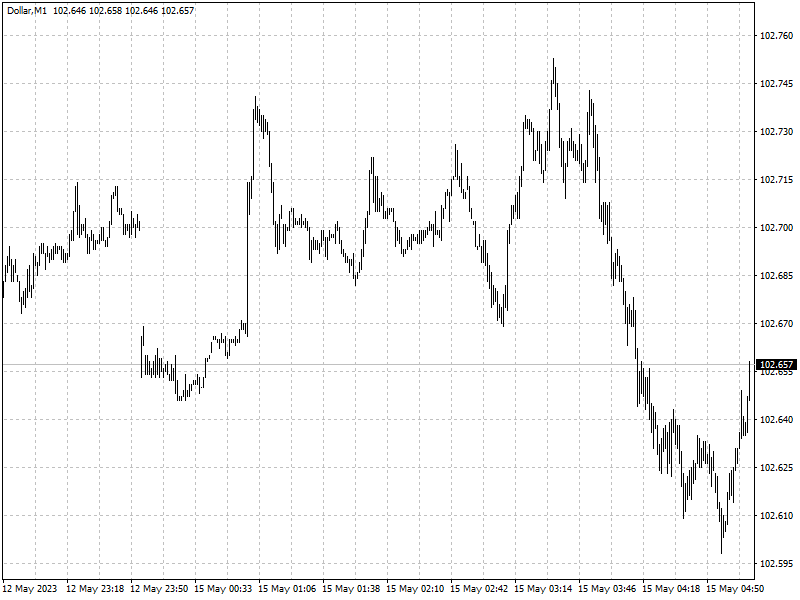

The dollar rose on Friday but a gauge of global stocks retreated on a report

that showed U.S. consumer sentiment slumped to a six-month low in May.

The dollar rose 1.4% for the week, its biggest weekly gain since September,

as concerns about the government's borrowing cap and Fed’s monetary policy

prompted a shift to safe havens.

Oil prices settled more than 1% lower on Friday, falling for the fourth

consecutive week, as the market balanced supply fears against renewed economic

concerns in the United States and China.

Commodities

U.S. oil rigs fell by two to 586 last week, their lowest since June 2022,

while gas rigs plunged by 16 to 141, their lowest April last year.

The market drew some support from the forecast emerging supply deficit for

the second half of the year, even as Iraq's oil minister Hayan Abdel-Ghani told

Reuters on Friday he does not expect OPEC+ to decide on further production cuts

when it next meets in Vienna on June 4.

The market also drew support after U.S. energy secretary Jennifer Granholm

signalled that the country could repurchase oil for the Strategic Petroleum

Reserve (SPR) after completing a congressionally mandated sale next month.

Forex

Longer-dated Treasury yields ended the week lower though the yield on

benchmark 10-year notes was up 6.7 basis points to 3.464% - on bets the Fed will

stop hiking rates at its next meeting in June.

Fed Governor Michelle Bowman said in prepared remarks that the U.S. central

bank probably will need to raise interest rates further if inflation stays high.

The consumer price index (CPI) and producer prices showed inflation is

slowing.

There could be a situation where U.S. inflation decelerates further and the

dollar's value declines, with European inflation staying high, said Thierry

Wizman, Macquarie's global FX & interest rates strategist in New York.