Technical analysis of forex trading is an essential part of conducting forex trading. In the process of using technical analysis to analyze trends, the most commonly used ones are the support and resistance levels of the K-line chart. How can we quickly determine the support and resistance levels and apply them to actual forex trading?

1. The Basic Principles of Support and Resistance Levels for Forex Trading:

The resistance and support in forex trading technology analysis are actually influenced by the long short relationship in the forex market. During the price rise process, as the short market gradually becomes larger than the long market, which affects the continued rise of prices, resistance is formed; During the process of price decline, as the price decreases, the long market gradually becomes more bearish, forming an upward supporting force.

support level: Support level refers to the price level at which support may be encountered during a price decline, thereby stopping the decline and stabilizing the price

Resistance level (also known as pressure level): refers to the situation where prices stop rising or even fall when they rise near a certain price level.

2. Common Methods for Determining Support and Resistance Levels:

1. Averages

The Moving Average has two main functions in forex technology analysis: one is to indicate direction; Another is to provide a basis for determining support and resistance levels. Because the moving average is the average of the closing prices of multiple days, it has a corresponding support and pressure effect on the fluctuations of the exchange rate. When the exchange rate rebounds near the moving average, forex traders often take the bottom and rebound, thus forming obvious support there.

However, when using the moving average to analyze short-term support resistance, it is generally necessary to adhere to the principle of large period small moving average and small period large moving average. For example, when looking at daily averages, we usually focus on the resistance of the moving averages on the 5th, 10th, and 20th. If it is a 60 minute chart or a 15 minute chart, it usually looks at the moving average of 100200 cycles.

2. Bollinger Line

Judging the resistance level of support through the Bollinger Line is usually done by observing the upper, middle, and lower tracks.

Generally speaking, forex technology analysis shows that the Bollinger Line is in a flat stage with relatively small changes. At this time, the support and resistance levels are relatively stable, and it is also the best time for high selling and low buying operations. However, investors should also pay attention to setting a stop loss to prevent breakouts when the Bollinger Line is flat.

In addition, when using Bollinger lines for judgment, it is important to choose as many cycles as possible, such as 55 cycles or even 100 cycles of Bollinger lines.

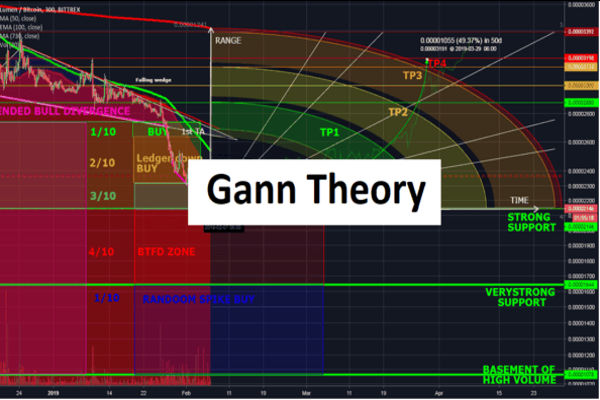

3. Golden Section

The golden section is the most common and effective way to find support and resistance levels in forex trading.

As long as you open the trend chart and use the golden section index to connect two relative high and low points over a period of time, using the low point as the base point. Based on the corresponding points of each golden section line, you can determine the support point of the price. The judgment of pressure level is based on the relative high point.

Among them, the golden section gears of 38.2%, 61.8%, and 50% are the most important.

3. Key Points of Operation:

Firstly, it should be clarified that the resistance level in forex trading does not necessarily have to be short, and the support level does not necessarily have to be long. Everything depends on the specific situation.

For aggressive investors who want to go long at a support level, it is best to adopt a batch entry approach and give it a try first. If the judgment is correct, increase the position after obtaining profits. If it is wrong, you can supplement the position at the next support position. But remember, you can only cover your position once, otherwise once the trend turns short, it will cause significant losses.

For stable forex traders, it is best to wait for the following trends before entering the market:

1. From the perspective of the K-line, it is necessary to wait for the appearance of a cross star, bullish engulfment, penetration, and hammerhead before considering entering.

2. From a morphological perspective, it is important to wait for deviations, head and shoulder bottoms, or W-bottoms to appear before considering entry.

3. From the perspective of the Trend Line, entry is only considered after the downward trend line at a small level breaks through.

In fact, the type of support level and resistance level is similar, and they can change each other. If it falls below the support level, it becomes a resistance level; After the resistance level is effectively breached, it will also become a support level. So we need to pay close attention to this when targeting the forex market.

EBC Platform Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.