Inflation in the United States Began to Stall in July

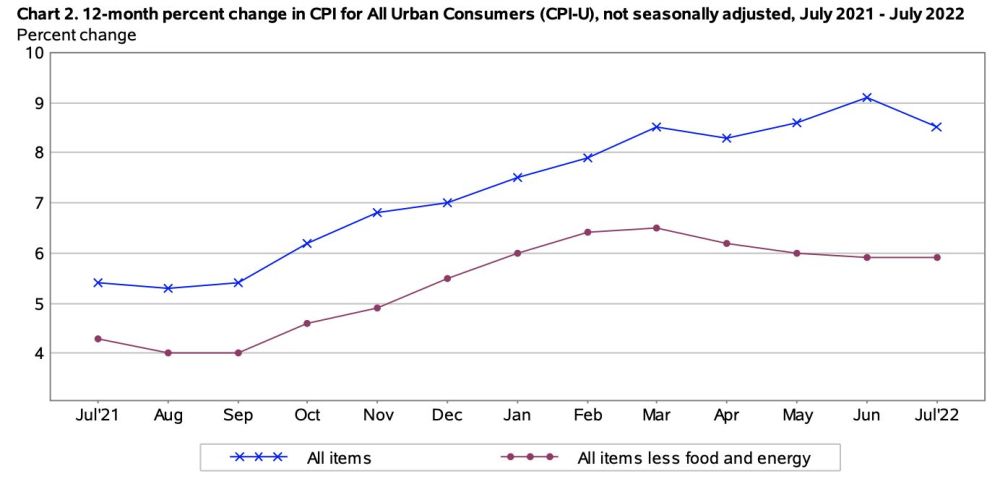

On August 10th, Eastern Time, the latest inflation data released by the US Department of Labor showed that the consumer price index increased by 8.5% year-on-year in July. Although this number is still at a 40 year high, it has significantly decreased from the previous 9.1% in June.

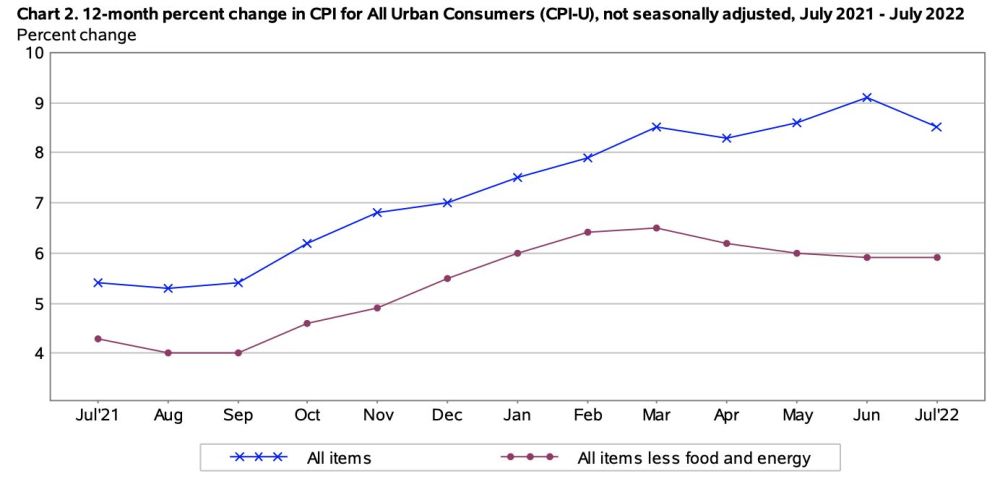

Year-on-year growth rate of consumer price index (CPI) and core CPI

Specifically, although the energy sector, which saw a year-on-year price increase of up to 32.9% in July, remains the main driver of inflation, it has fallen by 4.6% compared to June, with gasoline prices falling by more than 7.7% compared to June; The year-on-year growth rate of food prices is still as high as 10.9%, with a month on month growth rate of 1.1%.

The core consumer price index, excluding food and energy, increased by 5.9% year-on-year and 0.3% month on month. Among them, the month on month growth rate decreased to the level of March this year, and the year-on-year growth rate has been decreasing for four consecutive months.

The decline in inflation data is not surprising to the outside world.

President Biden stated before his trip to the Middle East last month that although the 9.1% inflation figure in June was unacceptable, there may be signs of a slowdown in the core Inflation rate. At that time, the core consumer price index had narrowed for three consecutive months.

As for the main factor driving this round of inflation - energy prices have turned downward since early June. With the slowdown of demand in major developed economies in the world and the agreement of OPEC and its allies to increase production slightly on August 3, the price of Brent Crude Oil has dropped all the way from a June high of $123.6 per barrel to $96.6 per barrel, the lowest since the Russia-Ukraine conflict at the end of February. Data from the American Automobile Association on August 4 also showed that the price of a gallon of gasoline in the United States had fallen 17% to $4.06 from the peak of $5.02 in June.

The Entire Europe is still Deeply Embroiled in An Inflation Crisis

According to data released by the German Federal Bureau of Statistics on August 10th, Germany's inflation rate slightly decreased to 7.5% month on month in July, but remained at a high level of over 7%. This is the fifth consecutive month in which Germany's inflation rate has exceeded 7%.

Previous data released by the Federal Bureau of Statistics shows that Germany's inflation rate has been consistently high since March this year. Among them, March was 7.3%, April was 7.4%, May was 7.9%, and June was 7.6%.

So the inflationary pressure in Germany, the largest economy in Europe, the locomotive, has not yet been truly alleviated, and the market expects the European central bank toOr further increase the pace of tightening. Specifically, the significant increase in food and energy costs was the main factor behind July's inflation exceeding expectations. Just this week, due to the heat wave increasing demand, Germany's electricity prices hit a historic high, putting pressure on energy supply before the onset of winter.

Data shows that energy prices in Germany increased by 35.5% year-on-year in July, food prices increased by 14.8% year-on-year, overall prices of goods including energy and food increased by 14.1% year-on-year, and service industry prices increased by 2.0% year-on-year. Excluding energy factors, the inflation rate for the month was 4.4%; Excluding energy and food prices, the monthly inflation rate was 3.2%, less than half of the overall inflation rate.

In 2022, due to sustained high inflation, consumer demand in the eurozone has significantly decreased, and commercial activity has also shown signs of slowing down. Under the superposition of the energy crisis, high inflation and monetary policy tightening, the risk of economic recession in Europe has increased.

In 2021, the Dutch economy grew by 4.9% due to the relaxation of epidemic control. In the first quarter of 2022, the Ukrainian Russian war led to a surge in prices and inflation, resulting in a new supply chain crisis and a decrease in economic growth rate to 0.4%.

It is expected that the economic growth rate of the Netherlands will decrease to 3% throughout 2022 and only 1% by 2023. In addition, inflation is sweeping across Europe at an unprecedented pace.

EU data shows that prices in 16 out of 27 countries have experienced double-digit growth within a year. Electricity and natural gas prices in the Netherlands have surged by 107% in the past 12 months.

The most tragic ones are Estonia, Lithuania, and Latvia, with inflation rates of 22%, 20.5%, and 19%, respectively. The average inflation rate of the 29 member states of the European Union is 8.8%, of which the average inflation rate of the 19 eurozone member states is 8.6%. The income level of European people is increasing, but it is not in sync with inflation.

The Bank of England: UK Inflation Rate Will Reach a 42 Year Peak

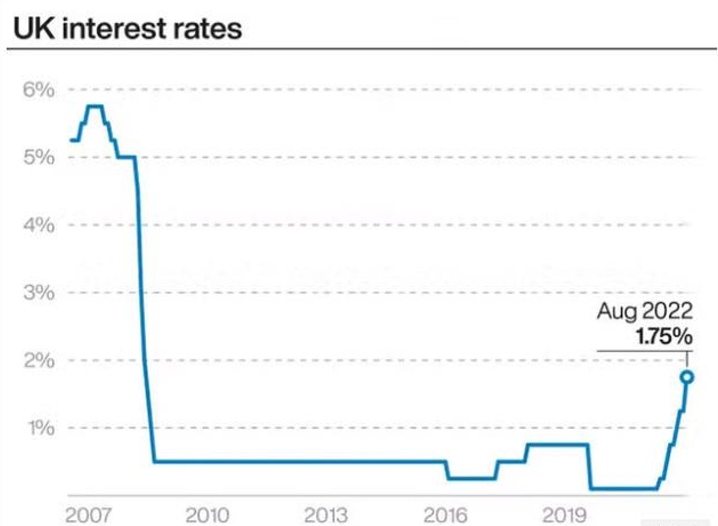

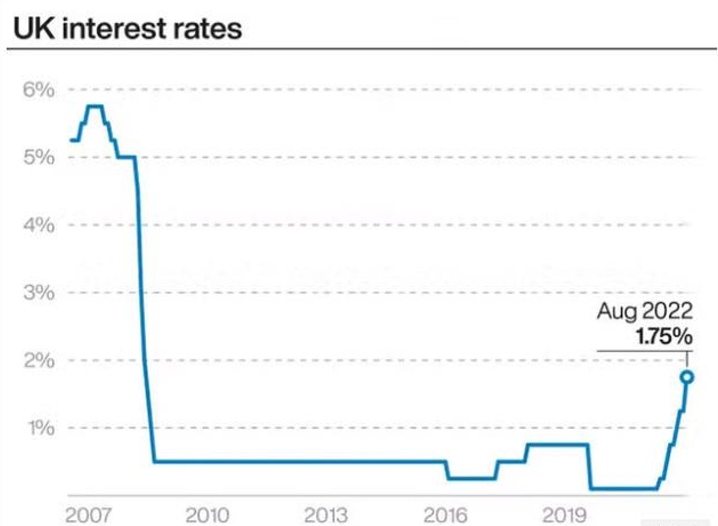

According to the New York Times website on August 4th, the Bank of England released a pessimistic outlook for the UK economy on Thursday, predicting that as the impact of high inflation gradually becomes apparent, the UK will begin a long-term economic recession later this year. However, the Bank of England has increased its efforts to cope with soaring prices, raising interest rates by 0.5 percentage points, the largest increase since 1995.

According to the report, the Bank of England has raised its benchmark interest rate to 1.75%, the highest level since 2008, as it predicts that when household energy bills increase significantly in October, the annualized inflation rate will exceed 13%. This will set the highest inflation rate in 42 years, six times the inflation target set by the Bank of England of 2%.

The Bank of England said that the soaring prices still largely stem from the global energy market. In the past three months, the wholesale price of natural gas has almost doubled this winter. The bank predicts that this will push up the upper limit of household energy bills this autumn to 3500 pounds (approximately $4245), which is three times the amount a year ago.

The prospects for millions of British families are worrying. After deducting factors such as inflation and taxes, it is expected that its income will significantly decrease this year and next, making it the most severe decline since the 1960s.

Bank of England Governor Andrew Bailey stated:The current increase in energy prices has exacerbated the decline in real income for British residents, and as a result, the economic outlook for the UK and even Europe has been further weakened. The growth rate of the UK's gross domestic product has slowed down, and relevant predictions indicate that the UK economy will enter a recession later this year.

As the Bank of England attempts to address inflation issues, the latest rate hike is the sixth since December last year.

Australia's largest bank warning: interest rates and inflation have not cooled yet

Melbourne Research InstituteAccording to survey data from the Institute, consumer inflation expectations in Australia cooled for the second consecutive month in August from a high of 6.7% in nearly 14 years to 5.9%, with a previous increase of 6.3%.

However, due to another rate hike by the Federal Reserve of Australia and the soaring cost of living, a measure of consumer confidence in Australia fell for the ninth consecutive month in August, reaching its lowest level since the early stages of the epidemic.

The Westpac Melbourne Institute (WESTPAC-MI) consumer confidence index for August, released on Tuesday, fell 3.0% from July, the same decline as July. The index fell by 22% compared to the same period last year to 81.2, indicating that the number of pessimists far exceeded that of optimists.

This pessimistic sentiment partially reflects the impact of the Federal Reserve of Australia's policy decision last week. Last week, the Federal Reserve of Australia raised interest rates by an additional 50 basis points to 1.85% and warned that further rate hikes were needed to curb soaring inflation.

But the reason for the decline of the Federal Bank is that its CEO MattComyn warned that inflation and interest rates remain high, and the bank expects inflation rates to have a negative impact on its lending business, which has weakened consumer sentiment several times this year.

The inflation rate is still very high, and we see a rapid increase in cash interest rates... With the increase in cost of living pressure, we expect consumer demand to ease

The Reserve Bank of Australia has raised interest rates by 175 basis points this year in order to curb inflation, which has reached its highest level in nearly 30 years.

At the recent meeting, the Federal Reserve of Australia warned that inflation may prove stubborn and there is reason for further interest rate hikes. Raising interest rates may suppress the housing loan market, although the profit margins of lending institutions may increase as a result, it puts pressure on borrowers.

In the past three months, the Federal Reserve of Australia has been tightening monetary policy, raising the cash interest rate from 0.1% to 1.35% to ensure that inflation expectations remain near the target of 2% -3%.

China's CPI only rose 2.7% in July

China's CPI showed a slight increase in July, with a year-on-year increase of 2.7%. Although we have not experienced high inflation like in the United States, the year-on-year increase in CPI has expanded month by month from 0.9% in January, exceeding 2% in April, 2.5% in June, and 2.7% in July. From a trend perspective, our inflation has a latecomer characteristic, with a high probability of exceeding the moderate inflation line of 3% in the short term.

From the perspective of supply and demand, since the outbreak of the epidemic, our consumption has been relatively sluggish. Overall, there has been a serious oversupply and a relatively passive economic situation of relying on exports to digest production capacity.

But the production capacity that we have been expanding through advanced investment is mainly reflected in infrastructure construction and the supply of production capacity in the industrial and service industries. In fact, there is not much investment in production capacity for food, especially agricultural products.

The basic necessities of life were the main force behind the price increase in July. Food, on the other hand, is a consumer necessity with very low consumption elasticity. In addition, consumption has been suppressed by investment for a long time. The Engel's coefficient (the proportion of food to consumer spending), which measures our consumption level, has rebounded in recent years, approaching 30% in 2021, resulting in a relatively large weight of food prices in CPI. Therefore, any fluctuations in food prices will have a significant impact on CPI.

Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice