Trading

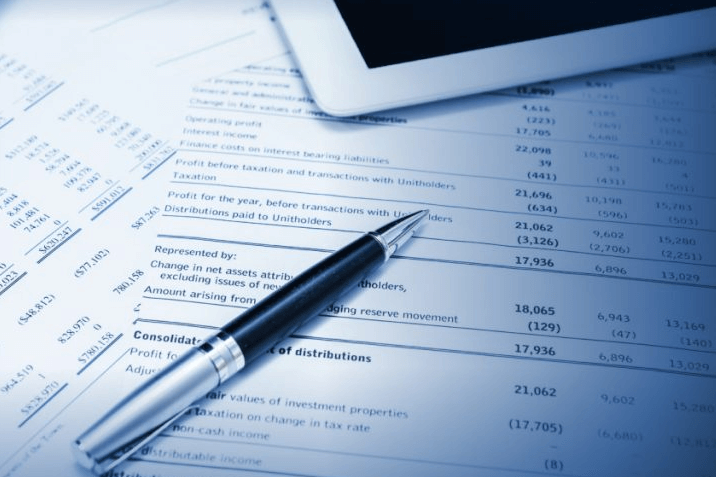

Accounts & Conditions

Trading Accounts

Leverage & Margin

Deposits & Withdrawals

Dividends

Institutional Services

Financial Technology

About EBC