Understanding commodity market timings is essential for anyone new to trading commodities. Market hours determine when you can buy and sell, impact liquidity and volatility, and shape your trading strategy.

Whether you're interested in metals, energy, or agricultural products, knowing when the market is open can help you make smarter, more timely decisions. Here's a beginner-friendly guide to commodity market timings, both in India and globally.

What Are Commodity Market Timings?

Commodity market timings refer to the specific hours during which commodity trading is allowed on exchanges. These hours are set by the exchanges and may vary depending on the type of commodity, the exchange's location, and global market influences.

Indian Commodity Market Timings

In India, commodity trading typically takes place on exchanges like the Multi Commodity Exchange (MCX). The market is open from Monday to Friday and divided into two main sessions:

By Commodity Type

Regular agricultural commodities: 9:00 AM to 5:00 PM

Internationally referenced agricultural commodities: 9:00 AM to 9:00 PM

Non-agricultural commodities (metals, energy): 9:00 AM to 11:30 PM (or 11:55 PM with DST)

A special pre-market session (8:45 AM to 8:59 AM) is available on MCX, allowing traders to cancel pending orders before the main market opens.

Global Commodity Market Timings

Commodity markets operate nearly 24 hours globally, thanks to different time zones and major exchanges. For example:

The global market's seamless flow is due to overlapping trading hours between regions. When Asian and European markets are open at the same time, or when European hours overlap with North America, trading activity and liquidity often increase.

Why Do Commodity Market Timings Matter?

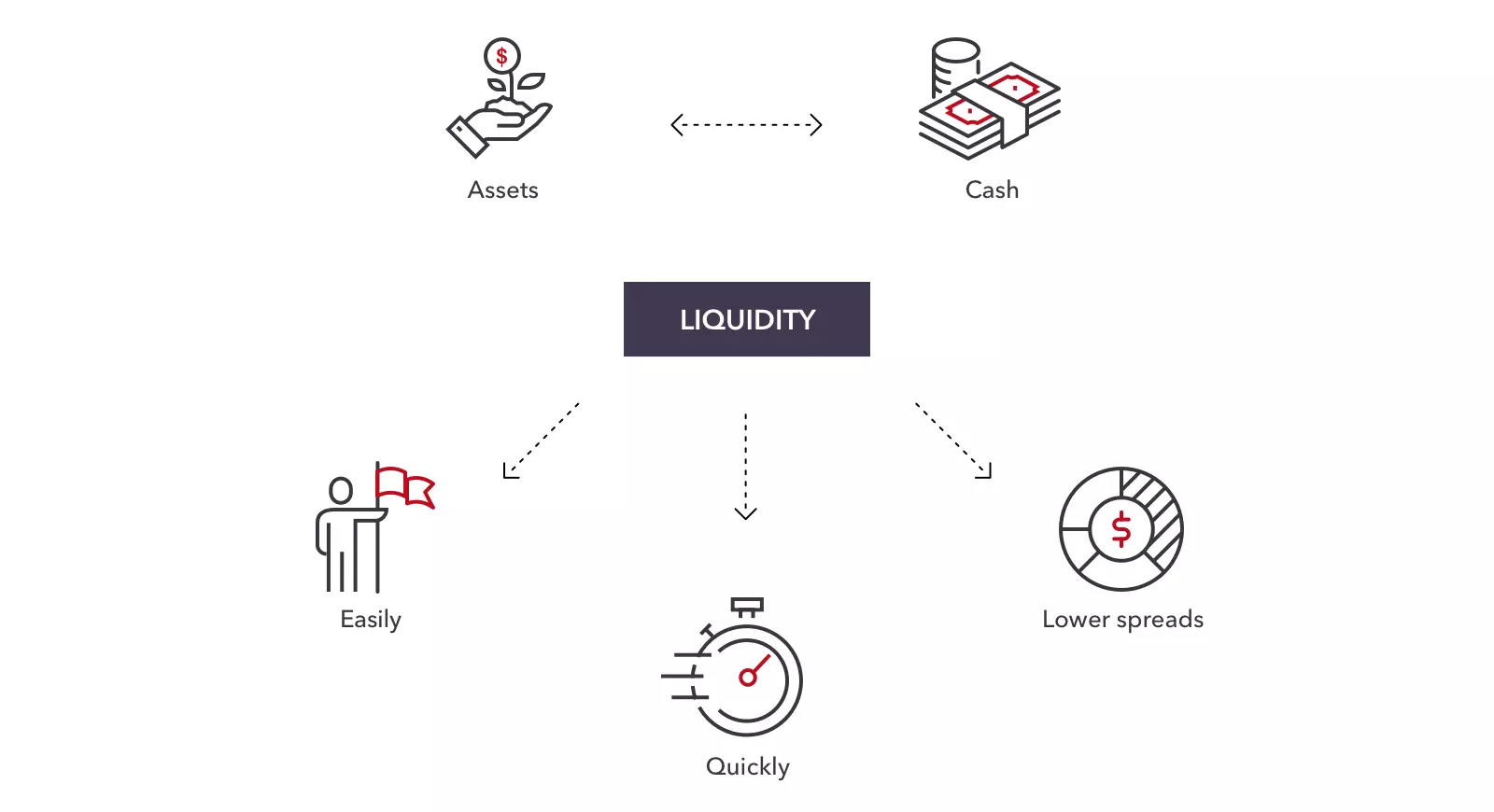

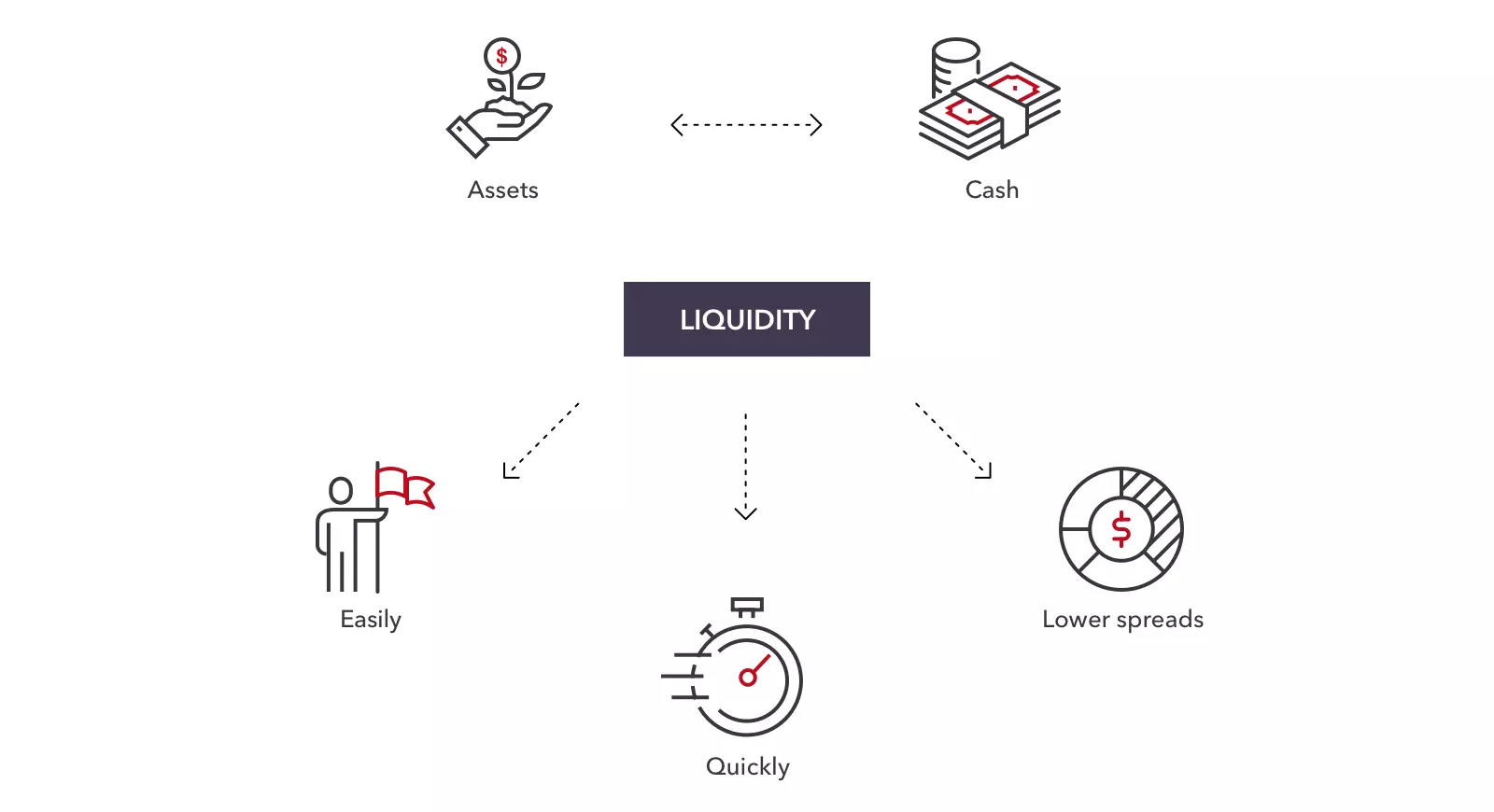

1. Liquidity and Price Movements

The first few hours after the market opens typically see the highest liquidity and trading volume, making it easier to execute trades at desired prices. Overlapping sessions between major global exchanges also create periods of high activity and price movement, which can present more trading opportunities.

2. Volatility and Risk

Market volatility often increases during opening hours, overlapping sessions, and around major global news events. While volatility can offer profit opportunities, it also increases risk, so risk management tools like stop-loss orders are recommended.

3. Commodity-Specific Timings

Not all commodities trade during the same hours. For example, metals and energy products on MCX trade late into the evening, while agricultural commodities are restricted to earlier sessions. Always check the timings for the specific commodity you wish to trade.

4. Seasonal and Global Influences

Seasonal trends, such as planting or harvest times for agricultural commodities, can affect trading hours and price volatility. Global economic and political events may also prompt exchanges to extend or adjust trading hours to accommodate increased market activity.

Tips for Beginners

Trade during high-liquidity periods: The first few hours after market open and during global overlaps are the best times for active trading.

Avoid trading just before closing: Liquidity drops and prices can become erratic near the close.

Monitor global news: Economic releases, geopolitical events, and supply-demand changes can all impact commodity prices and trading hours.

Use risk management tools: Stop-loss orders and careful position sizing can help protect against unexpected price swings during volatile periods.

Know your commodity: Always check the specific trading hours for the commodity you're interested in, as timings can vary widely.

Special Trading Sessions

Indian exchanges sometimes offer special sessions, such as Muhurat trading on Diwali, which is considered auspicious and lasts for about an hour in the evening. These sessions are announced in advance and provide unique trading opportunities.

Final Thoughts

Commodity market timings are a crucial aspect of successful trading. By understanding when markets are open, when liquidity is highest, and how global events influence trading hours, beginners can plan their trades more effectively and avoid common pitfalls.

Always stay informed about the latest timings and market news for the commodities you wish to trade.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.