An excellent investment opportunity may be purchased at an inappropriate

time, while a poor investment target may also profit under good risk management.

Therefore, when receiving external information, it is important to think

independently and establish a comprehensive entry and exit plan. My suggestion

is to consider purchasing gold. Even if you are not planning to purchase, please

remain vigilant as gold is about to embark on a relatively long-term upward

trend.

After global economic stagnation and the impact of large-scale banknote

printing and trade wars by central banks, gold has been supported. In short,

there is much good news, so I won't go into detail.

However, before we consider investing, let's discuss exit strategies to truly

achieve paper profits. Firstly, we need to understand why gold has fallen, or

rather, why it has fallen significantly. Firstly, a sudden collapse in the stock

market may result in investors' account assets being forced to zero.

Secondly, the global economy is gradually recovering, but please note that

the start of construction in European and American countries does not

necessarily mean economic recovery. In fact, the trend toward corporate

bankruptcy has just begun. When companies issue a large amount of bonds, similar

to the amount borrowed by the government, they will have to take measures such

as large-scale layoffs, selling company assets, and closing stores to maintain

business operations. Although the Federal Reserve has delayed this fragile scene

through printing money, when the economy reaches a low point and the economy

begins to slowly recover, there will be slight inflation in the market, which

will be more conducive to the growth of gold and real estate. This is also why I

initially predicted that gold would experience a relatively long bull market, as

economic recovery would take time.

Finally, the most crucial point is that no matter how in-depth and reasonable

our investment analysis is, the market may still not buy into it. At this point,

setting a stop-loss point or stop-gain point will become a good tool for

survival. You can temporarily withdraw from market observation until the time is

right, and then enter the market again.

Conduct in-depth research on the different ways of investing in gold among US

stock brokers. The first is to directly purchase the stocks of gold mining

companies. The Stock Prices of these companies are affected by fluctuations in

gold prices. When gold prices rise, their stock prices usually also rise, and

vice versa. At present, the world's largest gold mining company is Newmont

Corporation, headquartered in the United States, with a stock code of NEM. The

company's total assets are close to $50 billion, and its annual dividend payout

is approximately 1.68%. The world's second-largest gold mining company is

Barrick Gold, headquartered in Canada, with a stock code of GOLD and total

assets of approximately $48 billion. The annual dividend payout is approximately

0.07%. The third largest gold mining company is Freeport McMoRan, headquartered

in the United States, with a stock code of FCX and a market value of

approximately $17 billion. The annual dividend payout is approximately 3.48%.

However, it is worth noting that in addition to gold, they also engage in

businesses such as silver, copper, and oil, so fluctuations in other commodity

prices can also affect their stock prices. The fourth largest gold mining

company is Newcrest Mining in Australia, with stock code NCM and total assets of

approximately $12 billion, with an annual dividend payout of approximately 0.4%.

Finally, the fifth largest company is Kinross Gold from Canada, with a stock

code of KGC and total assets of approximately $9 billion, but no dividends have

been paid.

We can see that the stock prices of these gold mining companies are currently

at a seven-year high. Although some people may recommend companies with stock

prices below $5 or even a few cents, I personally believe that these companies

have higher risks. If you choose to hold them, it is important to control your

position.

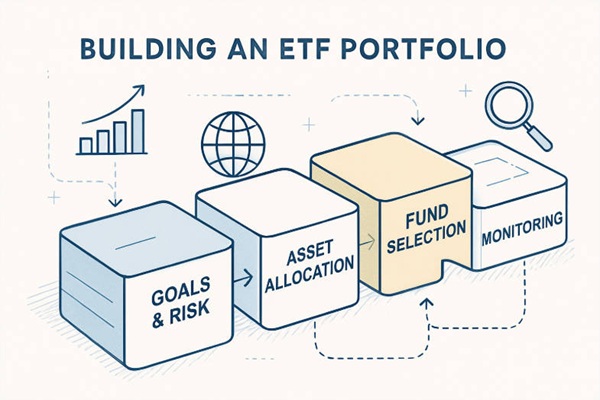

The second method is to purchase physical gold ETFs (exchange-traded funds).

These ETFs will purchase actual gold bars, with fluctuations consistent with the

price of physical gold. This is a relatively low-risk option, as there is no

need to delve into company financials or other information. The largest Gold ETF currently is SPDR Gold Trust, with the stock code GLD and an annual fee rate of

approximately 0.40%. The other is iShares Gold Trust, with the stock code IAU

and an annual fee rate of approximately 0.25%.

The third way is to track the ETFs of gold mining companies. These ETFs track

all gold mining companies in the stock market, so in addition to fluctuations in

gold prices, they are also affected by the overall health of the stock market.

The two largest gold mining ETFs are VanEck Vectors Gold Miners ETF (GDX) and

VanEck Vectors Junior Gold Miners ETF (GDXJ), with annual expense rates of 0.53%

and 0.54%, respectively.

The fourth approach is leveraged ETFs, some with double or triple leverage.

This means that if gold prices rise by 1%, their increase may reach 2% or 3%,

and vice versa. This kind of leverage brings greater potential returns, but it

also comes with higher risks, as the decline will also be amplified.

Additionally, such ETFs typically involve futures contracts, resulting in higher

fees. It should be noted that they are more suitable for short-term investors

and experienced investors.

Finally, the fifth method is to empty the ETF of gold, but this requires more

professional knowledge, so we will not explain it in detail here.

To summarize, in addition to the high-risk and highly leveraged methods of

futures and short selling, the main ways to invest in gold include purchasing

stocks of gold mining companies, purchasing ETFs of physical gold, tracking ETFs

of gold mining companies, and using leveraged ETFs. Each approach has its

advantages and risks, so when choosing the one that suits you, please be careful

and consider it carefully.

Finally, I would like to remind everyone that physical gold bars or gold

passbooks can be purchased directly, but safety and other factors need to be

considered. When trading gold ETFs at Securities firms, it is simple and fast,

and usually there are no additional trading fees.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.