Financial Astrology?

If someone could provide predictions about the trends of various asset classes based on astrology, we would think it would be ridiculous!

Consider that financial market prices are based on the convergence of thousands of global factors, including the development of science and technology, changes in consumer sentiment and preferences, changes in production prices, and public health emergencies (such as Covid-19)The competition between national political factors and other financial instruments, and even weather changes.

These prices are negotiated electronically on behalf of millions of investors worldwide on computers in large data centers. Every day, well-trained mathematicians, statisticians, econometricians, and computer scientists strive to achieve varying degrees of success to ensure that the complex programmatic trading operations they develop generate significant statistical profits.

For centuries, we have known that predictions can be made based on known laws of physics, and today there are high-precision data acquisition equipment to assist. If financial astrology can be effective, then does it mean that planets, stars, and constellations millions, billions, trillions, and tens of millions of kilometers away can be linked to highly interconnected trading and analytical operations?

But anyone with a little scientific training will definitely not believe this astrology-based financial market prediction!

However, there are indeed people who provide and believe in astrological predictions in finance

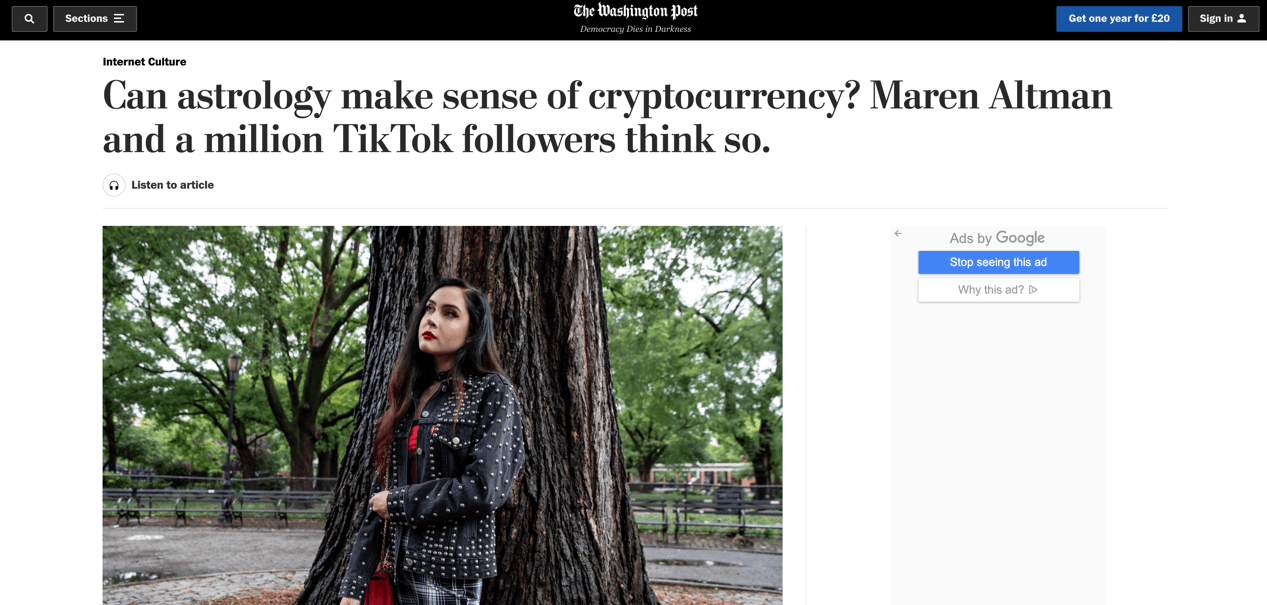

EBC Finance was surprised to see that the Washington Post highlighted several financial astrologers in an article on June 13, 2021.

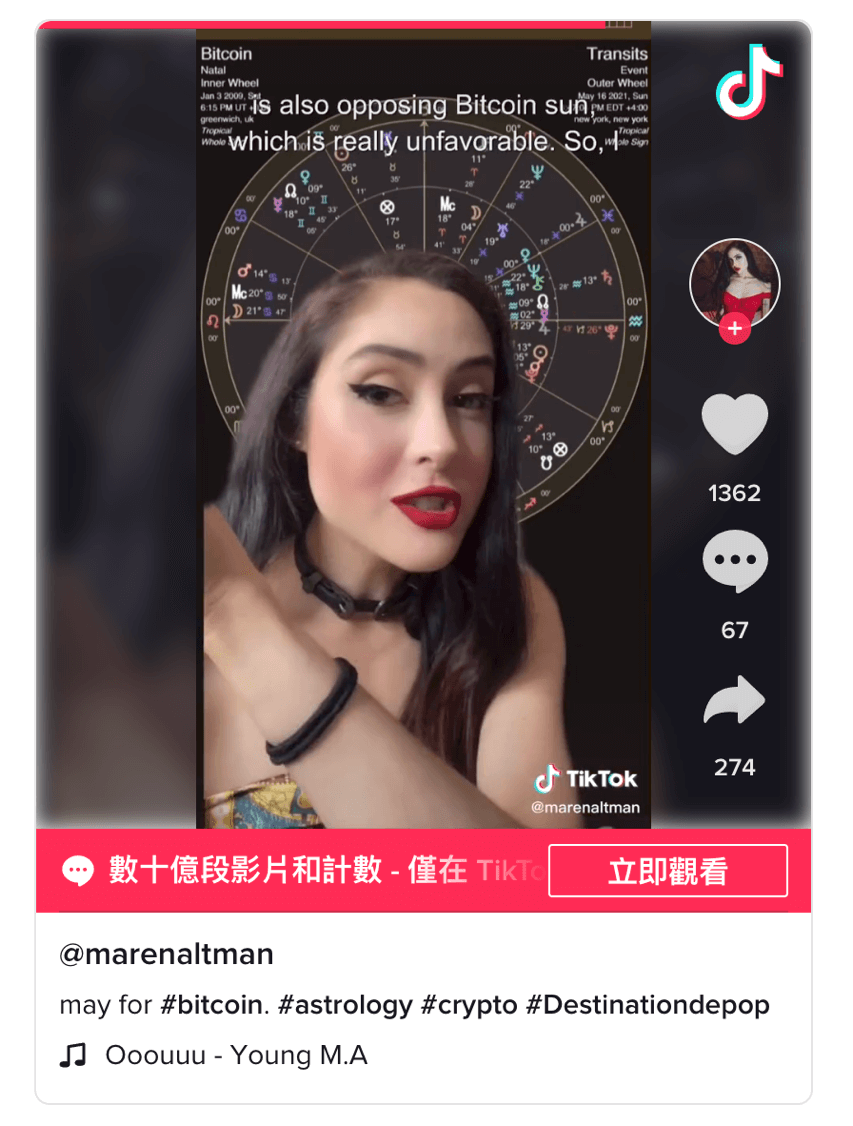

Maren Altman used astrology in TikTokAccumulated over one million fans on. She unexpectedly applied astrology to the field of cryptocurrency. Astrologers believe that anything with a verifiable birthday or creation date has a readable birth chart from which predictive information can be collected.

In her typical encrypted astrology video, Maren reads the birth chart of a specific currency and provides ideas for its near future.

Earlier this year, she read Bitcoin's "chart" using its creation date of January 3, 2009. In a video, she claimed:

The new moon in Capricornus on January 13 means a lot to the special coins. Saturn will be on January 11thAccurately adding Bitcoin to Mercury, this looks like some correction for Mercury and Saturn. This may be related to causing a temporary decline. But with this new moon, the sun, moon, Pluto, right above Jupiter in Bitcoin, it's like a new beginning at the atomic level.

In other words, she believes that the positions of Saturn and Mercury may indicate a decrease in value, but Jupiter and Pluto indicate that the price of Bitcoin will rebound from any correction and continue to rise. This looks like a bull market. Sure enough, the price is at 1On the 11th of the month, it fell and rebounded two days later, continuing to rise to some extent until April, when its value almost doubled.

In astrology, we are studying the correlation between certain planetary arrangements and world events, "she said, adding," This is predicting the future by looking back at the past

Maren also wants to use her fame to do more things, not justTikTok. She said, "I want a Wikipedia page that says, 'She founded this company and is a member of its board of directors.'

Nevertheless, many analysts see it as nonsense, Frederick Standfield, founder of Lifewater Wealth Management in AtlantaPeople tend to be emotional about cryptocurrencies, which is usually because they always see 'who made how much money', but at the same time 'how many people lost how much money'.

"When people start to get involved in it but do not really understand it or really grasp what it is, I think it is when they start to let themselves believe in astrology, financial pseudoscience and other things. If you think about it carefully, they do not fully conform to scientific methodology," Standfield said.

He added that when things do work, such as Maren mentioned earlierPredicting can create a sense of confirmation bias. People tend to explain the current situation in a way that confirms what they already believe, while ignoring anything to the contrary, especially on social media

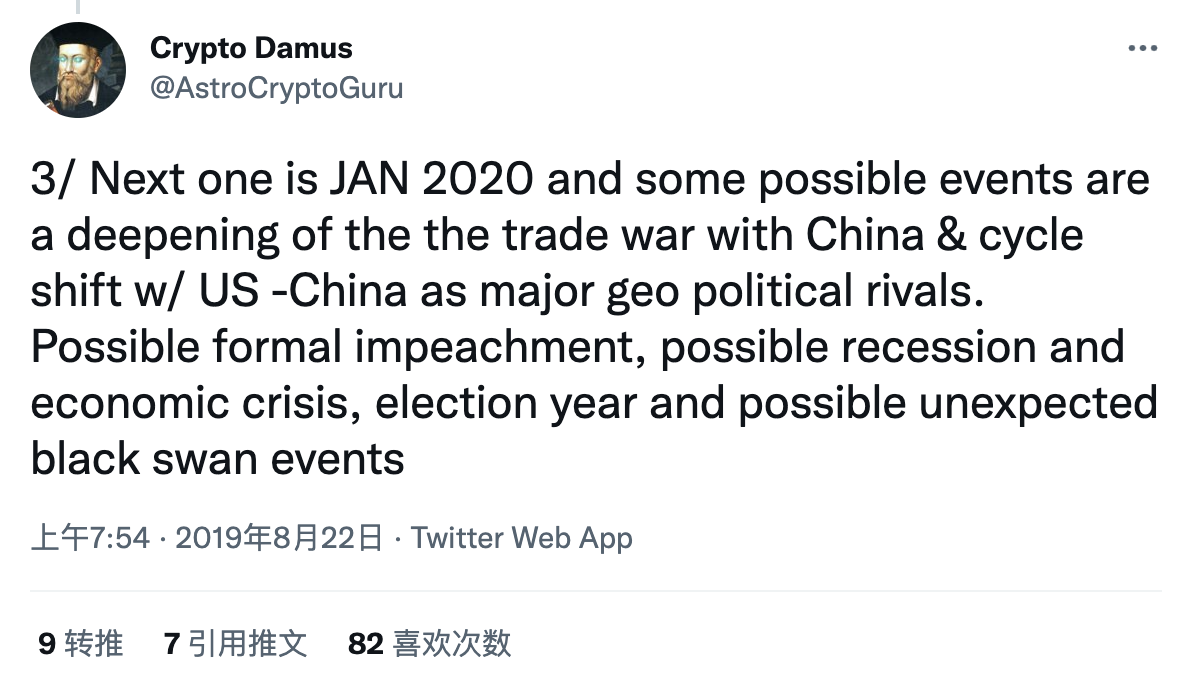

For decades, financial astrology has emerged in various forms. Weinstein became one of the first people to pay attention to cryptocurrencies, especially Bitcoin, in 2017. He's on his own website Astro CryptoReport and twitter account @ AstroCryptoGuru shared his findings, as well as other predictions, such as the 2019 tweet in which he predicted 2020The "Possible Unexpected Black Swan Incident" in the year.

When you laugh at others, see if you are also using pseudoscience?

Before laughing at astrologers and their followers, people in the financial world may need to ask themselves whether they also use pseudoscience in their work. As for which are pseudoscience, look at the following:

technical analysis. Have you ever thought that "technical analysis" may be as pseudoscience as astrology in today's market. Do traders truly believe in techniques for "trends," "waves," "breakout patterns," "triangle patterns," "shoulders," and "Fibonacci ratios" (none of which can withstand rigorous statistical scrutiny)? Can chart based analysis really compete with mathematical models or complex big data processing programs operated by successful hedge funds and other large organizations?

However, this includes Merrill Lynch, Bank of America, Fidelity, Barron Weekly, The Wall Street Journal, Bloomberg, and MarketWatchMainstream financial news organizations around the world often promote technical analysis, or at least provide convenient platforms and tools for technical analysis.

But does technical analysis really work?

Those who support pseudoscience in technical analysis believe that there is no clear and publicly recognized consensus in the field of technical analysis on what constitutes an operable model, especially when chart readings and interpretation rules themselves are ambiguous.

They pointed out the data collected by CXO Consulting earlier, analyzed 68 market forecasters, and adopted a new weighting scheme that takes into account the specific level of prediction.

Among these 68 predictors, 27 acknowledged using technical analysts as an important component of their analysis. So, this 27How is the performance of a technical analyst? Their average accuracy is only 44.1%. In fact, this average score is slightly lower than the average score of all 68 predictors in the study.

In short, there is no evidence in these data to suggest that technical analysis is effective in predicting the market. If so, the result must be optimistic, because the well-known survivorship bias phenomenon - it is likely that many unsuccessful technical analysis practitioners quit the industry.

Many quantitative funds and other organizations at the forefront of modern quantitative finance use highly complex mathematical algorithms (much more complex and extensive than any algorithm used in the world of technological analysis), possess vast dynamic datasets, and implement them on the most advanced basis - trading at the nanosecond or even microsecond level. More importantly, these organizations are increasingly becoming the only ones that continue to make money - for example, most of the highest earning hedge fund managers and traders work in quantitative companies.

Because if any effective strategy is quickly imitated by others, any "advantage" will quickly disappear. This is why market prices are almost completely random walk.

Intraday Trading. Even if amateur investors frequently buy and sell assets throughout the entire trading day, it will not work. One study after another shows that the vast majority of Day traders are losing money, with many of them suffering heavy losses; Only a small portion regularly earns profits. For example, 2017A study conducted by the University of California, Berkeley, and Peking University in found that even the most experienced day traders suffer losses, with nearly 75% of day trading activities being carried out by those with losses.

Market forecasters. In short, the record of market forecasters is disheartening. Jeff Sommer, a financial writer for The New York Times, summarized 2020The dismal predictions of stock market forecasters in.

Doomsday theory. The doomsday theory and its opposite may be called "amplification theory", which is also too common in the financial world as "pseudoscience". Many eye-catching headlines from financial media are mostly warnings of a catastrophic decline in global financial markets. A famous economist warned that in 2016In 2009, we are likely to see a global economic recession with no end in sight. Another author warned in 2018 that the next bear market would be the worst of our lives. The third person said, also in 2018In, it warned that the stock market would plummet by more than 50%; Another prediction is a 60% decrease. But moderate to severe correction is the inevitable fate of all financial markets.

For example, during the Covid-19 market panic in 2020, global financial markets lost 40%Or more, and then quickly recover. However, what is the significance of constantly issuing warnings of decline or rise when statistically speaking, such predictions do not have a scientifically reliable basis?

What should investors do?

People should not be too surprised by these findings. On the one hand, they are the direct meaning of the efficient market hypothesis: in an era when the market is dominated by large, mathematically complex big data mining participants, relatively immature forecasters and investors cannot always defeat the market, whether they rely on astrologers, crystal ball or "technical analysis".

Indeed, the efficient market hypothesis has its weaknesses, especially the fact that psychological factors often play a role in financial markets. Psychology can create over 90% of market trends, and psychological factors can affect trading results and market trends.

However, it is difficult for professional investors to improve their financial trading psychological qualities, let alone individual investors, so this is quite academic.