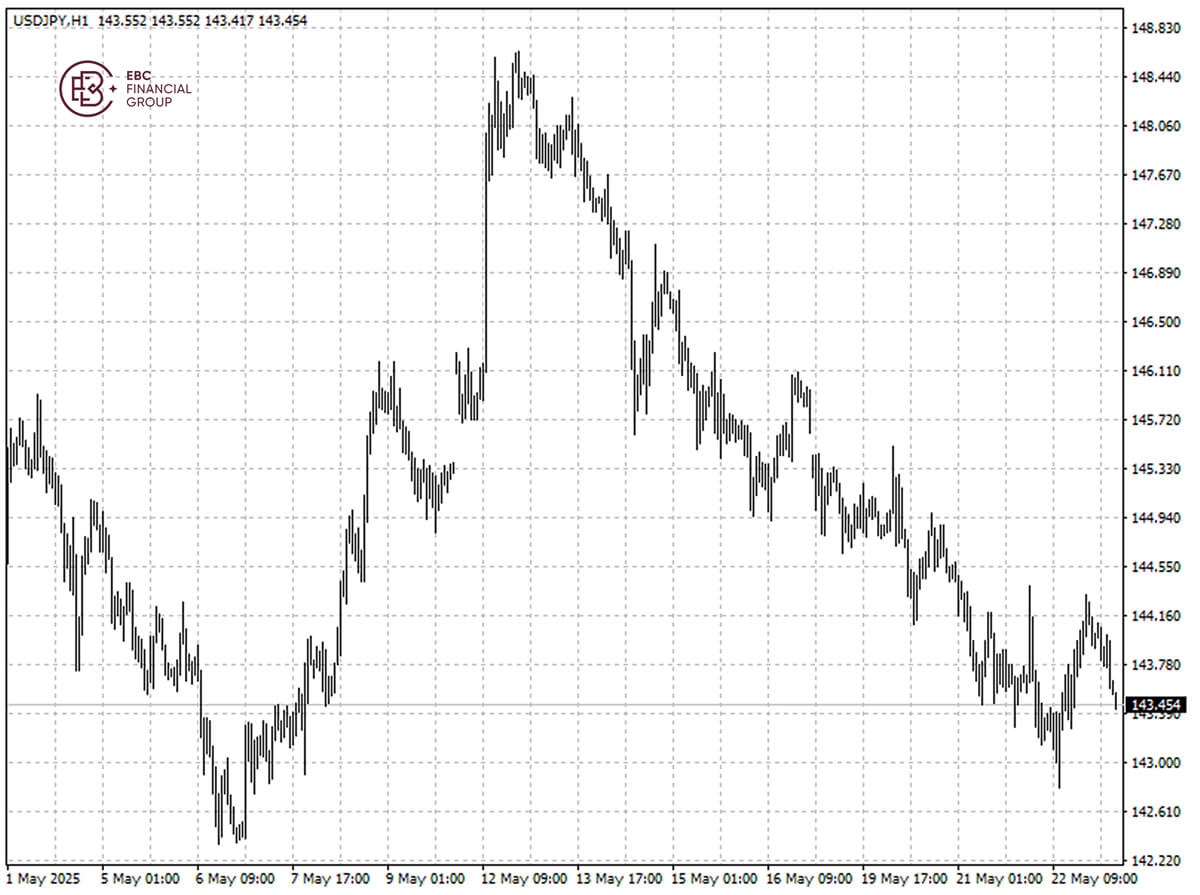

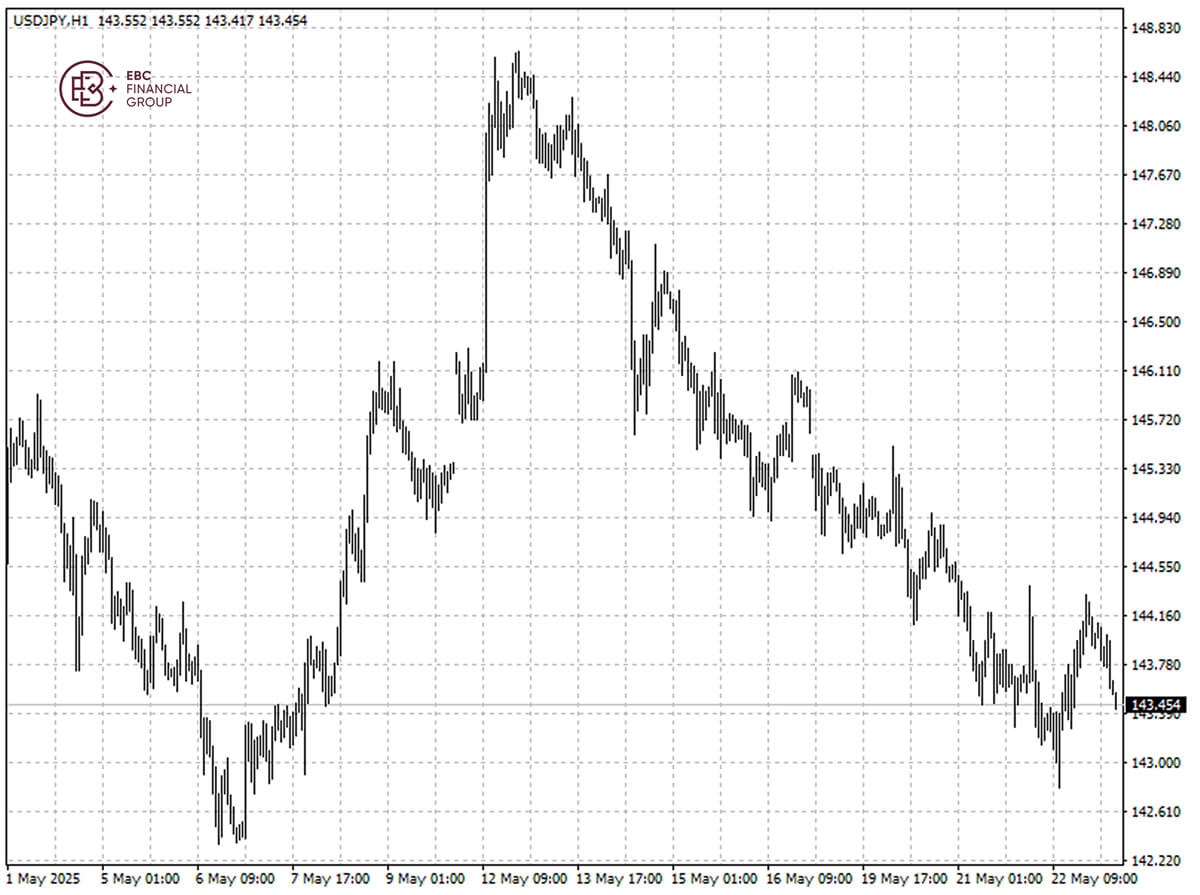

The yen edged up on Friday, on course for a 1.4% increase for the week.

Japan's core inflation grew at the fastest annual pace in more than two years,

which helped fuel rate hike expectations.

US Treasury Secretary Scott Bessent and Japanese Finance Minister Katsunobu

Kato agreed on Wednesday that the dollar-yen exchange rate currently reflects

fundamentals.

Asian currencies surged this month saw sharp swings on market speculation

about possible US pressure to prop up their currencies in their tariff talks.

The yen has increased about 9% in 2025.

Yields on long-dated Japanese government bonds rose to new records this week

in the wake of a poor auction result that cast doubt over debt sales looming in

the weeks ahead.

JGBs have been under pressure after a dramatic sell-off in March triggered by

a slide in German bunds. Recently, several political parties are calling for

consumption tax cuts, further denting the asset's appeal.

The BOJ has refrained from tightening for the time being given deadlocked

trade talk with the US and struggling bond markets. The yen's strength mainly

stemmed from the greenback weakness.

The yen rallied after hitting the low of 144.33 per dollar, and the path of

least resistance is heading towards 143 per dollar. But the upside room could be

limited.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.