In today's global financial markets, there is a fundamental consensus that US bonds serve as the bedrock of global risk-free interest rates.

This perception stems partly from the concept of "US dollar hegemony" and is reinforced by the historical fact that US Treasury bonds have never defaulted. While these ideas are often conflated, suggesting that the United States leverages the dominance of the US dollar to print money and service its debts, a closer examination reveals a more nuanced reality. This oversimplification overlooks the intricate relationship between the US currency and fiscal policies, particularly ignoring the inherent instability inherent in the US fiscal system, exemplified by recurring issues like the debt ceiling.

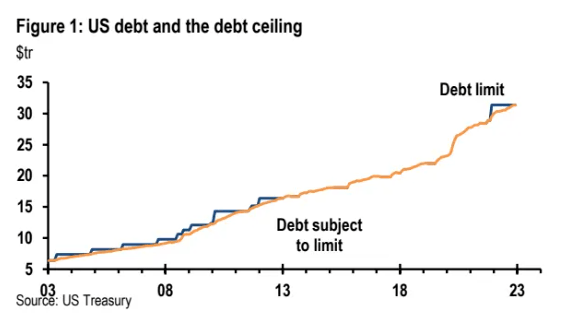

As we entered 2023, renewed concerns surfaced as the United States once again approached its debt ceiling. Questions loomed: Would the US default? Could this trigger a paradigm shift? Interestingly, the United States stands out among developed economies for frequently confronting fiscal crises due to its internal constraints. The origins and history of these fiscal challenges reflect distinct "American characteristics" and provide a compelling lens to explore the intersection of the US political system and financial markets.

Why is the Debt Ceiling a Unique Issue in the United States?

Unlike the inevitable development path of "taxation and death" in most countries, the financial powers of the federal government of the United States are not innate. Since the independence war's cry of "no taxation without representation," the struggle over financial authority has persisted throughout U.S. history. As Chinese citizens accustomed to the concept of a "big government," we need a preliminary understanding of this political issue: although the United States is undoubtedly a leading developed country, it is still grappling with becoming a "modern country" in terms of its political system.

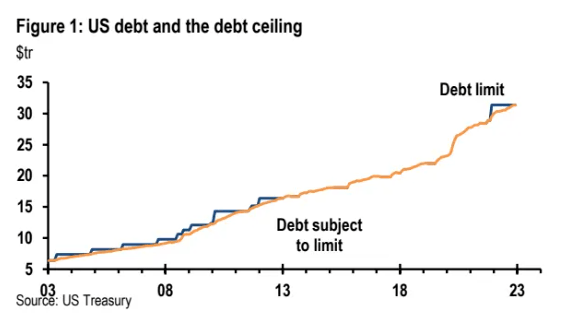

The tug of war over U.S. financial power primarily involves Congress and the federal government, conducted through two independent procedures: the budget and the debt ceiling. Among them, the fiscal budget is submitted by the President to the Congressional Budget Office every year, which votes and supervises the implementation of expenditures. If Congress cannot pass the budget on time, the government can pass a "Continuous Resolution" (Continuous Resolution) temporarily operates using the previous year's budget plan; The debt ceiling is different. The absolute amount of government debt is rigidly set by Congress, and there is no buffer plan. Once the debt ceiling is triggered, but the amount is not raised in time, the U.S. government will be unable to continue deficit operations, and treasury bonds will not be paid in full when they mature.

It is not difficult to see that the discussion of government debt can already be integrated into the discussion of the fiscal budget, and the coexistence of the two seems to be "unnecessary."

This strange mix of institutions is actually not very reasonable. So far, only the United States and Denmark among developed economies have a "debt ceiling," which is more a common "historical legacy" in the history of American institutions: the United States debt ceiling was born in 1917. To meet the needs of issuing war bonds during the First World War, the United States changed the "every issue must be reviewed" model of bonds issued by Congress to the Ministry of Finance, turning to a form of total debt control, which gives the Ministry of Finance more autonomy; The budget system, on the other hand, was created in 1921 after the war - a model that is actually more in line with our understanding of a "modern form" (implemented by most countries, including China). However, the debt ceiling rule was not abolished simultaneously, mostly because it provided a battleground for party struggle.

It may be said vividly that the debt ceiling problem is the "appendicitis" of the evolution of the American national capacity, and frequent outbreaks of inflammation are inevitable: even if the government's leverage ratio remains unchanged, with the increase of the total economic volume, the total debt will continue to rise, and continue to hit the debt ceiling, and active fiscal and social welfare policies may make the debt ceiling hit faster.

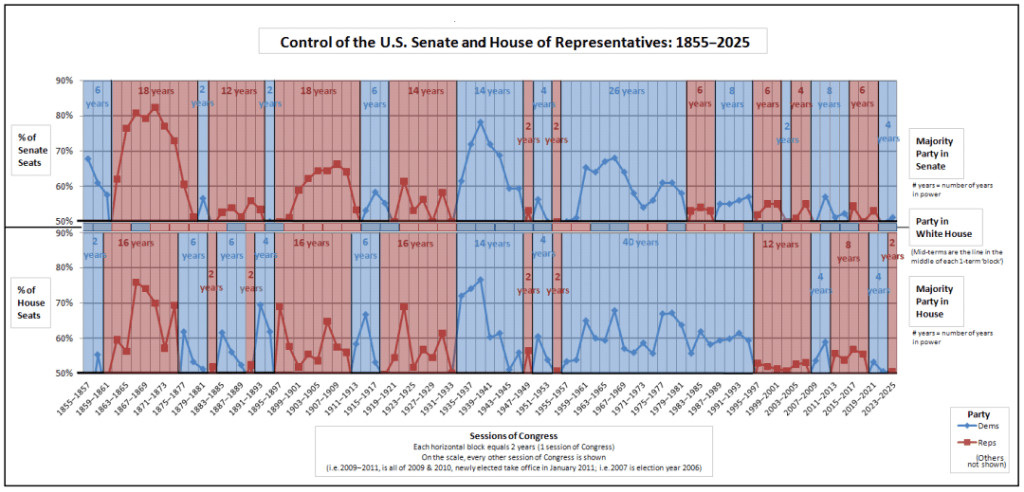

On the issue of raising the debt ceiling, both parties still maintain a record of "fighting but not breaking," but the bottom line game is still very intense. The two most severe debt ceiling crises in history occurred during Obama's presidency in 2011 and 2013: the debt ceiling increase in 2011 was achieved within an extremely narrow time window, causing significant volatility in the financial market; The temporary suspension of the debt ceiling bill in 2013 was buffered, but in the end it was the "No Payroll Without Budget Approval" bill (No Budget, No Pay) forced the lawmakers to pass.

(Debt ceiling and accompanying path of debt)

Is There Any Way to Avoid the Consequences of the Debt Ceiling?

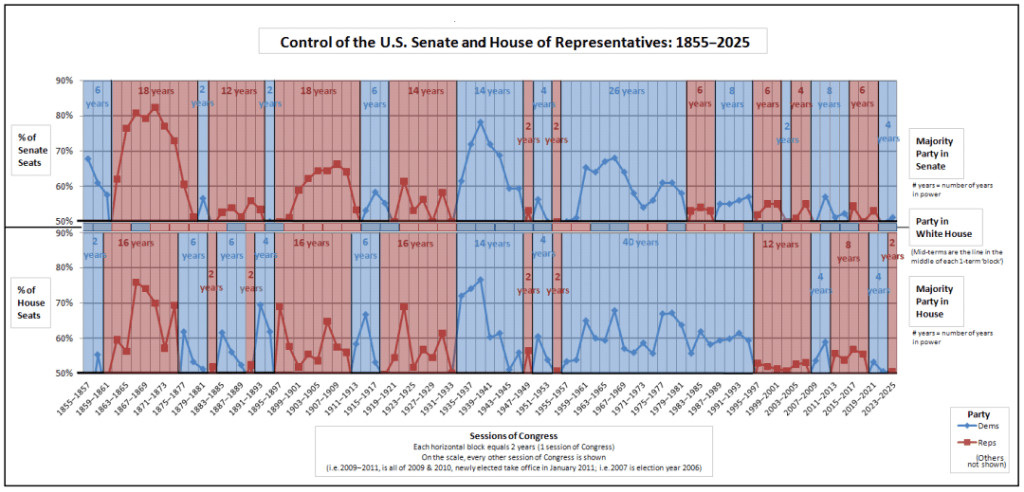

The most permanent solution is naturally to abolish the "old system" of debt ceiling. However, under the natural vigilance of Americans against the "Big government", the fact that the government "theoretically" can borrow indefinitely will still encounter widespread opposition. Therefore, currently, the most reliable method is still to raise the debt ceiling once again. At the same time, there is a relatively special option: to suspend the debt ceiling constraint for a period of time. However, this can only happen when the government and the two houses have relatively consistent control - for example, in the years 2015 to 2020 before and after Trump's term, the debt ceiling suspension bill was successfully extended multiple times.

(From 2015 to 2020, the Republican Party held absolute control of the government and both houses)

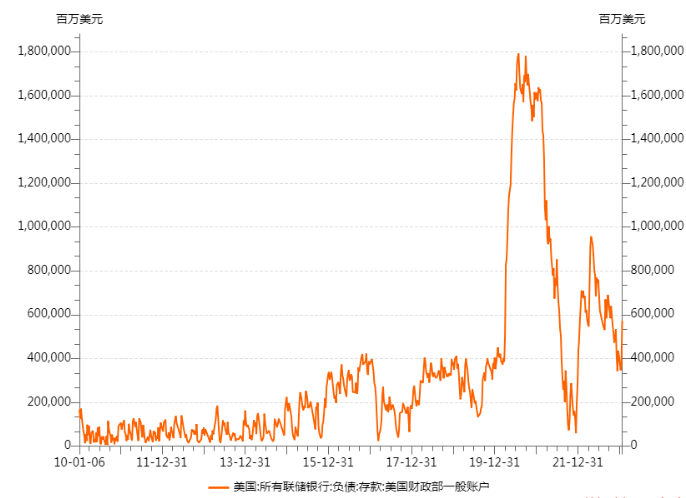

However, with Trump's defeat, this honeymoon period will come to an end in the second half of 2021. In January 2023, the United States once again faced the debt ceiling. However, it should be noted that hitting the debt ceiling does not mean that U.S. Treasury bonds will immediately face default. Generally speaking, before the establishment of a new debt ceiling arrangement, the Federal Treasury can take some temporary measures to buy time, including:

1. Changing the priority order of expenditure obligations to ensure bond repayment, such as closing some government agencies and delaying social security payments. This has a direct effect, but at the same time, they will also face political pressure of varying sizes.

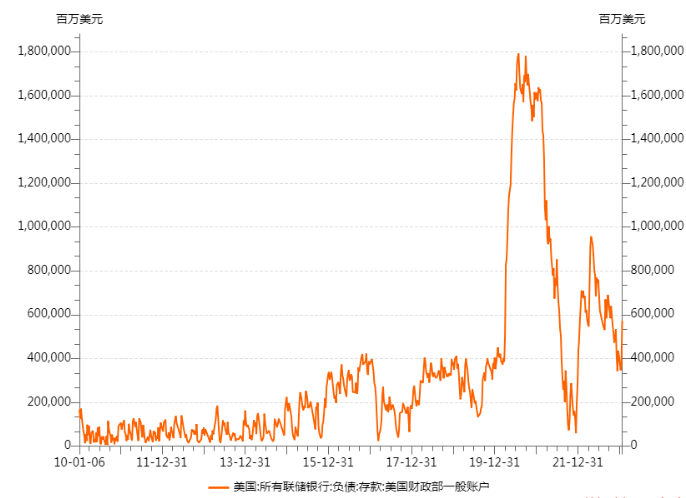

2. Using cash in the Treasury's TGA account with the Federal Reserve. The safest option is to use their own savings. Currently, the funds in the TGA account are relatively high compared to pre-pandemic levels in history.

(There is still a lot of balance in the TGA account...)

3. Suspending the investment and reinvestment of federal retirement accounts in US Treasuries: This is equivalent to temporarily "writing off" future pension investments for federal civil servants, diverting some funds for other necessary government expenses. Degg_GlobalMacroFin has analyzed on Weibo that this move may impact the US bond market.

4. Minting commemorative coins: This is an unusual and somewhat humorous solution within the American system. Since the US Treasury has the right to issue commemorative coins, it can theoretically receive "seigniorage" by the amplification effect of "seigniorage cost face value." However, will the Federal Reserve and the American people accept these millions of commemorative coins from the Treasury?

But if all these methods have been tried, will they still not survive?

So, it seems like it can only lead to a default on US bonds. This calculated time point is commonly known as the X-date, and it is currently widely expected that this round of the X-date will occur in the fourth quarter of 2023. Until then, there is still one final weapon worth using: invoking the fourth paragraph of the 14th Amendment to the Constitution of 1868.

The amendment states, "There shall be no doubt about the validity of the public debt of the United States authorized by law." Therefore, the Ministry of Finance can advocate that "the debt ceiling does not affect the repayment of existing debts, otherwise it would be unconstitutional," perhaps at least achieving the continuation of existing debts.

Will It also be Resolved Peacefully this Time?

From historical experience, there is a high possibility that it will still be a "safe and easy" passage. This bottom line game is occasionally described as a 'Boat Shaking' strategy, where a moderate threat may force the other party to compromise or trigger opposition from the opponent. However, ultimately, 'each other's excessive actions overturning the boat' is a win-win outcome. The resilience of the US political system is often reflected in critical moments of crisis, and the "bipartisan consensus" solution has played an important role.

Even if the ship does not overturn, simply obstructing the debt ceiling increase may not be a perfect strategy for opposition parties: research on the 2013 debt ceiling crisis shows that the Republican Party's continued obstruction and bottom line pressure led to further public disgust and raised public voices calling for a change in the two-party system.

However, in the current situation where both parties are torn apart, it is still uncertain whether the resilience of the US bipartisan system still exists and what we will see halfway through the process of achieving results.

How will the Debt Ceiling Game Impact Financial Markets?

Regarding whether the debt ceiling issue will lead to an economic crisis or the bankruptcy of US dollar credit, it is still considered excessive. Under institutional protection, the possibility of "appendicitis" ultimately being fatal is unlikely, and the financial market is unlikely to price such extreme scenarios in the short term. However, on the margin, the continued constraint of uncertainty on the federal fiscal capacity will undoubtedly inhibit economic confidence, especially in the current environment where recession expectations are getting stronger and stronger. If the game is fierce, the narrative of "hard landing" may be strengthened periodically.

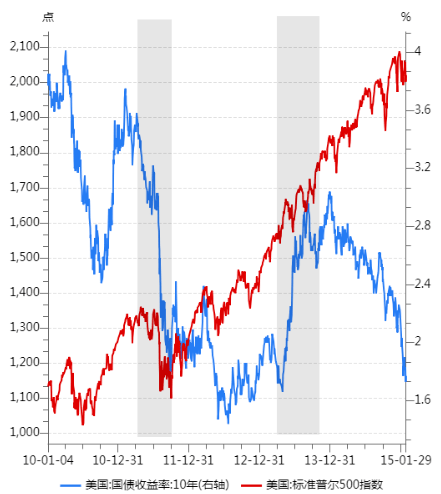

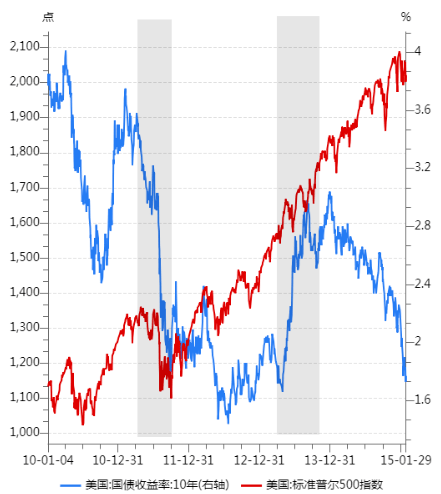

Drawing on the history of 2011 and 2013, the impact of the debt ceiling game on the market still depends on the macro scenario and game path. During the 2011 crisis, there was a significant decline in US stock and bond yields, which was closely related to the bottom line game between the two parties, as well as the rebound in inflation and the tightening environment of the Federal Reserve. During the 2013 game, thanks to the "suspension of the debt ceiling" and the relatively stable macro and monetary environment, the overall market showed an improvement in risk appetite with high yields on US stocks and US bonds.

(Compared to two rounds of crises: the market has shown significant macro driving and learning effects)

So, in this round of debt ceiling games, there is a high probability that we can still see the dominance of macro drivers and the stronger learning effect exhibited by the market... unless something unexpected really happens.

How to Evaluate the Future of the Debt Ceiling?

We also see that the debate over the sustainability and functionality of finance has become increasingly intense in recent years, especially in discussions of "Modern Monetary Theory" (MMT). It may be difficult to criticize the original intention behind the design of the debt ceiling mechanism, but in practical results, its binding force on government debt expansion is weak. This mechanism clearly affects fiscal efficiency and increases macroeconomic risks, making it increasingly difficult to adapt to the current macroeconomic demands for "fiscal functionality".

If the intensification of competition among major powers is currently the strongest consensus between the two parties, then improving national capacity, and more importantly, fiscal capacity, will ultimately be a necessary step.

Undoubtedly, the method of "pressure line game" is very dangerous, especially in an era where political polarization and division are becoming increasingly severe. If the issue of the debt ceiling continues to recur, it seems that the crisis will eventually spiral out of control, which is ultimately detrimental to both parties in power. Both parties have gradually realized this issue, but there is still a lack of effective solutions. A strong consensus is needed to completely abolish the debt ceiling, but the paradox is that only when a crisis truly occurs and the inevitable consequences are experienced by everyone can consensus be truly consolidated. Once consensus is gathered and institutional reform is promoted, will it be a good choice in the long run?

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.