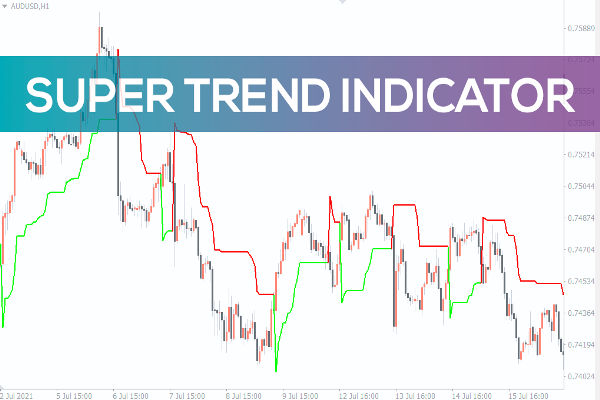

A currency pair is a trading tool in the forex market that represents the exchange rate between two currencies. For example, EUR/USD represents the exchange rate between the euro and the US dollar. The trading activities of currency pairs are usually based on predictions of the relative value changes of the two currencies. Traders can achieve profits by buying or selling currency pairs. Currency has high liquidity and high trading volume for transactions, as the forex market is one of the largest financial markets in the world. The effect of currency fluctuations on prices is influenced by various factors, including economic data, interest rate decisions, political situations, etc. Therefore, in-depth analysis and understanding of currency pairs are crucial for forex traders.

currency pairs with the highest trading volume in the forex market are commonly referred to as "major currency pairs" or "major cross currency pairs", and they are the most active and liquid currency pairs in global forex trading.

The following are some of the major currency pairs with the highest transaction volume:

1. EUR/USD

The euro against the US dollar is the world's most liquid currency pair and one of the most popular trading pairs. This is because the euro and the US dollar are the currencies of the world's two largest economies, covering the dynamics of the eurozone and US economies.

2. USD/JPY

The US dollar against the Japanese yen is the second-largest currency pair with the highest trading volume in the world. It is influenced by the Japanese and American economies and is also an important tool for investors to manage and hedge risks.

3. GBP/USD

The pound is the third-most traded currency pair against the US dollar. It is the currency of two important economies, the United Kingdom and the United States, and is affected by the Economy of the United Kingdom and the Bank of England.

4. USD/CHF (USD/Swiss Franc)

The US dollar is the fourth-largest currency pair in terms of trading volume against the Swiss franc. The Swiss franc is considered a relatively stable and safe currency, so investors tend to buy it when the market encounters uncertainty.

The high trading volume of these currency pairs is mainly due to the fact that they involve the currencies of the largest countries and regions in the global economy, playing a crucial role in international trade, investment, and financial activities. However, the currency pairs with the highest trading volume may fluctuate with changes in market conditions and economic factors.