Gold is one of the world's most actively traded commodities, prized for its role as a store of value, a hedge against inflation, and a safe-haven asset during times of uncertainty.

For traders, understanding the gold symbol is essential for navigating the forex and commodities markets efficiently. This article explains what the gold symbol is, how it is used in trading, and why it is so important for anyone dealing with gold-related financial products.

What Is the Gold Symbol?

In global financial markets, the gold symbol is XAU. This internationally recognised code is used to represent gold in trading platforms, price charts, and financial instruments. The symbol “XAU” is derived from the ISO 4217 standard, which assigns unique three-letter codes to currencies and certain commodities.

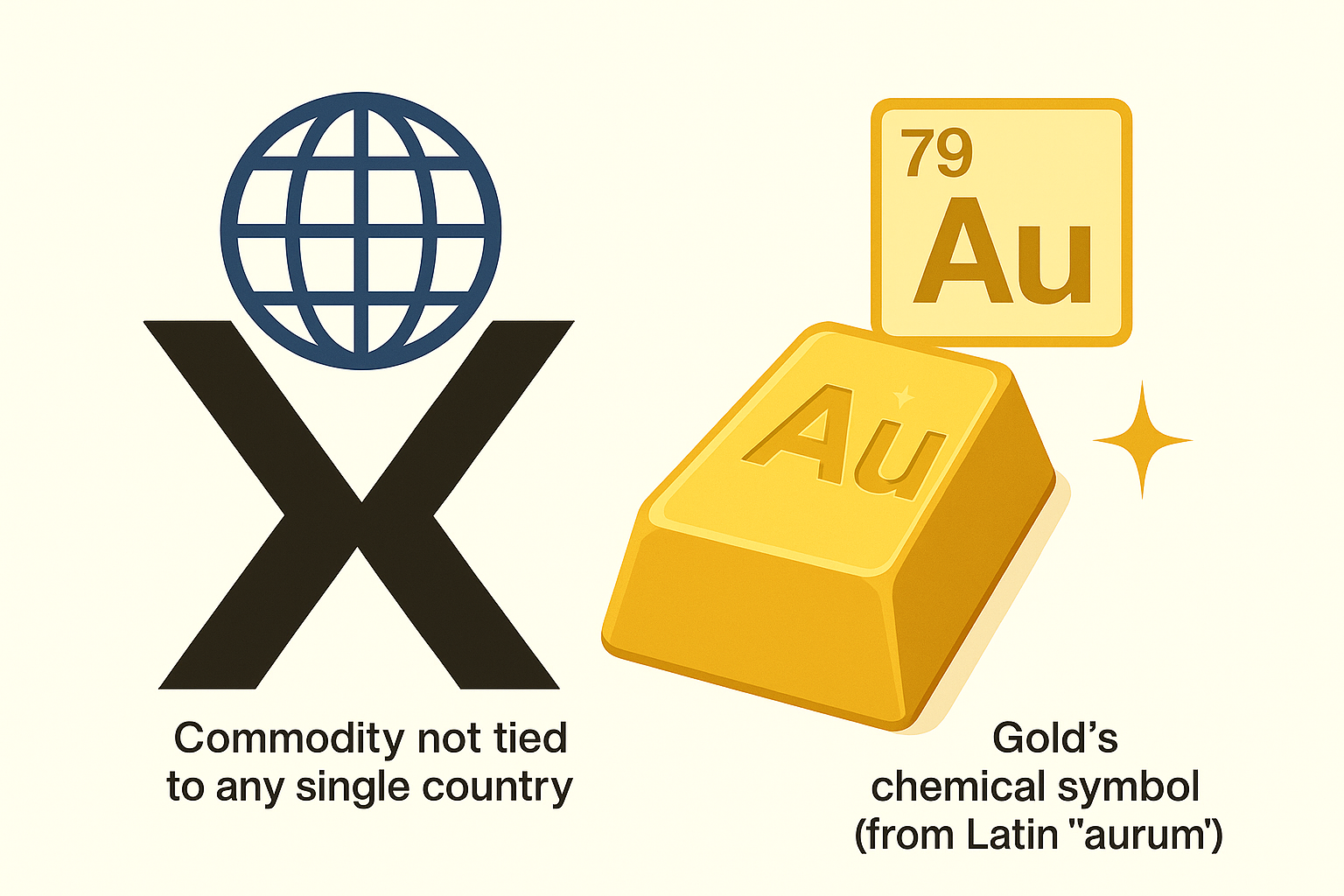

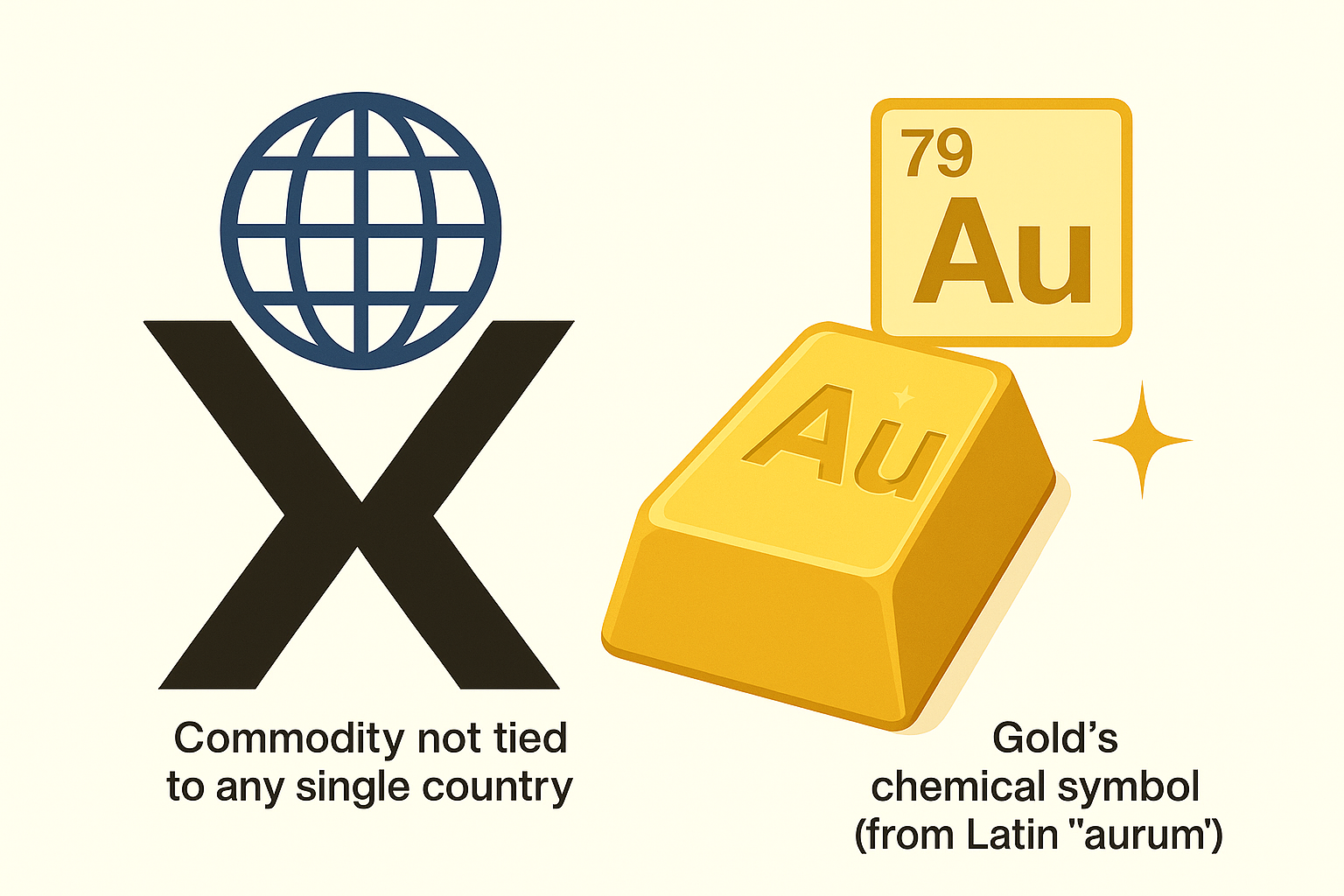

-

X: Indicates a commodity not tied to any single country.

AU: Comes from gold's chemical symbol on the periodic table, “Au”, which is based on the Latin word aurum.

This combination creates a universal shorthand for gold, ensuring consistency and clarity across all trading venues.

How Is the Gold Symbol Used in Trading?

The most common way traders encounter the gold symbol is in the currency pair XAU/USD. This pair shows the price of one troy ounce of gold quoted in US dollars. For example, if XAU/USD is trading at 2,400, it means one ounce of gold is worth $2,400.

Key Points for Traders

XAU/USD is the standard symbol for spot gold trading against the US dollar.

Gold can also be traded against other currencies, such as XAU/EUR (euro), XAU/GBP (British pound), or XAU/AUD (Australian dollar).

The price reflects the cost of one troy ounce of gold in the quoted currency.

Where You'll See XAU

Forex platforms: XAU/USD is one of the most liquid and widely traded pairs.

CFD brokers: Gold CFDs use XAU as the underlying asset.

Futures and options: Gold contracts reference XAU for standardisation.

Market data feeds: Real-time gold prices are listed as XAU/USD or similar pairs.

Why Is the Gold Symbol Important?

1. Consistency Across Markets

Using XAU as the gold symbol ensures that traders, brokers, and analysts worldwide are referring to the same asset, regardless of platform or region. This standardisation eliminates confusion and streamlines trading operations.

2. Efficient Trading and Analysis

The XAU symbol allows traders to quickly identify gold-related instruments, place trades, and analyse price movements. It also enables the use of technical analysis tools and Automated Trading systems that rely on standardised codes.

3. Transparency and Price Discovery

With XAU/USD quoted on major exchanges and trading platforms, traders have access to transparent, real-time pricing. This makes it easier to compare prices, execute trades, and manage risk.

4. Portfolio Diversification and Risk Management

Gold, represented by XAU, is a popular tool for diversifying portfolios and hedging against market volatility. Its unique properties as a safe-haven asset make it a staple for risk management strategies.

The History and Origin of XAU

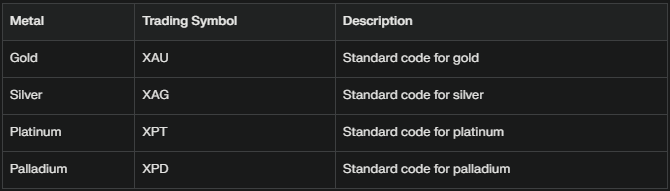

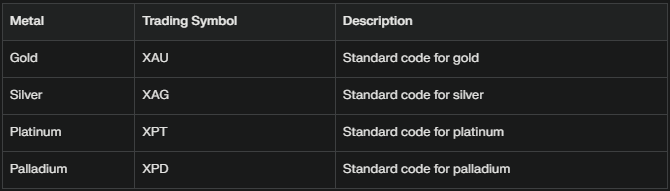

The use of XAU as the gold symbol is rooted in the ISO 4217 standard, which was developed to create uniform codes for currencies and certain precious metals. The “X” prefix is reserved for assets not issued by any single country, such as gold (XAU), silver (XAG), platinum (XPT), and palladium (XPD).

This system ensures that gold is easily identifiable and tradable across all global markets.

How XAU/USD Trading Works

Spot Gold Trading

XAU/USD is traded as a spot product, meaning transactions are settled immediately at current market prices.

The price is quoted per troy ounce, the standard unit for precious metals.

Trading is continuous, with prices derived from over-the-counter (OTC) markets and benchmarked by the London gold fixing.

Margin and Leverage

-

Many brokers offer leveraged trading on XAU/USD, allowing traders to control larger positions with a smaller capital outlay.

Margin requirements and leverage ratios vary by broker and account type.

Trading Hours

Gold trading is available nearly 24 hours a day, five days a week, aligning with global forex market hours.

Contract Specifications

Minimum trade sizes, pip values, and spreads are set by individual brokers.

XAU/USD typically has a minimum price movement (pip) of 0.01, with each pip representing a small change in the gold price.

Factors Influencing Gold Prices

Understanding what moves the price of XAU/USD is crucial for traders:

-

US Dollar Strength: Gold often moves inversely to the US dollar. A weaker dollar usually means higher gold prices, and vice versa.

-

Inflation and Interest Rates: Gold is seen as a hedge against inflation and currency devaluation.

-

Geopolitical Events: Uncertainty or crisis can drive demand for gold as a safe-haven asset.

-

Central Bank Policies: Gold reserves and monetary policy decisions by major central banks can impact prices.

Supply and Demand: While less volatile than other commodities, changes in mining output or jewellery demand can affect prices.

Practical Tips for Trading XAU/USD

-

Monitor Economic Data: US economic releases, such as inflation and employment figures, can move gold prices.

-

Use Technical Analysis: Chart Patterns, support/resistance levels, and indicators like RSI and MACD are widely used in gold trading.

-

Manage Risk: Set stop-loss and take-profit orders to protect your capital, as gold can be volatile during major news events.

Diversify: Consider gold as part of a broader portfolio to reduce overall risk.

Gold Symbol in Other Trading Contexts

-

Futures: Gold futures contracts on exchanges like COMEX use XAU as the underlying asset.

-

ETFs: Gold exchange-traded funds (ETFs) track the price of XAU/USD.

Options: Gold options reference XAU for strike prices and settlement.

Gold Symbol vs Other Precious Metals

Conclusion

The gold symbol in trading, XAU, is the universal code that represents gold across all major financial markets. Whether you are trading spot gold, futures, options, or ETFs, understanding and using the XAU symbol is essential for efficient trading, analysis, and risk management.

Its adoption ensures consistency, transparency, and accessibility for traders worldwide, making it a cornerstone of modern financial markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.