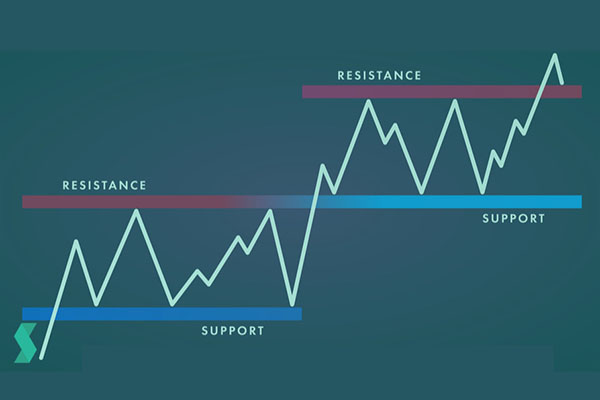

Reducing positions refers to the act of gradually reducing the amount of positions held, which refers to the sale of a portion of the stocks held. It is an operation taken to ensure that some profits are lost due to uncertainty about the future market situation. Reducing positions is usually due to investors believing that market risk has increased or they have earned a certain amount of profit, which requires risk control or profit protection.

The method of reducing positions can be to sell some positions and reduce capital investment; It can also be selling all positions and completely exiting the market. The timing of position reduction is usually when there is a clear turning signal in the market or when trading objectives are achieved, in order to avoid further losses or missed profit opportunities.

The advantage of reducing positions is that it can control risks and protect profits, avoiding significant losses caused by market fluctuations. However, reducing positions may also pose certain risks, such as missing opportunities for market growth or selling positions at prices lower than input costs. Therefore, the timing and methods of reducing positions need to be comprehensively considered based on market conditions and individual trading strategies.

Reducing positions is a trading strategy for risk control and profit protection, which usually requires considering the following prerequisites:

1. Increased market volatility: When there is a significant increase in market volatility and risk, reducing positions can help investors control risks and losses.

2. Achievement of profit goals: When investors' trading goals have been achieved, their positions can be gradually reduced or completely withdrawn from the market to protect profits.

3. Changes in trading strategy: When investors' trading strategies change, they need to adjust their holdings and reduce or increase their investments.

4. Fund demand: When investors need funds for other purposes, they can obtain funds by reducing their holdings.

5. Change in risk preference: When investors' risk preference changes, risk can be controlled by reducing positions.

In actual trading, reducing positions needs to be determined based on specific market conditions and individual trading strategies. Usually, it is necessary to control the timing and methods of reducing positions to avoid missing profit opportunities or experiencing significant losses.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.