Foreign exchange adjustment refers to the action taken by the central bank to

adjust or intervene in the exchange rate of a currency in the foreign exchange

market. It refers to the central bank influencing market supply and demand by

buying and selling foreign exchange to adjust exchange rate levels or prevent

excessive currency fluctuations.

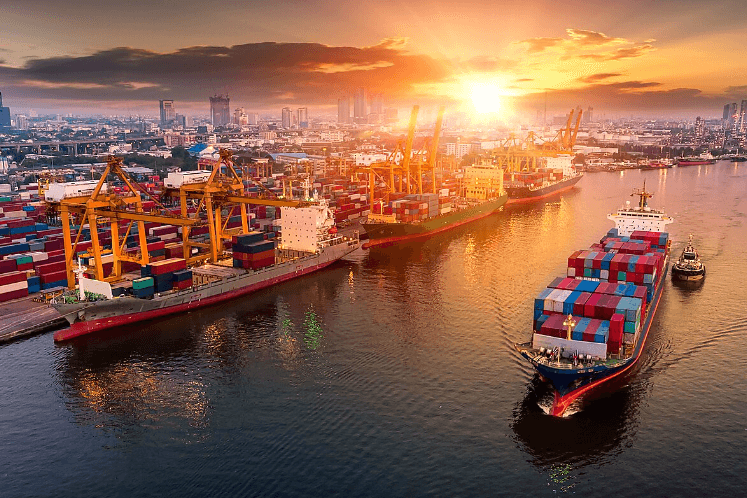

The purpose of foreign exchange adjustment can be to stabilize the exchange

rate of currencies, in order to maintain economic stability and competitiveness.

The central bank may use currency intervention to prevent the currency from

depreciating or appreciating too much, so as to maintain the balance of

international trade.

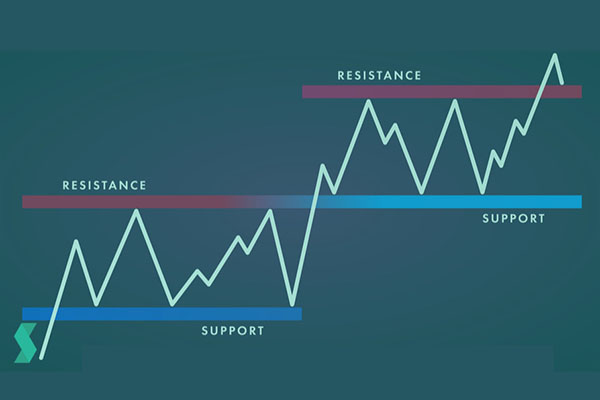

Firstly, the central bank can adjust foreign exchange by intervening in

exchange rates. When a country's currency exchange rate experiences significant

fluctuations or does not meet government expectations, the central bank can take

intervention measures, such as purchasing or selling currency in the foreign

exchange market, to influence the trend of the exchange rate. If the central

bank believes that the domestic currency is too strong, it may take measures to

sell the domestic currency to increase foreign exchange supply and lower the

exchange rate. On the contrary, if the central bank believes that the domestic

currency is too weak, it may take measures to purchase the domestic currency to

reduce foreign exchange supply and increase the exchange rate.

Secondly, the central bank can adjust foreign exchange through Currency

intervention. The central bank can directly intervene in the foreign exchange

market by purchasing or selling foreign exchange in order to affect the supply

and demand relationship in the market. By increasing or reducing foreign

exchange supply, the central bank can adjust the exchange rate level in the

market to achieve its goal of regulating the economy.

In addition, the central bank can also carry out foreign exchange adjustments

by implementing monetary policy. Monetary policy is a means for the central bank

to affect the economy by adjusting the Money supply and interest rate level. The

central bank can attract or suppress foreign investment inflows by adjusting

interest rate levels, thereby affecting the supply and demand relationship and

exchange rate level in the foreign exchange market.

In addition, foreign exchange adjustments can also be used to maintain

financial stability and suppress excessive volatility. For example, when a

country's currency experiences a large-scale depreciation, the central bank can

purchase its own currency, increase demand, and thus raise the exchange rate. On

the contrary, when the currency excessively appreciates, the central bank can

sell its own currency, reduce its supply, and stabilize the exchange rate

level.

Foreign exchange adjustment is an important tool of the central bank, often

used to intervene in the market and affect the value of currency. It can be

implemented through direct intervention in the market or through interest rate

policies. The implementation of foreign exchange adjustments usually requires

the central bank to have sufficient foreign exchange reserves and the ability to

stabilize the market.

In short, foreign exchange adjustment is an important means for the central

bank to adjust the exchange rate of currencies through market intervention in

order to maintain economic stability and competitiveness. It has a significant

impact on international trade, financial stability, and economic

development.

The scope of adjusting foreign exchange is:

1: Various retained foreign exchange reserves;

2: Foreign exchange owned by foreign-invested enterprises;

3: Foreign exchange donated by overseas Chinese and Hong Kong Macao contract

holders;

4: Foreign currency and foreign exchange deposits held by individual

residents;

5: Other foreign exchanges approved by the State Administration of Foreign

Exchange