In a market landscape where speed and timing dictate success, understanding the true trading meaning is vital for any participant hoping to operate effectively. While popular finance content often blurs the lines between trading and investing, the reality is that trading follows its own set of principles, timeframes, and psychological requirements. For traders — those actively seeking to profit from short- or medium-term market movements — clarity on what trading entails isn't academic. It's foundational.

Definition of Trading

At its core, trading refers to the buying and selling of financial instruments with the intent to profit from short-term price movements. Traders do not typically hold assets for years, nor do they primarily focus on long-term growth or dividends. Instead, they analyse market data — both technical and fundamental — to enter and exit positions within timeframes that range from seconds to months.

At its core, trading refers to the buying and selling of financial instruments with the intent to profit from short-term price movements. Traders do not typically hold assets for years, nor do they primarily focus on long-term growth or dividends. Instead, they analyse market data — both technical and fundamental — to enter and exit positions within timeframes that range from seconds to months.

Unlike investing, which often emphasises asset accumulation and compound growth over time, trading is defined by activity and reactivity. A trader monitors markets in real time, acts on rapidly changing information, and typically aims to capitalise on volatility, momentum, and patterns.

Trading vs Investing: Key Differences

Understanding the distinction between trading and investing is essential for defining trading meaning with precision:

Difference between Trading and Investing

| Aspect |

Trading |

Investing |

| Time Horizon |

Short-term (intraday to months) |

Long-term (years or decades) |

| Objective |

Capitalise on price volatility |

Accumulate wealth over time |

| Methodology |

Technical/fundamental analysis |

Fundamental analysis & macro trends |

| Execution Frequency |

Frequent |

Infrequent |

| Tools Used |

Charts, indicators, volume, sentiment |

Balance sheets, earnings, valuations |

| Risk Exposure |

Higher due to leverage and frequency |

Lower but exposed to market cycles |

Traders approach markets with a mindset shaped by immediate action. They thrive on liquidity and precision, whereas investors generally adopt patience and strategic inertia.

Assets Traded by Traders

A wide array of assets fall under the umbrella of trading activity. Depending on strategy and risk appetite, traders might engage with:

A wide array of assets fall under the umbrella of trading activity. Depending on strategy and risk appetite, traders might engage with:

Equities (stocks) – Commonly traded due to liquidity and accessibility.

Foreign exchange (forex) – The world's most liquid market, ideal for leverage and round-the-clock access.

Commodities – Including gold, oil, and agricultural products; often used in macro and geopolitical trades.

Cryptocurrencies – Increasingly popular among retail and algorithmic traders for volatility and decentralisation.

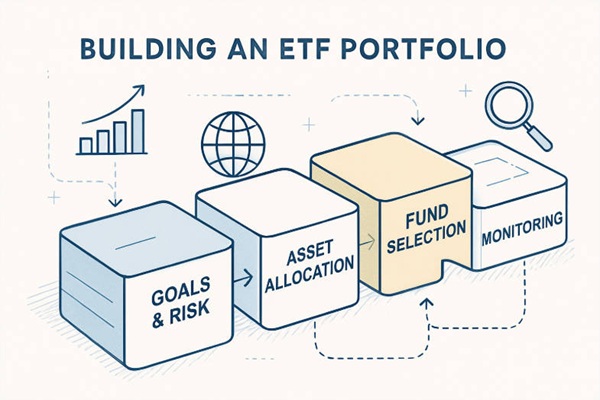

ETFs and indices – Suitable for thematic or sector-based strategies.

Derivatives (options, futures, CFDs) – Allow for advanced risk management and speculative positions.

Each asset class offers its own rhythm, volatility profile, and technical characteristics, making it crucial for traders to specialise or adapt their methods accordingly.

Trading Timeframes & Styles

The trading meaning varies slightly depending on the style and timeframe adopted. Some common types of trading include:

Scalping – Extremely short-term trades, often lasting seconds or minutes. Emphasises volume and small profits per trade.

Day trading – All positions closed before the end of the trading day. Requires discipline, fast execution, and a strong grasp of intraday patterns.

Swing trading – Trades held from a few days to several weeks. Relies on trend reversals, breakouts, and momentum signals.

Position trading – Longer-term trades based on macro trends or fundamental shifts. Sometimes overlaps with investing, but with more frequent reviews.

Algorithmic trading – Automated execution based on coded strategies. Used by quant firms and increasingly accessible to retail traders.

Each style carries its own risk parameters, capital requirements, and psychological demands.

Risk, Tools & Psychology in Trading

While trading can be lucrative, it also exposes participants to considerable risk — particularly when leverage is used. As such, tools and risk frameworks become integral to success:

Risk Management – Includes stop-loss orders, position sizing, and portfolio hedging. Without discipline, even skilled traders fail.

Technical Analysis – Charts, indicators (RSI, MACD, Bollinger Bands), volume, price action — these tools are central to timing entries and exits.

Fundamental Catalysts – Earnings releases, economic data, central bank decisions, and news events all drive short-term movement.

Trading Platforms – Platforms like MetaTrader, TradingView, Thinkorswim, or direct-access brokers support real-time decision-making.

Trader Psychology – Emotional control, patience, adaptability, and journaling are often the dividing line between profit and loss.

Mental resilience is often overlooked when defining trading meaning — yet it's arguably the most critical success factor for a trader.

Conclusion: Why Traders Must Clearly Understand Trading Meaning

For traders, ambiguity is costly. In a field that demands fast decisions, technical accuracy, and consistent performance under pressure, the trading meaning must be sharply defined. It's not just a matter of buying and selling; it's a discipline that combines analysis, timing, and self-control.

Whether scalping on minute charts or swing trading mid-cap ETFs, those who operate with a clear understanding of what trading entails are far more likely to navigate the markets successfully. In short: knowing the trading meaning isn't just semantics — it's strategy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

At its core, trading refers to the buying and selling of financial instruments with the intent to profit from short-term price movements. Traders do not typically hold assets for years, nor do they primarily focus on long-term growth or dividends. Instead, they analyse market data — both technical and fundamental — to enter and exit positions within timeframes that range from seconds to months.

At its core, trading refers to the buying and selling of financial instruments with the intent to profit from short-term price movements. Traders do not typically hold assets for years, nor do they primarily focus on long-term growth or dividends. Instead, they analyse market data — both technical and fundamental — to enter and exit positions within timeframes that range from seconds to months. A wide array of assets fall under the umbrella of trading activity. Depending on strategy and risk appetite, traders might engage with:

A wide array of assets fall under the umbrella of trading activity. Depending on strategy and risk appetite, traders might engage with: