MSCI's global index of stocks fell on Thursday while Treasury yields rose as

a surge in U.S. private payrolls prompted concerns that interest rates would

stay higher for longer.

The S&P 500 posted its biggest daily percentage drop since May 23. The

Dow logged its biggest single-day fall since May 2.

The U.S. dollar had pared some losses after the report. Gold prices slipped

to a near one-week low. Oil prices were little changed as the market digested

the higher likelihood of a U.S. interest rate hike that could dent energy

demand.

Commodities

Benchmark U.S. 10-year Treasury yields rose to a more than four-month peak,

while yield on two-year U.S. Treasury note hit the highest since June 2007 after

employment data.

Investors now see a 92% chance of a 25-basis-point hike in July after last

month’s pause, according to CME’s Fedwatch tool. High rates discourage

investment in zero-yield gold.

Crude inventories fell by 1.5 million barrels in the last week to 452.2

million barrels, compared with analysts' expectations in a Reuters poll for a 1

million-barrel drop. U.S. gasoline and distillate inventories also dropped.

OPEC is likely to maintain an upbeat view on oil demand growth for next year

when it publishes its first outlook for 2024 this month, predicting a slowdown

from this year but still an above-average increase, sources close to OPEC told

Reuters.

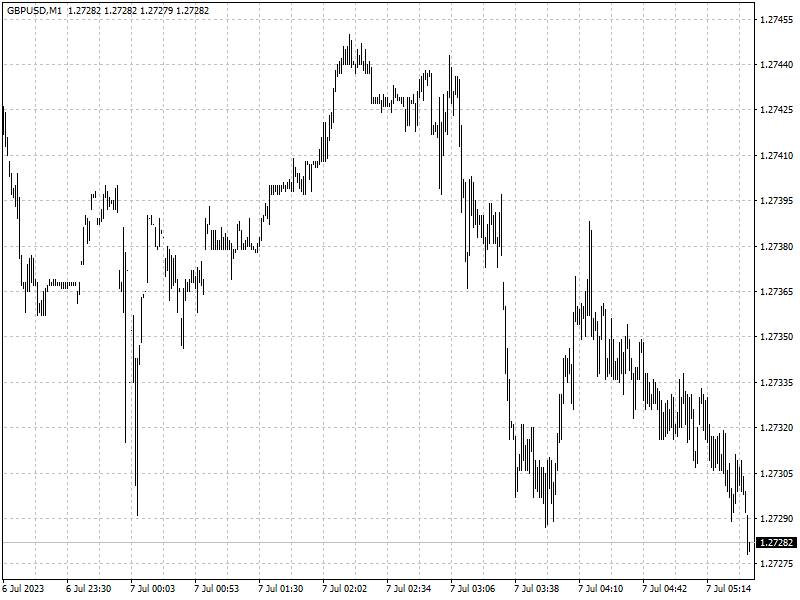

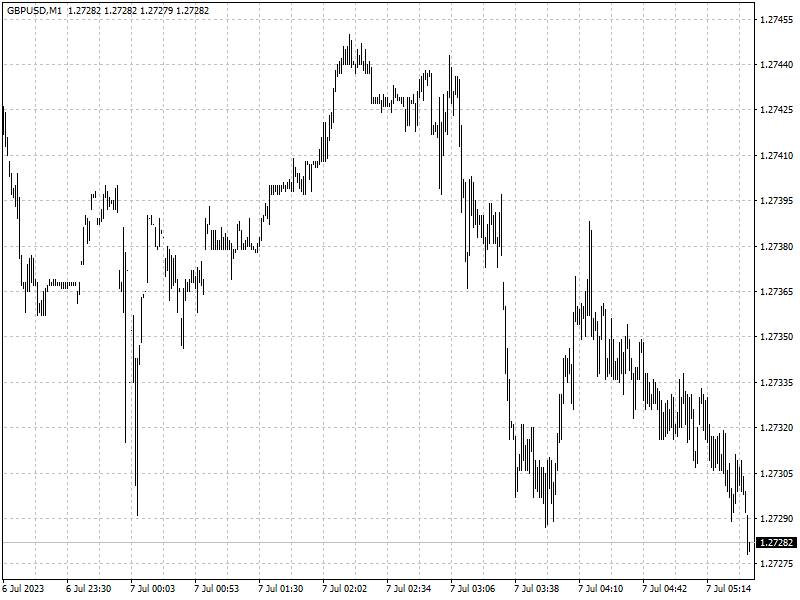

Forex

ISM showed the U.S. services sector grew faster than expected in June as new

orders picked up, adding to data indicating a resilient economy in the face of

tighter monetary policy.

‘This strong data today has a lot more of a 'good news is bad news' type feel

to it,’ said Brian Daingerfield, head of G10 FX strategy at NatWest Markets in

Stamford, Connecticut.

‘Take it together with how equity markets have responded, that gives a clear

picture of the dollar today. Call it a risk-off style move, where the Fed is

going to be tightening more and that has negative repercussions for risk.’

The pound hit two-week highs against the euro and dollar as financial markets

bet the BOE will raise rates to 6.5% early next year, pushing the yield on the

two-year UK government bond to its highest since June 2008.